Whether they’re looking for a first investment property or to add to their collection, investors should consider large cities when searching for the perfect real estate market, for a number of reasons. From high-rises to single-family homes, large cities provide more diverse housing options as well as ample opportunities to find tenants. Knowing where and when to invest, though, is a key factor.

Q4 2019 hedge fund letters, conferences and more

The Best Large Cities To Purchase An Investment Property

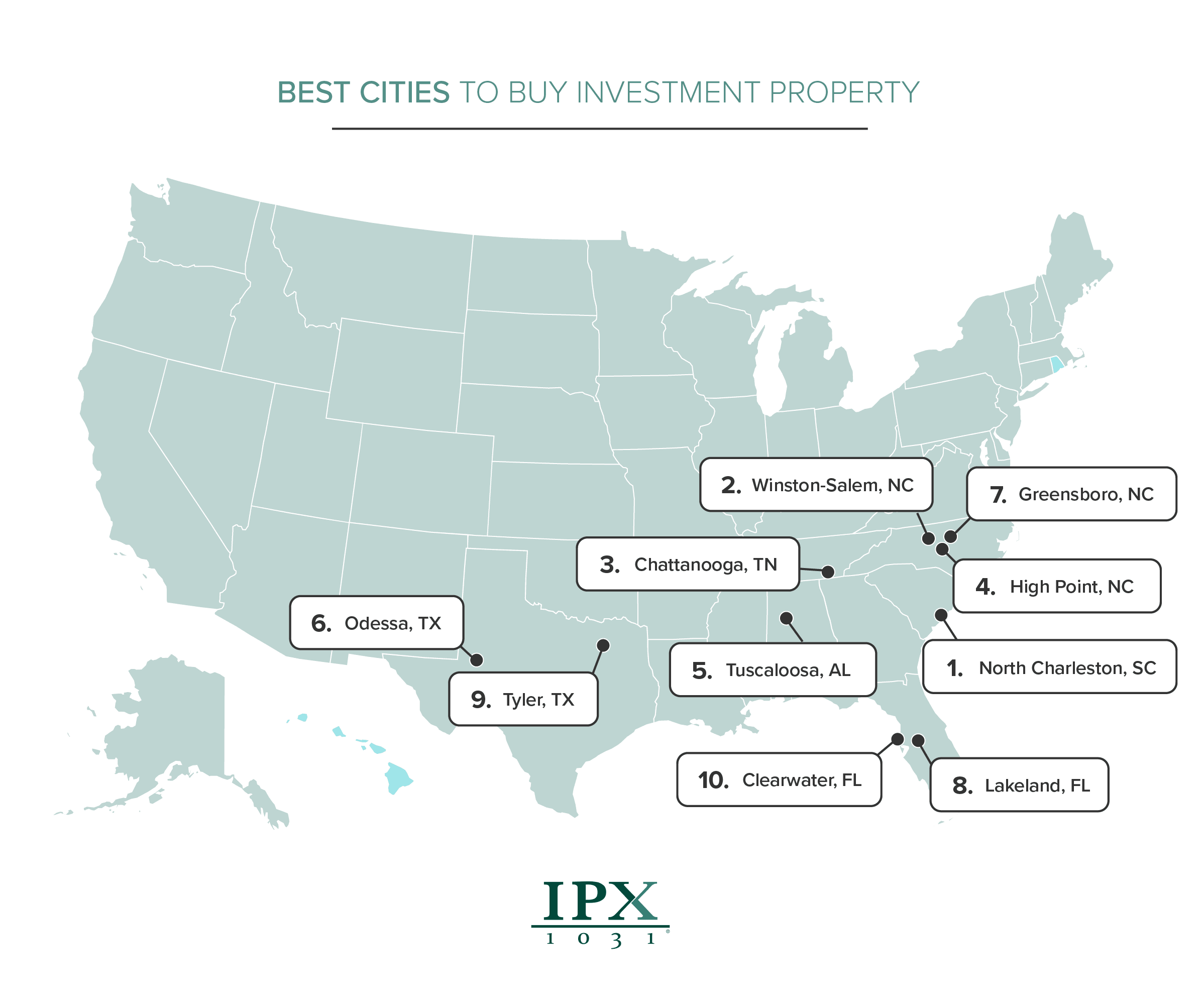

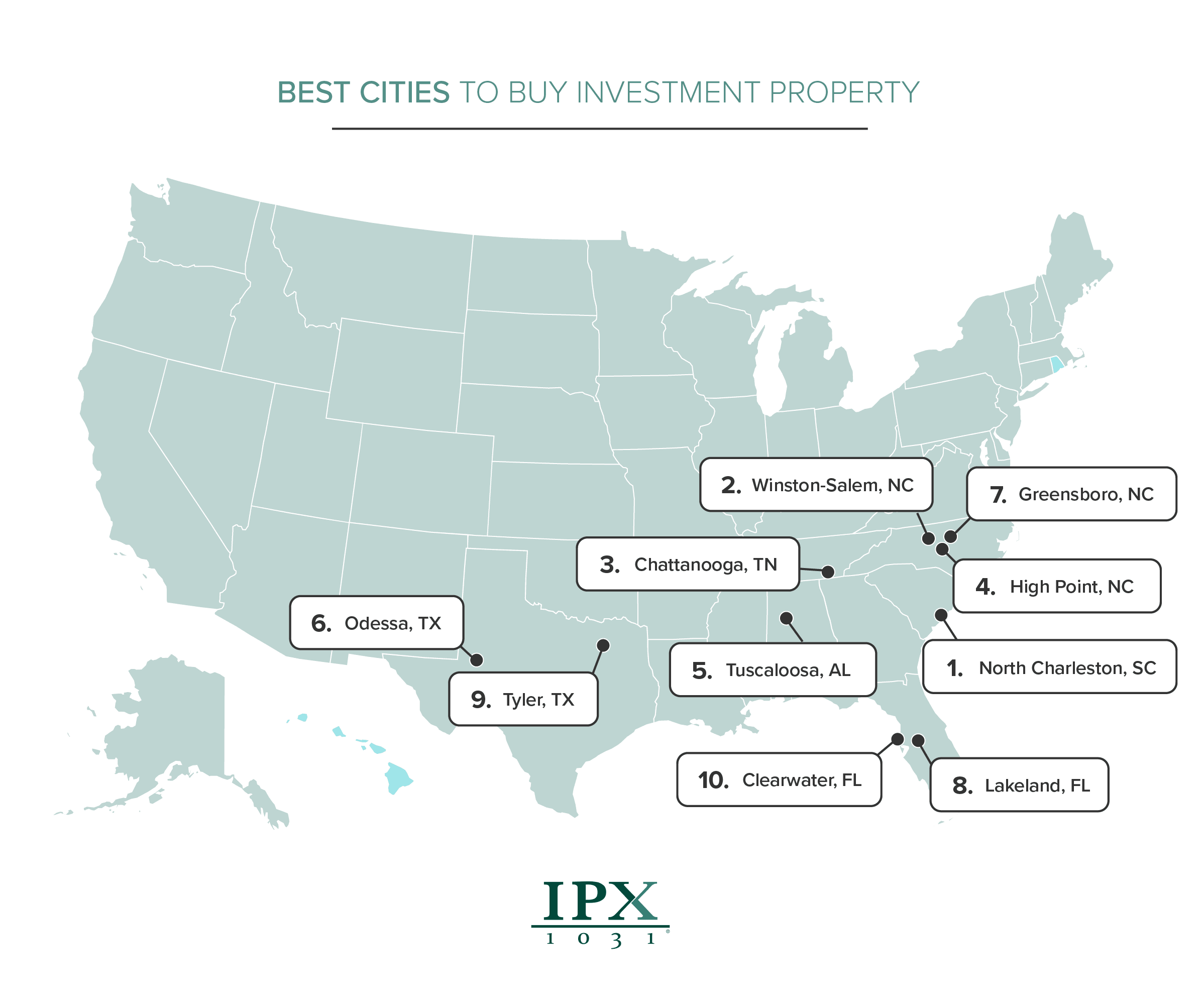

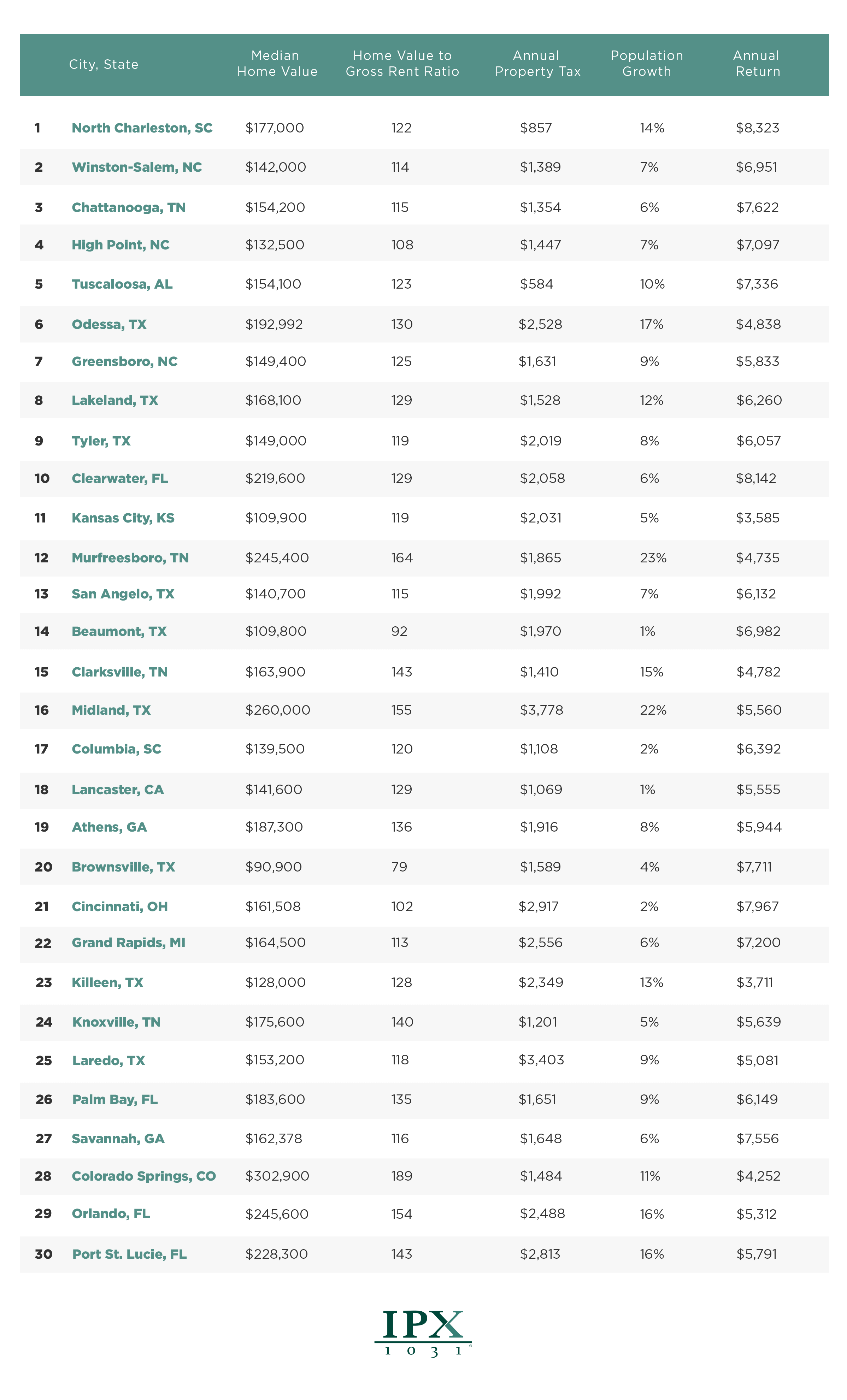

In a new study, IPX1031 analyzed cities across the nation with a population size of 300,000 or more to determine which are best to buy an investment rental property. Across five key factors, including median home value and annual return, they found that Cincinnati, Ohio is the best city to purchase an investment property. At nearly $8,000, Cincinnati offers the highest potential annual return on our list, if an investor financed a home at the city’s median home value of $161,508. Along with the low number of rental payments needed to pay off a home (102), the city’s 7.1% year-over-year home value growth shows that investors stand to make a pretty penny.

Just behind Cincinnati in the top five cities to invest are Colorado Springs, Tampa, Atlanta, and New Orleans, with an average population growth of 3.9% and annual return of just over $6,000. Though they round out the list as the bottom five cities, investors shouldn’t hesitate to also keep an eye on Tulsa, Riverside, Denver, Louisville, and San Antonio. With an average population growth of 8% and return of $4,522, investors can’t go wrong in those markets. If they’re looking just for a high return, investors should consider the Miami real estate market, which offers an $8,724 return per year; Raleigh’s real estate market (#14) offers the smallest, at $2,927.

Hottest Real Estate Markets

While the best large cities for investors span the nation, from Tampa, Florida (#3) to Bakersfield, California (#22), the hottest markets can be found in the South and the West regions of the country. More than half of the cities on the list are located in these parts of the country, including four cities in Texas (#24 Dallas, #19 Fort Worth, #30 San Antonio, and #9 Corpus Christi) and three in Florida (#3 Tampa, #13 Miami, and #10 Jacksonville).

Wherever they decide to invest, buyers can’t go wrong. On average, cities on the list have seen a 10% growth in population since 2010 and offered an annual average yield of $5,541 after mortgage, taxes, and insurance were taken into consideration.