How student loan cancellation could allow consumers to spend up to $92K+ more toward homeownership

Q2 2021 hedge fund letters, conferences and more

What Student Loan Cancellation Could Mean For Borrowers

Buying a home - often referred to as the “American Dream”. People fantasize about the idea of having their own space, a place where they can put down roots and make their own. The white picket fence, the space for the dog (or the kids) to run around in the backyard, the list goes on.

Student Loan Planner, the nation’s largest student loan advising company, wanted to find out the impact of student loan debt on homeownership right now. They found that when student loan debt was factored into the equation, homeownership became impossible for the average person in as many as eight states including: Washington, Arizona, Colorado, Oregon, Idaho, Utah, California and Hawaii.

A Student Loan Planner consultant discusses what student loan cancellation could mean for borrowers who want to buy a home including:

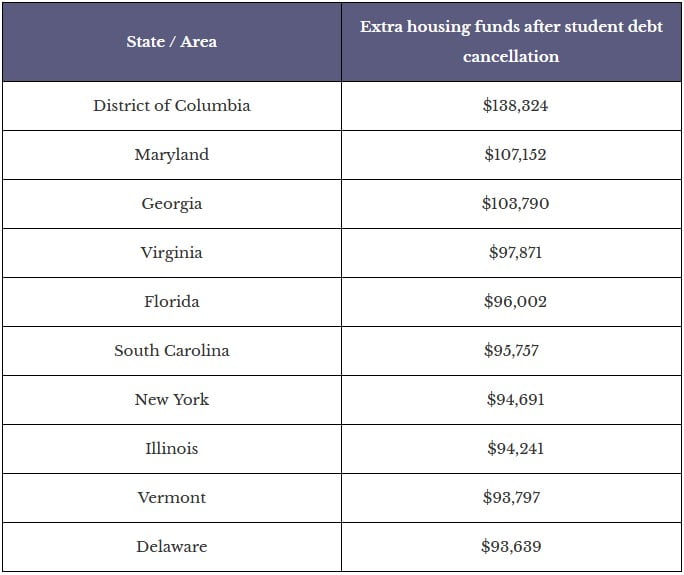

- What would happen with a $50K loan cancellation? Under the Senate Democrats’ plan to cancel up to $50K of student loans, the average American would have their entire student loan balance forgiven, allowing the average student loan borrower the ability to put an extra $92K+ toward a home purchase.

- Partial student loan cancellation? This would still have a beneficial impact, allowing borrowers to spend about $25K more on a home using a 30-year mortgage.

- The eight U.S. states where homeownership is nearly impossible for student loan borrowers. Here they can discuss the tough path that aspiring homeowners have when living in these locations, which interestingly enough are all out in the western region of the country.

- Predictions about the future of the housing market with the potential absence of student debt. Here a Student Loan Planner consultant could talk about the potential effects this could have on the housing market. For example, the average home price in the U.S. is $281,370, according to Zillow. This means that the average student loan borrower could therefore spend about 10% to 30% more on a house with a $10K or $50K cancellation of student debt.

Percentage of average monthly incomes put toward student loan and mortgage payments (by state)

Below is the methodology used for concluding that homeownership is impossible for the eight states mentioned.

Methodology

Our study uses the most recent data available for all data sets. For average income, we used the Bureau of Economic Analysis Personal Income Report for 2020. For average home prices, we used the Zillow Index of Single Family Home Prices for April 2021. For average student loan debt by state, we used data from the Dept of Education Q4 2020 fiscal year report.

Assumptions and calculations can be reviewed here at the bottom of the post.