PivotalPath issues a monthly hedge fund performance analysis report, called the Pivotal Point Of View – which tracks roughly 200,000 data points across more than 2,000 institutionally-relevant hedge funds and $2.3T of industry assets. This month, given the focus on inflation and rising interest rates, they have created a special edition looking at what these concerns mean across various hedge find strategies and AUM bands.

Q1 2021 hedge fund letters, conferences and more

The Impact Of Inflation On Hedge Find Strategies

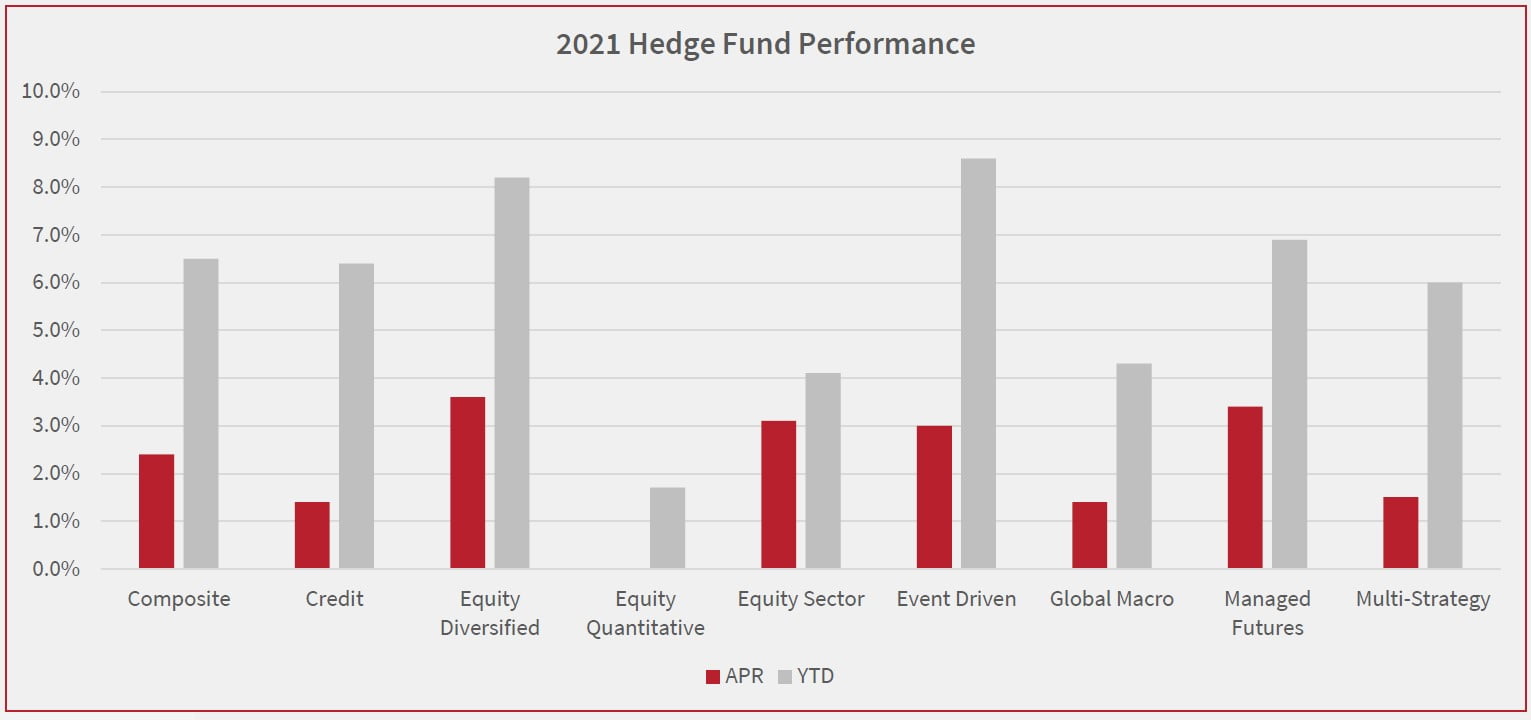

- First, a quick note on returns – 88% of managers reported positive monthly performance in April with over 86% of funds up YTD. Additionally, the PivotalPath Dispersion Indicator declined to 2.8 after remaining elevated in recent months.

- Inflation – For investors anticipating the rate of the 10-year climbing as the market prices in inflation, we offer historical guidelines based on 23 years of market and proprietary hedge fund data. We found that:

-

- When rates are in the process of moving up, the S&P tends to generate very strong performance, resulting in a high relative bar for hedge funds. During months when the 10-year yield increases, the S&P 500 has annualized at ~21.0% compared to ~12.0% for the PivotalPath Hedge Fund Composite.

- However, when rates arrive at their elevated destination (~3.0% for the purpose of this analysis), ALL hedge fund strategies outperform the S&P 500 substantially.

- More good news for allocators, when rates move back down, ALL hedge fund strategies outperform equities on the way. To wit, the PivotalPath Hedge Fund Composite Index annualized at approximately 9.0% to the S&P 500’s 1.0% return during those same periods.

- Lastly, at the strategy level, Equity Sector was mixed – Financials (+4.1% APR, 16.2% YTD) and Energy (+4.2% APR, +10.5% YTD) were among the top performers overall, while Healthcare (+1.2% APR, +1.1% YTD) and TMT (+3.9% APR, +2.8% YTD) were some of the worst.