Hybrid Electric Vehicles: A Stay of Execution for NiMH Batteries, Explores IDTechEx

Q4 2020 hedge fund letters, conferences and more

NiMH Batteries Are Still Commonly Used

When we talk about battery-electric vehicles, the lithium-ion battery is dominant; however, for full hybrid electric vehicles (those that have electric-only modes but do not plug-in), NiMH batteries are still the most common battery on the road. With the growing market for hybrid electric vehicles (HEVs), will this drive further demand for NiMH batteries and stop them from being eliminated from the automotive market?

The new report from IDTechEx on "Full Hybrid Electric Vehicle Markets 2021-2041" covers this topic along with the key players and geographical markets for HEVs. Battery and motor-generator technology is analyzed for HEV cars, buses, and trucks, giving forecasts for Li-ion and NiMH battery demand over the next 20 years.

Toyota is the ruling OEM in the global HEV car market, with over 60% market share in 2019. Other manufacturers have started to eat into this share over the years, but Toyota still reigns supreme. While the other OEMs have mostly transitioned towards Li-ion batteries for their HEVs, Toyota remains committed to NiMH batteries and HEVs for the foreseeable future, with the majority of their line-up now using either NiMH or Li-ion depending on the specifications. For the relatively small batteries that are used in HEVs, the NiMH is still sufficient to meet requirements. It is also much more technologically mature and lower cost than Li-ion.

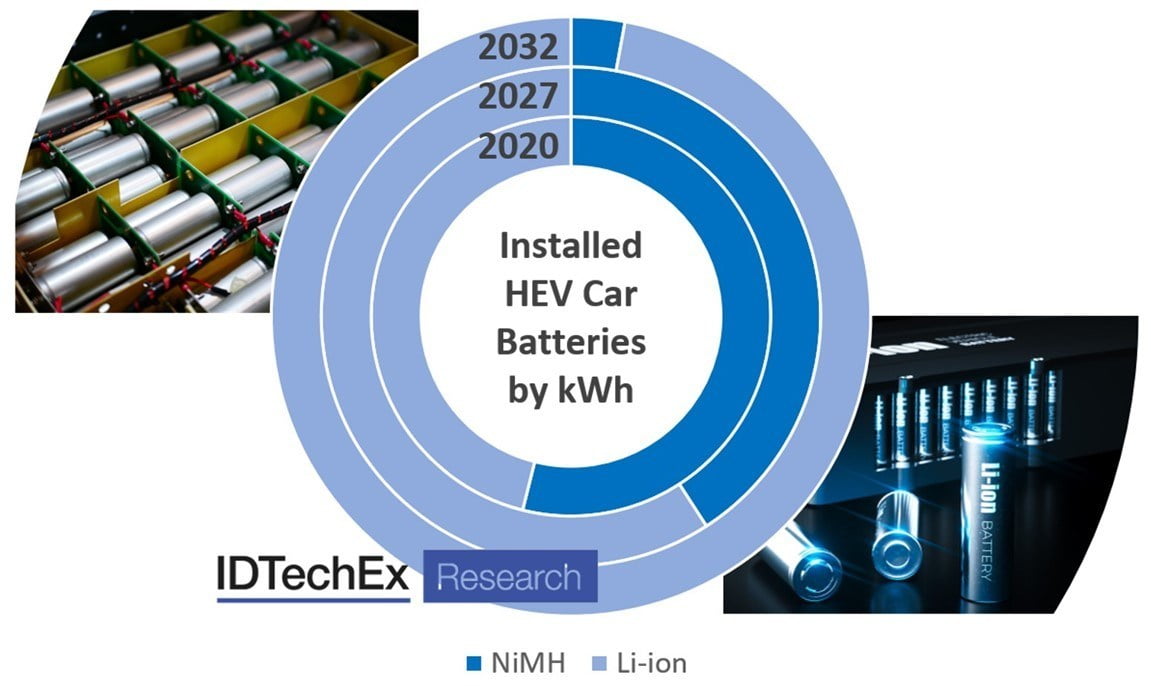

In 2020, NiMH batteries were still the dominant form installed in HEVs, largely due to Toyota. As Li-ion costs continue to fall and HEV battery capacity increases, NiMH are unlikely to remain competitive but will still see an increase in short term demand. Source: IDTechEx report: "Full Hybrid Electric Vehicle Markets 2021-2041".

Sales Of HEVs Continues To Grow

Sales of HEVs have continued to grow throughout the COVID-19 pandemic despite the downturn of the overall car market. This, combined with Toyota's dominance and NiMH portfolio, provides a good market for NiMH batteries, at least in the short term. Li-ion technology is still evolving and reducing in price; at a certain point, it may no longer be cost-effective to continue using NiMH. Additionally, fossil fuel bans are incoming, with countries like the UK banning purely internal combustion engine (ICE) vehicles by 2030 and only allowing hybrids "that can drive a significant distance with zero emissions". HEV manufacturers will likely increase the battery capacity in order to give more electric-only range, making the Li-ion option more appealing. Even with this stay of execution for HEVs, banning vehicles with ICEs of any sort is likely to follow shortly after. This will eliminate the HEV in many markets and hence the demand for NiMH.

IDTechEx recently published the report "Full Hybrid Electric Vehicle Markets 2021-2041". This report gives an in-depth look at the historic HEV market in China, Europe, Japan, South Korea, and the US, with an outlook over the next 20 years. An extensive model database of over 80 HEVs sold between 2015 and 2019 is used to determine the market's battery and motor-generator technology in addition to geographical markets and manufacturer market shares. The total cost of ownership calculations is compared with ICE and 48V hybrids, as well as how HEVs can help manufacturers meet new European emissions targets. For more information on this report please visit www.IDTechEx.com/HEV.