Sometimes the gun you legally have to protect your loved ones can pose a serious threat to them. This is where gun liability insurance can help create gun safety habits that will help you appropriately protect your family.

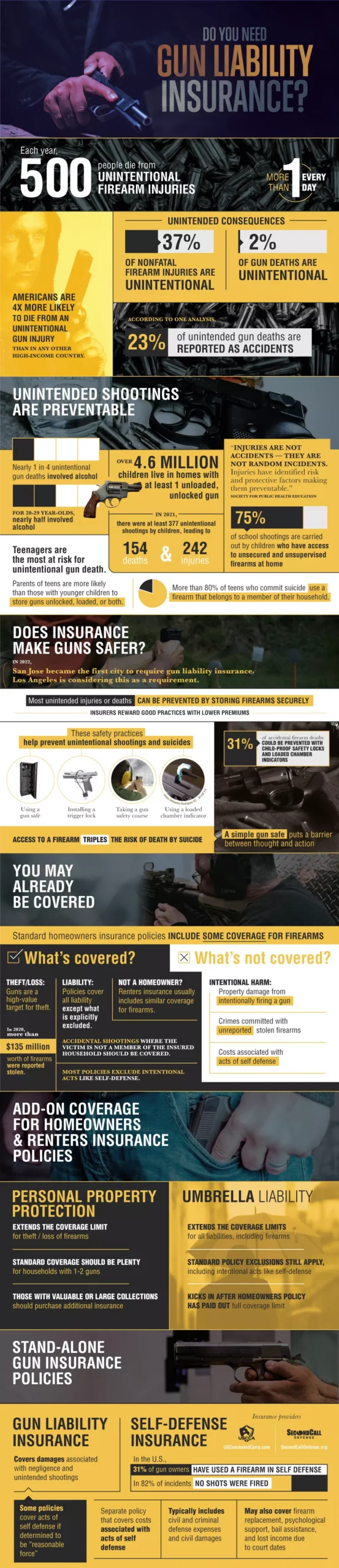

At least 500 people die every year from unintentional firearm injuries which is more than a person a day. Americans are actually more likely to die from an accidental gun injury than any other high-income country. Even if you own a gun with good intentions, there are several unintended consequences when it comes to owning a firearm. In fact, 23% of unintended gun deaths are reported as accidents while 37% of nonfatal firearm injuries and 2% of gun deaths are considered unintentional.

Q1 2022 hedge fund letters, conferences and more

However, many unintended shootings can be prevented. Almost 25% of unintentional gun deaths involve alcohol with the numbers going up to half of all cases for those in their twenties. Teenagers are the most at-risk age group for unintentional gun deaths as more than 80% of teen suicide involve a firearm belonging to a household member who stored the gun loaded, unlocked, or both.

In 2021, around 377 unintentional shootings by children resulted in 242 injuries and 154 deaths. With almost 5 million children living with homes that have at least one gun that is not safely stored, it is easy to see how 75% of school shootings are caused by children with quick access to household firearms.

Do You Need Gun Insurance?

Insurance doesn’t completely prevent unintentional deaths, but they can create good gun behavior and storing habits that lead to fewer casualties. Insurance companies provide incentives that can encourage more owners to pay more attention to gun safety. Securely locking firearms in a gun safe, installing a child-proof safety trigger lock, and taking a gun safety course are other ways accidental deaths can be prevented.

Homeowners and renters insurance provide some coverage for guns, but there are certain situations where insurance will not be able to cover the cost associated with damage, such as crimes carried out with a stolen firearm, any damage caused by acts of self-defense, and instances of intentional harm. However, theft or loss of firearms is covered as well as accidental shootings where the victim does not belong to the policyholder’s household. Liability is also covered in specific situations.

Add-on gun insurance coverage options are available with your basic homeowners and renters insurance policies. A personal property protection policy as well as umbrella liability extend coverage limits for any theft, loss, or liability issues.

If you don’t feel fully covered, you can purchase a separate gun insurance policy that covers any damages associated with negligence and unintended shootings. Some policies can also include coverage for psychological support and bail assistance. Another option you have is self-defense insurance which covers the costs related to acts of self-defense. This policy can even include coverage for civil and criminal defense expenses and damages.

If you own firearms, it’s a good idea to consider gun insurance coverage as well as learn the gun insurance options available to you and whether or not your firearms are already covered under your current insurance plans. Although gun liability insurance can vary depending on where you live, it’s important to consider all of your options so you can make the best decision for everyone’s safety.

Infographic source: USInsuranceAgents.com