The Broad Market Index was up 3.95% last week and 74% of stocks out-performed the index.

It was a busier update this week with 315 companies reporting financial statements to the Securities and Exchange Commission (SEC). The next two weeks will complete the third quarter update and give us a Macro Economic view of US corporate growth.

Q3 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

There was a pronounced shift in market behavior this month as stocks departed from bonds and advanced in a falling bond market.

That means that inflation expectations have moved into corporate growth and investors are recognizing that inflation is persistent and only corporate growth can defend against it.

Growth Is Falling

Our strategy has been to locate the portfolio in stocks of accelerating companies. Only rising growth can defend our money against rising inflation. The problem has been that 80% of companies report falling sales growth and 60% report a falling profit margin. Growth at most companies is falling.

We will get a renewed gauge of that in the coming weeks, but evidence shows that inflation is benefiting corporate growth.

So far, we have seen a timid policy response to the big jump in inflation. First the FED declared the increase in prices was temporary. Then finally this year responded to an inflation rate of over 8% with interest rate of 4%.

Mid-Terms

The timid approach may be a deference to the mid-terms but, as every monetarist knows, delayed response to inflation results in rising prices getting baked into expectations.

I have written before how inflation expectations are appearing in company pricing where prices are increased in anticipation of inflation rather than in response to it.

Once inflation is expected it takes a much more aggressive monetary policy response that will increase the cost of money (interest rates) but also decrease the availability of money. That can create a liquidity crisis in capital markets like the recent experience in the UK markets.

If the FED has been restrained by the mid-terms, then the best advice is to hit capital markets hard and fast after the election. It they continue to go slow, there will be a recession leading into the presidential election.

If the system is shocked into lowering inflation expectations by steeply higher interest rates and measured inflation falls in 2023, then the economy can be on a recovery path going into the presidential election.

In either case we can expect a long period of slower corporate growth either because high costs push down profit margins or recession pushes sales growth down.

Investors Do Not Wait. Get Ready For Active Management Now!

Now is the time for investors to incorporate quantitative tools to empower their portfolio management.

Any change in the direction of any of the principal components of earnings growth such as sales growth, gross margins, operating or financing costs, may be important indicators about future direction of the growth rate of the company. Graco Inc. (NYSE:GGG) is exhibiting a clear buy pattern.

Graco Inc. (GGG) $69.410 Buy This Rich Company Getting Better

Graco Inc. has been an exceptionally profitable company with inconsistently high cash return on total capital of 25.6% on average over the past 21 years. Over the long term, the shares of Graco Inc have declined by 8% relative to the broad market index.

The shares have been highly correlated with trends in Financial Condition Factors. The dominant factor in the Financial Condition group is shareholders capital(inverted) which has been 91% correlated with the share price with a five-quarter lead.

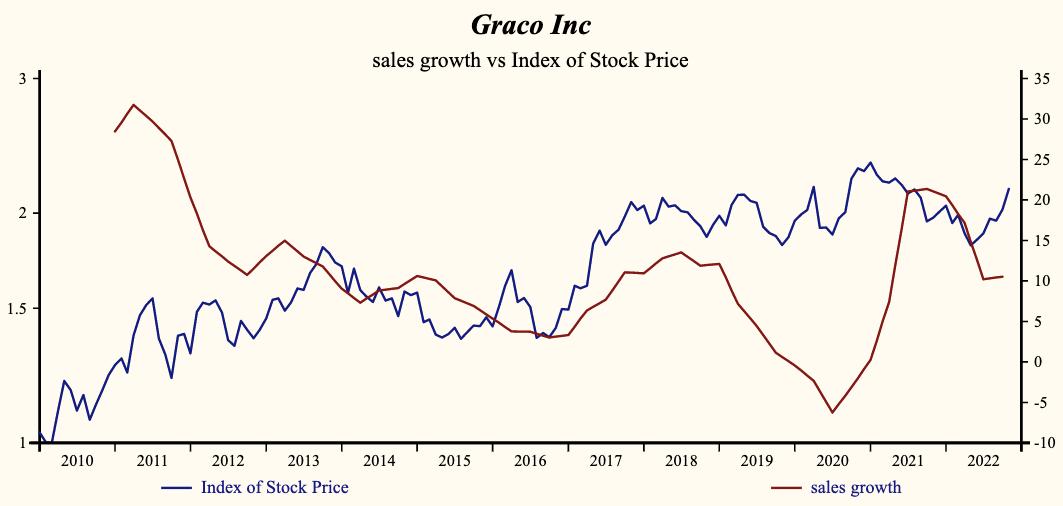

Currently, sales growth is 10.5% which is high in the record of the company and higher than last quarter. The shares have been very highly correlated with the direction of sales growth.

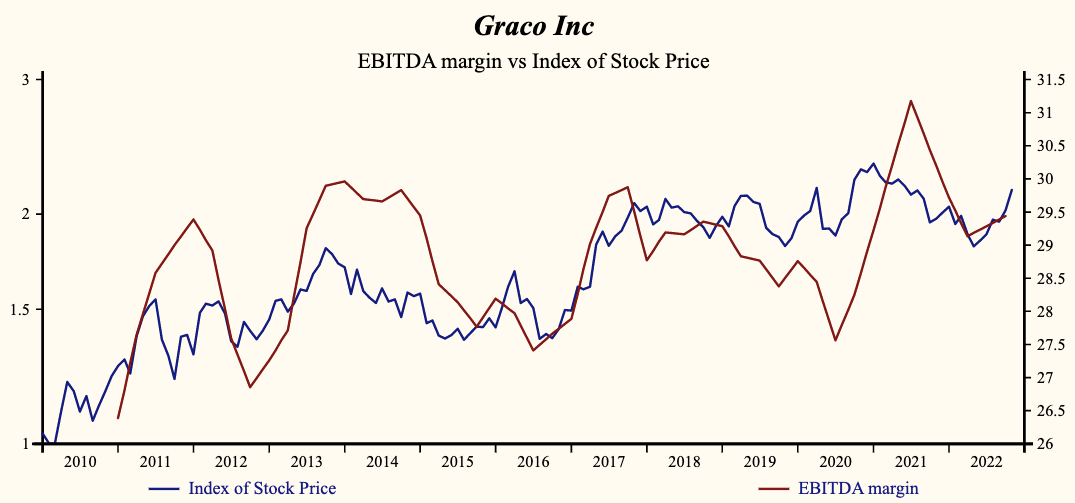

The company is recording a falling gross profit margin but SG&A expenses continue to fall producing a leveraged acceleration in EBITD relative to sales.

The current indicated annual dividend produces a yield of 1.4%. Five-year average dividend growth is 12.9%. Current trailing operating cash-flow coverage of the dividend is 3.8 times.

The shares are trading at upper-end of the volatility range in a 22-month falling relative share price trend. Despite the recently extended share price, the broad improvement in fundamentals forces a reversal of Otos June, 2022 sell decision and provides a good opportunity to buy the shares of this evidently accelerating company.

The more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.