New S&P Analysis: Fintech M&A 2020 Deal Activity Tracker – Mastercard goes on shopping spree

Q2 2020 hedge fund letters, conferences and more

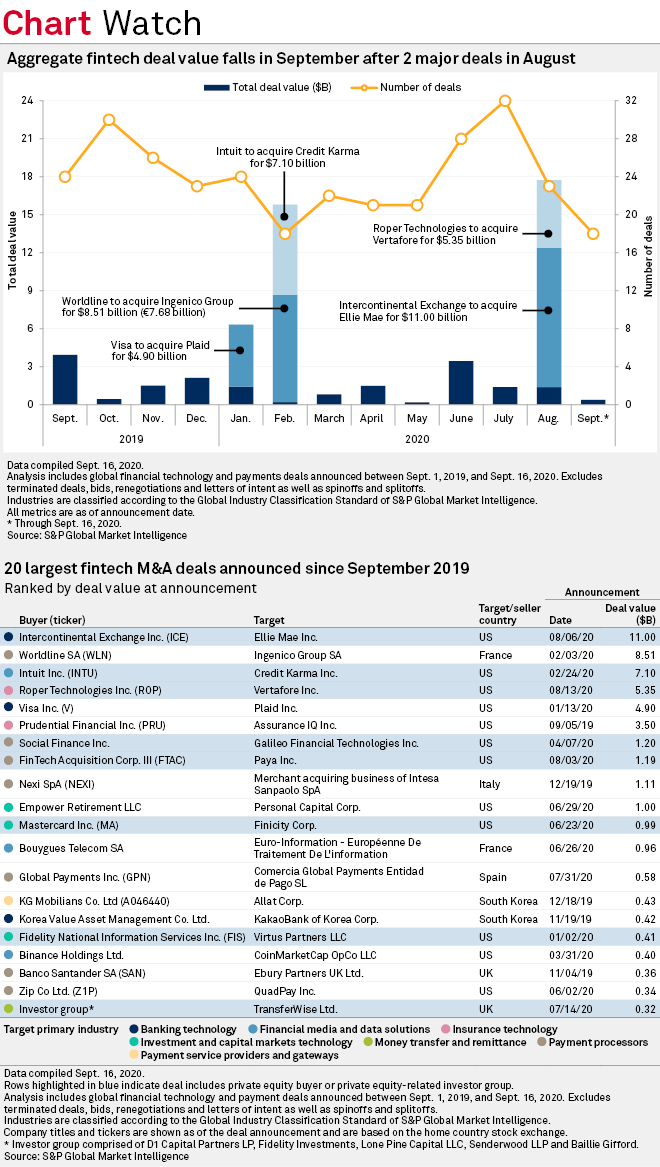

According to a new S&P Global Market Intelligence analysis, even in the teeth of the pandemic, there has been a steady flow of financial technology mergers over the $1 billion mark. Global card networks, and Mastercard Inc. in particular, have been important drivers of M&A activity this year.

Key highlights from the updated fintech M&A tracker include:

- Mastercard and its peers are using fintech acquisitions as a way to reinvent themselves and to signal to the market that they are more than just a set of payment rails, industry observers say.

- Visa Inc. set the tone with its $4.9 billion cash acquisition of California-based Plaid Inc. in January. Plaid provides application programming interfaces, the technology that sits at the heart of Open Banking.

- For Mastercard, the deal follows hot on the heels of its deal to acquire a unit of Danish-based payments company Nets Holding A/S for $3.19 billion in August 2019. The company's acquisitive streak has continued, with an agreement earlier this September to buy Australian payment services firm Wameja Limited for $126.1 million.

- American Express Co. struck an agreement during August to buy Kabbage Inc., a digital lender focused on small and medium-sized enterprises. The deal value has not been disclosed publicly, but American Express is understood to be buying Kabbage's tech and platform, but not its loan book.

Fintech M&A Activity: Mastercard Goes On Shopping Spree

Even in the teeth of the pandemic, there has been a steady flow of financial technology mergers over the $1 billion mark. Intercontinental Exchange, Inc. announced the $11 billion acquisition of mortgage software provider Ellie Mae Inc. in August, completing the deal earlier in September, while software firm Roper Technologies Inc. announcing its $5.35 billion purchase of insurtech company Vertafore Inc. in August, also going on to finalized the deal in September.

Global card networks, and Mastercard Inc in particular, have been important drivers of M&A activity this year. Mastercard and its peers are using fintech acquisitions as a way to reinvent themselves and to signal to the market that they are more than just a set of payment rails, industry observers say. In some cases, this is motivated by a desire to stay relevant in a world where an increasing number of transactions bypass credit and debit cards entirely.

Read the full article here by S&P Global Market Intelligence