The latest issue of ‘The Globe‘, Eurizon’s publication describing the Company’s investment view. In this issue, a focus is dedicated to “To what extent are central bank hikes priced in?”.

Scenario

The fight against inflation undertaken by the central banks remains the main focus theme for investors.

The US inflation reading for May outline another increase again, prompting the Federal Reserve to accelerate its rate hike cycle; futures are now pricing in a point of arrival for the fed funds rate at 3.5% by the spring of 2023. The ECB has also taken a hawkish stance, announcing that will start hiking rates at the end of July. Futures are pricing in EONIA rates on the rise to close to 2% in the middle of next year.

Q1 2022 hedge fund letters, conferences and more

In light of such a swift monetary restriction, investor focus could well shift from inflation to the economic slowdown. If so, medium and long-term government bond yields should stop rising, while the stock markets would remain volatile in waiting to assess the impact of the economic slowdown on corporate earnings.

Among other themes, the war in Ukraine is still being closely monitored by investors, for its impact on oil prices, while the dragging on of the war itself seems to have been priced into the scenario by now.

In China, the monetary authorities are easing credit conditions and lifting the lockdowns enforced to contain Covid. The Chinese economy could therefore reaccelerate after slowing in 2021.

Macro Economy

- US inflation continued to increase in May but will probably peak soon. Both in the United States and in the Eurozone, macro data have started to show initial signs of a weakening.

- The Fed accelerated the pace of its rate hike cycle in June (+75 basis points). The markets pare pricing in fed funds at 3.5% next spring. The first ECB rate hike is expected in July.

Asset Allocation

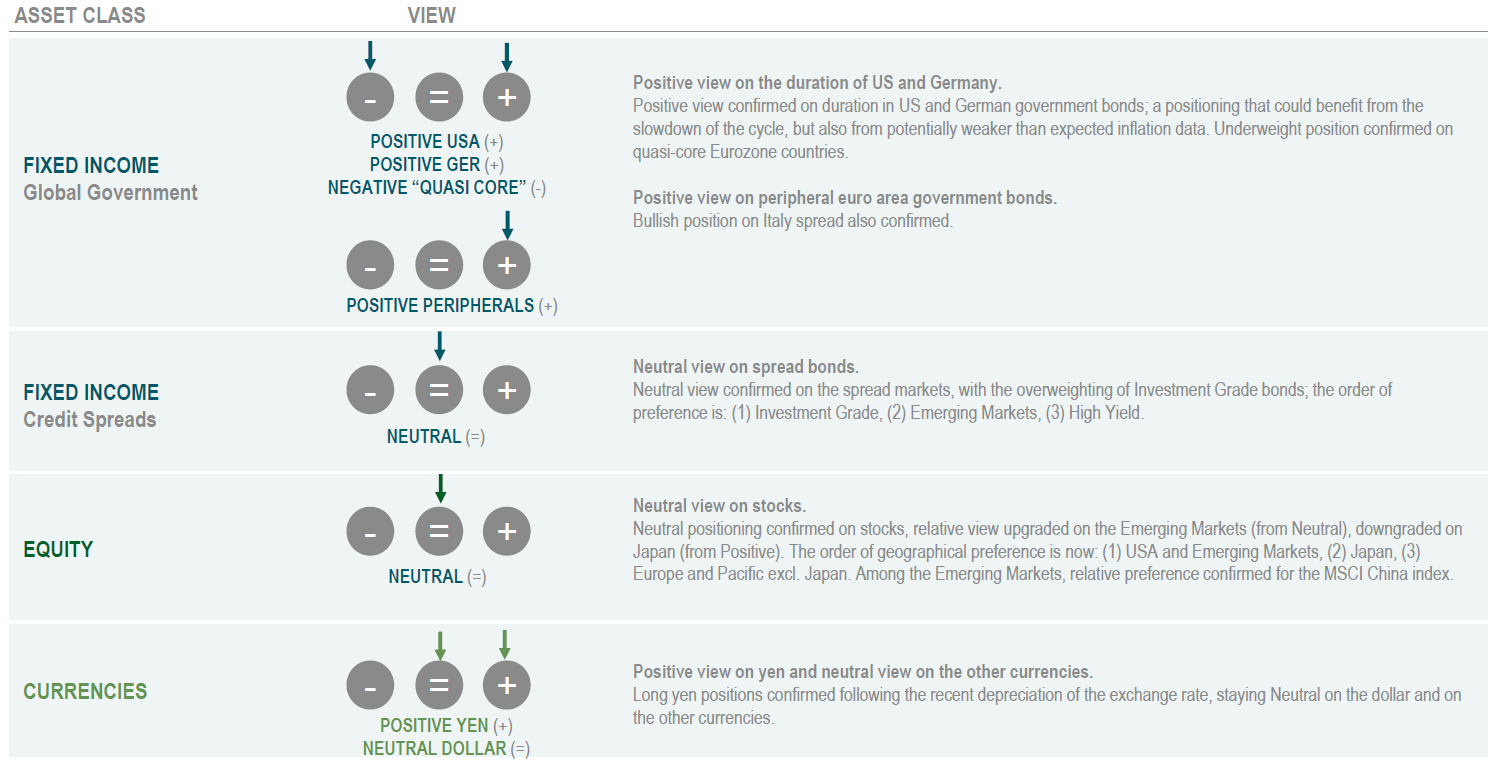

- The swift monetary tightening process may shift investor focus from inflation to the macro slowdown, resulting in a stabilisation of medium and long-term rates.

- The overweight position on US and German government bonds is confirmed, while staying neutral on stocks.

Fixed Income

- Overweighting confirmed of US and German government bonds, that could benefit from the slowdown in growth.

- Among spread bonds, a preference still goes to Italian government bonds and to Investment Grade bonds, whereas the context for High Yield and Emerging Market bonds still appears uncertain.

Equity

-

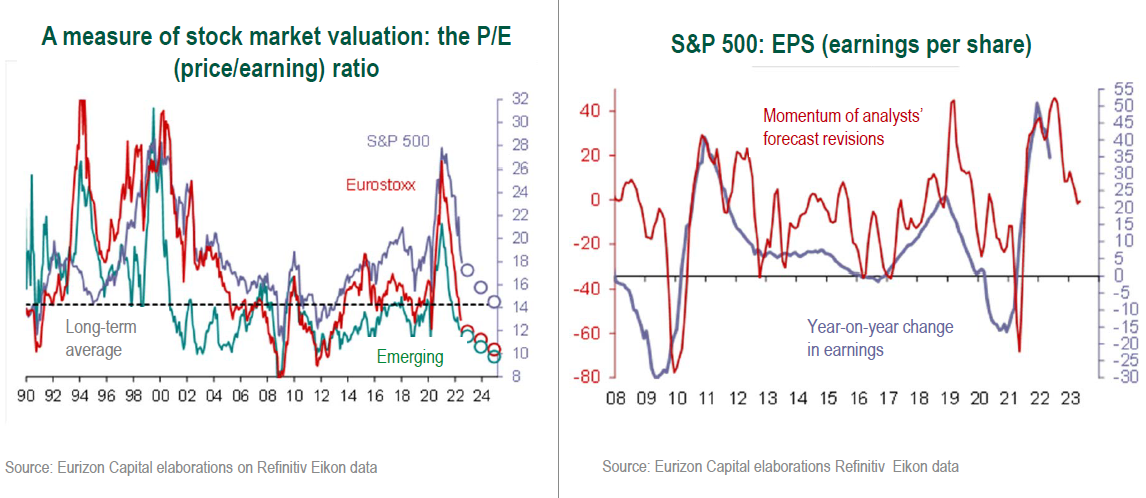

- Stock market valuations dropped to historically appealing levels, although earnings could be revised down in case of a macro slowdown.

- By geographical region, Europe could continue to be affected by the conflict between Russia and Ukraine. Among the major markets, a preference is awarded to the US, and exposure is being increased to the Emerging Countries, and China in particular.

Currencies

- The Fed’s restrictive policy turn seems to be largely priced in by the dollar, that could interrupt the uptrend observed since the beginning of 2021.

- Long yen positions maintained.

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Investment View

Our baseline scenario contemplates a progressive slowdown in economic activity, while the central banks press on with their monetary tightening. Medium and long-term government yields could in part reverse their uptrend, while the stock markets could stay volatile.

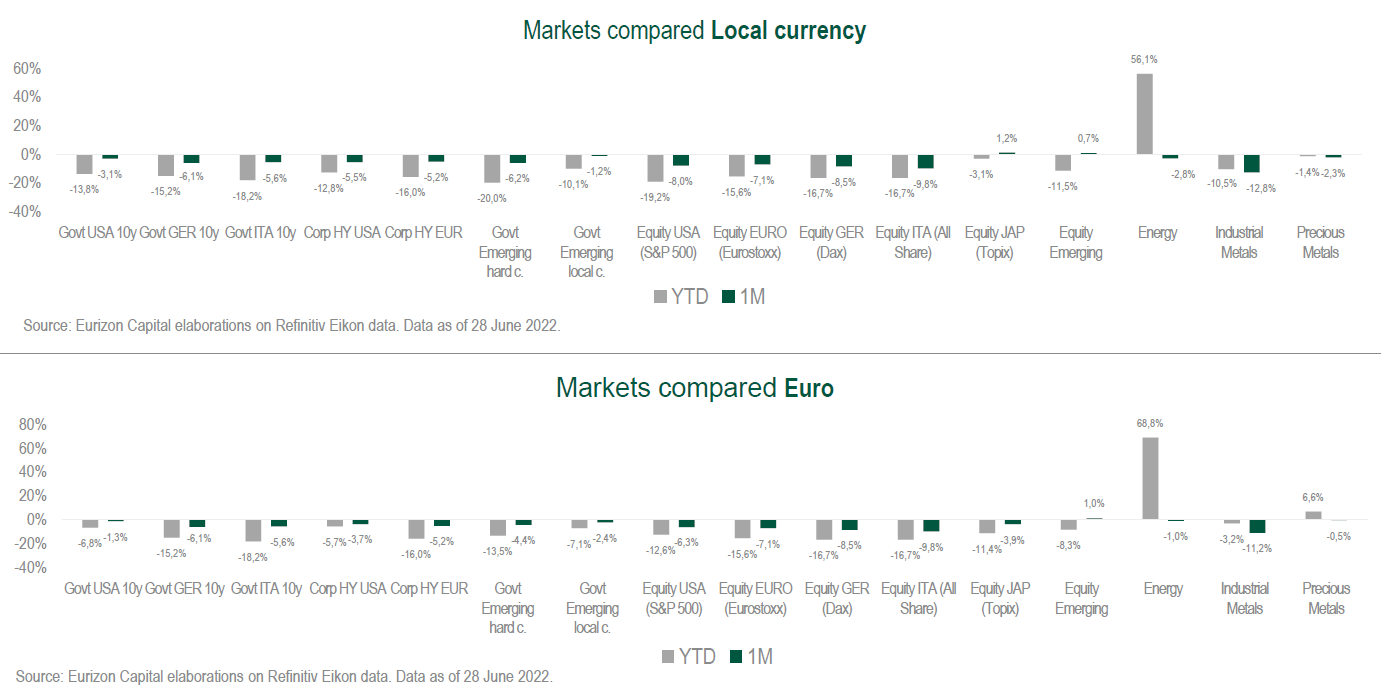

Asset Classes Compared

Government bond yields rose sharply until mid-June, then dropped back in part subsequently. Peripheral euro area spreads widened sharply, then narrowed back following the ECB’s verbal intervention. The stock markets incurred losses, with the exception of China. Dollar stabilising in the 1.05 area against the euro.

Theme Of The Month - To What Extent Are Central Bank Hikes Priced In?

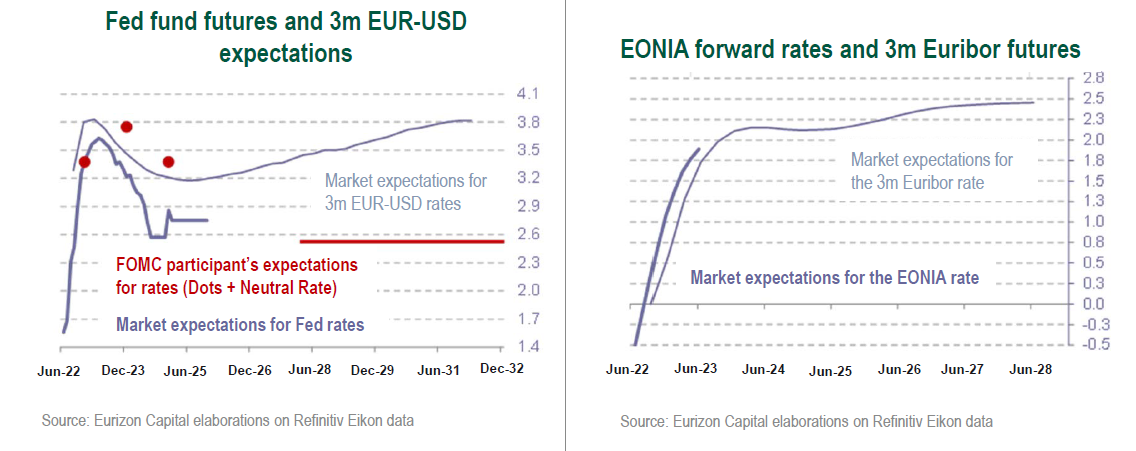

- The Fed has hiked rates three times since the beginning of the year, and has done so at an accelerating pace, with 25, 50 and 75 basis points moves. Based on the Dot Plot, the FOMC envisages a fed funds rate of 3.38% at the end of this year, from 1.6% at present, with a point of arrival of 3.75% in 2023. Rates are then seen to drop to 3.38% in the closing months of finale in 2024.

- After the latest 75 basis points acceleration, on the other hand, the market lowered its forecasts, indicating that at the present pace of tightening the economic slowdown, and the desired decline of inflation, will materialise sooner than expected. Based on fed funds futures, the 3.38% target for this year will be reached, then the upswing will virtually be over. In fact, the Fed should cut rates by around 1% by mid-2024 to contain the economic slowdown.

- When broadening the horizon by considering 3- month rate futures, however, the market emerges as not pricing in a full-fledged recession, but rather a mini-recession, with rates on the decline up to 2024, and then gradually on the recovery, resulting in a more balanced cycle subsequently.

- What about the ECB? EONIA forward rates, and the rates on 3-month deposits, project a peak at around 2% in the second half of 2023, followed by a stabilisation, and subsequently a slow upward reversal.

- If the point of arrival of the fed funds rate is around 3.5% at the beginning of 2023, with the EONIA at 2% in the same period, to what extend are the Fed and ECB’s forthcoming hikes priced into the government yields curves?

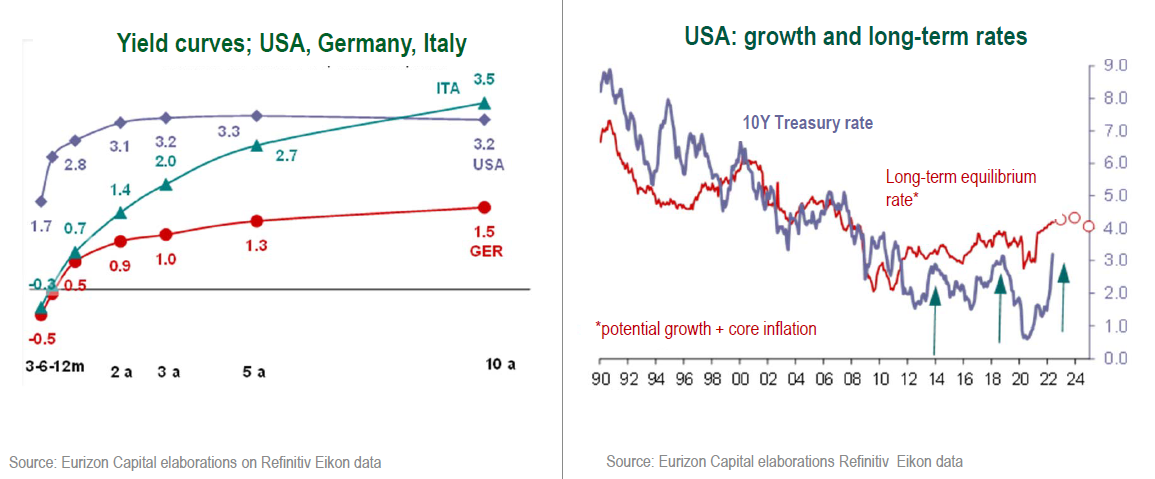

- In the US, for several weeks now the curve has been flat from the 2-year maturity onwards, at between 3% and 3,5%. The curve shape reflects expectations for a swift rise in near-term rates this year, followed by a downturn in 2023 to contain the slowdown.

- From these levels, if the Fed manages to guide the economy to a soft landing, medium- and long-term rates could gradually drop in the months ahead, rising back once the risk of hard landing (minirecession) will have been averted. By contrast, a hard landing would result in a sharper drop in medium- and long-term rates.

- In the Eurozone, spreads are making it harder to estimate to what extent the hikes are priced in. In Italy and Germany, government bond yields are respectively 3.5% and 1.5%, on average 2.5% higher than the forecast level of the ECB rate. In this case as well, we may say that, on average, the ECB’s forthcoming hikes are priced in.

- Both curves seem to hold appeal, both assuming a soft landing and, even more so, in case of a mini-recession.

- What the stock markets are pricing in is objectively less measurable. However, it should be said that this year multiples (P/E ratios) have contracted significantly, with markets on the decline as opposed to ongoing (still now) earnings growth.

- Multiples for the Eurostoxx index and the Emerging Markets indices are in line with the lows hit during previous crises. Multiples on the world’s leading market, i.e. the US, are not yet at extreme levels, but seem to be closing in on their long-term averages. These observations are not sufficient to claim that stock indices have reached their troughs; however, in a medium-long term perspective, these valuation levels are typically appropriate to start progressively building up positions.

- At these levels, multiples are almost certainly pricing in the soft-landing scenario, a materialisation of which would result in an upward reacceleration of stock indices. In case of a mini-recession, on the other hand, a lowering of earnings estimates should be put into account. The smaller the recession is perceived as being, the likelier the downward revision of earnings will be balanced by a resumption of the uptrend in multiples.

- The markets are not pricing in a great recession in 2008 style, an event that seems by all accounts unlikely. Businesses and consumers are entering the present slowdown phase showing solid balance sheets. The global economy needs to slow in order to remove some excesses, but is not in need of a sweeping restructuring.