Energy Vault Holdings Inc (NYSE:NRGV) is a $1.1B market value development-stage company that recently came public via a merger with the SPAC Novus Capital Corporation II. The company claims to have a simple, cost-effective gravity- based energy storage solution. However, the concept and company claims have been criticized and debunked by numerous sources. Moreover, it looks to be a simple repackaging of a failed concept previously launched by two NRGV founders.

Announced deals and relationships do not engender confidence in the business. The company has a history of customer and project announcements that never materialize. We think the probability of the company achieving projected revenue in 2025 of $2.8B using a system that has yet to be built approaches zero.

Q2 2022 hedge fund letters, conferences and more

Pre-IPO financings with low-priced stock makes the company look purpose-built to generate profits for insiders and other incentivized parties by creating a plausible enough story.

A debunked technology, clear profiteering, and a history of hollow deals with dubious partners lead us to conclude that NRGV will never have a viable business based on gravity-based energy storage. We think this is yet another de-SPAC’ed company with a flashy investment presentation and aggressive revenue projections with no real product - and a stock that trends down to $0. The lock-up ends on August 10th.

Issues include:

Is it too good to be true? Yes. NRGV’s technological concept involves storing energy by lifting and stacking blocks of cement/composite when electricity is cheap, and lowering the blocks to release energy and generate electricity when demand increases prices. The system has never been commercially implemented and the new version has never been built. Numerous sources have debunked NRGV’s claims calling its solution “very silly in obvious ways” and a “carbon-laden mechanical failure.”

Insider early investor profiteering – Executives of the SPAC sponsor personally invested in NRGV along with insiders a pre-IPO financings that exploited the SPAC process to generate low to no risk returns of 4.5x. We believe the financings which look like sure things were likely key to incentivizing parties to get the deal done.

Déjà vu – We have seen much of what NRVG is presenting and saying before. Company founders failed with a similar concept that stored energy by moving gravel; allegedly it could be built “virtually anywhere there is a hill”. In 2018 and 2019, the company announced its first deal and spoke of working with 150 customers with projects on every continent. Nothing ever materialized from the 2018 and 2019 customer base. We expect more of the same and doubt the company’s current ‘customers’ will result in a system deployment or material revenue.

Troubled relationships and partners –Key customer DG Fuels has a documented history of announcing large projects that never come to fruition. The deal in which NRGV is participating has been around in various forms since 2013, leading us to conclude it is a chimera. We estimate that more than 100% of the net proceeds from Palantir’s participating interest in the PIPE will be returned to the company in the form of software purchases. Palantir did not invest in NRGV, it financed the purchase of its own software.

Storing Energy by Lifting Blocks of Cement: Too Good to be True?

Renewable energy has a problem with the mismatch between the timing of energy production and consumption. As such, energy storage is a critical issue in the industry. Currently, large batteries provide something of a solution, though not perfect by any means.

Energy Vault provides what appears to be a simple environmentally friendly solution. The basic idea is that when electricity is cheap, a series of cranes raise and stack heavy blocks. When high demand makes electricity expensive, the cranes lower the blocks powering turbines that generate electricity. As the company likes to point out, conceptually it is similar to the principal of pumped hydro stations, which have been around for more than a century.

The only system constructed has been a prototype in Switzerland. The pictures below show the Swiss system and a computer rendering of a new design.

Source: Top left, company presentation, right Thunderf00t Mega Busted video, bottom company presentation.

The top two pictures show the prototype – a series of cranes fitted with wires that lift blocks of what appears to be cement. It is a prosaic, unsophisticated construct. However, on the bottom we see a computer rendering of EVx, the company’s version 2.0. This sleek, futuristic version has yet to be built.

In the company’s 1Q22 presentation, EVx is described as a flexible, modular solution with core proven technology. The company notes it can be built “anywhere you can put a building”.

The company’s seemingly common sense approach to storage has garnered some attention in the business press, such as this one from Forbes.

While there are a few positive puff pieces available, it is easier to find information challenging the company’s concept of gravity-based energy storage. Numerous sources have produced credible pieces debunking NRGV’s claims. This video provides numerous, compelling reasons why NRGV’s technology not viable.

The clean energy website CleanTechnica has published several articles on Energy Vault. In this one Energy Vault’s concept is termed “terribly silly in obvious ways”. This one calls the solution an “ineffective, expensive, carbon-laden mechanical failure”.

This article originally from 2019 and updated in 2021 notes a “thousands of single points of failure” with the company’s concept. The update took place at the time of the $100M Series C funding. The author found the investment surprising, particularly given changes in claims: the company reduced its round-trip efficiency claims, reduced tower height, and reduced storage duration.

We provide a possible explanation for why investors were attracted to the Sereis C round below.

Commercial Applications or Hot Air?

Thus far, the only scale application has been the company’s tower in Switzerland, which will be taken- down over the next several quarters. However, the company has put out guidance of $148M in revenue for the year based on projects in progress, the most prominent of which is with DG Fuels.

On the conference call, management stated that there is a possible $737M in revenue from three DG Fuels projects. The relationship is complex and the projects appear questionable.

In October 2021, NRGV invested in a DG Fuels sustainable aviation fuel (SAF) project. DG Fuels was paid $1M by NRGV, and DG Fuels has pledged to purchase $520M of products from NRGV. We find the cash ‘round-trips’ troubling. Additionally, there are problems with both DG Fuels and the deal.

Both CleanTechnica and the investment firm 1791 discuss DG Fuels and its principal, noting he has been involved in many large projects that have been announced, but never materialized.

An Article from Rethink Research raising further doubt on the viability of the DG Fuels deal. According to the article, DG Fuel’s deal to supply SAF was initially announced in 2013. The deal to supply GE aviation with SAF came back in 2016 as well. Given the long history of the deal, it is difficult to believe that it will now come to fruition using a new version of the company’s gravity storage system that has never been built.

Rethink Research concluded the article with “Our key concern here was that if Energy Vault doesn’t have a better deal than this to show the public, then it clearly has few deals, which reduces its chance of long term success.”

Management also discusses the deal with Enel Green Power on the 1Q22 conference call, noting that work should begin in earnest on the Texas project in 2H22. Part of the Enel deal that leads us to question its importance.

Enel's announcement focuses more on the fact that Energy Vault will be using recycled wind turbine blades than on the company’s storage. In renewable parlance, it is circular sustainability. Enel finds this attractive because decommissioned wind turbine blades are a composite material reinforced with fiberglass that is difficult to recycle or reuse. If NRGV can incorporate those into its blocks, it helps reduce the pollution and waste associated with wind energy. In other words, Enel has other interests in play.

We are skeptical that either of these key relationships discussed will lead to a sustainable commercial application, both due to the deals themselves and the history of the technology and company itself.

Déjà vu - Same Old

Before there was Energy Vault, there was a company called Energy Cache. Energy Cache was founded by NRGV founders Aaron Fyke and Bill Gross in 2009. Gross’ IdeaLab is a significant owner of NRGV.

Energy Cache was a company based an idea very similar to that of Energy Vault. It was a gravity-based mechanical battery using gravel. Like NRGV, Energy Cache made comparisons with hydro pump storage. This system was to move gravel up a hill to store energy and down to release it. Here is the promotional video and the article on the company.

According to an article, Energy Cache’s system could be installed “virtually anywhere there is a hill”, which sounds a lot like the current selling point of ‘anywhere a building can be built’. The company failed.

Energy Vault appears to have simply repackaged the gravel system into one moving cement blocks using cranes.

In addition to recycling the technology, discussions of customers and customer engagement echo with the past.

This article from 2018 in Energy Storage New discusses NRGV’s deal with Tata Power. Tata Power allegedly purchased a 35MWh storage system that was to be built in 2019. The article notes that the company claimed that further versions of the product could double nominal capacity and peak power output, and that it had “initial agreements with customers on multiple continents”.

We could find no evidence that the Tata facility was every built.

Similarly, this generally favorable article from 2019 discusses costs and customers. The company addresses costs in its presentations, but vaguely stating that the levelized cost is low. In the article, CEO Piconi said that pumped hydro had a levelized cost of storage (LCOS) of $0.17/kWh. He stated that NRGV’s solution at the time had a LCOS ~70% below pumped hydro at $0.05/kWh as calculated. Additionally, Piconi said that it was around 50% cheaper than battery storage.

Regarding business prospects Piconi is quoted as saying that the company was “working on many large projects on every continent globally with more than 150 customers”.

What happened to all these customers and deals? One would think that if not Tata then one of the other 149 customers would have resulted in a completed project, particularly if the technology has such a dramatic cost advantage over competing solutions. As far as we can tell, the company has never completed a commercial project. This is confirmed in the company’s SEC filings. The 1Q22 10-Q states that ‘prior to January 1, 2022, the company did not recognize any revenue”. In our view, the absence of revenue in previous years means there were no customers or projects.

It is difficult to take the company’s current claims at face value given this history.

Neither Investor Nor Vendor

It is often difficult to discern the relationship between NRGV and customers/investors. As noted by 1791 management in a presentation on Energy Vault, Saudi Aramco, accounting for one of eight purported deals, appears to be both investor and customer. Palantir Technologies involvement in NRGV is problematic as well.

Palantir (PLTR) is a software company, exemplifies the two-sided nature of NRGV’s dealings. PLTR invested in the company’s PIPE, and as noted the SEC correspondence quoted below, NRGV buys software from PLTR.

PLTR invested in NRGV’s SPAC and NRGV purchased software from PLTR. Cash goes in one door and out another. The terms of the deal contained Exhibit 10.39 show that NRGV is to pay PLTR a total of $7.5M.

NRVG’s IPO and PIPE raised gross proceeds of $235.8M and net proceeds of $191M, implying that 19% of capital raised went out the door as fees. Applying this to PLTR’s $8.5M investment implies that fees $1.6M were paid to the bankers leaving the company with ~$7M and a commitment to pay PLTR $7.5M.

What is described here is a kind of window dressing. It is neither a real investment for NRGV nor a real software sale for PLTR, though it creates the appearance of both.

Pre-IPO Financings that Enrich Early Holders and Incentivize Investors

NRGV conducted a number of financings in the year prior to merging with Novus Capital. They include insiders, early investors and a few funds that seem to specialize in investing in SPACs.

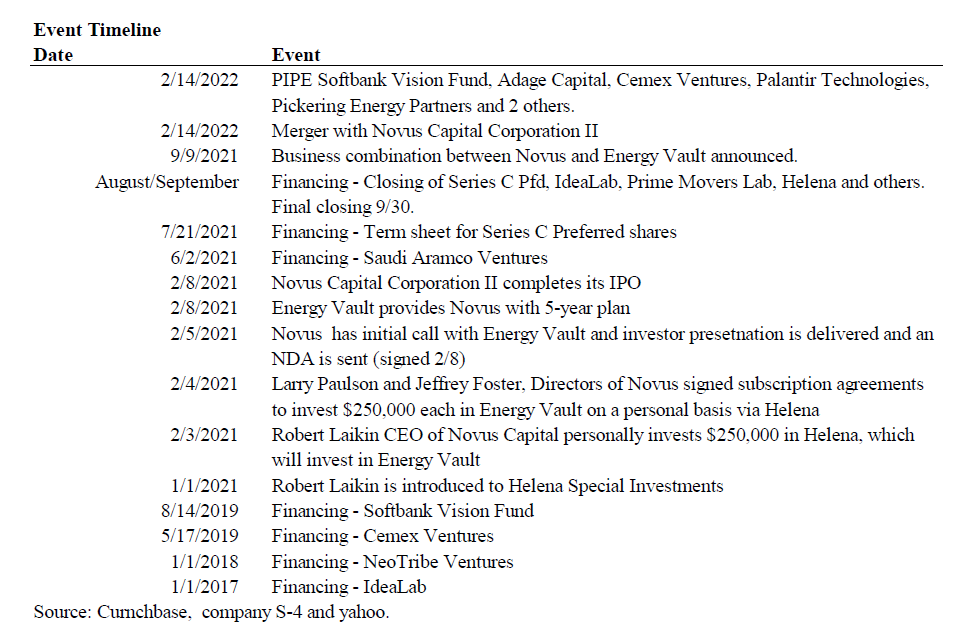

The first transaction involves executives of Novus Capital, the SPAC with which Energy Vault merged in February 2022. In the table below we provide a summary of events largely taken from the ‘background to the merger’ section of the company’s S-4. The exhibit provides a basic timeline of events that helps put the financings in the proper context.

The timing of the personal investments made by executives of Novus is astounding. According to the company’s S-4, in late January 2021, just prior to Novus’ IPO, company CEO Mr. Laikin was introduced as an individual investor to Sam Feinberg and Henry Elkus of Helena Special Investments, which had an special purpose vehicle to invest in Energy Vault. Mr. Laikin was given a ‘general, high-level explanation of Energy Vault”. Based on the discussion, Mr. Laikin requested a $250,000 allocation and suggested Helena speak with his colleagues Mr. Paulson and Mr. Foster.

A few days later on February 3, 2022, Mr. Laikin invested $250,000 and Mssrs Paulson and Forster committed $250,000 each.

The three executives personally committed a total of $750,000 prior to obtaining any detailed information on the company. It was not until February 5, that an NDA was circulated, they were given an investment presentation, and had an initial conference call with the company. Financial projections came on February 8th with the executed NDA.

On the same day Laikin et all received the financial projections and signed the NDA, their SPAC Novus Capital Corporation II completed its IPO.

With personal investments of its executives already in place, Novus began due diligence on Energy Vault as a merger candidate. On March 9, 2022, Novus sent Energy Vault a letter of intent. To account for the conflicts of interest, Novus formed a special committee which determined the deal was in the best interests of the company.

On September 8, 2022, Novus and Energy Vault made a joint announcement with respect to the merger.

The timing of events as describe in company filings is unsavory, at best, with professional investors allegedly committing nearly $1M on a personal basis prior to having any material company information. Then, after reviewing over 100 possible transactions, determined that Energy Vault was the best opportunity for the company.

The conflicts are clear, but the come into further focus when viewed in further detail.

NRGV conducted two series’ of financings prior to the IPO. Between December 2020 and May 2021, the company raised ~$55M in Series B1 preferred stock. This included Helena, the SPV in which Novus’ executives invested.

The company began another financing round in July 2021 for the Series C Preferred. The deal had a preliminary close on August 30th and final close on September 30th. The Series C round included Bill Gross’ Idealab, Prime Movers Lab, a VC firm that counts motivational speaker and life coach Anthony Robbins as a partner, and Helena’s SPV.

It should be noted that the closing of the Series C financing, in which early investors and Novus executives indirectly participated, took place after the September 8th merger announcement between Novus and Energy Vault. There was a pending public market valuation. Given the timing of the events, we can assume that it was a low to no risk deal. The question is, how good a deal was it?

An Excellent Deal If You Can Get It

We examined a number of filings looking for the conversion ratio for the private preferred stocks into public common to determine the cost basis of the Series B-1 and Series C shares, but could not find it. However, we did find different disclosures that allowed us to estimate the cost basis.

The accompanying exhibit contains both our conversion estimates and the estimate of price paid for both the Series B-1 and Series C preferred stocks.

We then converted Helena’s Series B-1 and Series C positions into common shares and used their total consideration paid to determine the $2.23 price per share. As investors in Helena, this represents the cost basis for the Novus executives as well.

After completing this work, we found a reference to stock cost basis in SEC correspondence from April 8, 2022. In it, the company agrees to disclose the cost basis of legacy NRGV shareholders.

We followed the lead to the company’s second amendment to the S-1 filed on April 8, 2022. The document gives the cost basis for Helena’s shares, which is very close to our calculations. The S-1 states that Helena’s Series B-1 shares converted into the public common with a cost basis of $2.14; the Series C converted at a price of $7.24. This implies an average price for Helena and the Novus executives of $2.57 per share.

The filing also has an exhibit showing that management affiliates purchased 1.61M or 75% of the total 2.1M shares in the Series B-1 financing.

The company’s timeline indicates that as the Series B-1 rounds were closing that the letter of intent was being signed. It was almost a done deal. By the final closing of the Series C round, the deal had already been signed. The Novus executives locked-in an estimated average price of $2.57 after the value at $10/share had been struck. The executives of Novus, by using the SPAC to merge with NRGV, generated a 4.5x return on their personal investment.

In our view, these were deals designed to guarantee profits to certain insiders and early shareholders. Further, the profit motive may have played a role in attracting investor/partners and even the SPAC sponsor.

The NRGV lock-up ends on August 10th.

Company Forecasts Should Be Dismissed

Management has provided guidance from 2022 to 2025, which we provide in the table below as a point of reference. Thus far in 2022, the company recorded revenue of $43M for the sale of intellectual property to DG Fuels. Recall, NRGV invested an undisclosed amount in DG Fuels in October 2021. $30M of the sale is in accounts receivable. No other such sales are expected. Cash stands at $300M or $2.24/share.

We would point out that revenue and EBITDA ramp quickly to $1.5B and $366, respectively, in 2024. Yet, the company has never built or tested the version of the EVx version of the system it is selling, the concept of which, according to third-parties, does not work.

Given the absence of a product, we do not expect the company to achieve its revenue projections. However, holding out the hope of outsized growth may convince a few investors to hold the stock for a short time, helping to stave off the inevitable.

About The Author

Keith Dalrymple is a Principal of Dalrymple Finance, a boutique firm providing investment research and related advice to hedge funds and other institutional investors. Dalrymple Finance is best known for exposing the fraudulent Gerova Financial, which was featured in the Wall Street Journal, New York Times and other publications.