What’s New In Activism

Elliott Management has built a large stake in cloud storage company Dropbox (NASDAQ:DBX), according to a report by the Wall Street Journal.

Q1 2021 hedge fund letters, conferences and more

Elliott informed the company that it is the largest shareholder after CEO Drew Houston, suggesting it controls more than 10% of the shares. Elliott and the company have been holding discussions since earlier this year, the Journal said.

Houston controls 71.6% of the votes via a dual-class share structure, which makes Dropbox an unusual target for Elliott, or any activist. This could show the dearth of activism opportunities in the U.S., or that activists are becoming bolder.

As a result of underperformance, Dropbox has been rumored to be a takeover target for some time. Dropbox peer Box has also underperformed and faces pressure from Starboard Value to pursue a sale, although the company is resisting the idea and has raised capital from private equity fund KKR to try and hold out.

Activism chart of the week

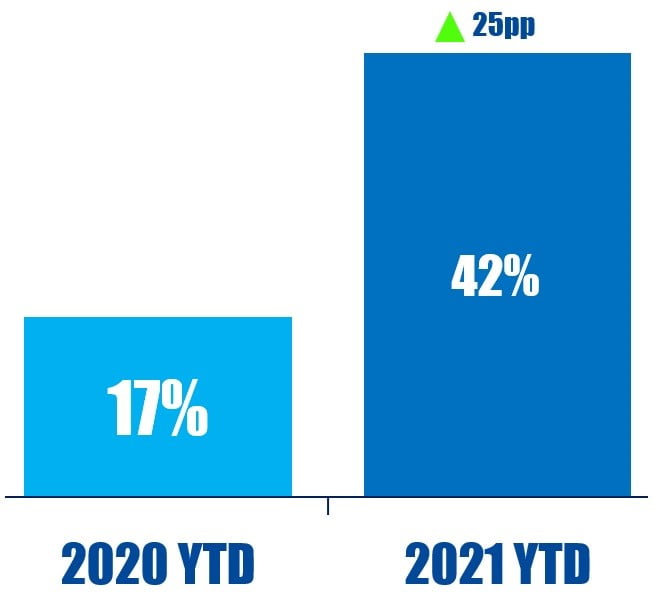

So far this year (as of June 3, 2021), 42% of resolved public activist demands at Japan-based companies were at least partially successful. That is compared to 17% in the same period last year.

Source: Insightia (Activist Insight Online)

What’s New In Proxy Voting

The U.S. Securities and Exchange Commission (SEC) will not recommend enforcement actions against proxy voting advisers and could overturn last year's rule changes, Chairman Gary Gensler announced.

The SEC, which was sued over rule changes by Institutional Shareholder Services (ISS), had declared that the recommendations of such firms were to be regarded as solicitations, meaning that they would meet a higher standard of scrutiny over alleged falsehoods or errors contained in their reports.

Following Gensler's appointment in April, which gave Democrats a 3-2 majority, the SEC has now announced that it will not recommend enforcement actions when the rule comes into effect on December 1 and will reconsider the changes. ISS' lawsuit is paused on the basis that the SEC will not press ahead with the changes and the detente could lead to both sides backing down completely.

The two Republican commissioners signaled that they did not see the need for a reversal, issuing a statement that said despite opposition from some lobby groups, “the Commission’s process in adopting these amendments was beyond reproach.”

Proxy chart of the week

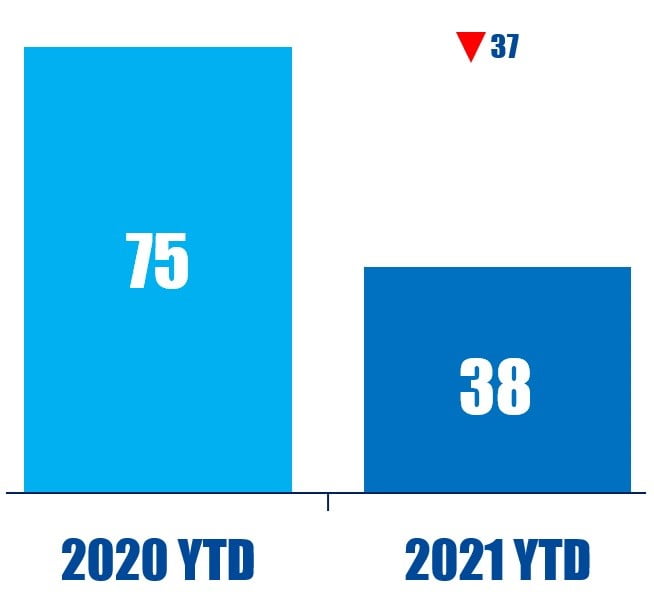

So far this year (as of June 6, 2021), the number of U.S. stock incentive proposals that received more than 20% opposition has hit 38. That is compared to 75 in the same period last year.

Source: Insightia (Proxy Insight Online)

What’s New In Activist Shorts

Jehoshaphat Research went after glass manufacturer View, saying the company's technology for making so-called smart glass is not viable as a business as it entails a huge negative gross margin.

View, a company backed by SoftBank's Vision Fund, claimed to build dynamic glass using artificial intelligence and machine learning to optimize natural light, control heat, and limit glare.

In a Tuesday report, Jehoshaphat said View’s technology is a “disaster of a business” because the unit cost for producing its glass is “far higher than any customer in the market would ever pay.”

"View’s business is permanently nonviable; its foundational technology will never produce glass profitably," said the short seller. After analyzing View‘s cash burn in the past three years and the company’s planned investments in its new capacity, Jehoshaphat argued that View will run out of cash within about a year.

Shorts chart of the week

So far this year (as of June 4, 2021), seven healthcare companies have been publicly subjected to an activist short campaign. That is down from 24 in the same period last year.

Source: Insightia (Activist Insight Shorts)

Quote Of the Week

This week’s quote comes from David Lazar as he filed a books and records demand at Israel-based My Size, alleging potential mismanagement and malfeasance by the measurement app developer’s top echelon. Read our coverage here.

“Given the company’s inability to turn a profit since its inception and the apparent failure by the company to conduct any independent, third party valuation of the assets, the board’s and senior management’s decision to enter into the amendment at this particular point in time is highly suspect.” – David Lazar