In 2020, the Trump admin approved construction of a massive Alaska LNG project that would open up stranded North Slope gas reserves for domestic use and export to Asia.

Q4 2021 hedge fund letters, conferences and more

In July 2021, a new review was ordered to consider climate change risks.

The U.S. Department of Energy will conduct a supplemental environmental review of the $38 billion Alaska LNG project, analyzing the project’s greenhouse gas emissions as the Biden administration prioritizes concerns about climate change.

The Trump administration approved the project last year for construction, operation, and to export the liquefied natural gas from Alaska to other countries, following a three-year environmental review of the project.

It’s uncertain how the supplemental review will affect the project. The Department of Energy in April said it retains the authority to “modify or set aside” its 2020 decision to authorize Alaska LNG exports.

The state agency that owns the project, the Alaska Gasline Development Corp., said in a statement that approval for the project remained “in full effect” during the supplemental review.

Yet it seems of no concern for the promoter of Driftwood, the subsidiary of Tellurian LNG LLC, developing a mega liquefied natural gas (LNG) terminal.

Driftwood LNG Among Gas Projects Subject to New Climate Policy

- U.S. regulators to increase scrutiny of natural gas projects

- Nearly 13 billion cubic feet of gas capacity affected

Tellurian Inc.’s Driftwood LNG facility and Equitrans Midstream Corp.’s contentious Mountain Valley Pipeline are among dozens of proposed natural gas projects set to face new scrutiny after U.S. regulators tightened their criteria for approvals.

Nearly 13 billion cubic feet of new gas capacity may be subject to the policy changes by the Federal Energy Regulatory Commission, which will now put more emphasis on the environmental impacts of proposed projects, as well as examine the demand for and intended uses of the gas being shipped.

Read the full article here by Bloomberg.

Bail Me Out

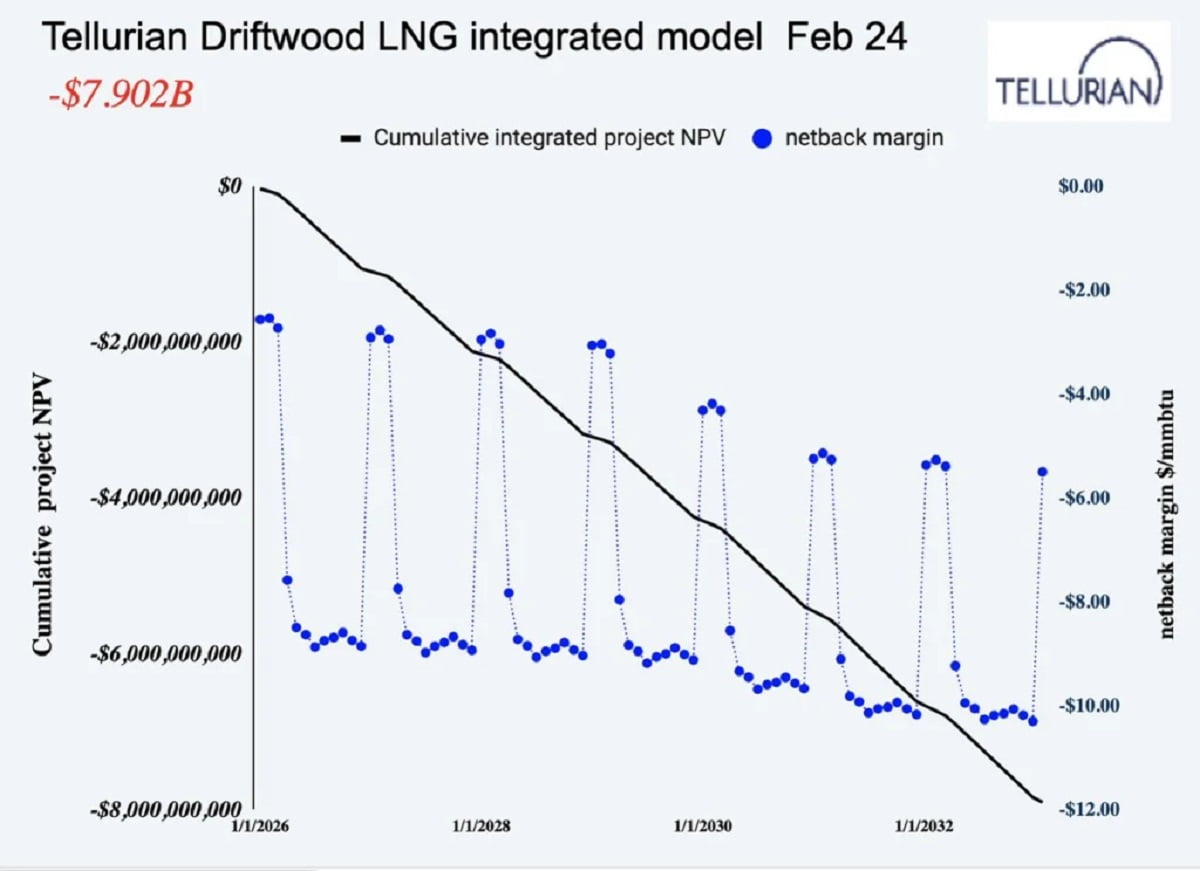

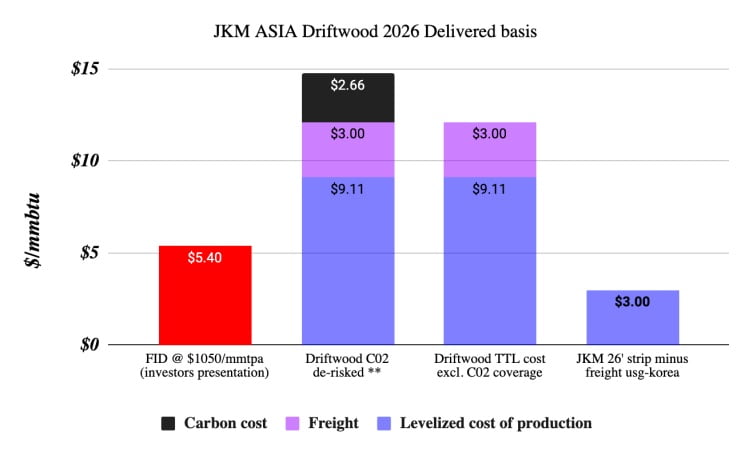

Souki is sinking. He has become very nervous and hesitant in his videos, for three good reasons he no longer mentions FID, and stays vague on financing: A Driftwood FID for 26′ delivery stands at a $7.90 billion deficit.

The current market situation in Europe LNG summarizes the “Chicken-Egg problem” for Tellurian: TTF hit $45/mmbtu JKM $37- thanks to the Ukrainian standoff but it doesn’t compound past 2024.

It means that despite the announcements, the glitter and placed ads about the JKM/TTF – Henry arbitrage by Tellurian inc. Driftwood IRR cash flows are negative for financing.

Secondly, Driftwood’s costs haven’t been actualized by Tellurian since +4 years. Our estimates. puts them at 78% above their investor presentation commercial break-even but Souki plays the con man game by not giving a cost refresher prior to an coming equity offering.

see Tellurian: 10 years $2.4B carbon exposure

Stay clear from driftwood, the Houston energy community does not have any faith in the project and neither the banks/financing.

The whole Aspen mountain resents him and with his ideas.

As Optimization Specialist Robert illustrated, from the onset Tellurian had not the organizational and financial resources to declare a FID on Driftwood.

The recent policy change towards emissions by the U.S Government is a game changer and adds a degree of certainty to the dead end and no-FID, non-financing of Driftwood LNG.

Souki did not expect that one day the industry would go after Tellurian and hunt him down.

The game is forcing them out.

Even at record JKM prices, positive arbitrage, it does not change anything. Tellurian faces new scrutiny from the U.S. regulators, a virulent opposition from the Sierra club plus the financial activists with the old and most recently deceived investors.

–The Driftwood 22 disclosure project

“Exposing the Truth on Driftwood LNG false accounting and misrepresentations to the investors."

Article by The Driftwood 22 DISCLOSURE Project

Disclaimer

The author may have short position in stock.