Whitney Tilson’s email to investors discussing Charlie Munger buying apartment buildings; Doug Kass’ 50 Laws of Investing.

Q2 2021 hedge fund letters, conferences and more

1) I freely admit to being an unabashed fan of investing legend Charlie Munger, Warren Buffett's long-time friend and right-hand man at Berkshire Hathaway (BRK-B)...

That's why one of the great honors of my life was being a contributor to the definitive book about Munger, Poor Charlie's Almanack: The Wit and Wisdom of Charles T. Munger.

So I was more than a little intrigued when I saw this tweet, as I've never heard anything about Munger buying apartment buildings:

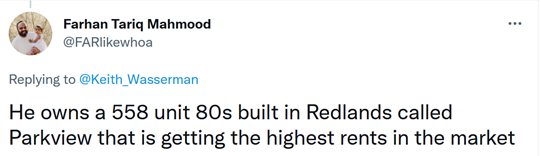

In response, one reader tweeted this:

I asked my analyst Kevin DeCamp to see what he could find. There wasn't much, but he did discover this nine-minute video in which Munger explains why he invested in Redlands: Why Charlie Munger is investing in Redlands?

So, should you run out and buy or invest in apartment buildings? I think not...

It appears that Munger has been opportunistic: He met a smart, entrepreneurial young man, took a shine to him, and invested with him to buy and manage some apartment buildings. I don't read too much into this, as I suspect Munger has invested well under 1% of his net worth in this area.

Doug Kass: My 50 Laws Of Investing

2) I enjoyed my friend Doug Kass' "50 Laws of Investing."

The stock market is filled with individuals who know the price of everything but the value of nothing.

"Let us not take ourselves too seriously. None of us has a monopoly on wisdom." - Queen Elizabeth

Since we are going down memory lane, here is another column that bears repeating:

- Common sense is not so common.

- Greed often overcomes common sense.

- Greed kills.

- Fear and greed are stronger than long-term resolve.

- There is no vaccine for being overleveraged.

- When you combine ignorance and leverage – you usually get some pretty scary results.

- Operate only in your area of competence.

- There is always more than one cockroach.

- Stocks have a gravitational pull higher – over long periods of time equities will rise in value.

- Long investing generates wealth.

- Short selling protects wealth.

- Be patient and learn how to sit on your hands.

- Try to get a little smarter every day and read as much as humanly possible – an investment in knowledge pays the best dividends.

- Investors sometime think too little and calculate too much.

- Read and reread Security Analysis (1934) by [Benjamin] Graham and [David] Dodd – it is the most important book on investing ever published.

- History is a great teacher.

- History rhymes.

- What we have learned from history is that we haven't learned from history.

- Investment wisdom is always 20/20 when viewed in the rear view mirror.

- Avoid "first-level thinking" and embrace "second-level thinking."

- Think for yourself – as those who can make you believe absurdities, can make you commit atrocities.

- In investing, that what is comfortable – especially at the beginning – is most often not exceedingly profitable at the end.

- Avoid the odor of "group stink" – mimicking the herd and the crowd's folly invite mediocrity.

- The more often a stupidity is repeated, the more it gets the appearance of wisdom.

- Always have more questions than answers.

- To be a successful investor you must have accounting/finance knowledge, you must work hard and you have to be keenly competitive.

- The stock market is filled with individuals who know the price of everything but the value of nothing.

- Directional call buying, when consumed as a steady appetite, is a "mug's game" and is often a path to the poorhouse.

- Never buy the stock of a company whose CEO wears more jewelry than your mother, wife, girlfriend or sister.

- Avoid "the noise."

- Reversion to the mean is a strong market influence.

- On markets and individual equities... when you reach "station success," get off!

- Low stock prices are the ally of the rational buyer – high stock prices are the enemy of the rational buyer.

- Being right or wrong is not as important as how much you make when you are right and how much you lose when you are wrong.

- Too much of a good thing can be wonderful – look for compelling ideas and when you have conviction go ahead and overweight bigly.

- New paradigms are a rare occurrence.

- Pride goes before fall.

- Consider opposing investment views and cultivate curiosity.

- Maintain a healthy level of skepticism as you never know when the Cossacks might be approaching.

- Though doubt is uncomfortable, certainty is ridiculous and sometimes dangerous.

- When investing and trading, never let your mind dwell on personal problems and always control your emotions.

- 'Rate of change' is the most important statistic in investing.

- In evaluating the attractiveness of a stock always consider upside reward vs. downside risk and 'margin of safety.'

- Don't stray from your investing and trading methodologies and timeframes.

- "Know" what you own.

- Immediately sell a stock on the announcement or discovery of an accounting irregularity.

- Always follow the cash (flow).

- When new ways of earnings are developed – like EBITDA (and before stock-based compensation) – substitute them with the word... "bullshit."

- Favor pouring over balance sheets and income statements than spending time on Twitter and r/wallstreetbets.

- Always pay attention to what David Tepper and Stanley Druckenmiller are thinking/doing. (Trade/invest against them, at your own risk).

Best regards,

Whitney

P.S. I welcome your feedback at [email protected].