What’s New In Activism – Carl Icahn Waiting On Southwest Gas

Southwest Gas Holdings Inc (NYSE:SWX) said it will offer shareholders a recommendation on activist Carl Icahn’s $75 per share tender offer within 10 days.

Q3 2021 hedge fund letters, conferences and more

"Consistent with its fiduciary duties and in consultation with its independent financial and legal advisers, the Southwest Gas Holdings board of directors will carefully review and evaluate the unsolicited tender offer to determine the course of action that the board believes is in the best interest of Southwest Gas Holdings stockholders," the company said in a statement.

Icahn's offer, which is open until December 27, is for "any and all shares." The veteran activist is concerned that Southwest will make a dilutive equity offering and has offered to backstop the utility, even offering to waive excess voting rights above 20% of the outstanding stock if his stake grows that large. His campaign began when it was rumored that Southwest was planning an acquisition of Questar Pipelines.

Southwest has said it is open to engaging with Icahn but has major differences with him over that deal and the company's performance relative to peers. It has a poison pill in place to deter Icahn from a pre-emptive move against its board.

To arrange an online demo of Activist Insight Online, send us an email.

Activism chart of the week

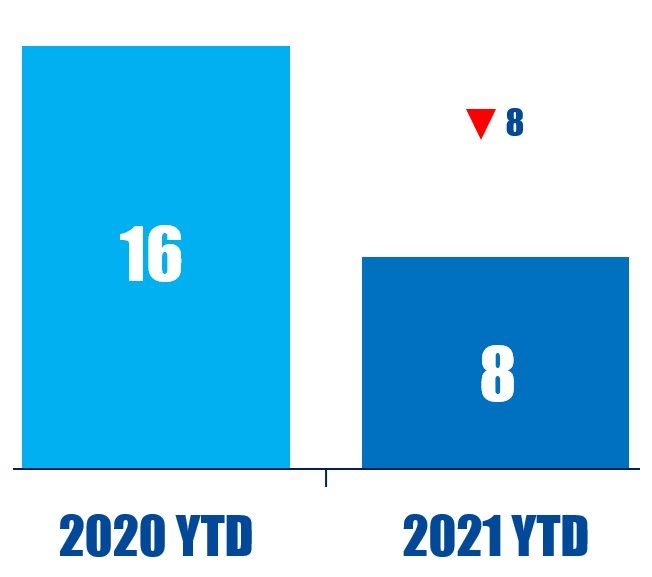

So far this year (as of October 28, 2021), eight Canada-based companies have been publicly subjected to demands by U.S.-based activists. That is compared to 16 in the same period last year.

Source: Insightia (Activist Insight Online)

What's New In Proxy Voting - COP26

More than 730 investors, representing $52 trillion in assets under management, issued a statement to governments ahead of the 2021 UN Climate Change Conference (COP26), calling for stricter measures to "avoid catastrophic temperature rise" and manage climate risk.

The initiative, developed by founding partners of the Investor Agenda, including CDP, Ceres, Investor Group on Climate Change, and Principles for Responsible Investment (PRI), represents the largest-ever collective assets under management to sign on to such a statement.

In order to limit global warming in line with a 1.5°C warming scenario, signatories ask governments to strengthen their Nationally-determined Contributions for 2030 ahead of COP26 and ensure a planned transition to net-zero emissions by 2050 or sooner.

Governments must also outline "ambitious" interim targets, including clear decarbonization roadmaps for each carbon-intensive sector, the letter read. "It's now time for governments around the world to move from commitment to action on climate change," said Fiona Reynolds, CEO of PRI, in a press release.

To arrange an online demo of Proxy Insight Online, send us an email.

Proxy chart of the week

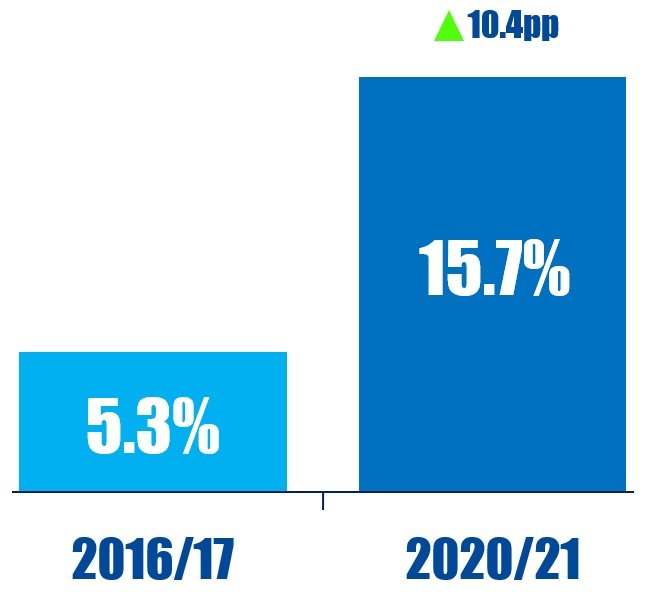

Support for environmental shareholder proposals has been steadily rising at carbon-intensive companies in the Asia-Pacific region, according to the Proxy Voting Annual Review. Average support in the most recent proxy season (year to June 30) was 15.7%, up from just 5.3% in 2016/17.

Source: Insightia (Proxy Insight Online)

Iceberg Research disclosed a short position in the special purpose acquisition company (SPAC) merging with former President Donald Trump's new social media company on Monday.

In two tweets, the short seller said it believed that the soaring stock price of Digital World Acquisition Corp (NASDAQ:DWAC) since the merger was announced last week made it likely that Trump would seek to renegotiate the arrangement to favor himself financially at the expense of the SPAC.

Patrick Orlando's DWAC raised nearly $294 million in September and said last week that it would pay $875 million to acquire the newly formed Trump Media & Technology Group (TMTG), which the former president is expected to use to launch a rival to social media giants Twitter and Facebook. The SPAC's shares, already trading above their $10 issue price, rose to $144 per share on the announcement.

"Now that initial excitement has passed, we see only risks for investors in near future," the short seller tweeted. "Based on Trump's track record, at current price, renegotiation is likely to keep more of the merged company for him."

Although Iceberg did not express a view on the TMTG business, it said Trump retained leverage before the deal was consummated. A shareholder vote must take place before that can take place.

To arrange an online demo of Activist Insight Shorts, send us an email.

Shorts chart of the week

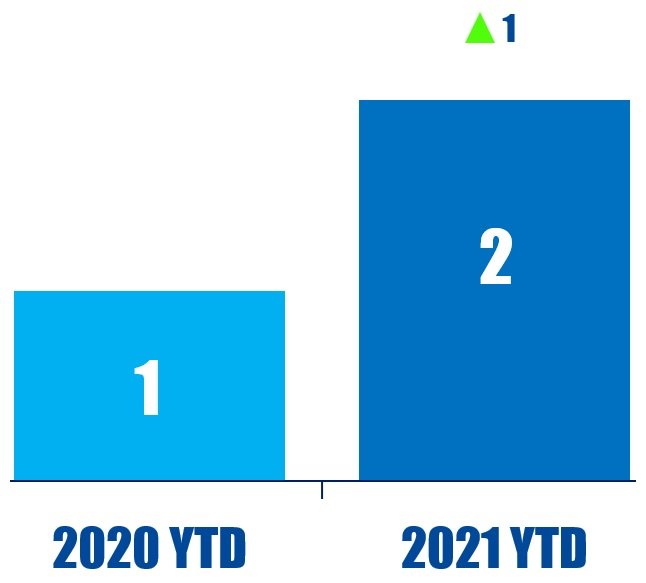

So far this year (as of October 29, 2021), two Brazil-based companies have been publicly subjected to an activist short campaign. That is up from one in the same period last year.

Source: Insightia (Activist Insight Shorts)

Quote of the Week

This week's quote comes from an October 27 tweet by Hindenburg Research's Nate Anderson lambasting CytoDyn Inc (OTCMKTS:CYDY) for its cash position and legal troubles.

“$CYDY has almost no cash, is under DoJ & SEC investigation, and its CEO is a world-class charlatan.”