The Broad Market Index was up 1.16% last week and 48% of stocks out-performed the index.

Q1 2021 hedge fund letters, conferences and more

The broad acceleration in sales that we have measured in the first quarter was not interrupted by the small list of companies that reported financial statements last week. These were companies with fiscal year ending in March. The update will be completed this week with the appearance of financial statements from companies with fiscal quarters ending in April-mostly retailers.

Recovery-from-the-virus-effect

The broad improvement in sales growth was expected with the virus-related weakness in the prior period. The post virus recovery conclusion will appear with the upcoming second quarter update as the full brunt of the shutdown produced dramatic declines last year.

What was unexpected is the average profit margin drop. The frequency numbers are better with 70% of companies achieving a gross profit margin improvement; this is up from 44% at the lowest point last year but nevertheless the average gross profit margin struggled and declined.

To some extent this mainly is the result of severe profit margin declines at companies most negatively affected by the virus. Still, the margin pressure is evident on average in every sector except Consumer Staples.

Cost cutting struggles

The data suggest that 30% of companies are dealing with rising costs of goods sold and are not able to pass those increases on as higher product prices. Even with sales growth up, the broad index has lower gross profits, higher operating costs and lower CF-ROI (Cash Flow Return On Investment) - the crown of the Otos Money Tree.

When will inflation rise?

Corporate growth is high and falling and the major indexes are near all-time highs. Valuation is extended with short-term interest rates near zero. The broad market has been over 70% correlated with profit margins (last year not withstanding). The lower gross profit margin results in an understated rate of inflation as companies absorb some of the price increases.

The only way for profit margins to advance on average is for companies to fully pass on higher costs as higher product prices. Given the price history and current data analytics; higher inflation is unavoidable as the recovery persists.

The Benevolent FED

Valuation remains at these lofty levels due to confidence that the Federal Reserve Bank (FED) will support capital markets. Both the Chairman of the FED and the Treasury Secretary have assured markets that the current inflation is temporary. Evidence from corporate growth suggests the opposite, that inflation is understated and will rise further as companies turn up the gross profit margin.

Switch to Active Management Now!

To navigate through this tangle of conflicting and contradictory data it is critical to maintain rising growth attributes in your portfolio of companies. Your Portfolio Analytics MoneyTree should show that your portfolio has high and rising sales growth and rising CFROI (long dark truck and lush green globe on the MoneyTree).

Ensure that your portfolio attributes show an increase in the average profit margin, modest capital expenditures and good financial condition (Stable, trim, brown/golden pot for your MoneyTree).

Sell your falling growth companies with shares trading at premium prices and only buy Winners! or stocks of companies with exceptional attributes. Look at accelerating companies; Intuit Inc. (NASDAQ:INTU) proves to be very persistent at cutting costs and protecting Profit Margins as well as Cash Flow.

Intuit Inc $439.90 BUY this rich company getting better

Intuit Inc. (NASDAQ:INTU) has been an exceptionally profitable company with persistently high cash return on total capital of 31.5% on average over the past 21 years. Over the long term the shares of Intuit Inc have advanced by 464% relative to the broad market index.

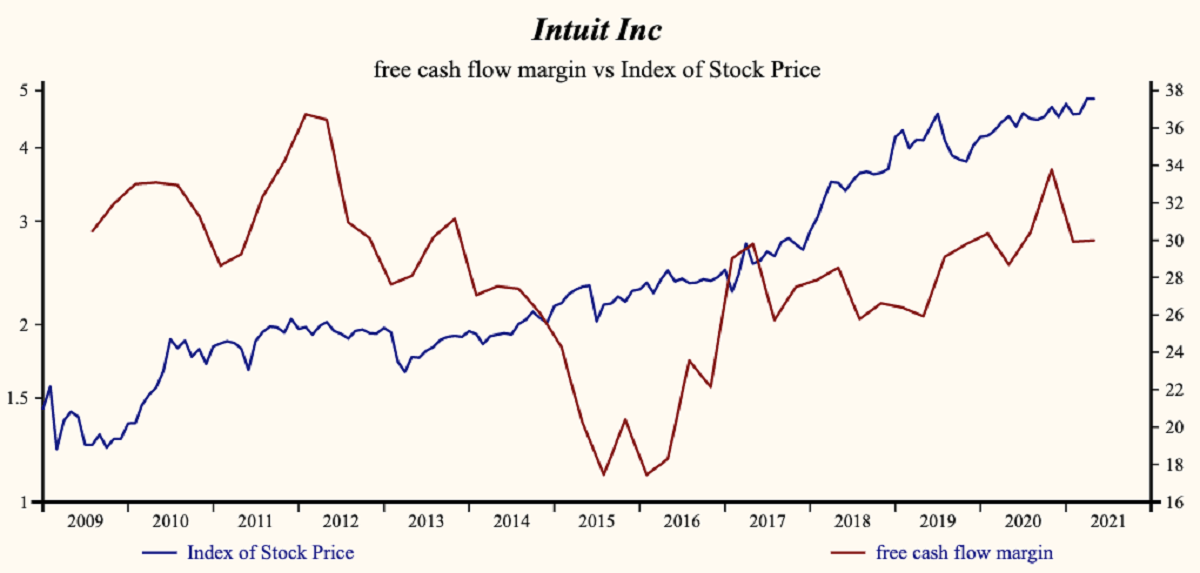

The shares have been very highly correlated with trends in Growth Factors. A dominant factor in the Growth group is Cash Flow from Operations which has been 89% correlated with the share price.

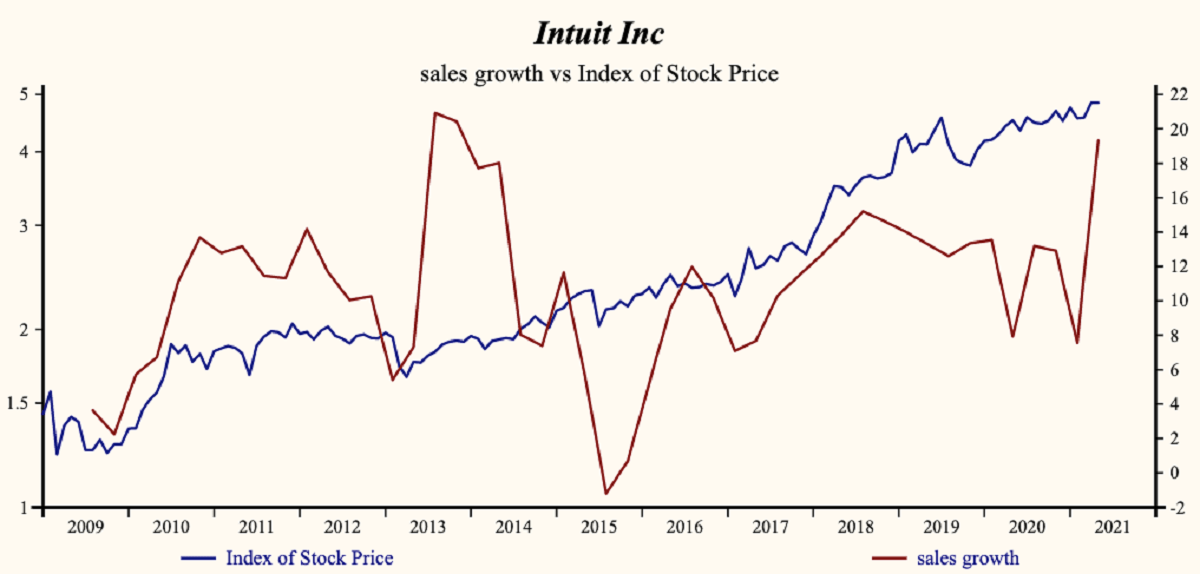

Currently, sales growth is 19.3% which is higher than the long-term growth record and is much higher than last quarter. Receivable turnover has remained stable which improves the quality of recorded sales.

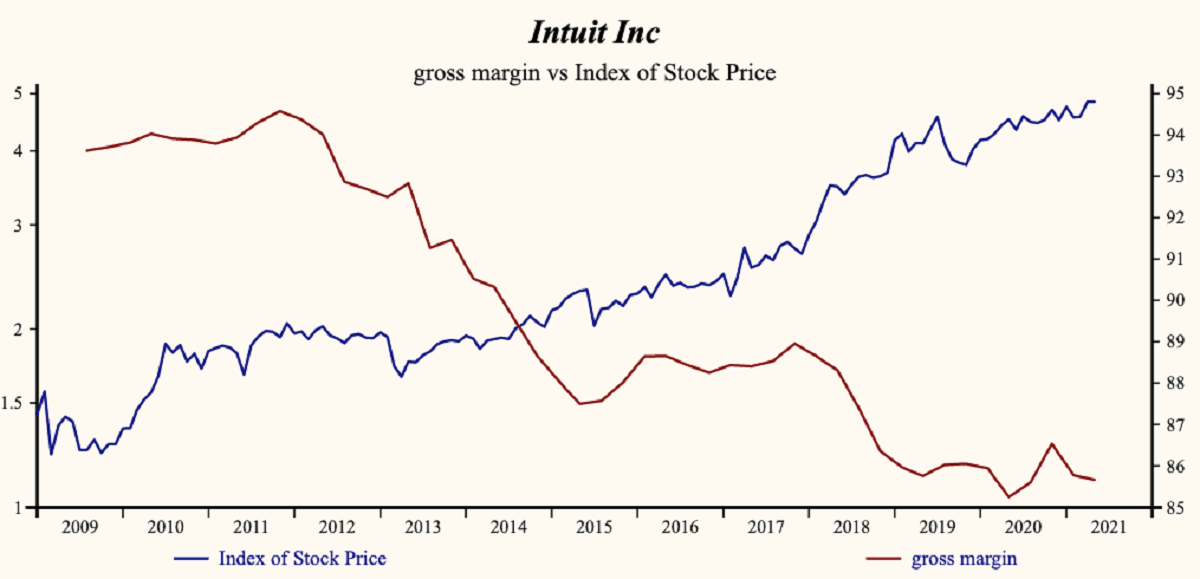

Gross Margin is low but stable

After trending downwards since 2011 the company is recording a low but seemingly stable gross profit margin for the past 8 quarters. Costs have been trending downwards since 2017 as seen by continuous reductions in SG&A Expenses.

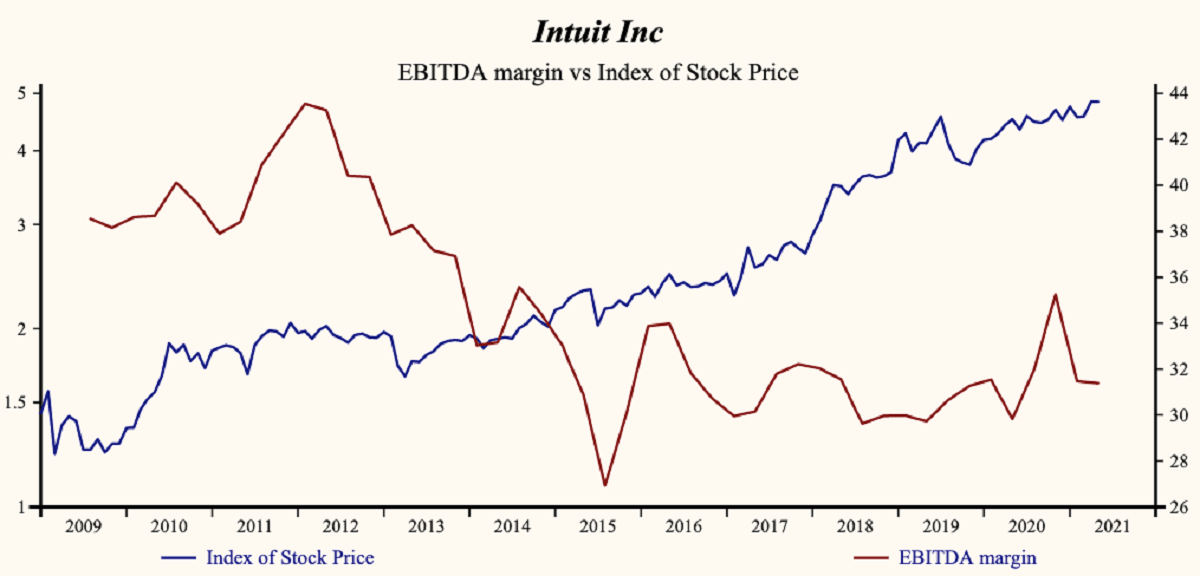

The robustness of the gross margin is significant since reducing cost has been key in supporting the bottom line. SG&A expenses reductions are not limitless however Intuit managed further contain cost last quarter. A healthy gross margin with continued cost management made an immediate impact on slowing last quarter’s falling EBITDA growth rate relative to sales. Interest costs continued to increase relative to sales but remains around the lowest point in the record of the company.

This continuous reduction in costs has also been supporting free cash flow and ultimately Free Cash Flow growth which is up again last quarter.

More recently, the shares of Intuit Inc have advanced by 165% since the (May 2013 low) and up by over 33% since our Otos September 2020 buy recommendation. The shares are trading at upper-end of the volatility range in a 96-month rising relative share price trend.

Despite the extended share price, this provides a good opportunity to buy the shares of this evidently accelerating company.

Imagine the stock market as a large greenhouse. Each stock is a plant in a pot. At the front of the greenhouse is a small group of very tall plants with large green globes and all in full bloom. These plants look healthy and sit in solid golden pots. Those are the pick of the crop!