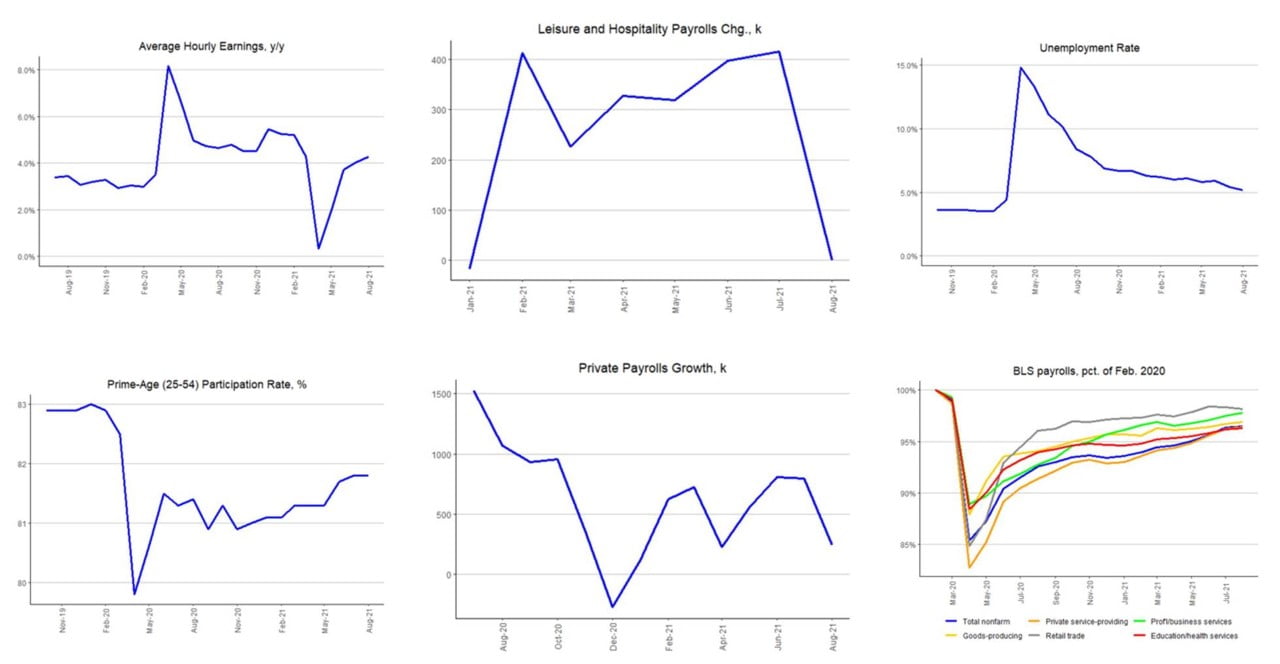

“IFR Markets grades the August Employment Report a ‘C+’, where straight ‘A’s’ are required for the Fed to initiate its taper sequence. The most disappointing aspects of the report came from the Establishment survey, which showed net growth of 235k in total payrolls and 243k in private payrolls,” says, Jeoff Hall, Managing Economist, Refinitiv IFR Markets.

Q2 2021 hedge fund letters, conferences and more

August 2021 U.S. Employment Report Assigned 'C+' Letter Grade by IFR Markets

Jeoff Hall, Managing Economist, Refinitiv IFR Markets continues:

“The Reuters poll consensus expected gains of 728k and 665k for total and private payrolls, respectively. A generous 110k upward revision to July total payrolls (of which 95k was in the private sector) took away only some of the sting from the weaker-than-expected August increase.

After rising an average 350k per month in the previous six months, employment in the Leisure and Hospitality industry was unchanged in August. Had growth in that industry remained on trend, the overall jobs report largely would have met expectations. Retail Trade shed 29k jobs in August, the most for a single month since April 2020. Keep in mind, however, this industry added an average 47k per month over the previous three months.

Most other service-providing industries posted attractive increases in August, many of them with gains that exceeded the trailing 3-month average. Transportation and warehousing added 53k jobs in August, bringing employment in the industry slightly (22k) above its pre-pandemic level in February 2020. Much of the job growth in this industry is for couriers and messengers. Financial Activities employment went up by 16k in August after gaining 24k in July, where the two-month net increase (40k) exceeded the cumulative change over the previous six months.

Employment in Education and Health Services rose 35k, roughly half its average monthly growth from May to July. Employment in private education rose 40k in August, matching the as-reported gain in July. That means employment in health care and social assistance fell 5k in August, compared to a 42k increase in July. Remember that whopping 211k increase in local government education reported for July? That now stands as a 225k increase, though August yielded back about 6k. State government education, which rose 19k in July, fell 21k in August. The BLS admitted, “Recent employment changes are challenging to interpret, as pandemic-related staffing fluctuations in public and private education have distorted the normal seasonal hiring and layoff patterns.”

In the goods-producing sector, manufacturing added 37k jobs in August, even though the ISM Manufacturing PMI’s employment component went below 50 last month, signaling a modest contraction in factory payrolls. Surprisingly, about two-thirds (24k) of the rise in factory jobs last month went to motor vehicles and parts. Another 7k went to fabricated metal products.

Construction employment decreased for the fourth time in the last five months, down another 3k in August. Since falling to 7.415 mn in May, the net change in employment has been +1k. The industry remains about 230k jobs (3.0%) below its pre-pandemic level.

Over in the Household survey, the news was better, if lacking industry details. Total employment rose 509k in August, bringing the 2-month average increase to 776k. Total unemployment fell 318k, which was in line with the average decrease over the preceding three months (-370k). The official (U-3) unemployment rate decreased 0.2-percentage point to 5.19%, the lowest since March 2020 (4.42%). The U-6 unemployment rate dropped to 8.8% in August, from 9.2% in July and 9.8% in June. In the three months leading up to the pandemic, this rate averaged 6.9%.

Back in the Establishment survey, average hourly earnings for private employees rose 17 cents or 0.6%, the most in four months. The fasted growth was for Leisure and Hospitality, whose average hourly earnings rose another 25 cents (1.3%) in August to $18.82, the most ever for the industry. Compared to a year ago, these earnings were up 10.2%, the most of any industry and the most in a single 12-month period for this industry since at least 2007.”

Source: Refinitiv IFR

Sources: Data - Refinitiv IFR Markets | Commentary - Jeoff Hall, Managing Economist, Refinitiv IFR Markets