Kerrisdale Capital is short shares of AST SpaceMobile Inc (NASDAQ:ASTS), a $1.8bn satellite company trying to sell the dream of connecting billions of people with mobile broadband directly to their phones from space, but without a credible ability to bring that dream to reality.

A 2021 SPAC, AST features a satellite design that is destined to fail, unsurprising given management’s uninspiring backgrounds, and a business case that makes little sense in nearly all respects, whether one scrutinizes the end markets it’s trying to monetize, its brutal competitive landscape or how it can ever justify its massive initial capital costs.

Q2 2022 hedge fund letters, conferences and more

Naturally, given how daunting the company’s end goal is – operating a constellation of hundreds of giant, complex satellites that will provide fast, reliable mobile internet globally – management keeps pushing out the projected timeline of when it could conceivably provide any sort of viable service.

Yet the stock has nearly doubled in the past few months, due to the launch of a test satellite that hopes to merely demonstrate that a simplified version of the ultimate theoretical satellite can provide internet connectivity.

AST - Unconnected From Reality

AST is an ambitious, wildly risky science project that has no business (literally) being public – only the SPAC bubble of 2021 could have managed to change its destiny from being a forgotten zero tucked away in a few venture capital funds into what is rapidly becoming a classic stock promote.

AST’s vision is to be the first space-based cellular broadband network that connects directly to any mobile phone, providing service to people when out of the range of terrestrial networks.

To pull off this feat and test its technology, AST recently launched a prototype, BlueWalker-3 (BW3), into orbit. In the next 2 weeks, BW3 will begin a critical step in its mission: delicately unfurling its massive, 64 square meter phased antenna and solar array, the largest ever commercial communications array in space.

Few entities beside NASA have attempted to deploy anything similar. Despite being larger than a 3-car garage, BW3 is only a few inches thick – a design which alarmed multiple experts we spoke with owing not only to its “terrifying” size, but also its “infantile” demonstration of structural and thermal engineering soundness.

AST will be operating BW3 without the benefit of reliable testing of full deployment of the array beforehand. Unfolding far simpler arrays by organizations with significantly more funding, preparation, engineering firepower, and space heritage than AST have still resulted in mission failure.

Even if AST passes this critical test, the obstacles to establishing a viable business model are massive. BW3 is an experiment. The production version of what AST needs to fulfill its vision, a satellite class named BlueBird-1, is anticipated to be a staggering 8x larger than BW3.

BlueBird-1’s capabilities are what underpins street models, what management promotes on calls, and what retail investors have pinned their hopes on. The unsettling reality, however, is BlueBird-1 has fallen two years behind initial promises, with management recently pulling guidance on when this much-hyped satellite will launch.

Our checks strongly suggest the constellation will continue to see further rising costs and launch schedule delays – setbacks that AST can ill afford given the entrance of fast-moving competitors in SpaceX and Apple.

The backdrop for all this is a TAM we believe is overstated and difficult to penetrate, with niche use cases that are hard to monetize for populations currently covered by terrestrial cellular networks and an underserved population that while large is nearly impossible to monetize for a host of entrenched, socioeconomic reasons.

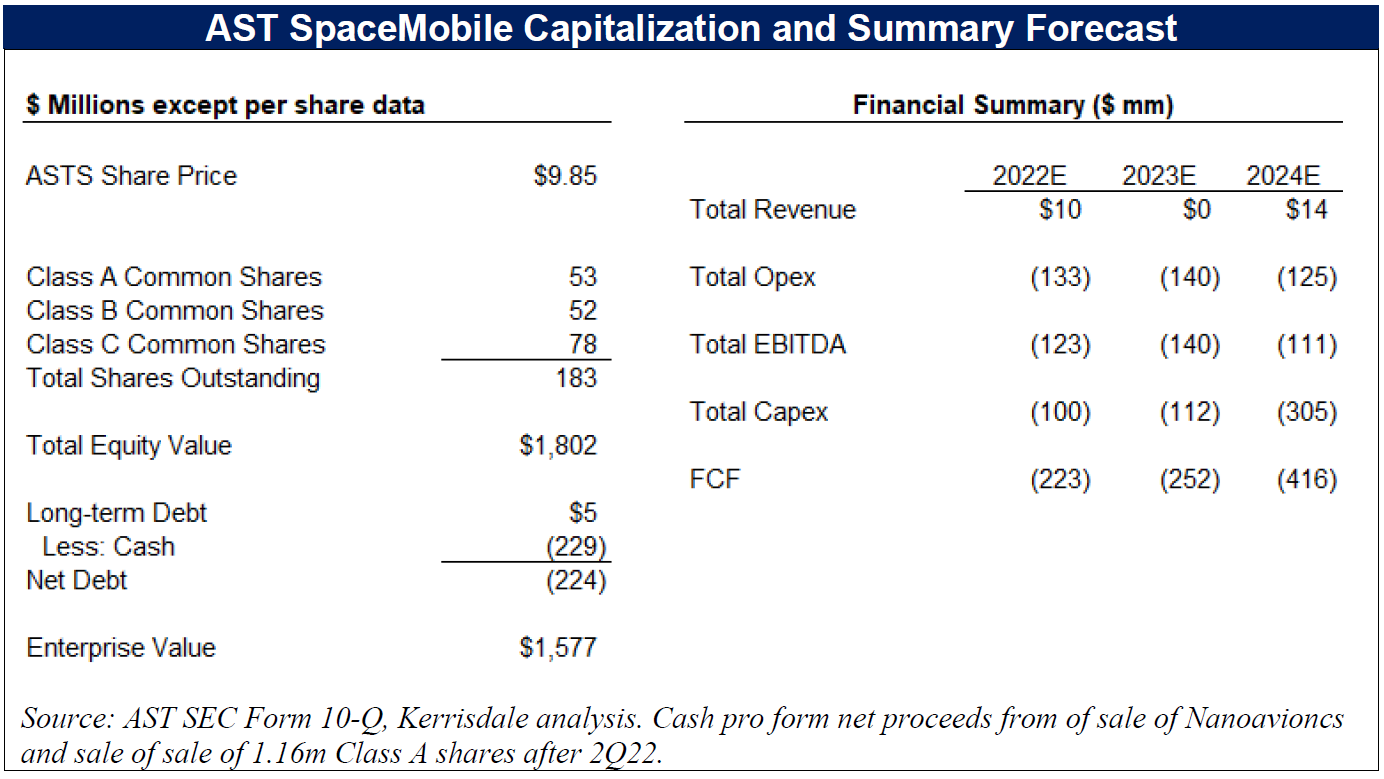

Investors were initially told that proceeds from the SPAC meant financing risk would be “substantially eliminated.” A year and half later, the company needs additional funding just to get commercial operations off the ground. The company’s ridiculously optimistic financial forecast called for $1bn in EBITDA in 2024; in reality, P&L will likely be deeply negative.

Billions must be spent to achieve full global coverage and the company will likely continue issuing dilutive equity (it sold stock at an implied ~$6.50 earlier this quarter and announced a new $150m at-the-market equity facility on September 8).

A successful demonstration of a singular prototype will not magically transform technology cooperation agreements with mobile operators into contracted revenue. Retail investors who busy themselves poring over the technical specifications of a long-delayed test satellite, without verifying management’s claims with independent experts on satellite technology, are unconnected from AST’s financial reality.

Executive Summary

- Fundamental design and engineering concerns surround AST’s spacecraft.

Interviews with a wide range of experts in satellite design, supply chain management, and manufacturing yielded overwhelming skepticism regarding key aspects of BW3.

A massive antenna is needed to establish a link between space and a consumer device, but the satellite appears to have focused on this requirement at the expense of sound structural dynamics and thermal engineering.

AST is about to deploy an extremely complex, unusually designed array – all without prior experience and accurate testing of the fully deployed structure beforehand.

- AST will likely struggle to provide reliable service.

According to analyses performed by a leading expert and author of textbooks on RF engineering and satellite communications, BW3 may be able to connect to a cellphone when conditions are perfect, i.e., in a field without any nearby tree trunks or buildings or while stationary in a car.

But fail to deliver reliable service indoors and in other real-world environments – and that’s assuming the satellite works perfectly. Dropped calls and interrupted streaming would lead to frustrated users, undermining a business built around delivering broadband and being “connected everywhere.”

- Expect BlueBird-1 program to witness further rising costs and delay.

BlueBird-1, the satellite which underpins AST’s planned global constellation, is running 2 years behind schedule and checks indicate that challenges continue to mount.

According to a supply chain consultant who reviewed an AST bid package for parts critical to unfolding the array, AST’s engineering was so “immature” that his highly qualified client no-bid the business. A former AST employee informed us the company’s forecasts for projected constellation costs assumes cheap launches using SpaceX’s Starship.

With Starship’s launch date still uncertain and SpaceX’s recent announcement that it will pursue its own competing direct-to-device (“D2D”) offering, we expect the BlueBird-1 program to suffer further setbacks.

- SpaceX and Apple pose growing competitive threat.

Having two of the most innovative, resource-rich companies on the planet offer D2D solutions within the U.S. for free – even if those initial services are very basic in nature – should be viewed as a worrisome development for shareholders. Whatever technological and competitive positioning AST perceives itself to have can be quickly eliminated by both.

- Confidence in MOUs as a competitive moat is misplaced.

Most Memoranda of Understanding (or MOUs) promoted by the company, and cited inaccurately as securing an unassailable competitive moat by retail investors, are little more than non-exclusive, non-binding, non-financial technology and regulatory cooperation agreements.

According to someone familiar with one of the largest signed MOUs, the agreement was simply about keeping abreast of emerging technologies, with expectations of actual success being nil.

- AST is bleeding cash and execution has been absurdly poor, even for a SPAC.

AST originally claimed cash proceeds from the SPAC transaction would be sufficient to fund operations through the launch of 20 Phase 1 satellites. AST told investors financing risk was “substantially eliminated.”

Incredibly, only 18 months later the company no longer has enough cash to fully begin commercial operation. Two years ago, AST management felt it was acceptable to issue projections that called for $1bn in EBITDA and zero capex in 2024, while we estimate EBITDA and FCF will be deeply negative for years.

AST needs to spend billions to reach full global coverage and has little choice but to issue highly dilutive equity at every chance it gets. Early in the current quarter it sold shares at implied ~$6.50 (~35% below current), which has been followed up with a $150m at-the-market equity facility earlier this month.

Read the full report here by Kerrisdale Capital