Arquitos Capital Management commentary for the second quarter ended June 30, 2021.

The clock does not measure time; it produces it. – Unknown

Dear Partner:

Arquitos Capital Management Q2 Performance

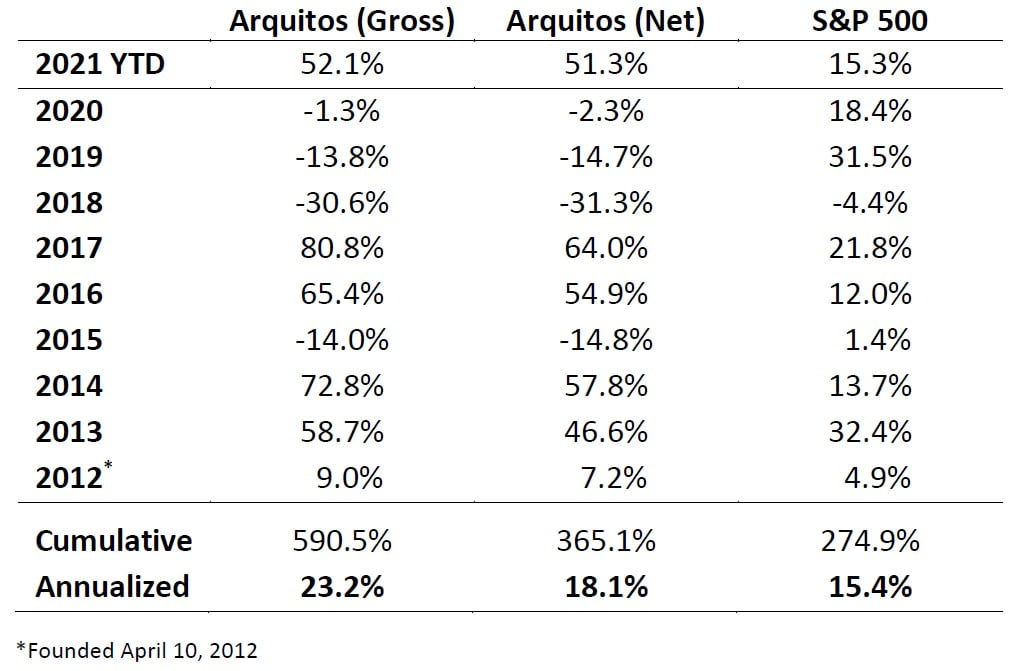

Arquitos returned 7.2% net of fees in the second quarter of 2021, bringing the year-to-date return to 51.3%.

Our portfolio has nearly doubled in the past nine months after underperforming for several years. Original investors from April 2012 have achieved a net return of 18.1% annually, beating the S&P 500 by nearly 3% per year. A $100,000 investment at inception is now worth a bit more than $465,000.

Not everyone is able to hold an investment in the fund for nine years, but there is a massive advantage to those who can. Just as there is a massive advantage for the overall portfolio if we are able to hold a position in a company over long time periods. This long-term perspective allows true skill and talent to reveal itself, both for the portfolio manager and for the management teams in the companies in our portfolio.

Time is, essentially, a human construct. The standard private fund practice is to report results to investors monthly, provide a quarterly update in these letters, and measure performance with an annualized number compared to a benchmark.

What difference does a month make? Or a year? Or several years? The only thing that matters is the value of your investment when you began, its value when it ends, and your opportunity cost, i.e., what you would have made in an alternative investment.

Portfolio Update

The Arquitos portfolio is unique and volatile. It is not for investors with high anxiety who are not able to internalize the advantage of a long-term holding period. It is not for investors who watch prices day-to-day. We have performed better over the lifetime of the fund because of the volatility. We can’t time the market, so we will often buy into positions too early and hold certain positions through what, in hindsight, is their troughs.

For the portfolio, despite the great recent performance, I made two mistakes that significantly affected results. One mistake involved Nam Tai Property (NYSE:NTP), which was a more recent holding, and one involved MMA Capital (NASDAQ:MMAC), which we have held for seven years.

Last quarter, I wrote about how we had trimmed our position in NTP. A chunk of NTP’s cash was caught in the Credit Suisse Greensill scandal; and it is likely the company will suffer some sort of permanent loss from it. The decision to invest company cash into Greensill Capital highlighted decision-making issues with the NTP management that activist investors are attempting to dislodge.

I sold out for that reason, and the fact that the special meeting that had previously been scheduled—and in which the activists were likely to prevail—was postponed.

I thought this would provide an opportunity to reinvest at a lower price. We did make a nearly 200% return in the equity and an even higher return in options. But we never had the chance to reinvest as I had intended. We sold out in the $14 range. Shares then began a rapid ascent, hitting a peak of $37.88 before coming back down to the mid $20s where they are now. Ouch.

In hindsight, it should have been obvious to me that investors friendly to both the entrenched management and to the activists would bid up shares. We missed out massively by selling out when we did.

MMAC Mistake

The second mistake was more long-term in nature. We have held a sizeable position in MMAC for many years. At the end of the first quarter, shares had dropped to $17, which was significantly below the company’s $39 adjusted book value. Even after a potential $4 per share hit to book value from problems associated with the major winter storm in Texas from February, shares traded at a massive discount.

Chronic underperformance leads to opportunistic transactions—opportunistic for acquirers, often, to the detriment of long-term shareholders. That happened here, as MMAC accepted a buyout offer for $27.77 per share. We made some of our money back thanks to this offer, but the opportunity cost for our position through the last few years has been enormous. I recently sold out of our position completely and have reallocated the proceeds to more attractive opportunities.

At the very least, we ended up having a great return in MMAC from 2014-2017, as our original purchase price was around $7.00. Unfortunately, the last four years have been relatively flat while it has been a large allocation for the fund.

Good News

In happier news, the results from being more nimble in the last six months have been tremendous. We will never be traders, but we have done well playing all angles of the meme stock phenomenon over the past six months.

We have also done well in three new positions. We opened up these positions in the past four months, and I am excited about their long-term potential. I would like to increase our allocations over time, so I don’t yet want to publicly discuss them.

I can say that two are in the real estate industry and one is in the health care industry. I don’t like to make macro opinions, but I believe each of these three businesses can thrive no matter the macro environment.

If inflation ends up being more than transient, we can hit a grand slam. If not, we can still do very well due to the specific operations of these companies. I believe their performance will continue to be uncorrelated to the overall markets.

The two real estate companies have market caps in the $3 billion to $4 billion range. The health care company is a microcap with a current market cap of about $250 million. Two are based in the United States and one in Great Britain. These three new positions currently make up about 38% of the overall portfolio.

Thank you for your continued commitment to Arquitos. I look forward to discussing the three new positions more in the future but wanted to highlight the turnover in the portfolio. And thank you for your grace in regards to the two mistakes highlighted in this letter.

Best regards,

Steven L. Kiel

Arquitos Performance Compared to the S&P 500