Deciding how to save for retirement is a tough choice. There are so many different ways to set your money aside and make it grow over the years to have enough for a decent and laid-back retirement, that it’s hard to figure out what the best choice is.

Q4 2021 hedge fund letters, conferences and more

Two popular choices are annuities and mutual funds, but which one is better for retirement? The answer ultimately depends on your particular situation and what you’re looking for in an investment vehicle.

In this post, we’ll compare annuities and mutual funds head to head, so you can make a more informed decision about which of the two is better for you.

What are annuities?

An annuity is an insurance contract created and issued by a financial institution or insurance company with the goal of paying out a guaranteed income stream in the future in exchange for monthly premiums or a single lump-sum payment. The contract is meant to produce a consistent income stream for a preset amount of time or throughout a person’s retirement years, therefore alleviating their concerns about outliving their savings.

How do annuities work?

Annuities are a type of insurance product, so they’re issued by insurance companies. Based on your age, gender, state of health and other criteria, they determine how long you are likely to live from the moment you start receiving payments. They then use this information and the income you expect to receive to calculate a premium you either pay in one sum or throughout an accumulation phase.

The insurance company assumes market risk

The insurance company will invest the funds from all the premiums paid by annuitants to make them grow over time. This eliminates the need to decide what to invest in or which bank to choose for your savings and financial goals.

However, there is an inherent risk of a market crash, and the accounts may lose value. In an ordinary investment, you would lose money, but in the case of an annuity, the insurance company assumes this risk and is obliged by contract to keep paying you the agreed income no matter what happens to the economy. Of course, this isn’t free, and the risk is integrated into the premium you pay when you set up the contract.

The phases of a typical annuity

There are different types of annuities that work slightly differently, but they usually go through several different phases:

The accumulation phase

This phase only exists in deferred annuities. It is the time during which you fund the account and before payments begin. Any money invested in the annuity grows tax-deferred during this period.

The annuitization phase

This is the phase where you start receiving payments. Its duration depends on the type of contract, with some stretching for a predefined period while others last for the rest of your life.

Some types of contracts never enter an annuitization phase but begin payouts through another mechanism set up in the contract as a provision called a contract rider.

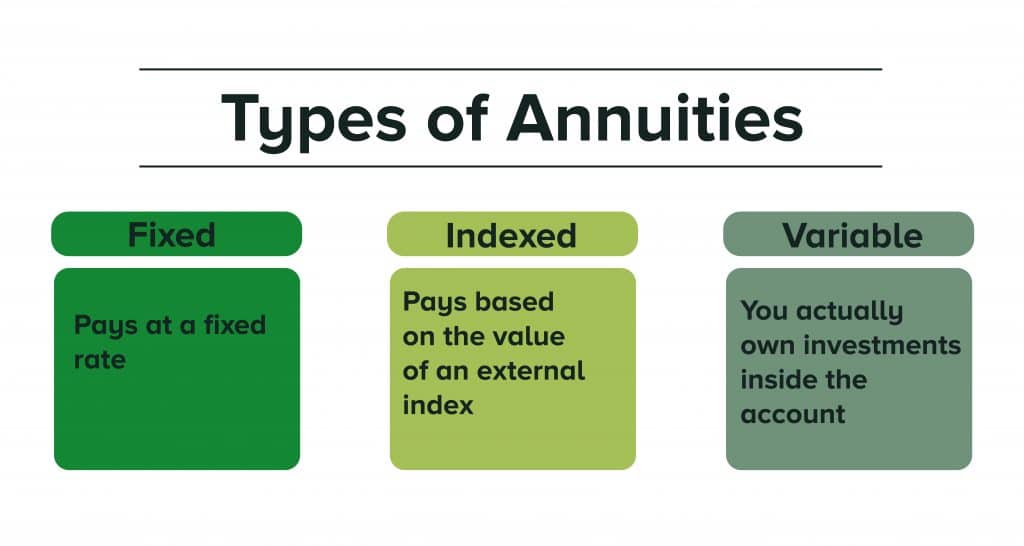

Types of annuities

There are several types of annuities that differ mainly on when payments start and whether or not your money is exposed to the market. Additionally, you can custom tailor an annuity to have the features and characteristics you want through contract riders.

Immediate and Deferred Annuities

Annuities can be set up immediately after a lump sum is deposited, or they may be delayed and paid later. In the first case, the annuitant makes a single lump-sum deposit to establish an immediate payment annuity that starts paying out right away.

On the other hand, deferred income annuities only begin paying after a predefined accumulation phase. In this case, the annuitant specifies when they would like to begin receiving payments in the contract. They can either make a single payment that grows tax-deferred over time or make multiple contributions to the account throughout the accumulation phase.

Fixed and Variable Annuities

Annuities can also differ in how they grow during the accumulation or the annuitization phases. Fixed annuities make periodic payments of the same amount, regardless of market performance. In this case, the insurance company assumes all market risk.

In the case of variable annuities, a part of your account is exposed to the market. This gives you the possibility of increasing your payout, but it also exposes you to the risk of losing part of your investment.

Contract riders

Apart from these base contracts, you can add riders to customize your contract and add things like death benefits or long-term care provisions. The cost of living rider is another popular provision that adjusts payouts for inflation based on changes in the consumer price index (CPI), ensuring that your monthly income will always have the same purchase power.

What are mutual funds?

Mutual funds are a type of investment company that pools money from many investors to acquire equities. The term is generally used in the United States, Canada, and India, although comparable structures exist in other countries like SICAV in Europe and the open-ended investment companies in the United Kingdom.

How do mutual funds work?

Investing in a mutual fund means purchasing “units” of the fund in a similar way to how you buy shares of a company. You then choose a portfolio of investments based on your risk tolerance, and the fund takes care of the rest, investing your and the other investors’ money in exchange for a fee. The portfolio grows over time thanks to the company’s investments. Then, you reap your rewards in the form of payments called distributions.

How do distributions work?

Since mutual funds invest in various assets and financial instruments, distributions can come from dividends paid by equities and interest received on bonds held in the fund’s portfolio.

Secondly, most funds will also pay out a part of their yearly revenue to shareholders, and if a fund sells assets that have appreciated in value, most will pass along these gains to investors via a distribution.

Finally, you can also profit by selling your fund units in the market if the fund’s net asset value (NAV) increases but is not sold by the fund manager.

How frequently are distributions paid?

The frequency with which a fund will pay distributions varies from fund to fund but are usually monthly, biannual, quarterly or annual. The size of the distributions is calculated based on the proportion of the number of units you own on a specified date.

Types of mutual funds

The types of mutual funds depend on the type of assets they invest in:

Money market funds

These types of mutual funds can only invest in high-quality, short-term investments from US businesses that have been authorized by federal, state, and local government lay, making them some of the safest mutual funds to invest in.

Bond funds

Because they seek to offer greater returns, bond funds have a higher risk than money market funds. There are numerous different types of bonds, so the risks and benefits of bond funds can differ considerably.

Stock or equity funds

These funds invest in corporate stocks. Since there are various types of stocks, there are also different types of equity funds, including:

- Growth funds that focus on stocks with the potential for higher financial gains.

- Income funds that pay regular dividends.

- Index funds that track a particular market index.

- Sector funds that specialize in a particular industry.

Target date funds

These funds hold a mix of bonds, equities, and other types of assets. Target-date funds are specifically designed as investment instruments for retirement.

Annuities vs. Mutual funds - Which is better for retirement?

Now that you know the basics of annuities and mutual funds, let’s break down their key differences, specifically for investors near or in retirement.

Security

Mutual funds do not guarantee income or the performance of your savings. If the market crashes, you’ll lose some of your investment, which doesn’t bode well, especially for those near retirement. If you’re looking for a guaranteed income, annuities are your safest bet. Annuities may also guarantee the growth of your account, albeit for a fee.

In the case of mutual funds, some have proven to withstand market downturns and even grow faster after a crisis, like what happened during the coronavirus pandemic. However, past performance doesn’t ensure good future performance, so risks will always be involved when investing in a mutual fund.

Cost

Guarantees are not free, so you have to pay insurance companies for them to assume the risk of a market downturn. Additionally, management expense ratio or MER fees are usually much higher for annuities than for Mutual funds. Therefore, annuities tend to be much more expensive than mutual funds.

Returns

Due to lower relative expenses and the possibility of profiting from market highs, mutual funds can earn much higher returns than annuities. This makes mutual funds a better choice for younger individuals looking to save for retirement since they can assume more risk by having more time to recover from market lows.

Income options and flexibility

Unless you pay for an expensive contract full of riders, annuities don’t usually offer much flexibility when it comes to your income. That can be a good thing if you want a steady cash flow during retirement.

However, as we saw, mutual funds can offer a wide array of income options and payment schedules to fit your needs, so if you’re looking for flexibility, a mutual fund is a better option.

Annual tax treatment during the accumulation phase

Annuities grow tax-deferred or can even grow tax-free if the money comes from a Roth IRA. However, mutual funds can only receive tax advantages if they are in a traditional IRA or Roth IRA.

Annual tax treatment on withdrawals

Your annuity payments are taxed as normal income once you enter the annuitization phase. This is the highest tax rate you’ll be charged, which is not ideal. On the other hand, although some mutual fund distributions are also taxed as income, they’re usually taxed as capital gains, making mutual funds more tax efficient.

The bottom line

When comparing annuities and mutual funds for retirement, it comes down to what you’re looking for. Retirees and other investors who want guaranteed income and the lowest risk possible and who don’t mind paying higher fees would probably do best by choosing an annuity.

On the other hand, if you’re looking for higher returns and can handle taking on market risk, mutual funds are the better option.

Article by Jordan Bishop, Due

About the Author

Jordan Bishop discovered the power of credit cards at a young age. His first splash into travel hacking came with the wildly viral launch of Yore Oyster, which landed him national media attention and more than a million frequent flyer miles. He leveraged that opportunity to help tens of thousands of people save millions of dollars on flights, all while globetrotting the world.