Whitney Tilson’s email to investors discussing Alphabet Inc (NASDAQ:GOOGL)’s robust earnings; Paypal Holdings Inc (NASDAQ:PYPL)’s weak guidance; my letter about PayPal to the CFPB; DWAC investors, watch out for the death spiral; as goes January, so goes the year?

Q4 2021 hedge fund letters, conferences and more

Alphabet's Robust Earnings

1) Internet giant Alphabet (GOOGL) reported blowout earnings after the close yesterday, with fourth-quarter revenue, operating income, and net income up 32%, 40%, and 36%, respectively.

The company also spent $13.5 billion on share repurchases, up 70% during the quarter and $50.3 billion in 2021, which reduced the diluted shares outstanding by 1.5%. Finally, the company announced a 20:1 share split.

Not surprisingly, GOOGL shares are up nearly 10% this morning.

Alphabet was an original, core holding of both our Empire Stock Investor and Empire Investment Report newsletters – and we like it as much as ever today.

PayPal's Weak Guidance

2) In contrast, payments giant PayPal (PYPL) reported mixed earnings and gave weak guidance, which sent shares tumbling this morning. The stock has now been more than cut in half since the all-time high it reached in July.

The company expects first-quarter non-GAAP earnings per share of $0.87, far short of the $1.16 analysts anticipated. It also gave weak full-year revenue growth guidance for 2022.

I wonder if PayPal's earnings miss has anything to do with increased scrutiny regarding a very profitable scam it was (and, I assume, still is) running? I doubt it, but you never know...

I detailed it in two of my e-mails, which I linked to in this letter I sent to the head of the Consumer Financial Protection Bureau ("CFPB") in December (to which I never received a reply):

December 2, 2021

Mr. Rohit Chopra

Director

Consumer Financial Protection Bureau

1700 G Street NW

Washington, D.C. 20552

Dear Mr. Chopra,

I am a fellow Harvard gov major, though a few years older than you: I was class of 1989. Kudos on the incredibly important work you're doing at the CFPB.

I am writing to make you aware of a scam being foisted upon the American people by the largest fintech company in the world, PayPal (PYPL), that, I estimate, may add up to hundreds of millions of dollars every year.

Very simply, PayPal offers two ways to send money: to "friends and family," for which there is no fee, and for "goods and services," for which there is a hefty fee.

If someone is engaging in a commercial transaction and wants PayPal's "buyer protection," then maybe it makes sense to pay the fee, but otherwise, it doesn't.

But that's bad for PayPal's bottom line, so, to pad it, the company engages in blatant trickery and deception by:

a) Not disclosing that there will be a fee for users of its app (their website, however, does disclose that "The seller pays a fee.");

b) Not disclosing the amount of the fee to the sender at any point; and

c) Refusing to cancel the transaction and refund the fee if the customer realizes their mistake and contacts customer support.

I have written two articles about what happened to me, with details and screenshots – one from two years ago, when I was using PayPal to send money (posted here: https://empirefinancialresearch.com/articles/how-amazon-wove-itself-into-the-life-of-an-american-city-thousands-protest-amazon-paypals-scam-the-seven-ways-getting-rich-increases-your-odds-of-divorce) and one from two weeks ago (posted here: https://empirefinancialresearch.com/articles/paypals-scam-redux), when I was receiving money (and was charged a 4.5% fee).

While the scam is small in scale for most individual customers – the fee I paid two weeks ago was only $21.91– if PayPal's deceptive and misleading process results in even a small percentage of its customers being charged unnecessary fees (which I definitely think is the case, given the feedback from my readers), it would add up to BIG money given the company's millions of transactions every day.

I know that the CFPB has limited resources, but I don't think this is necessarily something that would require much time or effort (unless you decide to launch an industrywide investigation). PayPal isn't committing a crime, so you don't have to indict or sue them. Just send them a letter telling them to knock it off or you'll publicly expose their scam and I suspect they'll quickly improve their disclosure and agree to issue refunds if a customer complains. It reminds me of what the Department of Transportation did 10 years ago, when it forced airlines to disclose the full price of their tickets, including all taxes and fees, in all advertising.

Sincerely yours,

Mr. Whitney Tilson

Empire Financial Research

P.S. Though I ran a hedge fund for 18 years and was once a very well-known short seller, I'm out of that business and have no position in PayPal's stock. My only interest in writing to you is to be a good citizen.

DWAC Investors

3) In my January 24 e-mail, I wrote of Digital World Acquisition Corp (NASDAQ:DWAC):

Here's a spot-on Seeking Alpha article by Phillip Braun, a professor of finance at Northwestern's Kellogg School of Management, on one of the worst stocks I've ever seen in my career: DWAC: SEC Approval Unlikely for Trump Media Merger Deal.

Professor Braun published a follow-up article on Monday, making the absolutely correct point that even if the SEC approves the deal, the share price is likely to collapse because of the way the $1 billion PIPE (private investment in public equity) is structured (namely, to rip the faces off of retail investors): DWAC Investors, Watch Out for the Death Spiral. Excerpt:

- The potential DWAC and Trump Media and Technology Group merger closing might be forthcoming.

- Investors need to prepare themselves for what will happen to DWAC's and then Trump Media's share price just prior to and then right after the merger closes.

- DWAC is financing a portion of the deal with a PIPE that is a death spiral, hence the share price of DWAC and then Trump Media could fall.

- If you currently own DWAC shares, sell before the merger closes and then buy back after it consummates the deal.

- If you do not own it yet but want to, wait until Trump Media is listed.

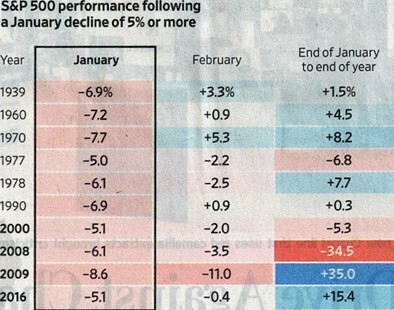

4) As goes January, so goes the year? Not so fast...

This table in yesterday's Wall Street Journal shows that in the 10 years in which the S&P 500 Index has fallen by 5% or more in January, it has risen the rest of the year seven times:

Best regards,

Whitney

P.S. I welcome your feedback at [email protected].