The Absolute Return Partners letter for the month of December 2018, titled, “The Art Of Defaulting.”

… the debt-financed overspending of the 1960s had continued into the early 1970s. The Fed had funded this spending with easy-credit policies, but by paying back its debts with depreciated paper money instead of gold-backed dollars, the U.S. effectively defaulted. — Ray Dalio

Principles for navigating big debt crises

Ray Dalio of Bridgewater Associates is one of my role models in life and, when he writes a new book, I would normally visit Amazon.co.uk more quickly than you can count to ten, but not this time!

Q3 hedge fund letters, conference, scoops etc

What? Have I fallen out of love with Ray’s way of thinking? Not at all, but I found out that his new book – Principles for Navigating Big Debt Crises – can actually be downloaded for free. Ray, being the class act he is, has decided that everybody should know how to navigate a debt crisis; hence he has chosen to make it freely available (as a PDF copy).

Much (but not all) of the content below is inspired by Ray’s thinking. He is not as explicit in his new book as I am below (and as he has been before) in terms of the timing of the next debt crisis, but it’s pretty clear that he also thinks the writing is on the wall.

If you want to read the wise words of a very smart man, I suggest you give yourself one for Christmas, which you can do here. Christmas presents rarely come cheaper than this.

Debt crises of different sorts

In the following, I will focus on what Ray calls major debt crises – crises that have caused a slump in GDP of at least 3% but, in reality, there are different types of major debt crises. For example, one should really distinguish between debt crises in OECD countries where most borrowings are in the domestic currency vis-à-vis debt crises in EM countries where much of the borrowings are in foreign currencies, and that is precisely what Ray does in his new book.

That dynamic changes the nature of the crisis. Where the former are very much disinflationary in nature, the latter are often inflationary – sometimes even hyperinflationary. Consequently, monetary authorities react very differently.

Debt cycles of different sorts

Long-term readers of the Absolute Return Letter will know that I always distinguish between short-term debt cycles and debt super-cycles. Short-term debt cycles move more or less in parallel with the underlying economic cycles and last on average 7-8 years – in line with the average length of economic cycles.

Debt super-cycles are a different kettle of fish. They typically last 50-75 years and have (unbeknown to many) existed for thousands of years. According to Ray, they even get a mention in the Old Testament, which described the need to wipe out debt every 50 years or so. It is referred to as the Year of Jubilee in the old book.

Debt super-cycles always end with a big bang. The previous debt super-cycle ended with the breakout of World War II, and a new debt super-cycle commenced its life when the canons fell silent in 1945. We are now almost 75 years into the current super-cycle; i.e. it will go down in history as one of the longer ones.

The dynamics of debt crises

What do debt crises have in common? To begin with, I should point out that the 41 major debt crises that Ray has identified since 1980 are part of an even bigger number of debt crises that he discusses in his new book, starting with the hyperinflationary debt crisis in Germany between 1918 and 1925.

I should also point out that every crisis he brings up is a mid to late stage super-cycle crisis. Not one crisis is from the 1950s, 1960s or 1970s. The logic is quite simple. In the early stages of a debt super-cycle, adding debt is actually a good thing and spurs economic growth; i.e. debt crises rarely occur in the earlier stages of debt super-cycles and almost never cause a major slump in GDP. Only later in the super-cycle does more debt actually become a problem.

Back to my question – what do all these crises have in common? All debt cycles start with a period of healthy borrowings, which is good for GDP growth (stage 1 in Exhibit 1 below). It is also worth noticing that, in the early stages of a typical debt super-cycle, a dollar of added debt leads to approx. a dollar of GDP growth. The two grow more or less in line, but that changes dramatically later in the super-cycle – more on that below.

Exhibit 1: The seven stages of an archetypal long-term debt cycle

Source: “Principles for Navigating Big Debt Crises” by Ray Dalio

Healthy borrowing eventually turns into what Ray calls the bubble stage (stage 2). At this stage, excesses are creeping in; borrowers assume that the good times will continue forever, so they continue to borrow, even if they cannot always afford it.

Three conditions are typically prevalent during the bubble stage:

- Debt grows faster than income.

- Equity markets rally.

- The yield curve flattens.

All three conditions have been prevalent in recent years. I should also point out that monetary authorities don’t always play ball at this stage of the debt cycle. Where they should seek to constrain the bubble, they often inflate it instead by being far too lenient.

Remember my earlier point about debt and GDP growing more or less in line during the early stages of debt super-cycles? As the bubble in stage 2 gets bigger and bigger, it takes more and more debt to deliver a dollar of GDP growth. As you near the end of the bubble stage, the debt-to-GDP ratio, which was about 1:1 earlier on, changes dramatically. It now takes about $5 of additional debt to generate a dollar of GDP growth. In some of the largest economies in the world, and that would include both China and the United States, the ratio is now 0.20-0.25; i.e. we are not far from hitting the proverbial wall.

Borrowings eventually peak (stage 3), and depression follows (stage 4) which Ray, as mentioned earlier, defines as a dive in GDP of 3% or more. All the debt cycles that he reviews in his book go through a slump in GDP of that magnitude or more.

Deleveraging (stage 5) follows, which Ray calls Beautiful Deleveraging. He assumes (which is almost always the case) that the stimulation offered by monetary authorities is powerful enough to offset the deflationary forces. In practice, this is done by providing ample liquidity and credit support.

Most of the time, that is it. Stage 5 marks the end of the debt cycle. Conditions normalise, and a new cycle can commence, but that is not always the case. Every now and then, consumers and companies don’t react to central bank policies the way the theory books prescribe. Consequently, monetary policy becomes inefficient.

This was a condition first recognised by central bankers in the 1930s, and they even coined a phrase to describe it: Pushing on a String, they called it. When that happens, you have come to the end of the debt super-cycle.

The dynamics of debt super-cycles

It makes perfect sense that, as the overall economy grows, so does total debt in society, but there is more to the story than that. Despite the occasional debt crisis, debt-to-GDP (when measured in %) continues to grow throughout the debt super-cycle, as we all have an inclination to spend more than we earn (apart from the Germans). Hence, over longer periods of time, debt-to-GDP continues to rise until we come to a crashing finale.

Furthermore, as risk assets tend to appreciate in value during the bubble stage of the debt cycle, people feel - rightly or wrongly - that they can afford to spend more than they earn.

At some point, the entire process goes into reverse. Servicing the debt now confiscates such a large part of borrowers’ income that they can no longer service their debts, and lenders won’t lend them anymore. As one person’s spending and borrowings are another person’s income, all wheels begin to come off. This marks the end of the cycle.

Near zero interest rates, low risk premia on risk assets in general and on equities in particular, central banks running out of gas, decelerating productivity growth despite being in the midst of a digital revolution, and anaemic GDP growth despite interest rates being so low are all powerful indications that we are not only coming to the end of the current debt cycle; we are very close to the end of this debt super-cycle.

The problem in a nutshell

The growth rate of net investments in the US and elsewhere have been on a decline for years and, when adjusting for the fact that all the new technologies depreciate faster than older technologies did, net investments in the US are no longer growing.

Phrased differently, the key issue facing the economy today is that we have under-invested massively for years and continue to do so. The reason productivity growth has been so abysmal throughout most of the computer age is that the savings computers have freed up have not been re-invested in re-skilling the workers affected to a higher level (remember – human capital is also part of the capital stock) but have instead been pocketed by capital owners.

The growth in debt-to-GDP implies that little of the fancy stuff that have enriched our livelihoods in the last 30-40 years has actually paid for itself. Instead, it has been financed by under-investing, driving productivity growth lower and debt-to-GDP higher. Global under-investments in the past half century amount to no less than $400 trillion or about five years of global GDP (Source: MicroStrategy Partnership LLP). That is what it would take to lift GDP growth back to the levels of the 1950s and 1960s.

The inevitable consequence of all of this is that real interest rates will stay low for years to come. Otherwise society simply cannot afford to service all that debt. Absent of any interventions, i.e. in a truly capitalist economy, debt-to-GDP would never have reached current levels. Debtors would have defaulted en masse by now. However, in the managed economy we are ‘enjoying’ these days, interest rates are kept artificially low, allowing debt-to-GDP to continue to rise. The fact that keeping interest rates artificially low has other – and very negative - implications is being largely ignored by those in power.

The case of debt fatigue

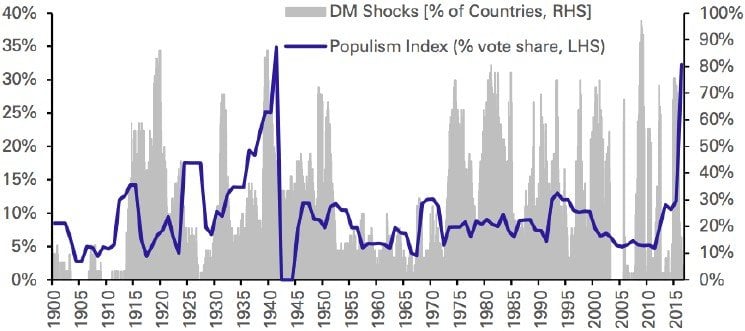

If we compare the current debt super-cycle to the previous one, which ended with the outbreak of World War II in 1939, 2007-09 were similar in nature to 1929-32, and the phase we are going through now is similar to 1935-39, where a sharply rising gap between poor and rich led to a monumental rise in populism (Exhibit 2).

Extreme levels of populism can, at worst, lead to monsters like Adolf Hitler or, at best, to demagogues like Nigel Farage who, almost single-handedly, managed to turn the British against the EU on a swarm of lies (If you disagree with me (and I am sure some do), I suggest you read this link). One can only hope the British wake up one day.

Exhibit 2: Populism index % of votes across key countries Population weighted (LHS) and DM financial crises (RHS)

Source: Deutsche Bank Research

Populism or not, when interest rates go to zero, monetary policy doesn’t work properly any longer. Central banks will instead resort to printing money (QE nowadays), which will drive up prices on risk assets, and that is the phase we have been going through over the last few years.

However, towards the end of all debt super-cycles, economic agents (whether households or corporates) increasingly suffer from debt fatigue. The appetite for borrowing drops and, consequently, economic activity comes to a virtual standstill. That is a hard nut to crack for policy makers, as traditional monetary policy tools like interest rates no longer work.

The meaning of debt destruction

Debt super-cycles always end with plenty of debt destruction. The slate needs to be wiped clean, so to speak. In a typical cycle, there are only two ways debt destruction can be accomplished – either through inflation or through defaults.

Yes, I am aware that there are indeed other ways a country can dig itself out if the excessive amount of debt is predominantly public. For example, governments can choose to raise taxes. However, let’s assume the four sectors in the economy – the government, the financial sector, the corporate sector ex. finance and the household sector – are all drowning in debt (as they are). In that case, we are effectively back to the two options just mentioned.

In the last century we have had two episodes of significant debt destruction through defaults – the Great Depression of the 1930s and the recent Global Financial Crisis – and one through inflation – the 15 years from 1966 to 1981 (give or take).

The big challenge for investors now is to identify which path the end of this super-cycle is most likely to follow – default, inflation or …?

Debt destruction through vanilla defaults

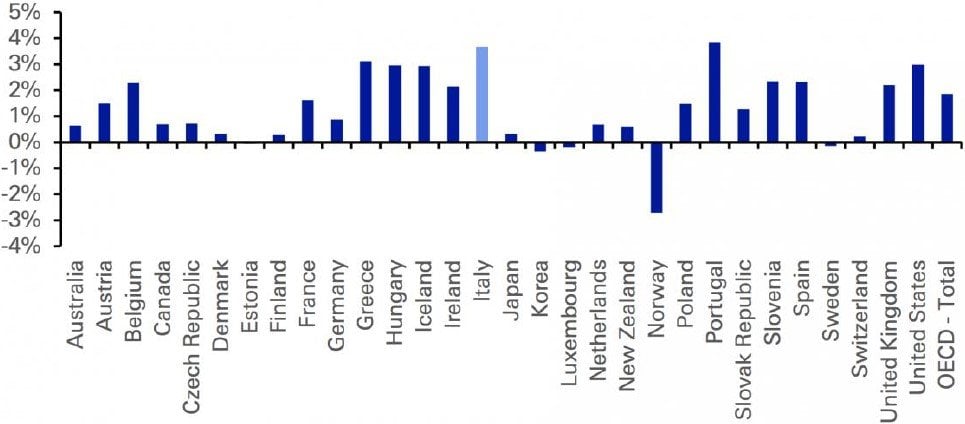

When measured as a percentage of GDP, no OECD country is more exposed to a rise in interest rates than Italy (Exhibit 3). Spending about 4% of its GDP annually on servicing its considerable debts limits the number of options the Italian government can pursue.

If you further consider that Italy suffers from (a) chronically poor productivity, (b) a rapidly ageing population, (c) a large shadow economy, and (d) huge refugee problems due to its proximity to Africa, you will probably understand why Italy is my firm favourite amongst DM countries to run into serious problems – potentially even a vanilla default – in the years to come.

Exhibit 3: Net government interest costs (% of GDP)

Source: Deutsche Bank Research

Exactly when that is likely to happen is hard to predict, though. As we have learned from Japan, as long as interest rates are kept very low, the show can go on for much longer than anybody thought possible. You can read more about the four types of vanilla defaults here.

Debt destruction through creative defaults

One could (with some right) argue that a vanilla default in an OECD country is highly unlikely. Economic integration across borders – and thus interdependency – is quite simply too high these days. A vanilla default in one country will cause so many problems for other countries that creditor nations will bend over backwards to find a more creative solution. Think Greece in 2010-11.

If you didn’t read the opening quote of this letter (which I took from another of Ray Dalio’s books), I suggest you do so now. According to Ray - and I don’t disagree - even Uncle Sam has defaulted in our lifetime. It is all about how it is organised and how it is presented.

A recent example of the need to think out of the box when having to deal with a possible default is none less than Donald Trump. In May 2016, when he was campaigning to become the next tenant of the White House, he said (and I quote):

“I would borrow, knowing that if the economy crashed, you could make a deal. If the economy was good, it was good. So, therefore, you can’t lose.” (Source: New York Times)

In other words, Trump will continue to borrow until all wheels come off, and then he will make an offer to creditors they cannot afford to decline.

Here in the UK, an obvious way to default would be for the government to renege on its pension obligations. Total unfunded UK pension liabilities are about £11 trillion with the majority being the government’s. £11 trillion is more than 5 times UK GDP. Does that money exist? No, and the UK pension model will definitely have to be revamped at some point.

That said, the subject is clearly not a vote winner, so politicians prefer to pass the problem to the next generation. In the meantime, the elderly will continue to steal from the younger generations who will end up with virtually nothing if this state-sponsored Ponzi scheme is allowed to go on for much longer.

You can read more about smart ways to default here.

Debt destruction through inflation

Let’s assume inflation gathers momentum to 5% per annum and stays at that level for five years. Let’s also assume that property prices rise in line with the underlying rate of inflation. Finally, let’s assume you are smart enough to spot the opportunity and have bought a property worth £1 million. You finance the transaction with an interest-only mortgage. For simplicity’s sake, we’ll assume that you can borrow 100%.

After five years of property prices rising by 5%, the house is now worth about £1,276,000, but you still only owe £1,000,000 to the mortgage provider. From the lender’s point of view, in inflation-adjusted terms, the £1,000,000 he lends to you at the outset is only worth £783,500 after five years. That is essentially debt destruction through inflation.

Now, I wouldn’t for one second argue that debt destruction through inflation only has positive implications. In the example above, think of one person’s gain being another person’s loss.

Or think back to the 1970s and think of all the negative implications of inflation being out of control for a while. Having said that, I am absolutely convinced that if a policy maker at the Bank of England, the Fed or any other central bank is presented with a choice between debt destruction though defaults (like in 2008) or through inflation, he/she will choose the latter any time. Any time!

For those of you with more appetite for this topic, I suggest you re-visit the Absolute Return Letter from March 2018 called An Inflationary Bust Or …?

The link to 'our' mega-trend #8

Long-term readers of the Absolute Return Letter will be aware that our entire business model is built around eight mega-trends that we have identified over the years. Trend #8 we call Mean Reversion of Wealth-to-GDP, and we think of it as the collective result of the other seven mega-trends.

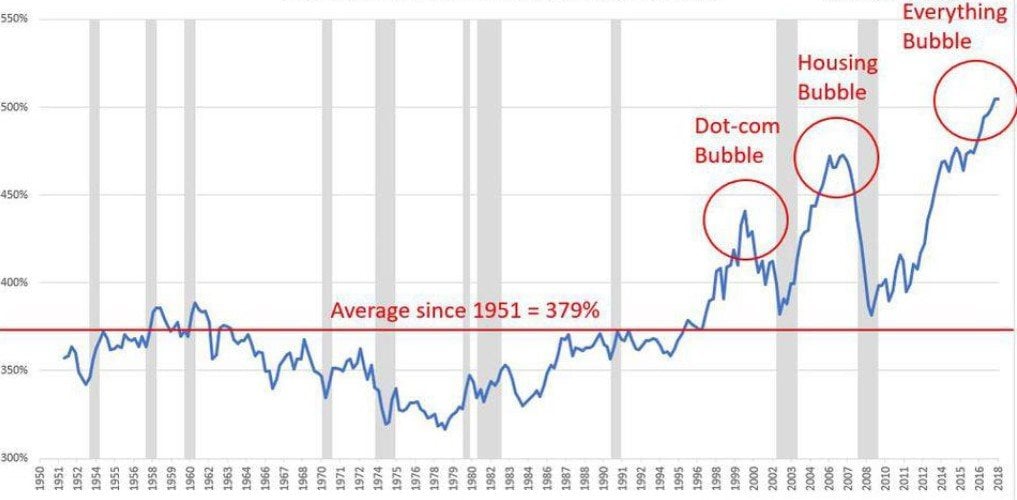

Wealth-to-GDP is long-term stable and, as you can see in Exhibit 4 below, the US long-term mean value is around 380%; i.e. total US household wealth is on average about 3.8 times US GDP. The mean value varies somewhat from country to country, but it is long-term stable everywhere. Think of the ratio as a measure of capital efficiency, i.e. how much capital does it take to produce one unit of output? The lower the mean value, the more efficient a country is at utilizing the capital at its disposal.

Wealth simply cannot outgrow GDP (or vice versa) in the long run. The two must grow hand-in-hand longer term. I have seen US data going back about 150 years, and every time wealth-to-GDP has deviated meaningfully from 380%, it has mean-reverted. Every single time!

As you can see from Exhibit 4, US wealth-to-GDP now exceeds 500%; i.e. it must drop 25-30% to re-establish the long-term mean value. That can happen in two ways. Either GDP grows faster than wealth for an extended period of time, or 25-30% of all US household wealth is destroyed.

The three most important contributors to wealth in society are property, bonds and equities (in that order). Nobody knows which one of the three will take most of the impact. The economic theory behind says nothing about that. Neither does it provide any guidance on timing. It could all happen tomorrow morning, or we could still be years away, but mean-revert it will.

Exhibit 4: Total household wealth-to-GDP (US only)

Source: The Deviant Investor

Final few words

At least one of the following three misfortunes characterise virtually all debt crises:

- Excessive leverage;

- Highly concentrated lending portfolios; and/or

- Asset/liability mismatch.

I am sure you don’t need to be reminded that all three are in full bloom at present all over the world!

The last major debt crisis – the Global Financial Crisis (the “GFC”) – kicked off in the summer of 2007 when excessively leveraged US financial institutions had too much exposure to sub-prime mortgages, and it culminated in the autumn of 2008 with the demise of Lehman Brothers.

The second leg of the GFC unfolded a few years later in Europe, when Greece and other Mediterranean countries ran into serious problems – again because of excessive leverage.

As a consequence of the sub-prime crisis, I got stung personally, as some of the investment managers I had invested with had quite a serious asset/liability mismatch. That taught me an important lesson – never to underestimate that risk factor when investing in private credit strategies.

Going forward, when and where is the next debt crisis likely to strike? And, when it happens, will it mark the end of the current super-cycle?

The easier one first. Given the information I have available today, I don’t think we are years away from the next major debt crisis. I have already referred to Italy as my prime suspect, but policy makers all over the world are guilty of being grotesquely complacent when it comes to debt management. If you happen to be European, don’t for one second think this is just a US and/or a Japanese problem. Donald Trump and Shinzo Abe have plenty of European company in the penalty box.

As far as the second question is concerned, could the next major debt crisis also mark the end of this debt super-cycle? It depends! Every super-cycle in history has ended with something major happening. I am not projecting something similar to what ended the last debt super-cycle (i.e. a devastating war), but the fact that populism is on the rise worldwide does worry me. What is that going to lead to?

For now, my favourite to mark the end of this debt super-cycle is a complete meltdown - and subsequent revamp - of the defined benefit (“DB”) pension system, but I do keep an eye on the rise of populism.

The problem is quite simple. In many countries around the world, large amounts of pension savings are still managed per the DB model; i.e. the risk is still overwhelmingly the employers’ (including the government). With falling interest rates and risk assets only delivering modestly positive returns, particularly outside the US, liabilities have grown much faster than assets in many pension funds in recent years.

One day in the not so distant future, one of our political leaders will have to stand up and say something along the following lines:

“Either we all take a haircut and convert to defined contribution plans [aka DC plans where the risk is transferred to plan members], or our country will go bankrupt, and you will get nothing at all. Which of the two outcomes would you prefer?”

All we need for that to happen is a Thatcher-like politician showing up on the stage – someone who is not afraid to tell the truth instead of the current generation of career politicians who only think about how to get re-elected.

Niels C. Jensen

3 December 2018

Investment Theme: The end of the debt super-cycle

Investment Theme: Mean reversion of wealth-to-GDP