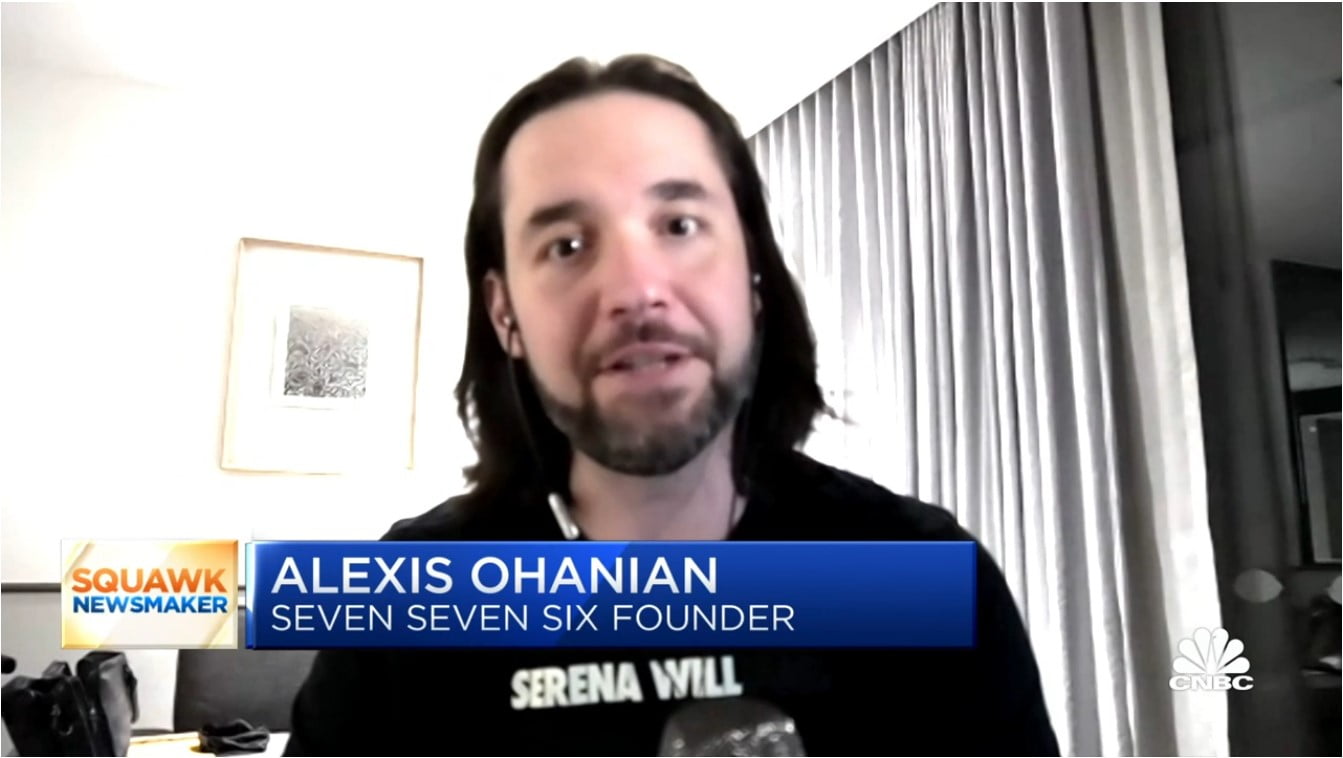

CNBC Excerpts: Reddit Co-Founder Alexis Ohanian, Former SEC Chairman Jay Clayton and Dallas Mavericks Owner & AXS TV Chairman Mark Cuban speak with CNBC’s “Squawk Box” today discussing the Wallstreetbets short squeeze.

Q4 2020 hedge fund letters, conferences and more

'This Is A Drastic Shift' - Reddit Co-founder Alexis Ohanian On Wallstreetbets Short Squeeze

Ohanian On Internet Trends

ALEXIS OHANIAN: As an observer of these internet trends and having gotten a final receipt thanks to co-founding Reddit, you know, this is a culmination of a lot of energy and a sort of kismet situation. I think even just looking at the comments around the internet is something that’s very personal to a lot of people, and a chance for, you know, Joe and Jane America, the sort of retail buyers of stock to flex back, and push back on these hedge funds, and I do think this is a seminal moment.

Ohanian On The New Normal

OHANIAN: Whether it’s one platform or another, this is the new normal, and we’ve watched the internet now over the last ten, fifteen years, thanks to the rise of social media and all this infrastructure, really bring a bottom up revolution. We have seen this across media, we have seen this across so many different sectors and now it is happening to finance, and I mean, it’s nothing short of remarkable and I really do think this is the start of a new era for how we’re going to sort of – how we’re going to perceive the public markets and the interaction of consumers with it.

Ohanian On Looking For Opportunities

OHANIAN: I think we’re seeing crypto currency is one example of this bigger story where I think people are looking for more opportunities to have more influence over ever part of their life, including in many cases, very importantly, their money, their investing and the access to knowledge, the access to information, the access to world class technology to process all of those things is now getting democratized to anyone.

Ohanian Says Menu Is Open

OHANIAN: The menu is open with this combination of technology and ubiquity of connected people sharing insights and opinions and, you know, I hear you, and I think it’s an important thing. There’s an important role to be played for protecting the little guy, it’s just so many little guys are saying clearly they felt unprotected for so long.

Former SEC Chairman On Regulators' Role In The Reddit Short Squeeze

Clayton Says This Is Euphoria

JAY CLAYTON: There are more retail investors participating in the market than ever before and we’re seeing that, and one thing that we don’t regulate directly, Andrew, is euphoria, and we’re seeing some euphoria here. I think I have heard other guests talk about euphoria. You know, when stocks run away, like the ones you mentioned, we do get concerned because it is a situation where professional investors understand this, I do worry that retail investors do not understand that trees don’t grow out of the sky.

Clayton On The IPO Process

CLAYTON: The IPO process is one that’s fairly tried and true, and you get indications of interest from sophisticated investors, that’s where you set the IPO price. You then see the market coming into the open. You set the opening price, and you know, I can tell, people do not like to leave a tremendous amount of money on the table. That’s not something that most people are in the business of doing.

Clayton On Spectrum Of Products

CLAYTON: There’s a spectrum of products here. We need to understand that spectrum of products and bring appropriate regulation across it. Let’s not forget how important to our society any money laundering, know your customer, preventing terrorist finance, and those types of things are, we should never lose sight of that.

Clayton On Diversity

CLAYTON: We all need to do a better job of making sure that this industry that provides so much to people and is frankly one that builds wealth, builds wealth over time and access, has composition that more reflects society, We’re not anywhere close to where we should be.

Mark Cuban Says He 'Hedged The Heck' Out Of His Portfolio

Cuban Says Do Your Best

MARK CUBAN: The reality is you just have to run your company and do your best. It doesn’t change the fundamentals of the company at all. In some many respects it’s window drifting. And if you are of American Airlines, if you’re an owner of GameStop, hopefully prior to all this, hopefully you owned it for a good reason, and you believe in the company.

Cuban Says The Swings In The Price Of The Stock Is All Just Mishegoss

CUBAN: All the manipulation, not even manipulation, all the swings in the price of the stock, it’s all just mishegoss. Right, I mean if it’s a good company it’s a good company if it’s a bad company it’ll end up going out of business. And you know the people who you know bought it just to speculate, some will make money some will lose money. That’s just the way the markets always worked.

Cuban On People Out Of Nowhere Showing Inefficiences In The Market

CUBAN: People who are making the push aren’t who we expect them to be. And so that’s why I like it. You know when you bring people out of nowhere to really show the inefficiencies of the market it’s a good thing.

Cuban On More People Buying Just To Speculate And Trade Than Invest

CUBAN: The days of, okay you know give me a share, I gave my son or daughter a share of IBM and I hope it’s going to be worth a hundred times by the time they’re thirty years old. Those days are long gone. Right, more people just buy just to speculate, and trade than actually invest.

Cuban Says You Can’t Change Wallstreetbets

CUBAN: As long as we’re allowing companies to you know trade stocks in milliseconds, how can we expect this to be an investors market. And until you change that, you can’t change what’s happening with WallStreetBets.

Cuban On What We Want

CUBAN: We have to decide what we want in our market. Do we want this just to be an open, this is just a very liquid market and here are the rules? And whatever comes along we’ll deal with it. Or do we want to encourage investing again. And you do that through the restrictions right.