Three Costly Common Misunderstandings About 5G, Identified by IDTechEx

Q3 2020 hedge fund letters, conferences and more

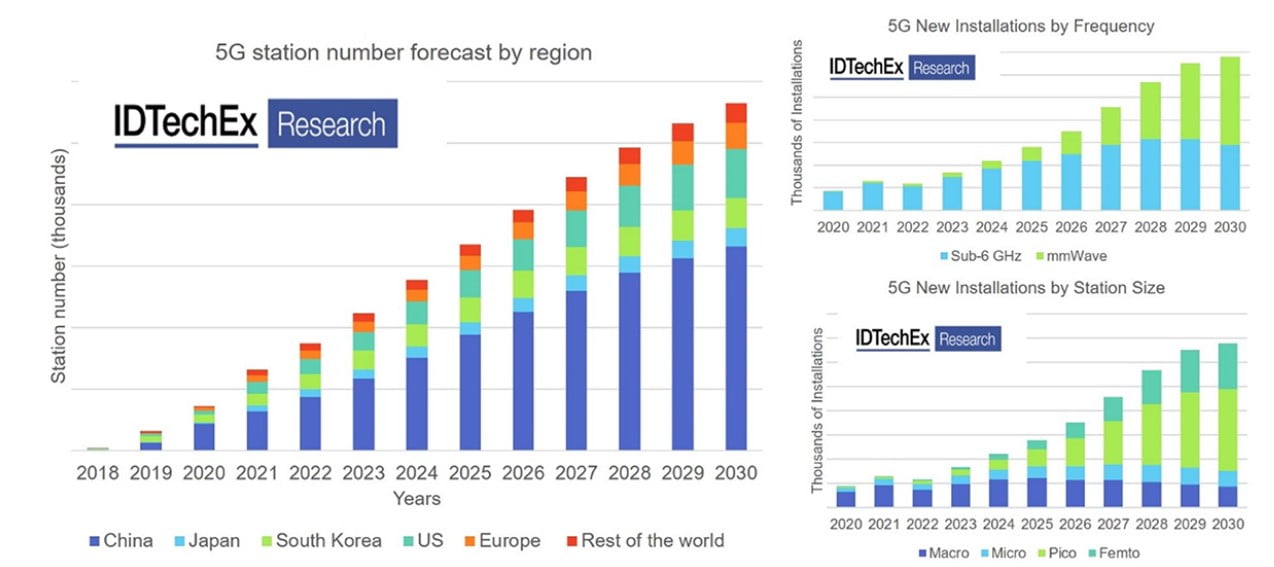

5G is a rapidly growing market and will reach 300 billion USD by 2025 as forecast in the IDTechEx report “5G Technology, Market and Forecasts 2020-2030”. However, there are many common misunderstandings about 5G that might lead to the wrong interpretation. This IDTechEx report points out the real opportunities of 5G, identifies the key trends in technology innovations, clarifies the possible misleading assumptions and provides a ten-year forecast. This article will focus on three common misunderstandings around the 5G market which are extremely important for decision making.

First Misunderstanding: 5G network will need mmWave devices and massive MIMO

It is very dangerous to take it for granted that 5G network will need cm- or mm-wave devices/base stations at its earlier phases of deployment. In fact, most of the global commercialized 5G networks are based on sub-6 GHz 5G, which does not differ from existing 4G LTE network significantly at the device level. Telecoms in South Korea are struggling to deploy enough mmWave 5G stations as mandated by the government. China does not even have a plan so far to adopt high frequency 5G in its commercial 5G network. Also, at the early stage of 5G, the signal amplification of massive MIMO is not necessary and active antennas and associated beam steering is not a must.

Second Misunderstanding: All 5G station are new builds

It is easy to get excited for the large 5G base station number claimed by vendors and telecoms and wrongly take this as the market size. However, at the early stage of 5G, many countries choose to simply upgrade the existing advanced LTE (4G) station to 5G by simply pushing a button. Thus, a considerable amount of 5G stations now are actually the “old” stations.

5G base station forecast. Source: IDTechEx report “5G Technology, Market and Forecasts 2020-2030”

Third Misunderstanding: 5G mainly focus on the telecommunications market

It is true that smart phones will continue to be the most important market for 5G, but only at the early stage. 5G is beyond the mobile phone. The goal for 5G is to create a universal network to link various vertical applications. The true opportunities in 5G is actually beyond mobile. The promising markets as mentioned in “5G Technology, Market and Forecasts 2020-2030” include remote healthcare, private 5G for industrial usage, enhanced AR/VR and more.

How to benefit directly from the massive market opportunity of 5G is a key question for all business leaders and those responsible for business innovation. IDTechEx reports on 5G, Low-loss Materials for 5G and Thermal Management for 5G, are aimed at helping companies clarify the real opportunities in 5G apart from hypes or misunderstandings. While “5G Technology, Market and Forecasts 2020-2030” focuses on the 5G infrastructure, killer applications and user equipment, “Low-loss Materials for 5G 2021-2031” and “Thermal Management for 5G” highlight the market from the advanced materials perspective.