Logica Capital commentary for the month ended October 30, 2020, discussing the 2020 volatility events.

Q3 2020 hedge fund letters, conferences and more

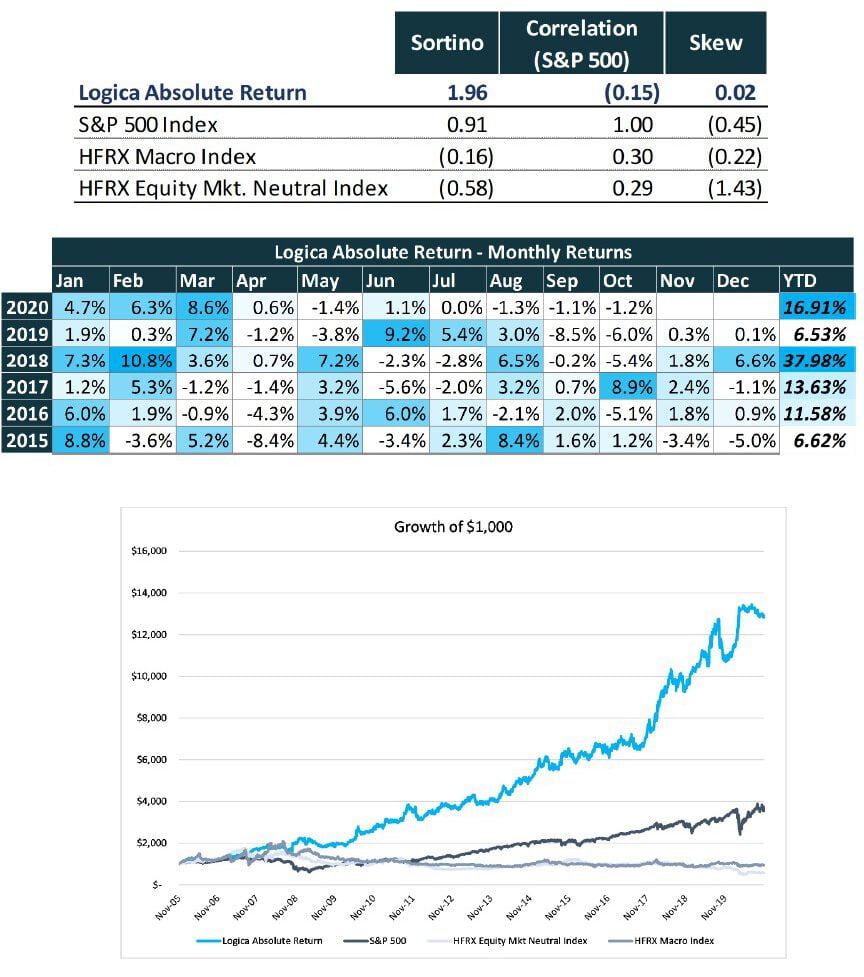

Logica Absolute Return - Up/Down Convexity - No Correlation

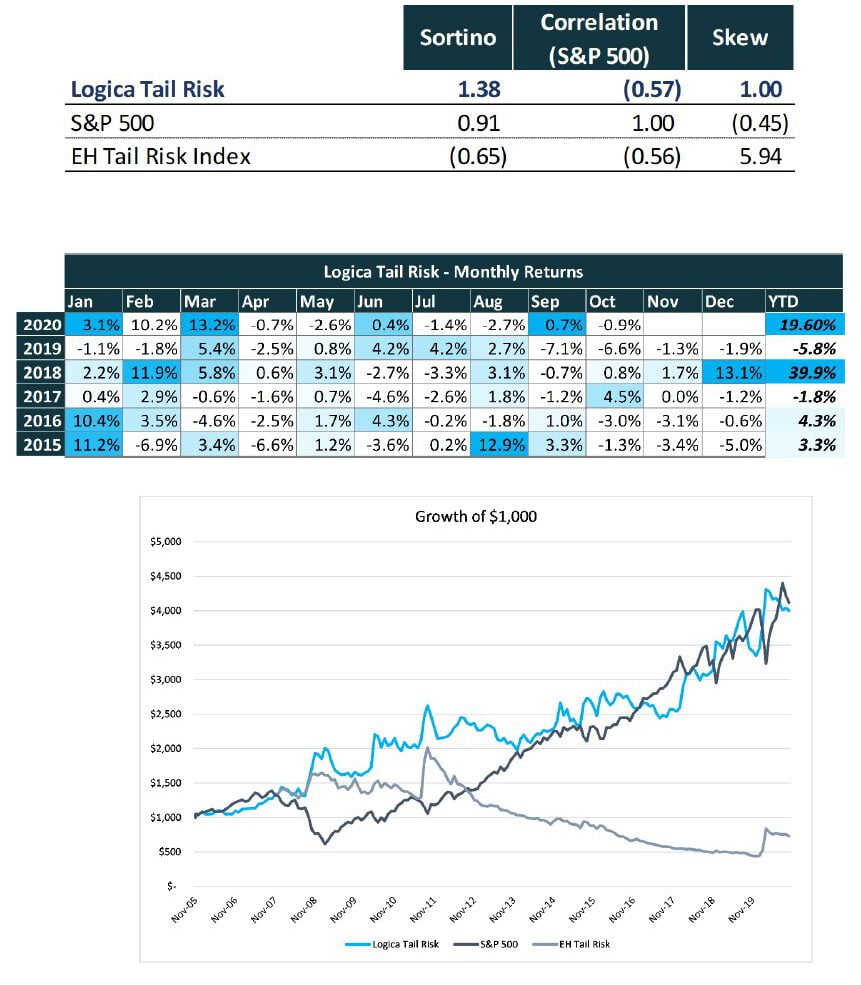

Logica Tail Risk - Max Downside Convexity - Negative Correlation

October 2020 Performance*

Logica Absolute Return -1.25%

Logica Tail Risk -0.90%

S&P 500 -2.49%

VIX +11.7 pts

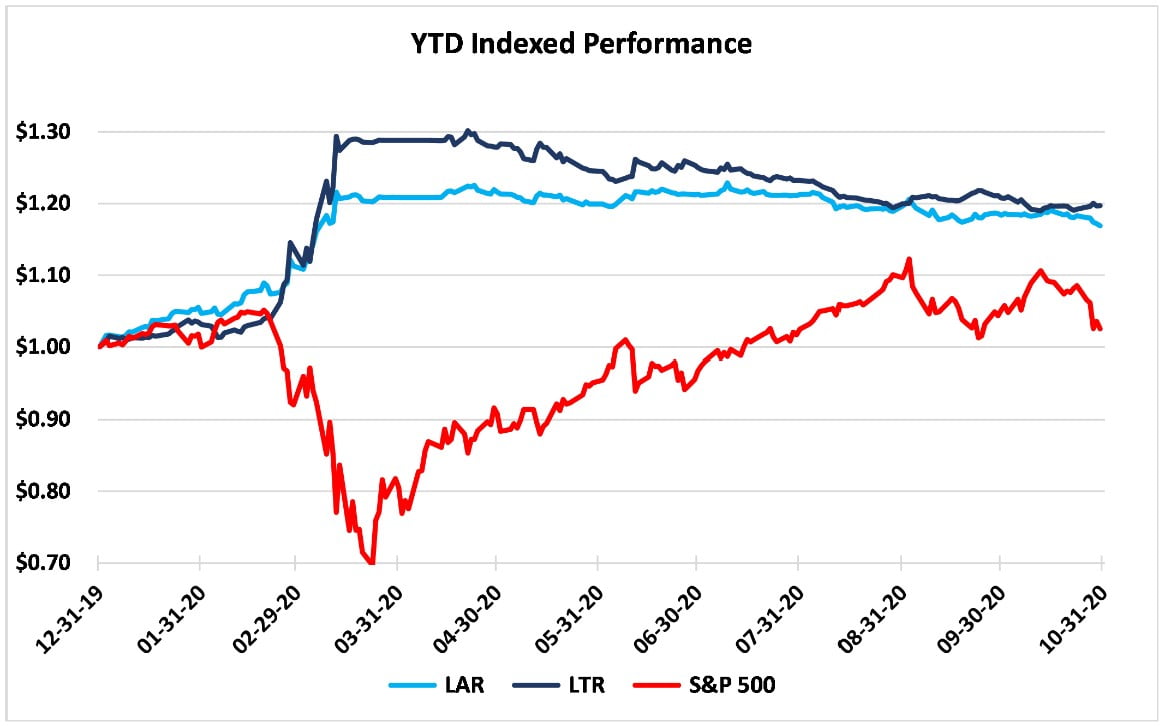

Year To Date Performance*

Logica Absolute Return +16.9%

Logica Tail Risk +19.6%

S&P 500 +2.5%

*Returns are Gross of fees to illustrate strategy performance.

Logica Absolute Return Fund, LP returned -1.56% (net) for October 2020

“I put my soul on black If the house wins, I don’t want it back” - Hidden Giants, 2020

Tricky Waters

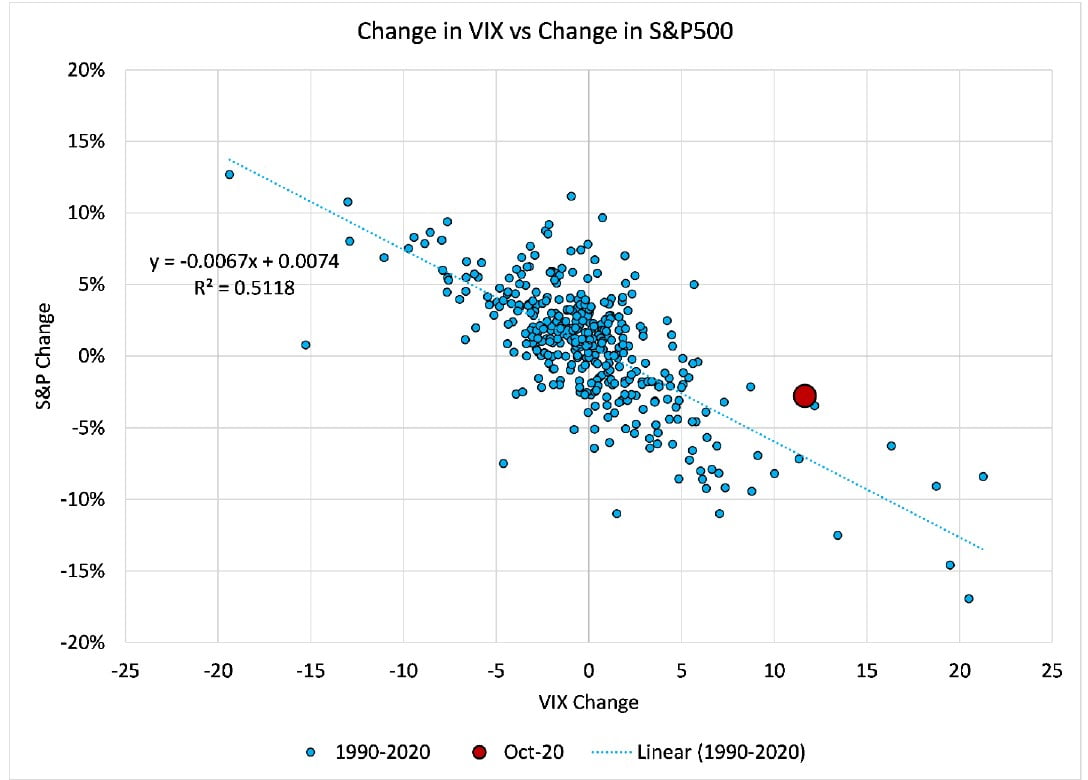

The month of October continued to present unique challenges to a profitable long volatility approach and unfortunately these challenges are continuing into November. This seems implausible given a decline in the S&P 500 and an increase in VIX of nearly 12 pts, but as we have seen over the past few months, everything and anything is possible.

In the context of October, it is important to understand what an interesting outlier we just experienced (has anything in 2020 not been an “interesting outlier”?). This size move in the VIX “should” translate to a roughly 7.5% decline in the S&P. Instead, we got a 2.5% move.

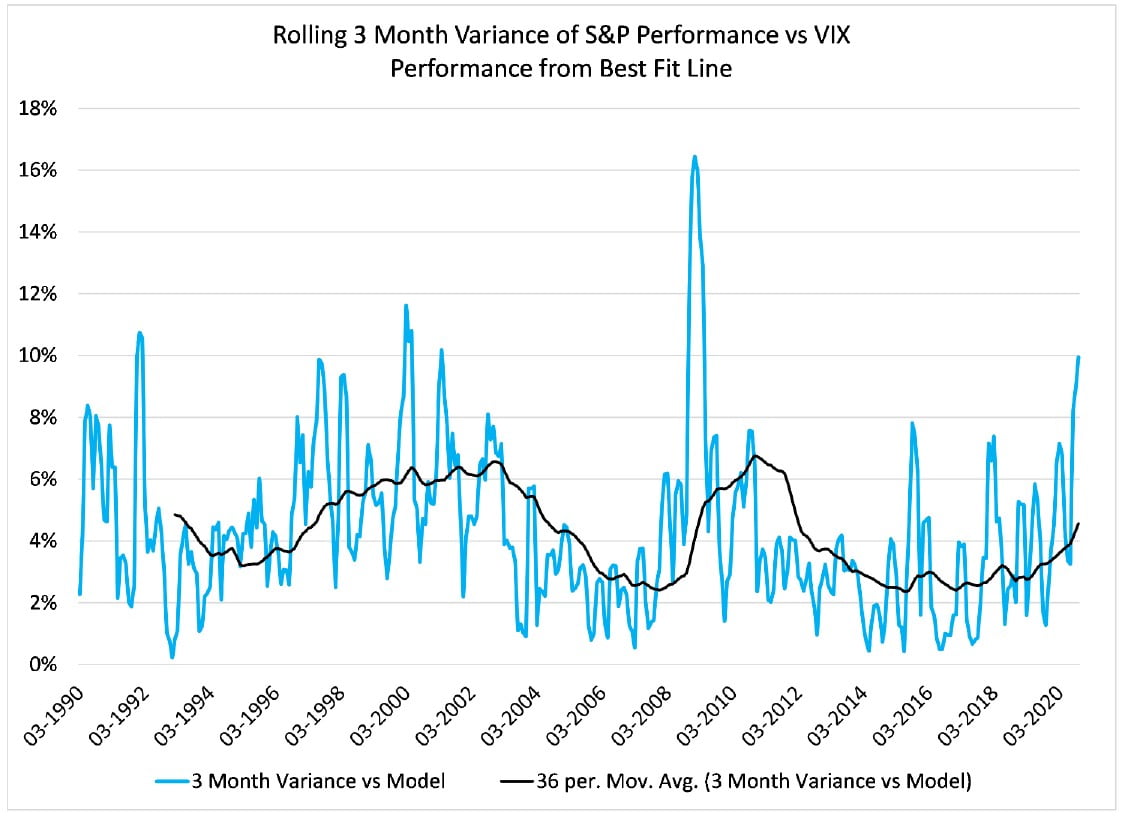

The pattern of variance from an expected relationship is unfortunately one that has fundamental underpinnings and exhibits autocorrelation. We increasingly inhabit a world where the “value” of assets, expressed as the price created by buyer and seller behavior, is increasingly uncertain. As stable relationships recede, variance increases, and risk must be reduced. Said differently, we are on the upslope of a period of increased uncertainty that is being expressed by a near constant rotation. We have previously shared thoughts on the concerns of a breakdown in the post-1998 negative relationship between rates and equities (the “Fed Put”). This month we are going to focus on volatility and momentum as we review Logica’s performance over the past seven months.

Historical periods of elevated variance in the relationship between the VIX and the S&P have largely been driven by economic recessions (1990-91, 2000-2003, 2008-9). While the CoV-19 induced recession has certainly contributed to another bout of variance, this uptick began well in advance of the 2020 sharp, but brief, recession.

This suggests further volatility events we are concerned about sit ahead, rather than behind. For many of our investors that did not participate in the profits from the February & March 2020 volatility events, this would obviously be welcome. While we have had notable relative success versus other long volatility strategies, we have not met our goals of positive absolute return for one very simple reason – the Logica decision to express our upcapture modules in options was hampered by the substantial decline in implied volatility (proxied by VIX). This created a headwind that we were not able to overcome over this period.

"The difference between stupidity and genius is that genius has its limits." - Alexandre Dumas-fils

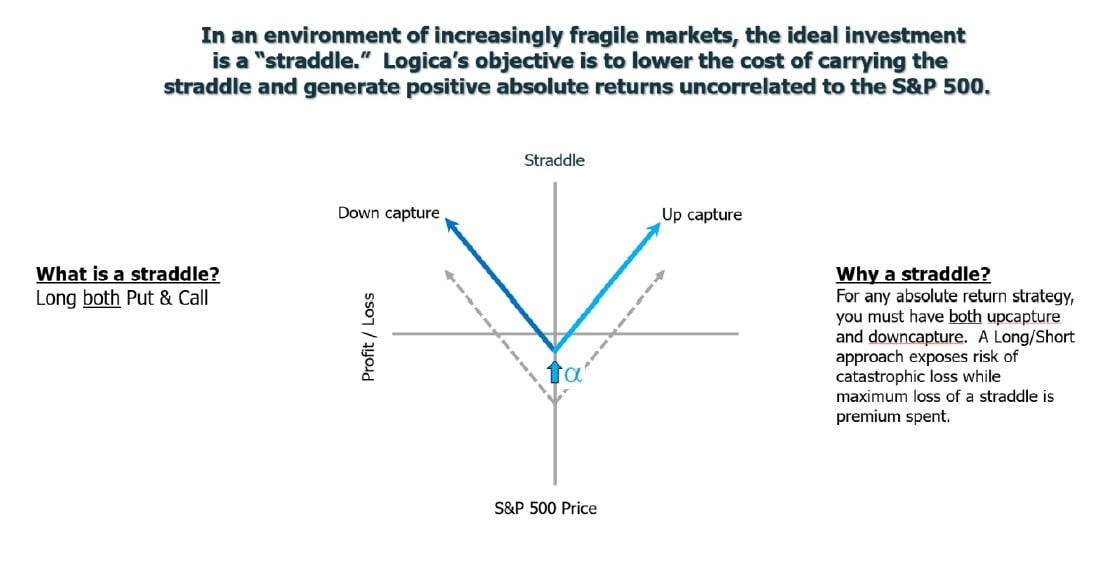

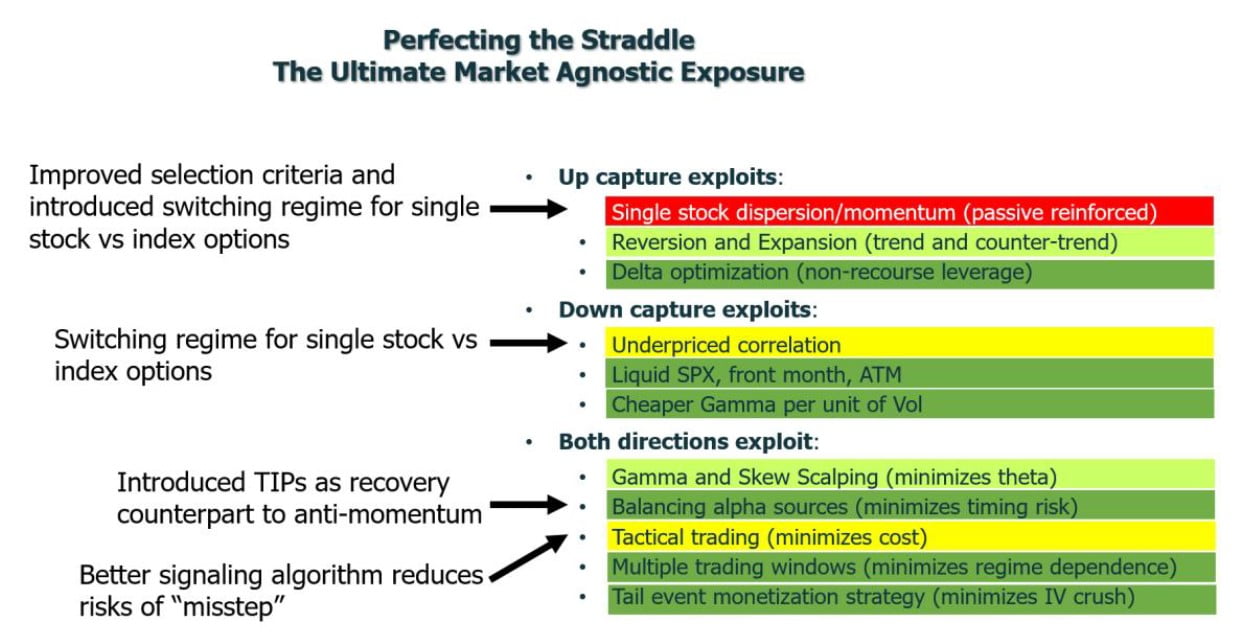

As a reminder to our investors, Logica approaches the world from an absolute return standpoint. All absolute return investors must have components of their portfolio that offer positive return potential regardless of the behavior of the S&P 500. Most approach this with a long-short approach, buying assets likely to appreciate in price while shorting assets likely to depreciate in price. At Logica, we use a different approach that we believe is made possible by substantive changes in market structure that have occurred over the last decade. By deploying a straddle, a position long both put options and call options, we offer investors the opportunity to generate positive returns in both directions without taking on the unlimited risk associated with shorting assets, and always maintaining positive expectancy associated with significant downside market events.

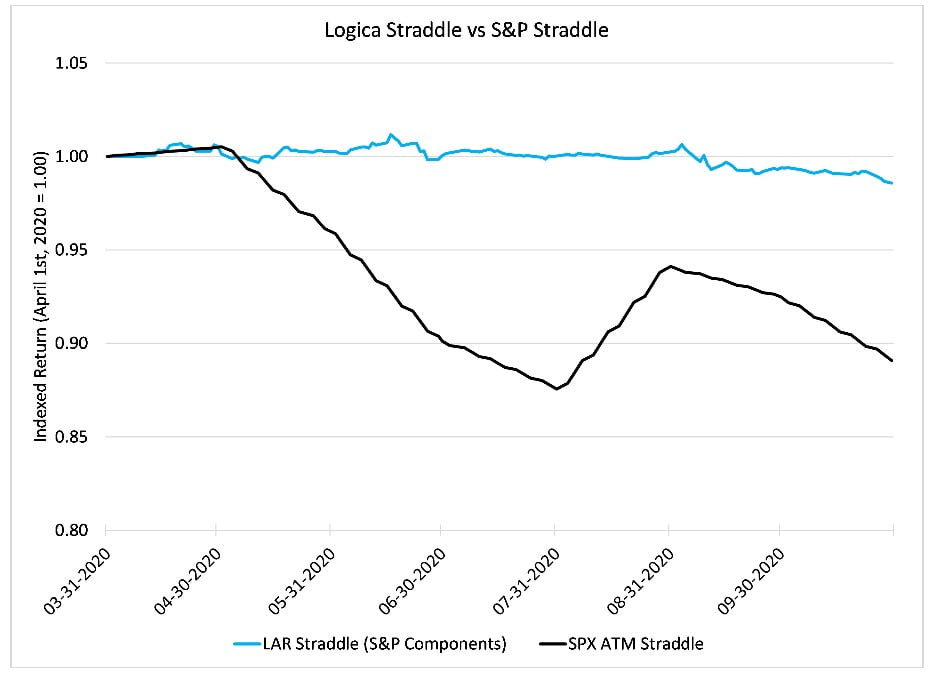

Over the past few months, we have discussed dynamics that contribute to the difficulty of managing a long volatility portfolio. Foremost in our minds is the challenge of investing during a higher volatility environment, as higher volatility manifests itself with a deepening of the trough in the straddle. Even more alpha must be generated to offset the cost of the position. Likewise, the higher volatility environment makes gamma scalping a bit more challenging as volatility can decline even when the directional tilt is correct (positive delta is offset by negative vega). Fortunately, we have succeeded in this difficult environment by meaningfully outperforming a naïve straddle on the S&P. Our core S&P puts and calls positions have been almost positive despite an incredibly difficult environment created by the consistent collapse of implied volatility after the lows in March 2020.

While this is a victory versus the naïve implementation, the straddle still underperformed an absolute return expectation. Does this affect our belief that a straddle is the correct implementation? Fortunately, no.

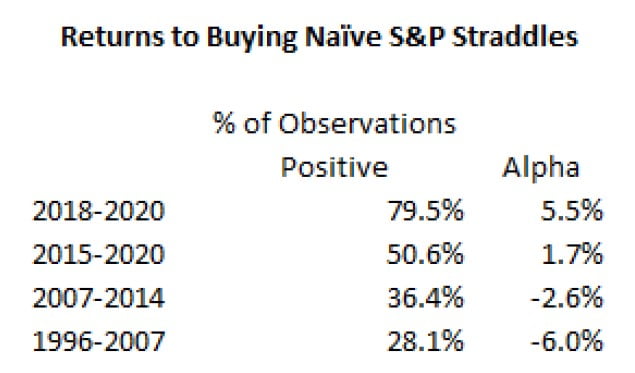

2020 has been an important year in confirming many of Logica’s theories relating to the opportunity set of changed market structure due to the growth of Passive investing. We have seen the returns of strategies that attempt to sell options deliver the worst performance in history:

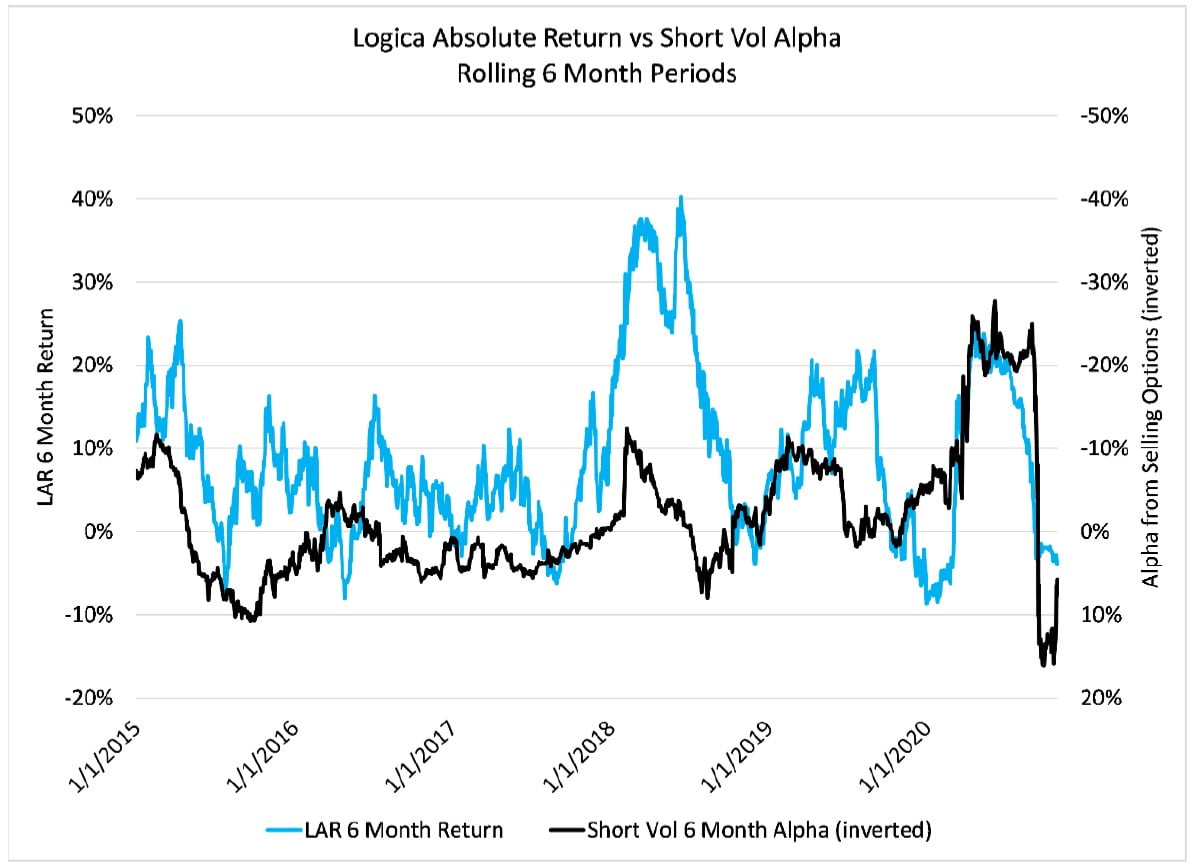

However, as we might expect given the stellar performance of long volatility in Q1-2020, there has been a significant headwind to overcome as the nearly inevitable retreat occurred. Over the last six months, returns have been very strong for short volatility strategies. Given this unfavorable environment, we would expect challenges for our long volatility strategies. While there is significant value created above the naïve straddle implementation (annualized ~10% alpha over our history), the results of LAR will unquestionably be influenced by this dynamic.

Fortunately, the pattern of improving fortunes for long volatility (straddle) implementations is quite clear and as we have noted, we see nothing to suggest this has changed:

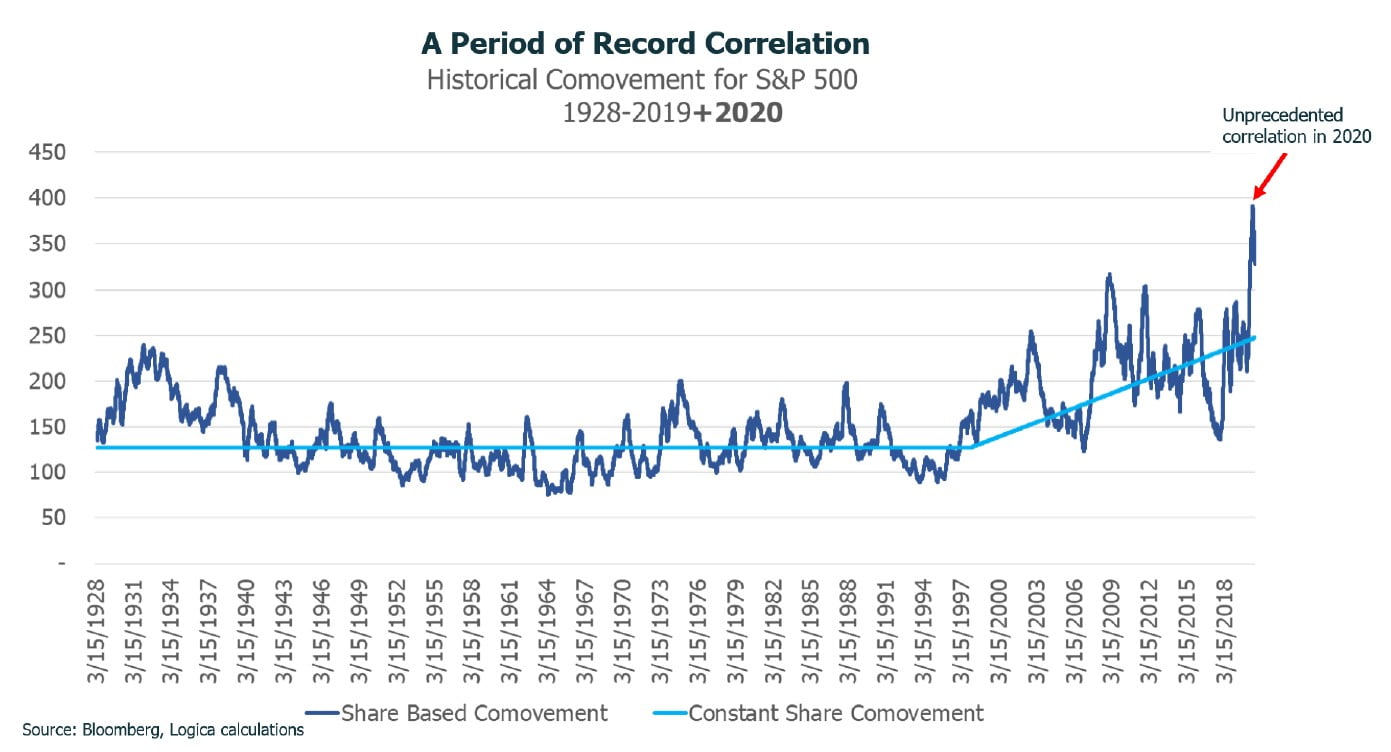

Adding even more strength to the Logica hypothesis that market structure is moving in our favor has been the remarkable increase in correlation experienced in 2020, especially when holding realized volatility constant. As a reminder, a structural increase in correlation makes markets more risky and increases the value of options. Most investors will be familiar with our analysis of correlation from 1927 through 2019, but the 2020 results are simply breathtaking.

So with all the wonderful demonstration of value creation, why have absolute returns not been positive?

The obvious answer has been the steady decline in volatility and associated positive return to short volatility strategies. As shown on the previous page, this creates a significant headwind. But the headwinds have also given us the opportunity to identify areas for improvement.

First, while momentum strategies outperformed from the March lows, and Logica’s momentum equity basket faithfully outperformed the S&P 500, the option implementation of this approach used in LAR underperformed the equity implementation. The Logica momentum implementation also marginally underperformed a cap-weighted S&P500 momentum index due to the very narrow advance this summer led by a few mega cap technology stocks. We documented some of these dynamics in our summer white paper, “Let’s Talk About Skew, Baby”, but this hurt our results. In simple terms, Logica attempts to find cheap optionality was challenging. This approach did not work as markets in August and September were driven by aggressive call buying on these equities which made them look less cheap on our metrics and so led our models to underweight these holdings. Our models also have historically ignored market cap in our selection criteria, leading us to emphasize smaller stocks on average. As you might expect, this proved to be a disadvantage in summer 2020.

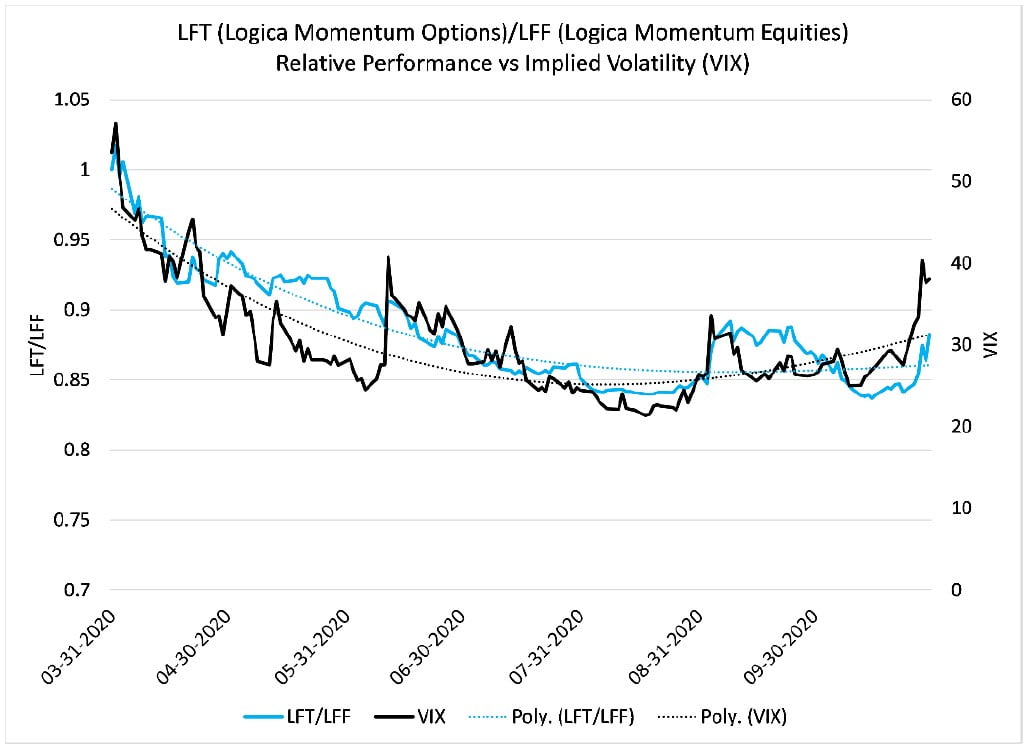

We also struggled with the expression of these equities in option form. This is less true on a risk-adjusted basis, as you can see by the generally smoother equity curve of our options implementation above, but using options to express our point of view exposed us to the steep decline in implied volatility over the past few months. In January to March 2020, this worked in our favor as rising volatility drove our option portfolios to outperform their equity equivalents. This summer, the opposite was true. The relationship between our option portfolios performance and the underlying equity portfolio performance can be directly linked to the behavior of the VIX.

We have taken advantage of this environment to deploy minor improvements to our process. These improvements join the list of innovations previously disclosed, e.g. the “anti-momentum” portfolio (LFB) and the rates switching dynamic that introduces inflation-protected bonds (TIPs) into our macro overlay. As we approach the end of our first full year with the Logica Absolute Return fund, we have been quite busy:

“The eastern world, it is explodin', Violence flarin', bullets loadin', You're old enough to kill but not for votin'” - P.F. Sloan, 1964

We would be remiss if we did not touch on the dynamics of the United States election. As of this writing, our expectation is the Joe Biden is our new President. Regardless of political affiliation, we hope you will join us in wishing him success.

Markets, as they often do, proved quite befuddling to both those predicting explosive moves higher and likewise to those predicting a crash. While there has been plenty of excitement in November, including the largest single day momentum reversal on record, we are largely sitting within the same range for the S&P 500 since August. With corona virus cases surging with winter flu season and lockdowns threatening to become widespread, it will be interesting to discover if 2020 ends as it began. The good news for Logica investors is that volatility has declined significantly since the election which positions our portfolios to outperform when elevated volatility returns.

“It ain't me, it ain't me

I ain't no senator's son, son

It ain't me, it ain't me

I ain't no fortunate one, no”

Creedance Clearwater Revival, 1969

Business Update - Logica Absolute Return Offhsore Fund

Logica has launched the offshore version of the Logica Absolute Return Fund on November 1st. If you are an offshore eligible investor currently in our onshore vehicle, please reach out if you have interest in transferring. If you are a new investor interested in our offshore vehicle, please contact Steven Greenblatt for more information.

New Chief Operating Officer and General Counsel

Logica continues to grow our infrastructure. We are excited to announce the finalization of terms with Joe Tagliaferro to take the role of our Chief Operating Officer and General Counsel. As a senior partner at Withers LLP, Joe led their Los Angeles corporate practice in the areas of corporate finance and transactions, investment funds, regulatory compliance, asset management, and securities. As an added benefit, Joe is already deeply familiar with Logica and its inner workings, having been our primary legal counsel for many years. Joe has been both an entrepreneur and an active corporate and securities attorney with a diverse client base with over 20 years of experience originating, managing and representing clients in a wide variety of domestic and international corporate, finance, securities and regulatory matters with a focus on private equity, venture capital, mergers & acquisitions, investment fund formation and compliance, broker-dealer / investment adviser formation and compliance and a wide variety of domestic and international transactional matter. Please join us in welcoming him to the Logica family.

Logica Strategy Details

Note: We have comprehensive statistics and metrics available for our strategies, but only include a select few to highlight what we believe is our most valuable contribution to any larger portfolio.

- If you would like to learn more about our strategies, please reach out to Steven Greenblatt.

- If you would like to speak with Wayne or Mike on their views on Hedge Funds/Investing/Trading and trends they see shaping the industry, please contact Steven Greenblatt at [email protected] or 424-652-9520.

Follow Wayne on Twitter @WayneHimelsein

Follow Michael on Twitter @ProfPlum99

Logica Absolute Return

2015-2019 stats & grid, reconstitution of live sub-strategies

2005 to present growth of $1000 chart, simulation

Jan 2020 live with partner capital

Logica Tail Risk

2015-2019 stats & grid, reconstitution of live sub-strategies

2005 to present growth of $1000 chart, simulation

Jan 2020 live with partner capital