Whitney Tilson’s email to investors discussing that Joe Biden would win a narrow victory over Donald Trump; election; gun stocks; bitcoin is back trading near three-year highs.

Q3 2020 hedge fund letters, conferences and more

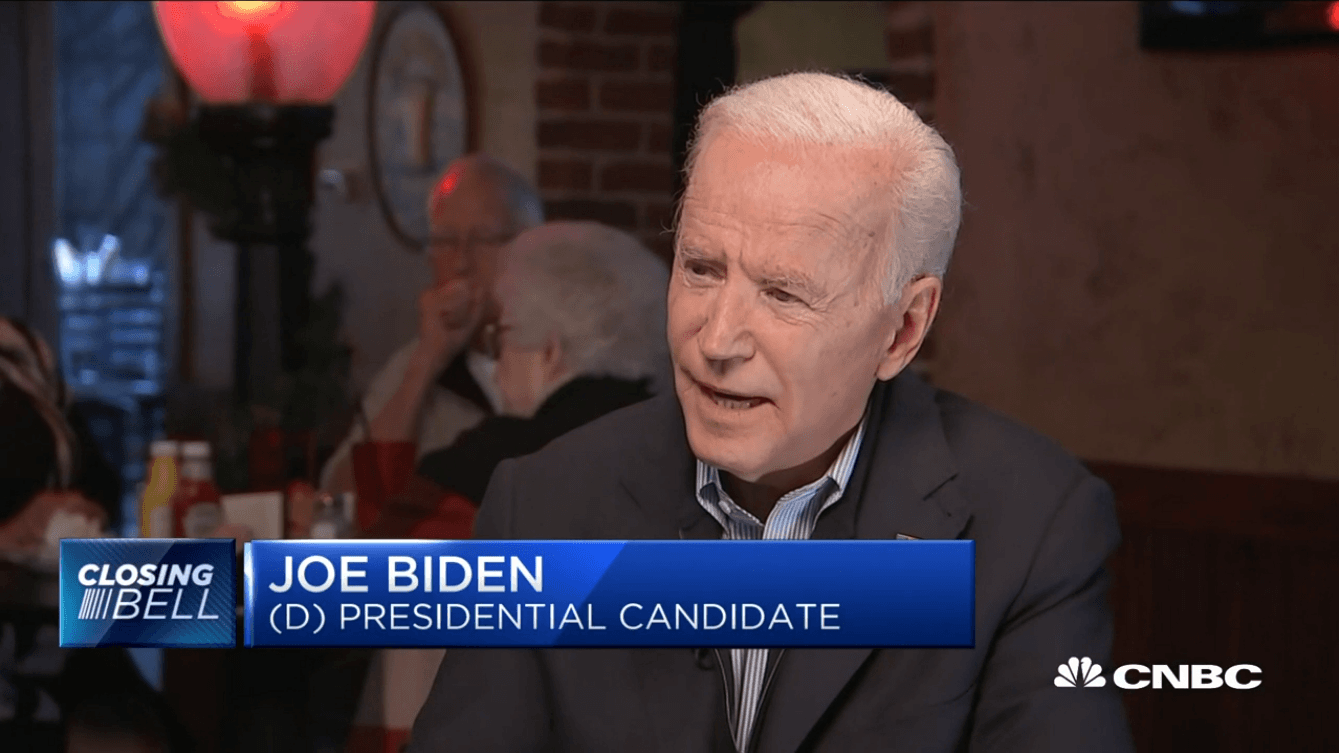

Joe Biden Might Score A Narrow Win Over Donald Trump

1) Things are moving so quickly that by the time you read this, it may be out of date...

But as of 8 a.m. this morning, it looked somewhat likely that former Vice President Joe Biden would win a narrow victory over President Donald Trump, while Republicans would maintain their majority in the Senate.

A split government is the outcome many investors were hoping for, so this is likely good news for stocks.

The polling outfits that I relied on in making my assessments have egg on their faces this morning, as their errors were even greater than in 2016. Thus, I'm turning to the real-money betting sites like PredictIt and the U.K.'s Betfair, which have been far more accurate (more evidence for the wisdom of the crowds!).

Right now, both PredictIt and Betfair have Biden 80% likely to squeak out a narrow victory – you can check their latest forecasts here and here. (Note that on Betfair, you have to convert their numbers to percentages; Biden 1.25 and Trump 4.0 means Biden is 80% likely to win.)

To understand why Joe Biden is the favorite, consider that he currently has 238 electoral votes (including Arizona), so he needs only 32 more to reach the 270 he needs for a win. Here are the opportunities he has to get there in states that have not yet been called (with each state's electoral votes and Biden's current odds of winning on PredictIt):

- Wisconsin (10 votes, 94% likelihood)

- Nevada (6 votes, 88% likelihood)

- Michigan (16 votes, 92% likelihood)

- Pennsylvania (20 votes, 61% likelihood)

- Georgia (16 votes, 48% likelihood)

- North Carolina (15 votes, 12% likelihood)

The key thing to understand here is that by winning Arizona, Joe Biden no longer needs to win Pennsylvania. If he carries Nevada, Wisconsin, and Michigan, it would give him the exact number of electoral votes he needs to win.

Additionally, if he wins Georgia, that would offset losing either Michigan or both Nevada and Wisconsin.

I'll have plenty more commentary on the election and its implications for stocks in future e-mails.

Bitcoin Trades Near Three-Year Highs

2) Bitcoin is on fire, as this Wall Street Journal article notes: Bitcoin Is Back Trading Near Three-Year Highs. Excerpt:

While stocks, oil and gold prices careened last week, one asset set new highs for the year: bitcoin.

The price of the digital currency has surged about 90% in 2020 and traded as high as $13,848 on Tuesday, according to CoinDesk. That is the highest level since January 2018, when bitcoin was coming down from its record high of $19,783 set in the previous month.

Many investors agree the renewed surge of interest is tied to bitcoin's potential as a hedge against inflation.

Bitcoin's proponents have touted that prospect for years, mainly because the bitcoin network has a set limit on the number of units that can be created: 21 million. With the coronavirus pandemic wracking economies across the globe, governments and central banks have been forced to spend trillions to prop up their economies while sapping the purchasing power of their currencies. That has revived fear that inflation will ramp up in the coming years, and that fear is winning bitcoin new converts.

While I would never short bitcoin or any other cryptocurrency – since they have no cash flow or intrinsic value and could literally trade anywhere – I continue to believe that they're a techno-libertarian pump-and-dump scheme and thus recommend that most investors avoid them.