Whitney Tilson’s email to investors discussing his favorite big-cap stocks and tech giant earnings.

Q3 2020 hedge fund letters, conferences and more

Empire Financial's Favorite Big-Cap Stocks

1) When we launched our first newsletter, Empire Investment Report, on April 17, 2019, we told our subscribers to build a solid foundation for their portfolio before they started buying the higher-risk-but-hopefully-higher-return smaller stocks that we'd be recommending.

This core consisted of large positions in four of our favorite big-cap stocks: Berkshire Hathaway (BRK-B), Amazon (AMZN), Alphabet (GOOGL), and Facebook (FB).

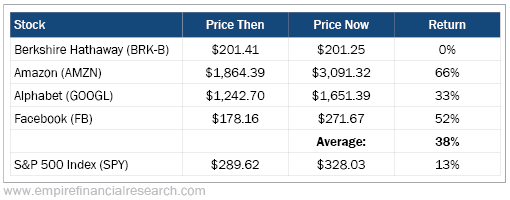

As you can see in this table, these stocks have, collectively, nearly tripled the return of the S&P 500 Index since then (using prices as of 9:45 a.m. this morning):

The three tech giants reported exceptionally strong earnings after the close yesterday: Facebook's earnings per share ("EPS") of $2.71 handily beat analysts' estimates by $0.80... Amazon's EPS of $12.37 beat estimates by nearly $5... and Alphabet's EPS of $16.40 also beat estimates by $5.

Since our initial recommendation, both Facebook (excluding the one-time $5 billion payment to the Federal Trade Commission for its role in the 2018 Cambridge Analytica scandal) and Amazon have grown their trailing-twelve-month free cash flows by more than 50%, which makes Google's robust 19% growth look weak!

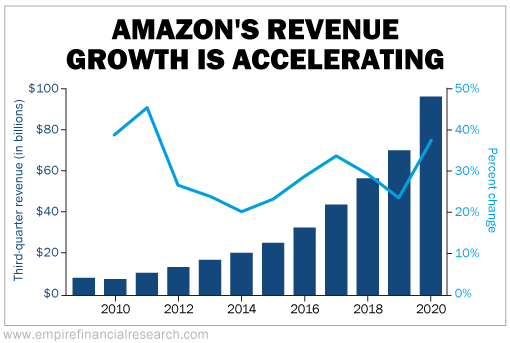

And it doesn't look like they're slowing down anytime soon...

Tech Giant Earnings

Amazon is on pace for $375 billion in revenues (a growth rate of 33% year over year) in 2020... Google for $175 billion (9% year-over-year growth)... and Facebook for a (measly) $84 billion (19% growth year over year).

The chart below shows Amazon's third-quarter revenue since 2009 (blue bars), with the percentage growth (red line). It's astonishing to see revenue growth accelerating as such a large company!

I remain as bullish as ever on these stocks... and we'll update subscribers further in our next issue of Empire Investment Report. If you aren't already a subscriber, you can sign up right here.