Whitney Tilson’s email to investors discussing that everybody expects a 1999-style ‘melt up’.

Q3 2020 hedge fund letters, conferences and more

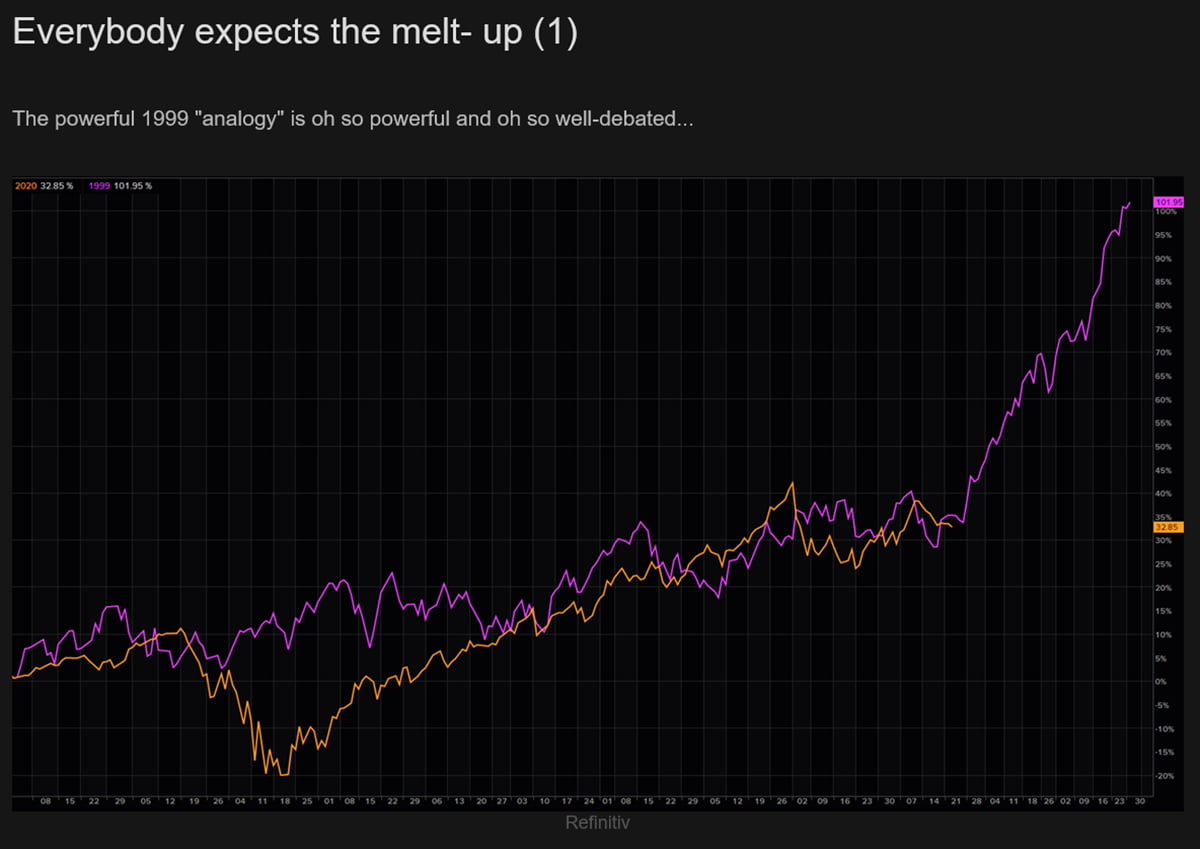

A 1999-Style Melt Up Is Likely

1) My colleague Enrique Abeyta has been pounding the table since March that the market is going higher – and he has been 100% right so far.

He's also on record saying he thinks a 1999-style "melt up" is likely going forward, and just sent me some fascinating charts about this from The Market Ear, with the following comments:

My view about the coming melt-up is no longer as out-of-consensus as it once was.

I still think it's going to happen... but if you're going to play for a melt-up, you'd better be ready for some volatility and be ready to stick it through. Many stocks could be down 10% before going up 50%.

Thank you, Enrique!

(By the way, our other colleague Berna Barshay agrees with him – noting that "Bullishness is very consensus now. Shorts are weary.")

Here are the seven charts Enrique sent me: