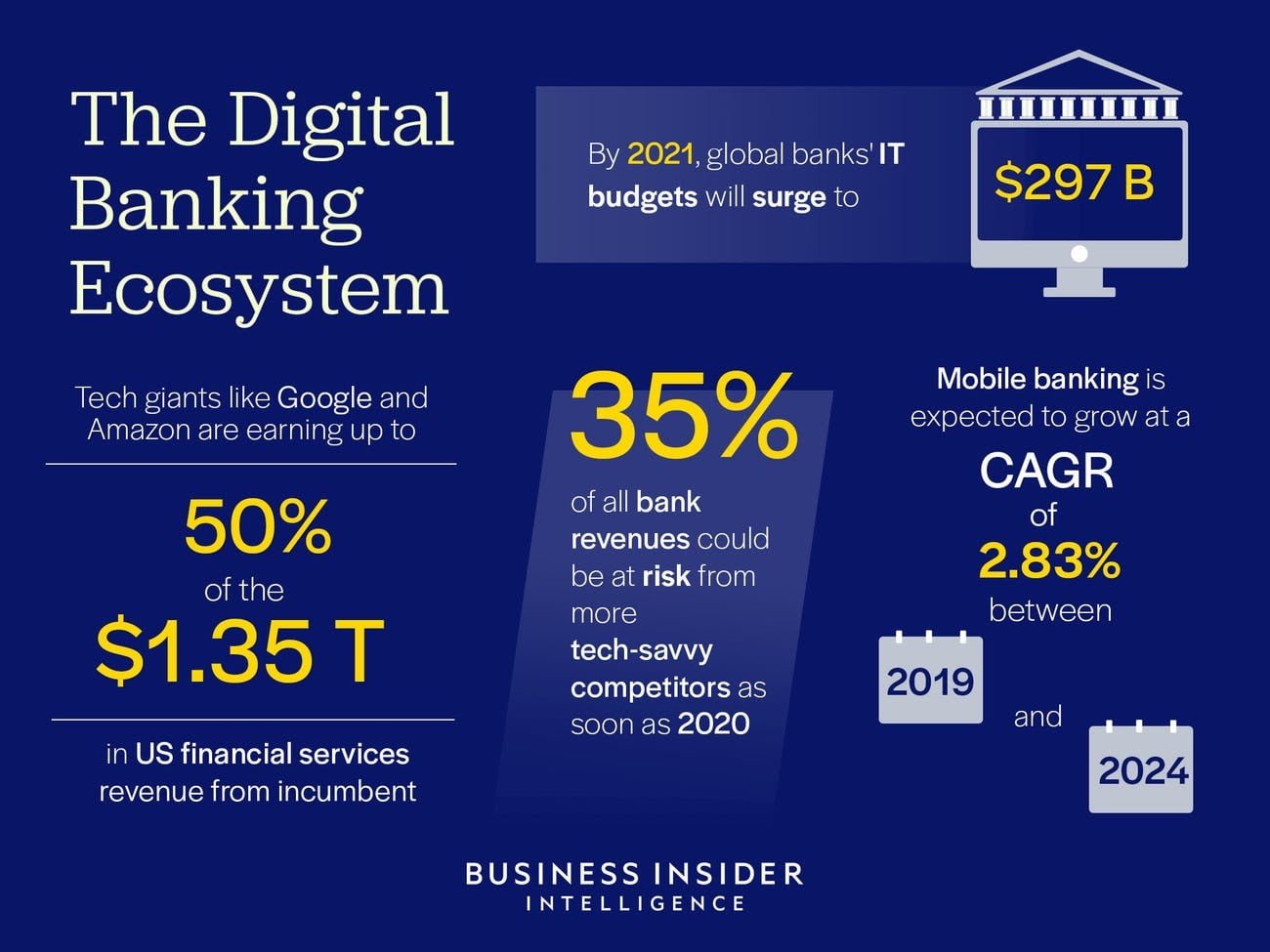

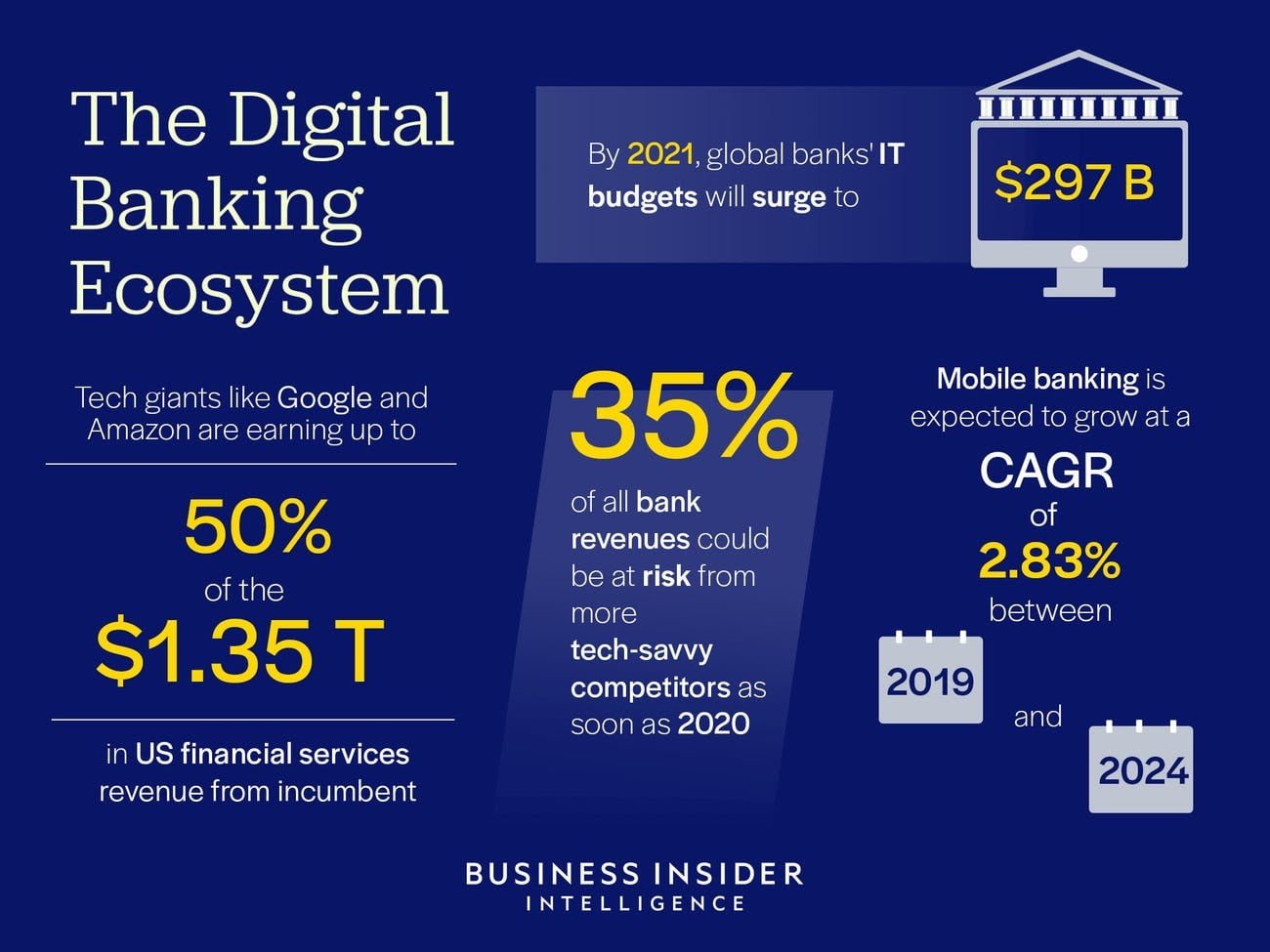

The speed of digital evolution has increased drastically in the last few decades, this is mainly because of the changing customer behavior and evolution in emerging technologies. Digital transformation has changed everything and opened huge opportunities and scope for almost all businesses worldwide. Coupled with new and emerging technology has transformed the business sector and helps businesses to come with the best ideas to boost their business worldwide in less time. Senior Vice President of Global Financial Services Dan Cohen said, “financial or banking sectors are at a crossroads and are continuously adopting new technologies and finTech innovation. They have stepped ahead for adopting technology such as blockchain, or any other which is disrupting the market. This advanced technology creates threats and has opened multiple opportunities for financial services to thrive and reinvent themselves in the market.” Financial service providers can improve their result by 30% if they opt for modern technology in their sector.

Q4 2019 hedge fund letters, conferences and more

Modern Technology is Shaping the Future of Financial Service Providers: Know-How

The advent of new technologies is threatening the banking or financial industry and offering them various opportunities. The financial sector who are leveraging big data and new analytics technologies can easily improve their customer experience. They can also build loyalty, revenues, and trust, which are effective keys for bagging massive success in any of the business sectors.

Research by Atos shows that modern technologies provide numerous opportunities for the banking sector. It allows them various advantages, such as:

- Response to customer needs.

- Optimization of costs.

- Creation of new revenue streams.

- Development of security.

- Crafting compliance systems.

There are many other benefits that the financial sector can gain when they opt for the latest technologies like blockchain, artificial intelligence, or any other within the working environment. Today most of the financial services are based on leading technology, during the past day's technology was only used for processing transactions, but now as the technologies have become customer-centric and more efficient, it can be used for various purposes if it is considered in the right way.

Financial service providers in the fintech era

The adoption of modern technologies can prove to be the best decision for the banking sector as it provides them with security and intelligent solutions. It will also help organizations to redefine themselves to become more responsive and competitive so that they can meet the demand of the present generation in a much accurate way. Let's explore, which are those technologies that will disrupt financial services in 2020 and beyond.

1. Hybrid Cloud

A report by IBM represents that cloud computing has gained massive popularity in the banking sector in recent years. Most of the banks search and prefer to opt for public and private clouds. Presently almost all the banking sectors are moving to opt for a hybrid cloud strategy for their business so that they can manage and maintain all the data more accurately and efficiently than ever before.

Hybrid cloud offers more flexibility to the banking sector when they opt for it and also avail them with benefits of both public and private cloud. It also allows them to address data security and various needs of their sector in the most effective way. Some of the benefits of a hybrid cloud are improved operational efficiency, enhanced innovation, reduced cost, and much more.

In one of the research, more than 75% of bankers responded that they have successfully appointed cloud technology for their business. This decision to adopt cloud technology has helped them to expand into new industries, products or services portfolios, create new revenue streams, and much more.

2. Blockchain

This modern technology was first used in the cryptocurrency Bitcoin. It is a distributed database that helps the individual to keep track of transactions in a permanent or verifiable way. According to an Asia Blockchain Review, blockchain technology is going to disrupt banks in a similar way in which the internet disrupted media.

Blockchains are highly secure, relatively cheap, and transparent to operate. More and more financial organizations have realized the importance of blockchain technology these days, they know it well that it can help them to save money, improve security, customer satisfaction, and much more if they adopt the technology for their business.

3. Artificial Intelligence (AI)

There is no doubt that financial and banking services tend to be slower when it comes to adopting the latest and leading technologies. A recent report by a PWC revealed that almost all financial services decision-makers are ready to invest in artificial intelligence (AI), it shows that more than 52% of executives confirmed that they are making “substantial” investments in Artificial intelligence while around 72% believe that it will avail them with various business advantages.

One important thing which makes everyone believe in artificial intelligence is its potential, and the cost savings of the industry who adopt this leading technology is expected to reach around $447 billion by 2023. Most of the entrepreneurs who are dealing with the financial sector have started opting for this leading technology, they hire node js development company to craft an advanced solution using which they can do all the financial work more systematically and accurately at their workplace.

4. Augmented Reality

Technologies such as Virtual, Mixed, and Augmented reality are helping businesses to provide the best experience to their prospective customers in real-time. The banking sector can adopt the same solution for enhancing its customer's experience. The possibility of implementing AR technology in the banking sector is undoubtedly very limited then our imagination, but seeing the evolution, it is estimated that this technology will be adopted very sooner by the banking sector.

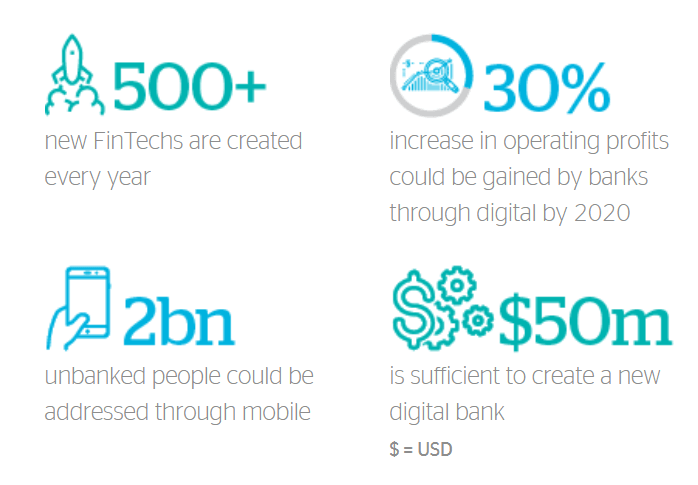

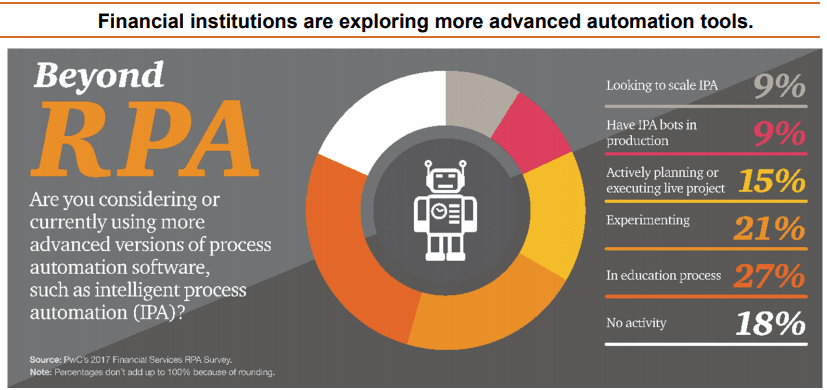

5. Robotic Process Automation

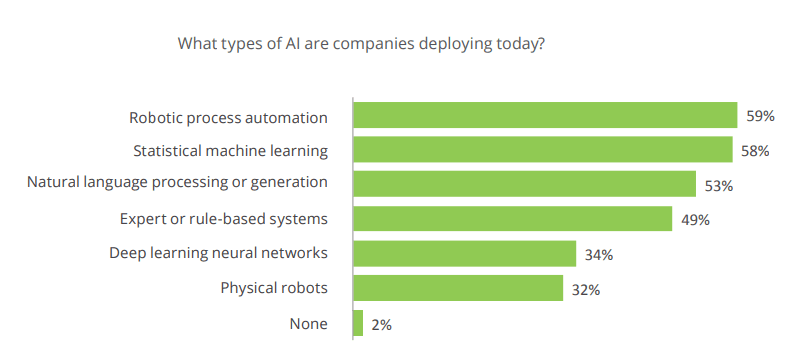

The volume of unstructured is increasing drastically with the rise of the digital economy, which makes it quite tough for the banking sector to perform various operations on the data. Thus it becomes essential for the banking sector to find leading technologies that can mimic numerous human actions. The technology which enables cognitive in the banking sector is robotic process automation, it can help all the work more accurately as it consists of natural language processing, machine learning, chatbots, and intelligent analytics, which allow bots to improve its process.

Deloitte’s 2017 survey found that more than 88% of financial service professionals agree that such technologies are very beneficial for the banking sector as it is a strategic priority. Cognitive capabilities will increase with the robotic process automation and will offer an even better result in the sector.

6. Smart Machines

Most of us are familiar with the leading assistants like Siri, Amazon’s Alexa, and many others. But no one of us has imagined its impact on the banking sector, but Bank of America has come up with Erica which can be considered as a virtual assistant that helps them to deal with various banking operations. These smart machines have also become the act of digital concierges for most of the customers who have indulged themselves with the banks. Financial service providers who invest in digital technology assures long term relations with the customer.

7. Big Data

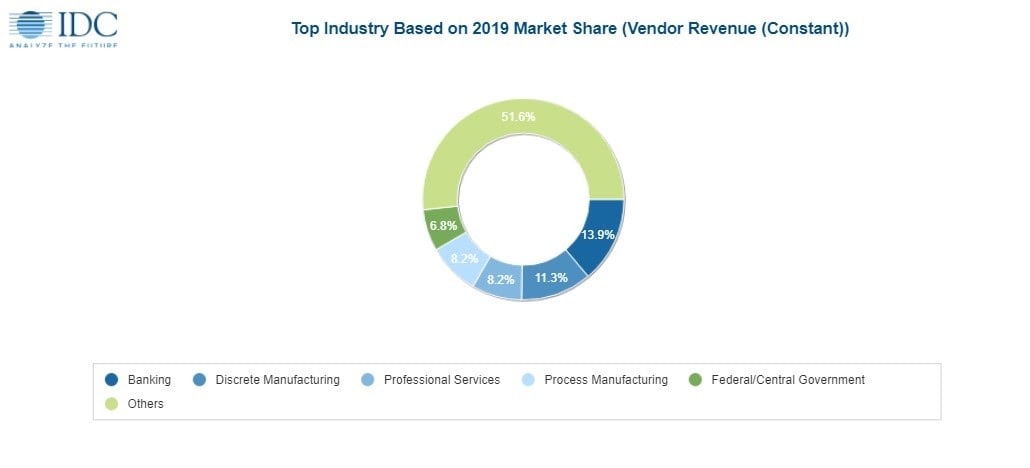

The IDC Semiannual report predicts that the banking sector is one of the top investors who is investing a huge penny on business analytics and big data solutions. A large amount of data is generated by the financial industry, this data modules details about the ATM withdrawals, credit card transaction, scores, and much more. Therefore it becomes essential for the business sector to make the business processes more accurate and how they can do so is the help of big data analytics. It helps them to get actionable insights that will be critical to staying competitive in today's competitive market.

8. API Platform

The financial service providers could control the whole customer experience with the help of a monolithic system, this system helps them to control everything starting from keeping records to customer interaction. Both the evolving customer's needs and regulatory requirements have turned this humongous system completely. The financial service provider needs to build instant banking stacks, which helps them to provide an excellent platform that connects third-party service providers and customers, this result in offering a personalized experience to the end-user.

9. Quantum Computing

Quantum computing is one of the best ways to get the work from quantum mechanics, it can be considered a beneficial way for financial service providers as it helps them to perform an effective operation on complex data. As we all know that computers use bits that consist of only two values that are 0 and 1. When it comes to quantum computing, then it uses “quantum bits” that are posing three states 0 or 1 or both. This helps banking service providers to unlock exponential computing power, they just have to implement the right algorithm to leverage the various advantages which fall on their way.

10. Prescriptive Security

The incidence and nature of cyber risk are changing without any notice. It simply means that typical approaches that are used for risk management might be inappropriate. The exact sources of cyber footprint and threats can't be eliminated at first glance, hence it becomes essential for financial service providers to nimble in the cybersecurity approach.

Advanced analytics, Artificial intelligence, real-time monitoring, and many leading tools can be used by the financial sector to detect and prevent potential threats. Digital disruption may increase instability and risk factors in the financial system, but by considering prescriptive security, it becomes easy for the sector to prevent the risk and result in increasing effectiveness in the long term.

Financial Service Providers: Wrapping It Up

Adaptation of today's emerging technologies provides numerous advantages to any of the individual sectors. Combo of digital technologies and data can help to set new standards for the banking sector. The investment and prioritization in individual technologies depend on the business strategy and model. For instance, financial services can adopt blockchain technology or any other technology for improving its process, this ensures providing the best experience to end-users in real-time.