Fixed or adjustable variable rate mortgage, pick the better one when taking a mortgage you are making a 30-year long decision, decide wisely.

Fixed or (Adjustable) Variable Rate Mortgage in 2019 – Pick The Better One

Q3 2019 hedge fund letters, conferences and more

Transcript

Good day fellow investor. So my stock markets research platform, I recently received a very, very good questions about whether to pick a fixed or adjustable variable rate mortgage. And I really want to give my perspective on that to help. I'm sure there are a lot of you who are thinking about that. My message is, be careful, you're making a 30 year long financial life decision when taking a mortgage usually of 40 years. And people usually have one month or one coffee perspective that they have with their mortgage advisor when taking such an investment when making such a decision. So 40 year long, you should really have a long term perspective on that. And that's what I'm going to give you.

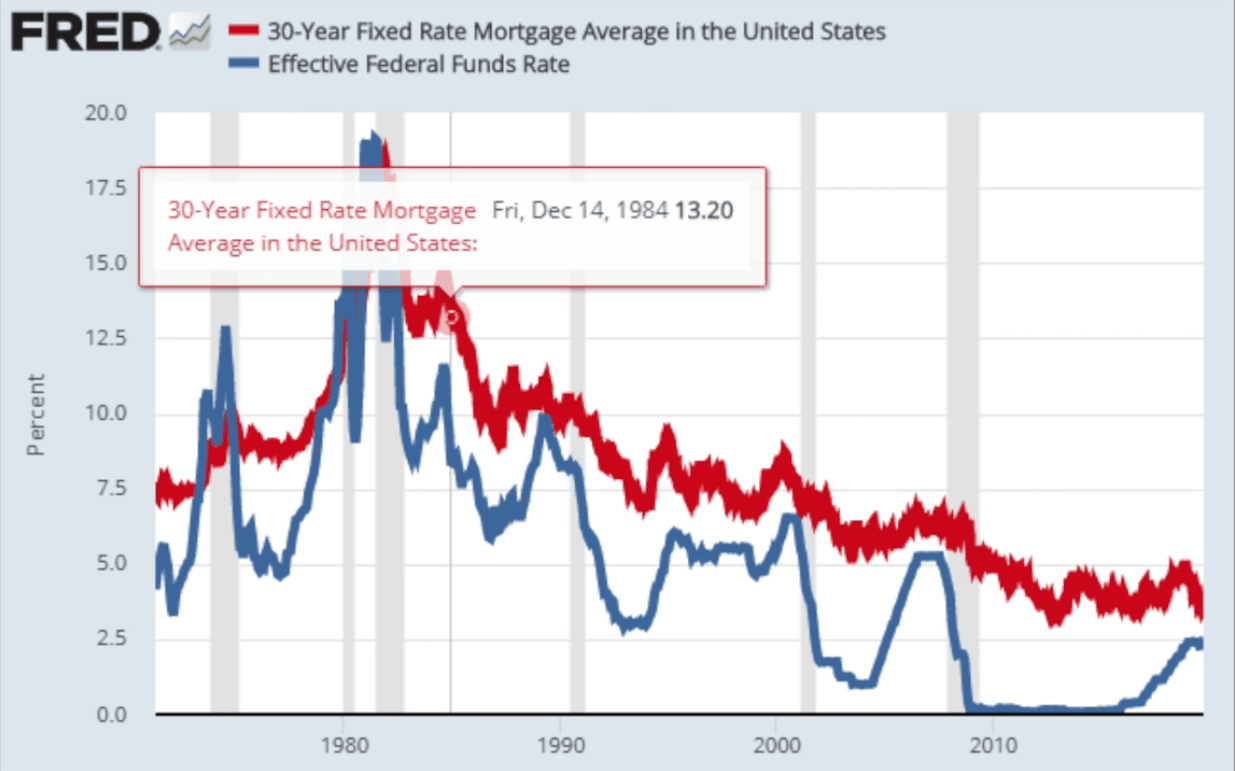

We're going to discuss the difference, the risks, the payments, examples, and then you're going to make sure and then you're going to be able to make a really educated decision on what's better for you. Let's start. So a variable interest rate or adjustable interest rate changes in relation to how the market interest rates change, your mortgage would probably have an interest rate that is a bit higher than the interest rate said. But the central bank interest rates are here. On the blue, you see the 40 year mortgage rate always a little bit higher. The adjustable rate is in between these rates, and they are lower usually than the 30 year mortgage rate.

What is important from this picture is that the 30 year mortgage rates have also been above 13% over a long period of more than four years in the 1980s. So that is a risk that if you take an adjustable or variable rate, you might see rates 5, 6, 7, 8, 10, 15% over the next 40 years. It wasn't that long ago, the mortgage is what the 7% and now but now many think it is impossible. So don't take things for granted as those are now and I'll show you later how things might change in the costs that you are paying the fixed interest rate mortgage, if you don't like uncertainty when it comes to a monthly payments, you will take a mortgage with a fixed interest rate.

Fixed vs adjustable variable rate

That should not change over the whole course of the mortgage plus, currently, really now, you see the big volatility in those rates 355 percent 3.5. Now some really low historical lows, and that's why I'm pushing for a 30 year, 30 year not 10, not 20, 30 year fixed mortgage rate.

The negative side of the fixed mortgage rates is that rates and that's the cost of your monthly payment is usually higher than what variable rates a bank has to insure against changes in interest rates for the next 40 years and therefore reports a higher rate the red one is the 30 year fixed mortgage rate and the blue one is the adjustable rate there is always a 1 percentage 2 percentage points difference not Currently, but it will probably again, adjust to debt.

Nevertheless, let's take 1% point difference and on an 80k mortgage that you need in the United States to buy 100k home, it's $50. So that's the cost of taking a fixed rate mortgage and sleeping well over 40 years now, okay $50 you can have a lower payment with adjustable rate or higher payment with a fixed mortgage rate.

Small is a lot with mortgages

The difference is that they made calculation for the Netherlands are even lower than this because the interest rates are down there from 1.25 variable adjustable to 2.5 30 year mortgage. That's really crazy. And still people are taking the adjustable even if the difference is 10, 20, 30 euros on a 100,000 mortgage. That's crazy to me.

Let me put things into perspective. Let's say you take an 80k loan, you take an adjustable rate of 3.6% on it, the rates remain fixed for 10 years but then you to inflation rates spike 10%. On an 80k loan after 10 years, you pay down only $15,626 of your principal because you have to first pay interest on your loan. The remaining balance is what you have to pay over the next 20 years. if interest rates spiked to 10%, you still have 20 years to return 64,000 the monthly payment rate of 10% would be 742 or 47% higher than the current one.

If you take an adjustable rate that is the risk for taking adjustable mortgages. You never know what lies ahead or even 10 year fixed mortgages. If interest rates go even higher, then you are really screwed. So this is the difference in costs between taking a fixed.