Tollymore Investment Partners commentary for the third quarter ended September 30, 2019: long thesis on GRUB.

Dear partners,

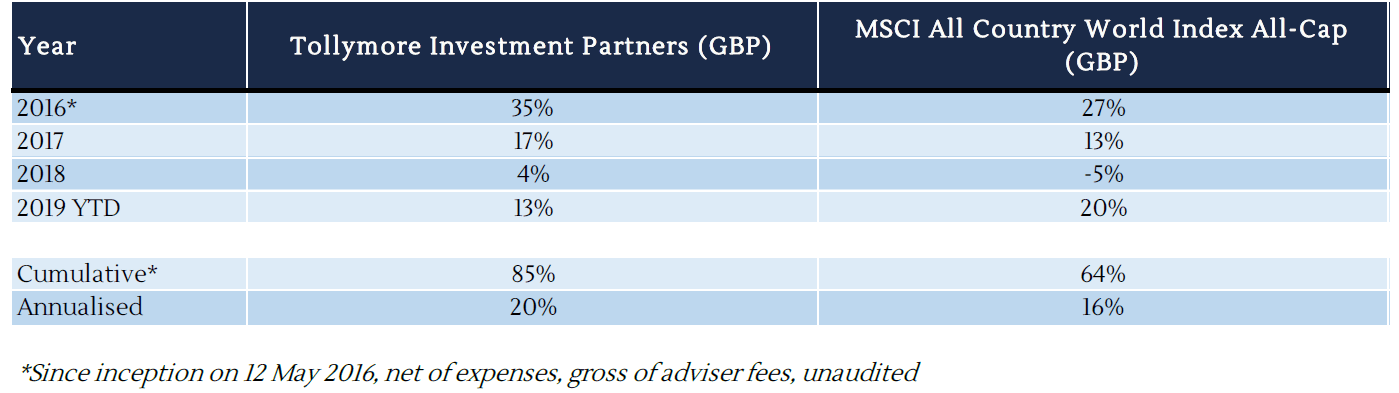

Tollymore generated returns of +13% in the first nine months of 2019. Tollymore has generated cumulative returns of +85% since inception, annually compounding capital under its management at +20% pa1.

Q3 2019 hedge fund letters, conferences and more

Incentives, wealth and happiness

Tollymore’s mission

Tollymore’s first investment letter to partners stated that its objectives were to (1) create value in an industry that in aggregate transfers value from investors to managers, and (2) create a flexible lifestyle in which there is no distinction between work and play. In a way in which business and investment success are determined by productivity, relationships, serendipity, and personal energy. It is this flexible way of living which facilitates a commitment to the happiness of Tollymore’s principals, their family, and the delight of the firm’s investment partners on a multi-decade basis.

The goal here is to secure sustainable freedom. Underlying such freedom is the permission to make decisions in the interests of creating value for those whose lives Tollymore influences. That is: the investment partners of the firm, and the friends and family of those individuals who are the firm.

“The really important kind of freedom involves attention, and awareness, and discipline, and effort, and being able truly to care about other people and to sacrifice for them, over and over, in myriad petty little unsexy ways, every day.” - David Foster Wallace

Is the accumulation of personal wealth consistent with this goal? To the extent that personal financial progress may allow one to free up more time to devote to the interests of the meaningful people in our lives, it may seem like an important ingredient in achieving Tollymore’s goals. Yet there is ample, hardly undiscovered, studies questioning the correlation between wealth and happiness2.

Specifically relating to the investment management endeavour, a money manager’s personal objective to maximise her own personal wealth may be harmful to the prospects of creating the most aggregate dollars of value for the investment firm’s owners and investors. This is because investment management, in its most widely practised form, is extremely scalable. In its most widely practised form, there exists strong incentives to gather assets, scaling revenues without commensurate increases in the costs of dispensing fiduciary responsibilities and exercising sensible investment and business judgement. These incentives include managers not invested in the funds they manage, high management fees, no performance fees, and opacity regarding the appropriate benchmark for complex strategies, and therefore an inability to measure the manager’s capacity to create value. An asset growth imperative is compounded by large and expensive teams and bloated, gold-plated cost structures designed to convey institutional suitability.

More generally, wealth can be a distraction. This observation places no judgement on how financially successful people choose to enjoy the fruits of their success. But such enjoyment may create a conflict of interest with those who helped create it, and to whom there remains an ongoing responsibility to deliver acceptable results. An investment manager may become distracted by the enjoyment or redistribution of the prosperity he has acquired as the owner of an investment management business. This may be through the obvious channel of consumerism – yachts, private jets, property and luxury travel acquired in increasing doses via hedonic adaptation – but also through more laudable, philanthropic avenues. This is not an opinion of the devotion of capital to charitable projects. But the commitment of time to philanthropic causes could be a distraction from the business of money management. This industry is hard enough for those dedicating their entire working existence to the pursuit of investment outperformance.

This is not to say that wealth is an undesirable outcome, nor that its pursuit is not worthwhile. Indeed, the objective to create substantial personal wealth may well contribute to higher life satisfaction. But (1) the benefit of wealth as an outcome is often overstated, and (2) the pursuit of individual wealth may be at the expense of more likely contributors to happiness. Addressing these in turn:

Process vs. outcomes in the wealth-happiness correlation

There is evidence to suggest that the method of wealth acquisition in an important determinant in the happiness associated with such wealth. People whose prosperity had been earned, vs. won or inherited have report higher levels of life satisfaction3. There are also studies to suggest that altruism is linked to more enduring versions of reported happiness than, for example, the purchase of experiences. That is, people who are emotionally and behaviourally compassionate enjoy greater well-being, happiness, health, and longevity4. One of the reasons for this is the connection to others altruistic behaviour empowers. This self-serving benefit of empathetic behaviour highlights the question over whether true altruism exists. The observation that altruistic acts are self-interested was most profoundly underlined by one of the greatest philosophers of the 1990s: Joey from Friends. After Phoebe deliberately allows herself to be stung by a bee “so it can look cool in front of its bee friends”, Joey explains that the bee probably died as a result, and concludes that “there are no selfless good deeds”.

An extension of these observations might suggest the accumulation of personal capital through a working life dedicated to creating value for others vs. transferring value from others, is more likely to lead to greater happiness. We seek “non-zero-sumness”, or symbiotic value chains, in the small selection of companies in which we invest, and in the relationships with the small number of investment partners whose capital we manage alongside our own.

The role of relationships in leading a good life

“A good life is a life that feels good to live, a worthwhile life of progress, achievement, enjoyment and engagement – and above all, with good relationships at its heart.” - AC Grayling

One of the most treasured virtues of Tollymore is the freedom it allows its principals to think independently. Nonetheless, humans are social animals; we function better in communities rather in isolation. Studies suggest our mental health and well-being are connected to the quality of our relationships5. This involves nourishing valuable connections and minimising or removing negative associations.

Tollymore is a multi-decade effort to build and sustain trusted relationships with long term investment partners. Great investment partners are a competitive advantage: an evolving, mutually appreciative and increasingly resilient relationship is an enabler of greater and more sustainable value creation.

“An important dimension of successful investment management organisations – true of great organisations in many fields – is having great clients. If you have clients you do not enjoy or admire, or clients that do not expect much of you, you should seriously consider terminating the relationship with them. They will hold you back. If you have great clients, wonderful clients, reach out to them and ask them to demand even more of you. The great role of the client is to challenge you to be the very best that you can be.” - Charles Ellis, The Characteristics of Successful Investment Firms

There is a natural alignment between an investor with a long term, possibly perpetual, investment horizon, and a younger, emerging, investment management organisation. As the manager ages and the fund matures, this alignment may be challenged if the manager’s personal investment objectives become more influenced by preservation vs. growth. Assuming good health and sound mind, Tollymore’s investment runway is 30-40 years. But a recognition of this potential future misalignment is important. As is a willingness to work with investment partners whose missions outlast the biological constraints of the investment firm’s owners, in order to think about succession or other safeguards.

Several aspects of Tollymore’s investment and business process are designed with this goal to engender meaningful and valuable relationships in mind:

- A balance sheet and a cost structure that enables us to adopt a patient approach to building these relationships.

- Transparent and candid investor communication acts as a filter for investors who can think unconventionally and act countercyclically.

- Incentive structures which make it more sensible to forgo additional management fees in lieu of excess returns on insider capital.

- Frameworks for economic profit-sharing which reward acceptable performance and coordinate manager and investor enrichment. These include the employment of hurdles to make weak performance cheap and strong performance expensive.

Tollymore’s new fee structure

Over the last few months, we have reappraised the consistency of Tollymore’s business principles with the objective of non-zero-sumness. As a result, we are introducing a fee structure for investors who invest a minimum of £1mn of net contributed capital, and who agree to commit that capital for a minimum period of three years. For these investors Tollymore will offer a choice of fee structures as follows:

- 1% management fee and 10% of any investment returns above a 5% hurdle

OR

- 1% management fee and a 20% performance fee above a benchmark return (the MSCI All Country World Index (USD)).

The rationale: we want to ensure that investors receive most of any outperformance generated, not just most of the absolute return. As such we want to offer a fee structure that allows us to talk about integrity with some legitimacy. Too many managers charge egregious fees with the sole purpose of enriching themselves at the expense of clients.

A benchmark hurdle has not been part of the original fee structure6 due to Tollymore’s benchmark agnosticism and absolute return remit. However, we recognise it is the opportunity cost for many investors. A benchmark hurdle is an elegant solution to ensuring that investors receive the majority of any alpha generated. The fixed hurdle is an option for those investors not wishing to pay fees in a year in which Tollymore generates negative results which are superior to the benchmark. The fixed hurdle is also lower than one might expect the very long run performance of a global benchmark to be.

Grubhub Inc GRUB: Profiting from lazy journalism

Narrative fallacy and the Murray Gell-Mann Amnesia effect

For part of my career I was a sell-side equity research analyst. I was a specialist covering pan-European telecoms companies. And as a specialist I remember reading newspaper articles relating to the telco sector in respected business broadsheets and feeling that the journalism was often subjective, unsubstantiated and shallow. Often it was factually spurious. I would then turn the page to read an article about some other sector outside of my specialism, and afford it much higher trustworthiness than the telco piece. Michael Crichton gave this a name: The Murray Gell-Mann Amnesia effect7.

Serious media publications invent stories to explain outcomes, without the resources or inclination to determine causality. This often manifests itself in major descriptive U-turns as the outcome changes with the wind. The matters about which financial and political journalists opine are complex. This limits the mechanism to scrutinise these stories and hold their authors to account. And there is value to their readers and listeners, who can paraphrase talking heads’ memorable soundbites at cocktail parties rather than acknowledging ignorance or retrieving the relevant facts from their addled brains. Authority bias plays a role: media appearance confers credibility, the belief in which is counter to independent thought and self-awareness. Unsubstantiated conjecture is rife. As Mr. Crichton puts it: “one problem with speculation is that it piggybacks on the Gell-Mann effect of unwarranted credibility, making the speculation look more useful than it is”.

The goal of epistemic humility is consistent with maintaining a careful distance from today’s media. To exercise good judgement, we should shield ourselves from the Gell-Mann effect. Financial markets, political and economic systems, unlike meteorology, are reflexive; participants are second guessing one another and the bases on which decisions are made are altered by the decisions themselves. Speculation thrives because it is cheap and speculators are not held to account, but forecasting is foolish when nobody knows the future.

Narrative Fallacy is the backward-looking mental drive to attribute a cause and effect chain to our knowledge of the past. Without searching for reasons, we would go around with blinders on, one thing simply happening after another. This helps us make sense of the world despite sensory overload. However, it can cause us to make poor decisions. The power of narrative causes us to violate probabilities and logic8. Tollymore seeks to profit from the narrative fallacy by specifically seeking out stocks without good stories, or those with bad stories.

GRUB: negative stories create opportunity

We purchased an equity interest in Grubhub (GRUB) during the quarter. GRUB provides a marketing service to restaurants to help them generate takeaway orders. The company does this via an online and mobile platform connecting 125k local restaurants with 20mn active diners wishing to order takeaway food, either pick-up or delivery, in 2.4k cities across the US. The company was founded in 2004 and listed in 2014.

The restaurant proposition is the generation of higher margin takeaway orders at full menu prices. The diner proposition is a more satisfactory and less error-prone mechanism vs. paper menus and telephone ordering; more choice, more convenience, better informed decisions.

Traditional offline takeaway ordering is the principal source of competition. That is, the dollars that most restaurants direct to paper menus and local advertisements. The largest marketplace and delivery competitors are DoorDash, Uber Eats and Postmates. The following quotes sum up the prevailing press commentary on GRUB’s business progress in recent times:

“Grubub posted its best revenue growth in four years in the third-quarter; but it also reported increased expenses, particularly in marketing, suggesting competition is finally heating up.”

“Grubhub is relying on partnerships to counter competition from the likes of Doordash and UBER Eats.”

“Grubhub once owned close to 70% market share as recently as 2017, but extreme competition has caused it to dwindle”.

“…battleground in the escalating competition for dominance…”

“As competition increases…Grubhub has had to boost its advertising and promotional spending to compete.”

“Grubhub has responded to increased competition with marketing campaigns and technology updates, which has cut into margins”

The implied causality between higher spending and higher competition is unsubstantiated. There is little evidence for this in the form of higher customer acquisition costs, which have remained stable. Rather, the company’s accelerated spending in recent quarters has resulted in strong acceleration in customer growth, with net additions running at treble their historic rates. To refute the ill-evidenced claims of lazy journalism requires no special insight, insider knowledge nor proprietary analysis. But the acknowledgement of publicly available information has led us to a different conclusion.

Which is that this seems to be far from a zero-sum situation. Despite the entrance of well capitalised rivals such as DoorDash and Uber Eats, GRUB’s diner churn has not been affected. GRUB’s quarterly food sales growth is accelerating. The attrition rate of restaurants leaving the platform has also not changed in several years, and diner retention rates continue to improve. Amazon closed its meal ordering and delivery business Amazon Restaurants in the summer of 2019, after four years of failing to build profitable scale.

Rationality is a superpower

Tollymore is charged with applying logic to anomalies. In our view the objective investment merits of GRUB are compelling, and are at odds with the prevailing narrative concerning the company’s prospects. GRUB enjoys lasting unfair business advantages which we expect to protect the company’s discretionary profits.

Barriers to profitable participation in this industry emanate primarily from two-sided network effects. That is, a marketplace connecting restaurants with diners. This is a platform that can create considerable value due to fragmented supply. One sided network effects are also present in the form of user reviews. GRUB has invested in the expansion of the two-sided network via marketing dollars and business acquisitions. The merger with Seamless in 2013, for example, allowed the company connect GRUB’s diners with more restaurants.

GRUB’s value proposition extends beyond diner acquisition and food delivery. The LevelUp acquisition is an example of investment directed to deepening the level of service integration between the restaurant and the platform. But GRUB also provides 24/7 access to support staff. GRUB tracks restaurant performance on the platform and helps restaurants to manage capacity and adequately resource demand fluctuations, and to price to maximise takeaway revenues.

As the platform grows, we could expect that brand and product awareness grows, lowering diner and restaurant acquisition costs as word of mouth and reverse solicitation replace marketing efforts in the generation of business leads.

GRUB enjoys an incumbent advantage: restaurants do not wish to partner with many digital food delivery platforms. Dealing with five different partners and operating five different tablets and systems becomes cumbersome and unappealing. They are likely to have partnerships with a small number of platforms.

GRUB has an opportunity to redeploy discretionary profits into value -accretive activities:

The takeaway market in the US is c. $250bn, almost 50x GRUB’s gross food orders. If GRUB has about a third of the market the total digital penetration is still in the single digits. Then there is the very real possibility that the current takeaway industry underestimates the addressable market if digital food ordering platforms take share from grocery stores and home cooking. In 2015, for the first time, Americans spent more money at restaurants than at grocery stores. Food-service locations account for 40% of all new leases in Manhattan, more than clothing stores, banks, and health clubs combined. In 2020, more than half of restaurant spending is projected to be off-premise. This off-premise spending is projected to account for 80% of the industry’s growth in the next five years.

While the annual cost of customer support and payment processing fees is unlikely to be meaningfully scalable, the principal source of GRUB’s capital intensity is technology and software, which is scalable. A quarter of operating expenditure is directed to sales and marketing activities and primarily focused on growing existing assets (monetisable restaurant and diner relationships).

Significant portions of cost are directed at growth investments: 95% of sales and marketing according to management. And at the end of 2018 GRUB spent more on advertising that it ever has in the past. On the FY17 conference call management stated that after stripping out overhead and only including direct costs such as customer service and credit card processing fees the company’s profit per order = $3.40, much higher than the current reported EBITDA per order of $1.23. There will always be some maintenance tech and marketing requirements to service existing business operations. But the gulf between these two numbers highlights the reinvestment rates of the business. At $3.40 per order, GRUB’s 2018 EBITDA would be $540mn, a 10% yield to the current enterprise value.

The press speculation around margin compression and competition have contributed to an erosion of two thirds of GRUB’s market quotation over the last year, creating a compelling opportunity for long term investors capable to making purchase decisions on the basis of very positive and possible long term outcomes, but in the face of near term uncertainty and media noise.

Thank you for your partnership.

Mark