In the forty years that I have been studying and participating in investment markets, the current conditions are among the most challenging. That may sound odd – interest rates are low, credit spreads are tight, stock prices are at records, real estate has recovered from the great crash to reach new highs. But those are exactly the problems. What matters to investors is how their investments will perform in the future and from current levels the future is very challenging. All the past good news is the reason that times are so perilous today. Let’s run through the major asset categories and ask what they offer today.

Fixed income

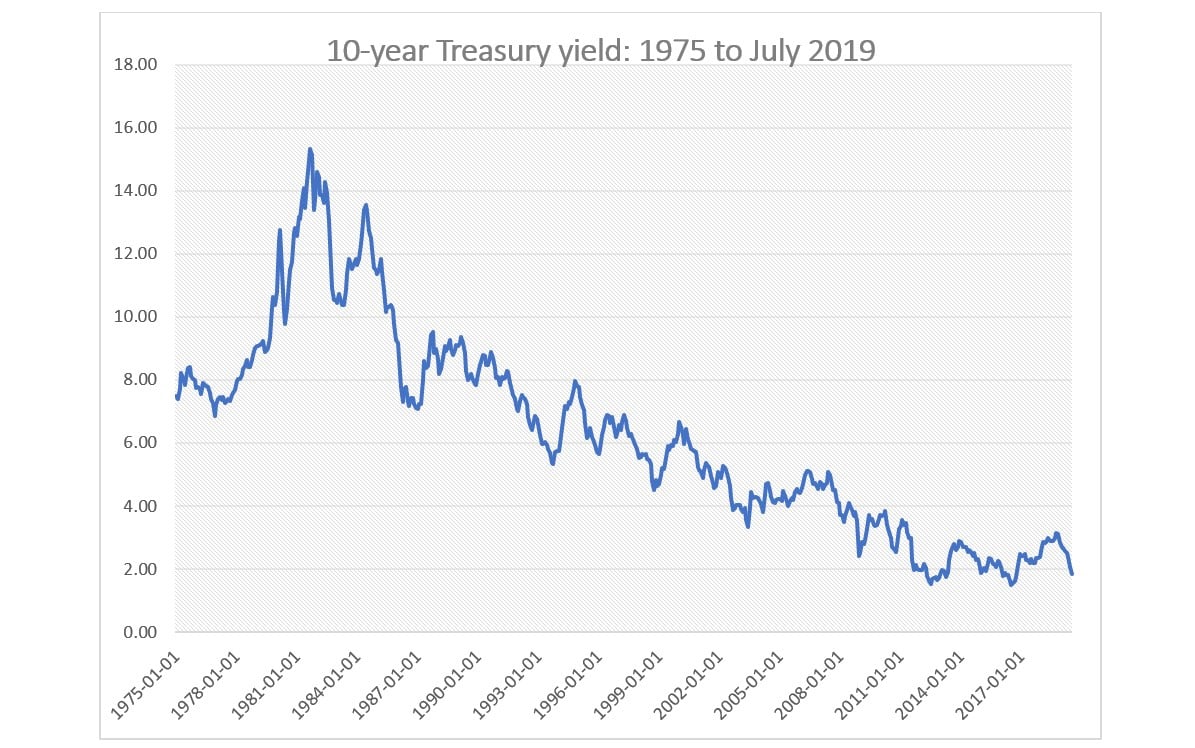

Yields are near historic lows. The current yield on the ten-year Treasury bond has dropped to 1.85% as shown in the exhibit below. The Vanguard EFT of intermediate-term high-grade corporate bonds has a yield of 3.01% – again near historic lows. Of course, yields are higher if you are willing to bear more risk, but not by much. For example, the Vanguard high-yield EFT has a yield of 4.90%. However, these are promised yields, not expected yields which are lower because of the risk of restructuring for lower-grade bonds. To make matters worse, if inflation were to accelerate investors would face capital losses across the board on fixed income securities. In short, fixed income securities currently offer anemic returns combined with the potential for substantial capital losses. Not a happy combination for investors.

Q2 hedge fund letters, conference, scoops etc

Stocks

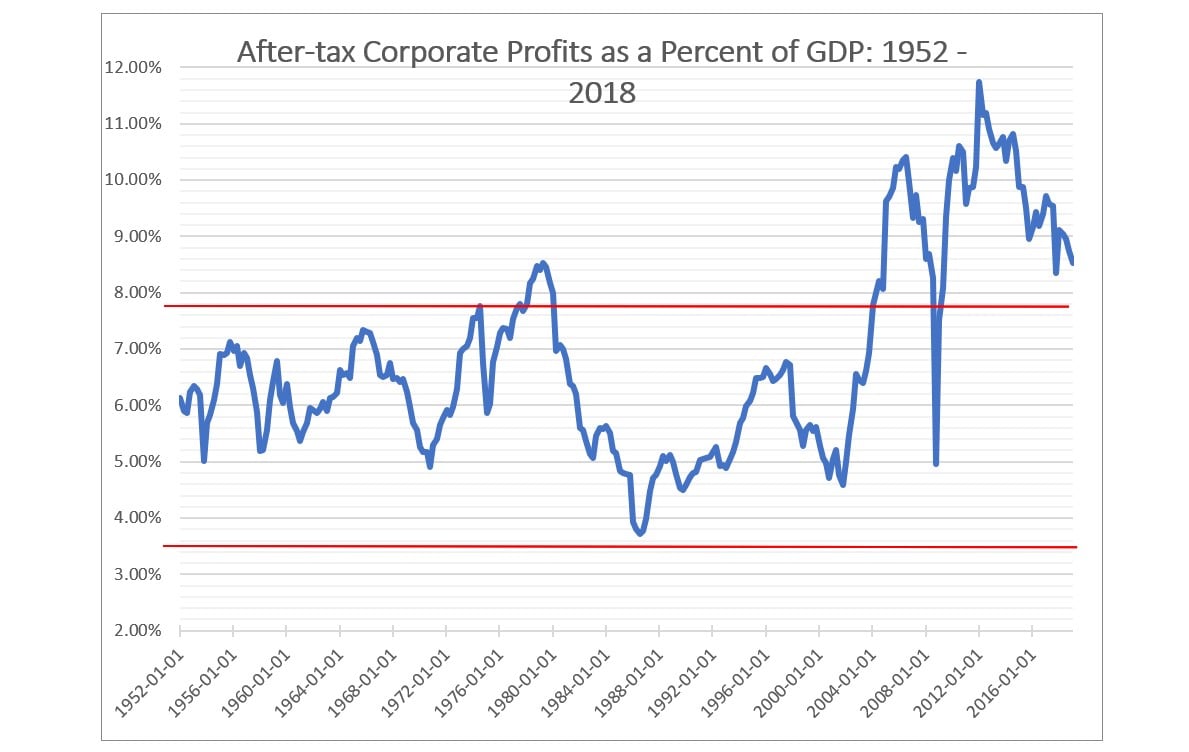

The yields on government securities also affect stock prices because they are the foundation of the discount rate at which future cash flows are discounted. The lower the discount rate, the higher the stock price and the lower the expected return on an equity investment. The falling interest rates partially explain the rise in the Shiller CAPE index, shown below, to levels matched only during 1929 and the dot.com boom.

The Shiller index measures prices relative to earnings, but earnings are also at extraordinary levels relative to GDP as evidenced by the graph below. Given this confluence of circumstances, it is hard to see stock prices rising much in the next few years.

Turning to individual stocks, in many cases prices have been pushed to bubble levels as Rob Arnott, Shane Sheppard and I describe in our recent article, Bubble, Bubble, Toil and Trouble, which is available on the Research Affiliates website. As we note in the article, not all stocks are bubble stocks. There are attractive opportunities but finding them requires careful economic analysis and avoidance of popular, crowded, stocks particularly those in the technology space.

In short, these are trying times for equity investors.

Real Estate

Low interest rates and correspondingly low discount rates have the same impact on real estate assets as they do on common stocks. Asset values rise and expected returns fall. Real estate is such a large, heterogenous class that this is not true of all properties, but careful selection is clearly in order. There is one added risk with real estate. Never a liquid asset, real property tends to become especially illiquid during downturns. For this reason, investors should place reasonable limits on the fraction of their wealth in real estate.

Options and Other Derivatives

Due to the long bull market, many investors have portfolios have large embedded capital gains, particularly in tech stocks that have run-up the most. This makes investment management more difficult because sharply appreciated positions cannot be sold without generating large tax obligations. One way to manage the situation, especially in light of the overall high level of stock prices, is by careful use of stock options. For instance, selling call options in the proper proportions can provide added income and downside protection. To be fair, such option hedging strategies are not a free lunch. Some upside potential must be foregone to provide the added income and downside protection. Nonetheless, given the current level of the market the benefits provided by thoughtful option selling warrant serious consideration.

Bradford Cornell

Cornell Capital Group

Anderson Graduate School of Management, UCLA