Pitfalls to avoid in Evaluating Crypto-assets: Defining reasonable discount rates in nascent markets

The crypto market is one of the most volatile markets in history. Not only does it make investing in crypto currencies an extremely high risk (and potentially high reward) game, but it also makes it very difficult for the teams behind the tokens to perform valuations on the networks and various token use cases.

Q2 hedge fund letters, conference, scoops etc

Many questions arise when looking to invest in or evaluate a token or project; notably - what is the correct rate the future value flows should be discounted at?

The Current Discount Rate is Arbitrarily High

The existing body of work around crypto asset valuation recommends using an arbitrary high discount rate to accommodate for the risks associated with these early stage networks.[1] We felt unsatisfied with this approach as it introduces distortions which we will discuss below.

The discount rate should reflect the risk the diversified holder of a crypto asset should expect for the value flows across all scenarios, good and bad. At the same time we want to avoid making the discount rate a receptacle for all uncertainty.

The discount rate factors in continuous risk that can not be diversified away, discrete risks such as a network failing should not find their way into the discount rate but rather independently estimated and brought in only after one has the discounted value flows.

The discount rate is composed of the risk free rate, the risk premium for the benchmark, and the relative risk to the benchmark. If one estimates the value flows in U.S. dollars then that is the currency of analysis and the risk free rate in this case is the U.S. 10 year T-Bond rate.

We Need a Benchmark

In order to determine the relative risk of the asset or the Beta we need to establish a benchmark for the asset class. Currently we use Bitcoin as the benchmark, as it is the largest, most liquid and longest running crypto network. We acknowledge the possible limitations in this approach especially where networks built on top of Ethereum might be more tied to ETH and the risk factors of that network. While this is an ongoing area of investigation there is not yet enough data to estimate these risks in a satisfying manner. In the future we may use a basket of assets or compute the bottom up Beta based on overlapping features of other networks as an example of more robust Beta estimation.

With Bitcoin as the benchmark, we regress the returns of our crypto asset against the returns of Bitcoin to get the relative risk of the asset.

The Risk Premium

The last remaining component needed is the risk premium. This is the return holders expect for being in the asset class. In other assets such as stocks, this would be the return of the S&P in excess of the risk free rate. So if the S&P returned 10% and the risk free rate is 2% our risk premium is 8%.

Crypto markets are too young to use past returns as an estimate for the expected forward returns since projecting triple digit annual returns means crypto assets would exceed global assets values coupled with crypto networks being less risky as they mature leads us to find a better way. We can not escape that crypto as an asset class will have above average risk for some time due to the uncertainty of the future value flow and therefore compare it to a venture type asset.

Over the past 30 years venture capital funds have delivered historical returns of about 17.5% per annum[2]. One major difference between venture capital funds and cryptocurrencies is that venture capital investments are not liquid which means they will be discounted pushing the returns up. Studies that look at liquidity effects find the returns of illiquid assets to be about 4% higher than liquid assets.[3] Liquidity raises valuation thus lowering return. A different way of thinking about this is that owning a liquid crypto asset means owning a venture style asset + the option to sell, where the option is worth 4% per year. With that in mind we give our crypto benchmark a liquidity premium by removing the 4% from it’s expected return, giving us a final expected return of 13.5% and a risk premium of 11.5% using the t-bond rate of ~2% at the time of this writing.

A Real World Example

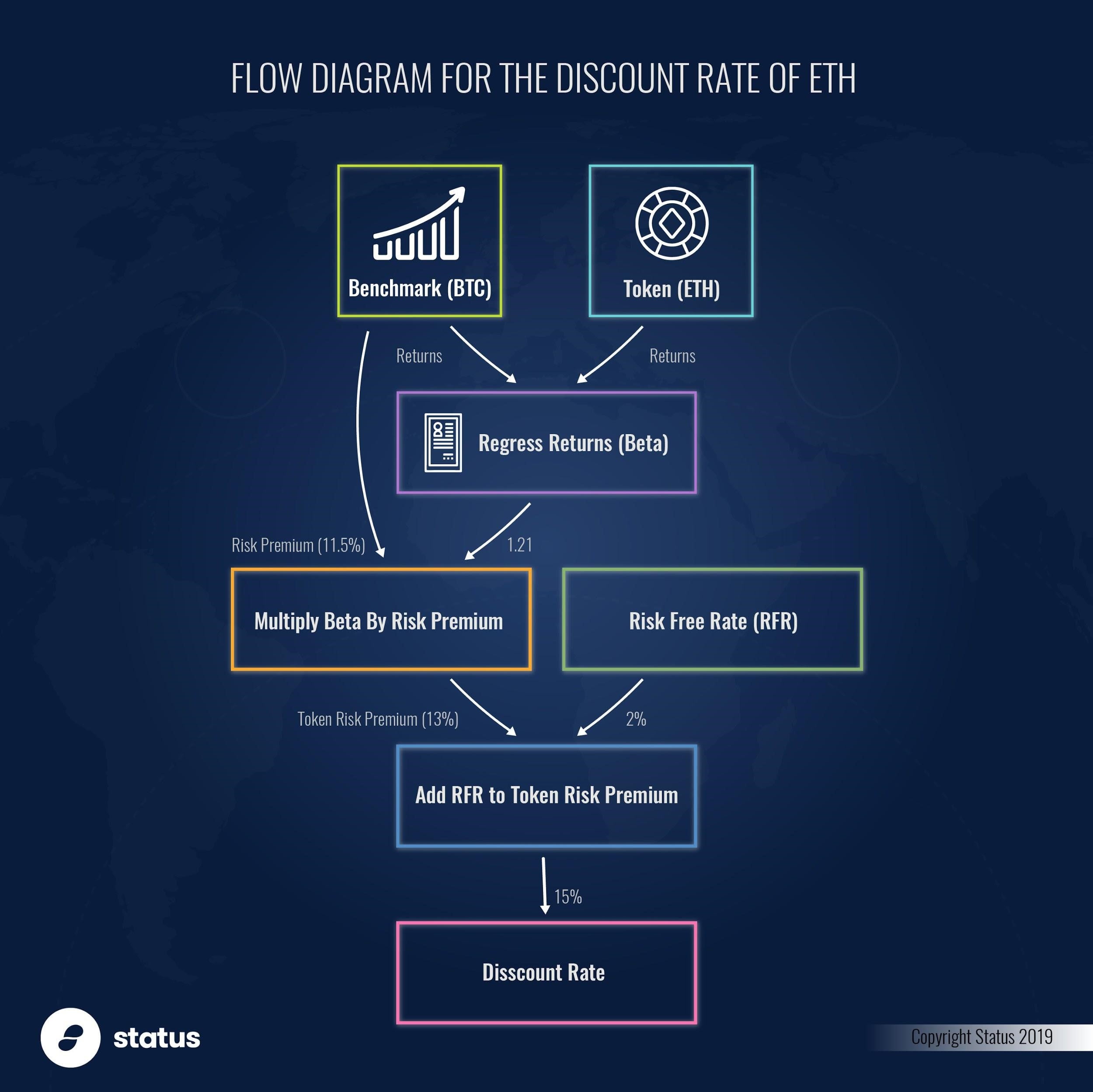

Let us use an example to tie this together and come up with a discount rate for ETH.

Using a one year look back period we regress the returns of ETH against BTC (our benchmark) to get a Beta of 1.21.

Let’s multiply it by our risk premium to get 13% and finally we will add in our risk free rate of 2% to get our discount rate of 15%

We can use this rate to discount the future value flows associated with ETH.

After we have the discounted value flows we can bring in our discrete risks. Risks such as total network failure and loss of funds due to security issues can be brought in here through the probability of failure.

Once the probability of failure is estimated we can convert it to the probability of success (1 minus the probability of failure) and multiply that by our figure from the discounted value flows to get our final valuation.

In Conclusion

Be mindful of arbitrarily high discount rates when looking to invest in a crypto asset. In such a nascent market, many projects may leverage arbitrarily high rates to account for unknowns. On the other hand, be wary of projects that do not account for such risk and assign an irrationally low discount rate – such rates may invite investment into projects that you should ultimately steer clear of.

About Barry:

Barry Gitarts is a web3 engineer at Status - building secure communication tools with blockchain technology. He began building tools to track, test and help implement portfolio allocation decisions on behalf of a trading and research desk inside an investment bank supporting a group of hedge funds and institutional money managers. Specifically, they were tracking about 3500 external equity analysts and the changes in their earnings and revenues estimates in real time. This is where he learned about the market moving impact of these estimates and the fundamental reasons for why they work.

Footnotes:

[1] “I then choose a discount rate, often in the 30–50%+ range, which is 3–5x the discount rate used for risky equities that have high WACC’s. “ - https://medium.com/@cburniske/cryptoasset-valuations-ac83479ffca7

[2] https://www.cambridgeassociates.com/wp-content/uploads/2015/05/Public-USVC-Benchmark-2014-Q4.pdf

[3] http://people.stern.nyu.edu/adamodar/pdfiles/country/illiquidity.pdf