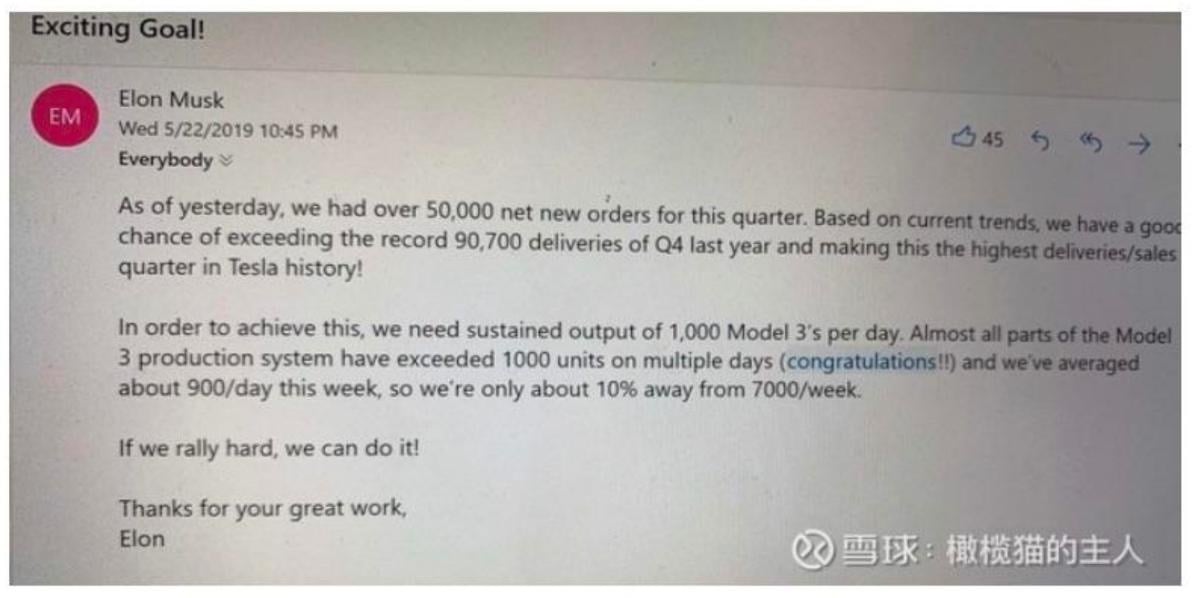

Whitney Tilson’s email to investors discussing Elon Musk’s leaked email in which he claims that the Tesla Inc (NASDAQ:TSLA) Model 3 have 50,000 net new orders for the second quarter.

Musk’s “leaked” email

Assuming it’s real, Musk appears to have “leaked” another email:

Q1 hedge fund letters, conference, scoops etc

Even with this, the stock is down $3.61 right now.

1) A friend’s take:

I assume it's real. But the interpretation of it is not all that great. The definition of the 50,000 may not be all that impressive. It probably includes all the carry-over "orders" they had from Q1 that weren't delivered by March 31. It is not an impressive number, and they won't sell 91,000 cars.

2) Mark Spiegel’s tweet:

Lol, the math doesn't even add up. $TSLA supposedly exited Q1 with 10K cars in transit and no backlog. If it exits Q2 with 5K in transit (for "in-transit net deliveries" of 5K), then delivers the supposed 50K new orders it's 55K Model 3s. Throw in 15K S/X & it's 70K cars in total. If $TSLA had no backlog, why is 50,000 quarterly orders considered "good," lol?

3) Another tweet:

Guys, he said Tesla have 50k net new orders for q2. Did not say they received them in q2. Big difference. The 50k likely incl 10k in-transit, 2-3k uk (which they are too late yo deliver) and a small q1 backlog... new orders ex uk likely ~35k if this is true. Its for all cars.

Email from a Tesla owner

It would be hard to find a better example, I think, of the kind of inexperienced individual investor who’s confused the product and the dream (both of which I’m a big fan of) with a hard-nosed assessment of reality. As a result, he is paying (and will continue to pay) a heavy financial price (despite my best efforts to save him)…

My wife and I love our Tesla S, a true breakthrough of brilliant engineering and concepts on so many levels that has permanently changed an entire industry, our lives and in reality is changing, or accelerating a better life worldwide too. In our 3.5 years of ownership, we’ve driven it coast to coast to coast, some 65,000 miles. It is, simply put, a superb machine unlike any other, that clearly deserves by all that’s right, to evolve and live. You are out to destroy the good for your own pecuniary and present purposes, in a way not unlike how many people in other arees of life these days act. Too much quality life, in our opinion, starting with news sources and balanced politics are being trashed; now our society is also on to mind changing fads as good and promoted. Why? The 1920’s all over again? Necessary? A position you aspire to lead?

You indeed have been shrill. Opinions and personal judgments mix too easily with facts; with you, editorial comments, biased sources and assessments masquerade as news. So one sided, sort of like an internet version of NY's Daily News or the National Enquirer. So far, the opposite of adding to ongoing quality of life. Still, I do filter thru your trashing for facts because there has been good info buried in your posts. Do many others sort these out or just absorb the overall flavor? IMO, you need a good editor!

It is a truth that you and your strident opinions have impacted the financial market which, when all is said and done is a delicate opinion judgment netted down to a number; you are affecting this iconic, needed, life leading firm (and its similar polarizing leader), and potentially their future. Yes, they are in trouble again, caught up in their own too far "out there" dreams and aspirational hyperbole. Dreamers, however, are still a much needed quality of life. To give you a little credit, it does seem you have not hung your words on totally quashing the firm but rather at heart aim to get the stock price to a certain level, which you may achieve; but really, the two are too mixed up.

My fervent hope for all that’s right and needed in today’s world, is that you don’t succeed in doing both. In light of your ecologically related background, I think you should also be making clear the many good aspects/results of this firm that in truth have been exceptional, and note too its frequent past ability to survive trials that would do credit to a new book of the Perils of Pauline.