Black Bear Value Partners LP letter to investors for the first quarter ended March 31, 2019.

“The art of prophecy is very difficult, especially with respect to the future.” -Mark Twain

Q1 hedge fund letters, conference, scoops etc

To My Partners and Friends:

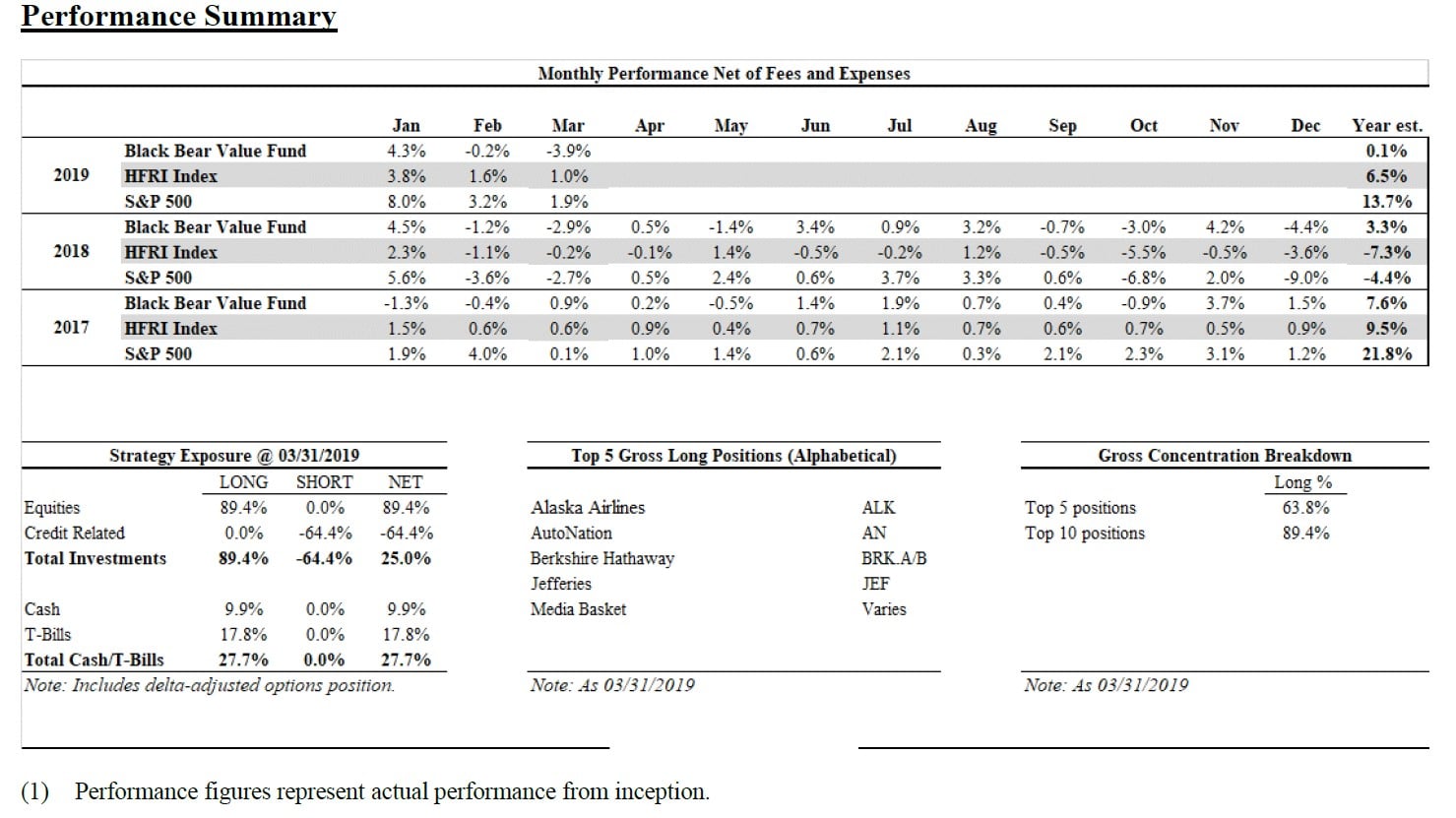

- Black Bear Value Fund, LP (the “Fund”) returned +0.1% in the 1st quarter of 2019.

- The S&P 500 returned +13.7% in the quarter.

- The HFRI index returned +6.5% in the quarter.

- We do not seek to mimic the returns of the S&P 500 and there will be variances in our performance.

Our credit shorts negatively impacted our performance in the first quarter as credit instruments rallied. In the year-end letter I advised caution in extrapolating our 2018 performance as this is a long-term game. The bond market decided to make my point for me and we’re breaking even thru Q1. Long-term investing takes time and requires patience.

Each investors’ return will vary depending on the timing of the investment. I would caution those reading that our portfolio is shown at a point in time and can change for a variety of reasons.

Top 5 Businesses We Own (Alphabetical)

These positions comprise ~64% of the portfolio at quarter-end.

Alaska Airlines

We have discussed Alaska in previous letters. Our recent piece from Value Investor Insight and letters can be found on our website: www.blackbearfund.com

Alaska is broadly comprised of 2 businesses: a transportation/seat-distribution business which has cyclicality and a sticky cash flowing credit-card business with limited cyclicality. Large amounts of cash are generated by the airlines selling miles to banks irrespective of airline capacity or ticket prices.

Recently, Delta and American Express extended their credit-card deal at terms that were very favorable to the airline. This theme will likely repeat with other airlines and eventually the increased and sticky-flow will become more apparent to the investor community.

AutoNation

AutoNation has been a top 5 holding for us in past years. Our AutoNation presentation is on the website.

Much of the sell-side and investor focus is on the new car business. Selling new cars has long been a lower-margin business and gets more attention than is deserved. Car dealerships have resilience with car buyers migrating to used vehicles (higher-margin). Historically, the new car customers received more of the focus both on the sale and the subsequent warranty and service work. AutoNation has been building out their used car and private label parts businesses allowing them to be more price-competitive for the cost-conscious used car owner. Over the coming years, the business should generate meaningful cashflow from the used business as well as the parts/service segment (both for new and used cars).

Berkshire Hathaway

Berkshire Hathaway returns to the top 5. We have owned it continuously since the inception of our Partnership in varying sizes. The combination of a fortress balance sheet, a relatively cheap equity portfolio and healthy/growing operating businesses with sustainable moats allows me to sleep at night. Berkshire has recently been buying back their stock and has allocated capital in a thoughtful manner since inception. If we encounter any periods of distress in the marketplace, Berkshire is able to capitalize.

Jefferies

Jefferies is an investment bank and merchant bank AKA the former Leucadia.

The business is valued cheaply with thoughtful and talented capital allocators at the top buying back tons of stock at a significant discount to its intrinsic value. Absent a major shift in the company’s performance, the value will be realized, and we will own an increasing amount of the company. There are “hidden” assets within the merchant bank that are undervalued on the balance sheet due to GAAP accounting. Economic accounting would result in a far higher value on the balance sheet.

To be fair, the investment banking business is tough. It’s competitive, people-intensive, and somewhat dependent on the health of the economy. The price we are paying for the bank and the underlying assets provides a margin of safety.

Media-Content Basket

I am deviating a bit from past letters and discussing an investment theme instead of a specific name. Individually, none of our media investments would make the top 5, but collectively they do. Given the overlapping nature of some of these companies it made more sense to include and as an LP I would want to be made aware. If you are an LP and desire to know the names, please reach out and I am happy to share.

Media-content companies (companies that produce the shows/events we watch on screens) have been out of favor. There is fear about cord-cutting, millennial apathy, increased penetration of Netflix, the destruction of the cable bundle and an increasing amount of direct-to-consumer video delivery. These fears are fair but are more than reflected in the stock prices which trade anywhere from 10-15% free-cash-flow yields. Our businesses produce unique content that has advertising value, consumer loyalty, and an engaged customer. Methods of media consumption will inevitably change over time. What will remain the same is a need for content to attract the consumers. The industry is ripe for consolidation and M&A (“mergers and acquisitions”) Who buys who and when? I’m not sure. We will clip meaningful cashflows from the businesses while we wait.

Shorts

We remain short credit in large size in the Fund. I have discussed the thesis at length in previous letters. Please check out our past letters and/or presentations as our feelings have not changed.

While the Fed has put rates on hold, corporate lenders typically charge a premium to lend to companies. If the Fed is concerned about the economy, I would presume the spread being charged to companies should widen as their fears of potential default rise. So far that presumption has been wrong and resulted in mark-to-market losses in our portfolio.

Bonds sold off in rapid fashion in December on very little fundamental news. They have subsequently broken records in their Q1 rally, also on little fundamental news. Investor emotions can be powerful in the short run.

Cash

We had approximately 11% of our assets in cash/T-bills (ignoring the cash we get from our shorts). We do not target a cash balance.

General partnership business

K-1’s and the 2018 audit were completed by mid-March. If you did not receive them, please reach out.

Thank you for your trust and support. For those attending the Berkshire Hathaway annual meeting please say hi if you see us.

Black Bear Value Partners, LP

This article first appeared on ValueWalk Premium