Whitney Tilson’s email to investors discussing a few good posts on Tesla on the VIC message board about the massive increase in delivery volume in Europe and China.

41 – jcoviedo – 3 days 2 hrs ago

Re: Re: Re: Several bullish points

40

Q4 hedge fund letters, conference, scoops etc

Elon leaked to Business Insider the company email about upcoming delivery hell. Why a company delivers over ½ of its quarter in the last week is beyond me. Obviously this is being leaked b/c prior pumps the past few weeks have all failed.

“For the last ten days of the quarter, please consider your primary priority to be helping with vehicle deliveries. This applies to everyone. As challenges go, this is a good one to have, as we've built the cars and people have bought the cars, so we just need to get the cars to their new owners!

What has made this particularly difficult is that Europe and China are simultaneously experiencing the same massive increase in delivery volume that North America experienced last year. In some locations, the delivery rate is over 600% higher than its previous peak! This was further exacerbated by supplier shortages of EU spec components and a sticker printing error on our part in China that were only resolved in the past few weeks.

North America is also stressed, as the final month of this quarter is almost all North America builds. Moreover, for the first two weeks of march most cars were sent from our factory in California to the East Coast to ensure arrival before the end of the quarter.

The net result is a massive wave of deliveries needed throughout Europe, China and North America. This is the biggest wave in Tesla's history, but it is primarily a function of our first delivery of mass manufactured cars on two continents simultaneously, and will not be repeated in subsequent quarters.

To help, please contact Sanjay Shah in North America, Robin Ren in China and Ashley Harris in Europe.”

Who is the intended audience for this email? I doubt you would send to low level people the instruction to go email the heads of NA, China, and Europe. Just seems strange. Almost as if this email was really written just to be leaked.

Its worth putting this email in context.

On Monday, Business Insider (funny same publication gets the multiple leaks this week) reported that Tesla was preparing to deliver 30,000 cars in the end of Q rush.

https://www.businessinsider.com/tesla-asks-employees-help-delivering-30000-cars-end-quarter-2019-3

According to an internal email sent on Friday from senior vice president Sanjay Shah to department heads at the company, a copy of which was seen by Business Insider, Tesla again sought employee volunteers from across the company to pitch in and deliver cars before the quarter ends this month.

"We need your help to make more progress in volunteer sign ups," Shah said in the email. "We have to deliver 30,000 more cars in next 15 days."

Clearly this was leaked in an attempt to dispell worries about demand in the market. Assuming this is true, is it inconsistent with our projections for the Q?

What do we know?

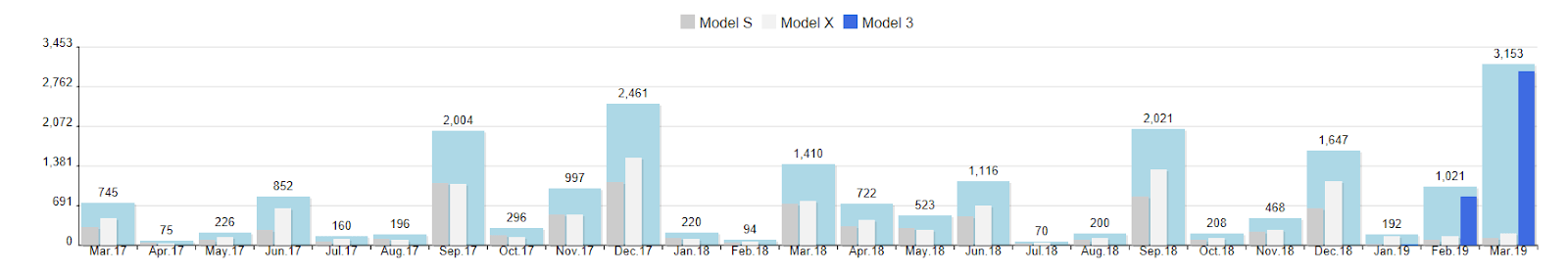

Model S/X Demand is terrible QTD

Its the worst 3rd month of a Q for the S and X since data begins in Norway

Norway + Spain + Netherlands through last night.

M3 4,979

MS 522

MX 318

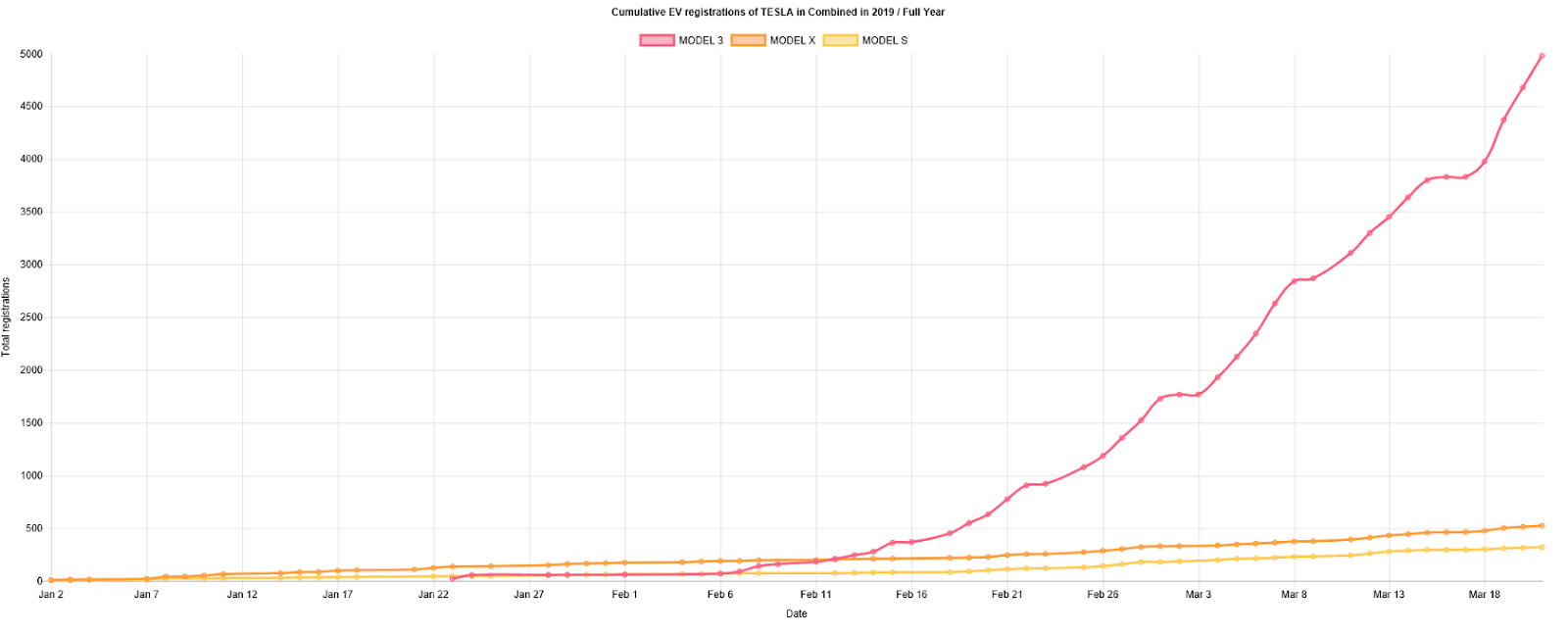

Through the 15th of March they had delivered 3,799 M3 cars in these markets.

Germany was ~1,000 M3 through February. In the Netherlands it looks like March will be roughly the size of February. Spain looks like March will be about 1.5x the size February

The last ship for Europe arrives on Sunday or Monday. So they will have a week to deliver these cars. It lands in Belgium though possible there is a second leg to Norway. This will be the 8th ship to Europe during the Q.

So my estimates for Total European Sales

Norway + Spain + Netherlands = 6,500

Germany = 2,500

Other Europe (Switzerland, France, Italy, Denmark, Luxembourg, Portugal, Austria, Sweden, Finland) = 2,000 (this is a total guess on my part)

Total Europe = 11,000 which implies deliveries of about 1,400 per shipping vessel (which is pretty consistent with the 1,500 number we were seeing from the initial vessels that landed)

This would imply ~6,000 M3s to be delivered in the second half of March.

5 vessels have landed in China. We know the first 3 vessels had 4,678 cars (1,559 per ship). There are another 3 vessels expected to arrive this weekend.

I think its reasonable to guess Chinese M3 deliveries will be roughly equivalent to European deliveries with the caveat that “delivery hell” could push some of these cars into Q2.

Basically no M3s had been delivered in China through the middle of March b/c of the issues at the ports.

U.S. we estimate from Inside EVs that 12,250 M3s were delivered in Jan/Feb combined.

This gets to 34,250 M3 deliveries before factoring in March U.S. deliveries. I’d guess March ends up being like June 2018 where they delivered ~15,000 M3s. April/May 2018 were similar to Jan/Feb 2018 which is the basis for which I make this guess. Also I don’t get the sense that things are as crazy as they were in December 2018 which was ~25,000 M3.

I’d guess given the sale they were running last weekend that 80%+ of March deliveries are done in the second half of March so lets call that 12,000 vehicles to be delivered in H2 of March.

So I think its reasonable to assume they will print a M3 delivery number around 49k for Q1 2019 if they can fully solve “delivery hell.” I think its plausible that they have 29,000 M3s to deliver in the second half of March.

S/X deliveries are likely to be terrible. Figure ~1,000 from Norway, Spain, Netherlands + 1,000 from the rest of Europe. 2,000 from China. U.S. was 4,200 through February. So Maybe U.S. does 5,800 in March or 10,000 for the Q. Maybe 1,000 in other markets (UK, Australia, HK, et cetera.) Seems like you end up around 15k for the Q.

Europe likely only has maybe 500 H2 march deliveries. Figure China and ROW ,markets similar. U.S. probably 3,000 H2 March deliveries so like 4,000 S/X deliveries in H2 March.

This all totals to 33,000 cars to be delivered in H2 of March which is actually a little higher than the 30,000 number they leaked to business insider, ie these estimates are likely a little high.

In conclusion, these leaked releases can be true that Telsa has ~30,000 cars to deliver in the last 2 weeks of March while it would also be true that Tesla is going to miss Q1 M3 and S/X deliveries by a mile in Q1.

Its also worth pointing out that all ~95 of those car carriers Tesla paid equity for are sitting idle rotting in the sunlight in Lathrop, CA.

We found Tesla's shiny new fleet of purchased-with-equity car carrier rigs. Well over 100 of them. Sitting. Doing nothing. pic.twitter.com/EpshXpvhxR

— Machine Planet (@Paul91701736) March 22, 2019

11

40 - Leo11 - 3 days 3 hrs ago

Re: Re: Several bullish points

39

And here it comes:

"What has made this particularly difficult is that Europe and China are simultaneously experiencing the same massive increase in delivery volume that North America experienced last year. In some locations, the delivery rate is over 600% higher than its previous peak! This was further exacerbated by supplier shortages of EU spec components and a sticker printing error on our part in China that were only resolved in the past few weeks."

But:

"This is the biggest wave in Tesla's history, but it is primarily a function of our first delivery of mass manufactured cars on two continents simultaneously, and will not be repeated in subsequent quarters."

39 - Harden - 4 days ago

Re: Several bullish points

37

Others will probably put this more eloquently but:

1) I think resale value is the current problem

2) It seems unlikely to me that they will be low enough even if some of the worst inefficiencies have been dealt with.

3) To keep the dream alive (pump the stock). Tesla wants to appear promising whether it is to entice some dumb money into a private placement or to stay above Musk's margin call levels.

4) The price is so high compared to the median income.

5) You could be right about this. For it to collapse on short notice Musk probably needs to be removed, his margin call level needs to get triggered or it needs to default on something.

2

38 - Light62 - 4 days ago

Re: Several bullish points

37

On #4, China's economy is smaller than that of the U.S. with ~4x the people (per Capita GDP is ~1/7th) and income inequality is worse (though I guess that could, perhaps, work in TSLA's favor). U.S. M3 sales have been ~200,000 to date (I think) and demand appears to be rolling over. It seems hard to imagine China could generate the same level of demand given the relative state of their economy (far fewer people who could afford such a car), M3 prices in China appear to be substantially higher, and there is far more competition in China from other, more economical, EV options.

Hopefully "materially less than the U.S." is of some use as an answer.

2

37 - Leo11 - 4 days 2 hrs ago

Several bullish points:

Yesterday I had a discussion with Tesla bull. Although most of his points turned around the usual 'Musk is genius' and 'Tesla might be the next Apple' (just in more sophisticated form), several of his remarks somewhat resonated with me and would love to hear any additional thoughts on these:

1) How much of incremental demand would Model 3 leasing open up? Unlike X/Y, Model 3 is currently financed by cash or loan only (any thought why that's the case?) and while financing by loan seems fairly easy (plenty of forum discussions on the topic), leasing would lower monthly payments significantly and would make Model 3 affordable to the wider audience.

2) Lower production costs going forward vs Q3'18 and Q4'18. The last two quarters involved significant ramp up and were generally a mess on production sites (tents, incremental workforce and etc.). With production now more streamlined and far less pressure to meet delivery targets, costs per vehicle are likely to be lower. While my thinking is that the reduced sales prices more than offset any positive cost savings effect, market might still look favorably at this development and potentially extrapolate similar cost saving gains into the future.

3) If Tesla is really out of cash and potentially facing bankruptcy, why it continues with the China expansion? My thinking is that China and other investment plans were put in motion during Q4 when situation looked much better and Tesla has no option to call the reserved capital back. At the same time China factory dream is a Hail Mary that might keep Tesla's wheels turning and investors committed for couple more quarters.

4) Untapped China demand for Model 3. Although shipments so far have been limited, anecdotal evidence from English language media suggests crowds in stores and videos of M3 DMV lines. These are likely results of interest/purchases by Tesla fan base (or even organized PR stunts), but I have no strong arguments on how to handicap the eventual M3 demand in China. NIO sales dipped and China car market is declining overall (although EV sales still up c. 60% YoY), however Tesla fan base might be sufficient to drive M3 sales materially higher in the upcoming quarters.

5) How will Tesla bulls view Tesla after badly missed Q1 deliveries? Share price is at the same levels where it was back in Q1 2017 when it was still uncertainty whether Tesla can scale up M3 production. Now Tesla has shown that it can be done (even if margins are questionable). Q1 will be spinned as seasonally low, affected by Q4 pull-forward due to subsidy changes, China customs problems and etc. All seemingly temporary issues. Additionally, sales in Europe/China will be presented as steeply sloping upwards. Cash problems will be explained by China factory expansion, M3 sales in new regions, Model Y development and etc. So looking at Q1 alone, there does not seem to be enough meat to cause change in market perception.