Activist interest in buying companies outright have risen over the last 12 months to beat previous records, according to data from Activist Insight Online.

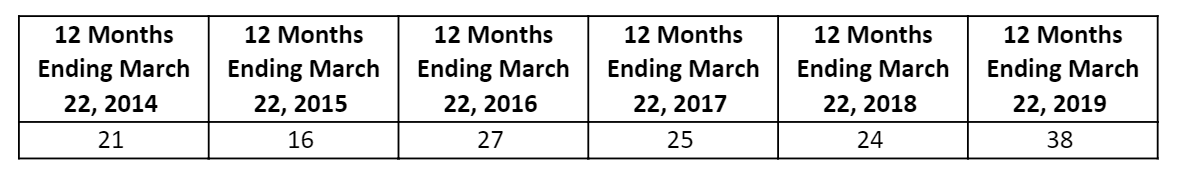

Ever since Elliott Management started a revolution by initiating a plan to take whole companies private, other activists have been inspired to get in on the act. Takeover approaches were up 58% in the 12-month period ending March 22, 2019, compared to the equivalent period ending March 22, 2018.

Q4 hedge fund letters, conference, scoops etc

Companies publicly subjected to activist takeover attempts in the 12-months ending March 22, each year, globally.

Elliott Management has made four takeover demands in the most recent period, with a previous effort at Gigamon in May 2017 its first since 2014.

Sharp volatility at the end of 2018 may have provided the spark for the overall uptick, with 12 takeover demands recorded since the turn of the year alone.

Companies publicly subjected to activist takeover attempts in the period January 1 to March 22 of each year.

Hostile bids using activist tactics such as shareholder proposals or proxy contests by Barrick Gold, MNG Enterprises, and Sports Direct also explain some of the uptick.

Other increasingly popular tactics over the past 12 months include a push for companies to divest assets, return cash to shareholders, and replace management.

About Activist Insight

Since 2012, Activist Insight (www.activistinsight.com) has provided its diverse range of clients with the most comprehensive information on activist investing worldwide. Regularly quoted in the financial press, Activist Insight is the trusted source for data in this evolving space. Activist Insight offers five industry-leading products: Activist Insight Online, Activist Insight Governance, Activist Insight Vulnerability – a tool for identifying potential activist targets – Activist Insight Shorts, and Activist Insight Monthly – the world's only magazine dedicated to activist investing.