Whitney Tilson’s email to investors discussing the market rips; Facebook Q4 was positive due to ad price increases in Instagram feed and Instagram stories; Tesla; Munger meeting.

1) I’m not at all surprised that stocks had their best January in 30 years. Exactly six weeks ago in my email on December 21 (posted here), I wrote:

Q4 hedge fund letters, conference, scoops etc

A friend of mine emailed me this evening, writing that “the markets DEFINITELY feel like 2008 now. Absolutely insane. You buy stuff and immediately it’s down 3%.”

I disagree. Yes, it’s been a tough December and Q4, but the S&P 500 is down a mere 6% this year – yawn.

There is no comparison to late 2008/early 2009. It's a tough market but a drawdown of 20% is a far, far cry from a 50% drawdown. Also, the macro environment today is quite healthy vs. back then when the economy and corporate earnings were in freefall, the debt markets had seized up, unemployment was 3x today's level, etc. Lastly, while stocks, in my opinion, have gone in the past couple of months from very richly valued to merely the high end of fair value, they’re not cheap by any measure – much less insanely cheap like they were a decade ago.

I repeat: no comparison.

I came within a day of nailing the bottom, as you can see in this chart – and the S&P 500 is up 12% since then:

2) In the same email, I wrote:

Mark my words, however: at $125 today, Facebook's stock is going to do very well over the next 2-3 years. This study shows how much its users value it: How much is social media worth? Estimating the value of Facebook by paying users to stop using it. Excerpt:

…we consistently find the average Facebook user would require more than $1000 to deactivate their account for one year. While the measurable impact Facebook and other free online services have on the economy may be small, our results show that the benefits these services provide for their users are large.

Here too I came within a day of nailing the bottom (its 52-week low is $123.02), as you can see in this chart – and it’s up 33% since then:

My current take: while it’s not as crazy cheap as it was six weeks ago, I still think the stock will outperform over the next 2-3 years.

I agree with this assessment, posted anonymously on the ValueInvestorsClub message board (you have to be a member to access it; I highly recommend signing up as a guest here and then applying to become a member, which is highly competitive, as this Barron’s article notes):

Q4 was positive in my book and thesis-confirming. As far as I can tell, a significant portion of the YoY revenue growth beat in the quarter (30% actual vs 26% consensus) was due to ad price increases in Instagram feed and Instagram stories beyond what was baked into management's October guidance. These ad price increases were a key part of my pitch in September. While the 30% announced revenue growth was below my 32% estimate for the quarter, I admittedly underestimated how long it would take management to roll out its "automatic placements" feature, which allows advertisers to automatically convert feed ads into the new stories format. Management indicated that this feature was "launched and expanded" but not yet fully implemented. Big picture, I still think that both management guidance and market expectations undersell the long-term potential for Stories ad pricing to converge with pricing for feed ads. Sheryl even explicitly mentioned on the call that advertisers who are currently running Stories ads are getting "really attractive" pricing with "benefit to being an early adopter."

My biggest concerns are with the high capital investments and opex growth forecast for 2019. It is clear at this point that Facebook was structurally overearning prior to 2018 by ignoring the security and compliance costs that society expects it to incur in order to police the online actions of more than a third of the world's population. I would like to think the return on incremental capex will continue to be high given the quality of the business, but operating margin and ROIC will undoubtedly be more pressured going forward as a result of increased security costs. FCF will also likely continue to be lower than net income for the foreseeable future, and I'm not comfortable estimating how much of capex is truly geared towards growth in profitability.

All that said, I think the headwinds are priced in while the revenue upside is not and therefore continue to believe in the original thesis and long-term prospects of the company. In my view it's likely that 1H 2019 will continue to show revenue growing significantly faster than operating income, but that towards the end of the year operating income growth will accelerate somewhat as the company laps big investment quarters in Q3 and Q4.

3) Tesla reported earnings yesterday (you can read Elon Musk’s update letter here) and, as usual, there was plenty of fodder for both bulls and bears.

If you’re interested in the debate, here’s a 28-minute video analyzing the earnings by a young uber-bull on the stock, Galileo Russell (I’ve also posted screenshots of some of his charts here).

On the bearish side, here’s the January letter of uber-bear Mark Spiegel of Stanphyl Capital and here are two articles by Anton Wahlman:

- Tesla Earnings: This Is a Hypergrowth Company?

- The Many Puzzling Non-Answers Tesla Provided On The Conference Call

My take: I think Mark Spiegel is likely correct that “Tesla is now just another car company with a busted growth story.” If so, the stock has more than 50% downside this year – maybe much more given the debt levels.

That said, I don’t recommend shorting it. There’s too much of a cult around it, and there’s a ton of upside optionality if Musk and his team can pull more rabbits out of their hats (as they’ve done so many times before). I had to learn the hard way in 2013 the perils of betting against them.

4) Another reminder that Charlie Munger’s Daily Journal annual meeting is coming up in 13 days on Thursday, Feb. 14th at the DoubleTree Hilton in downtown Los Angeles. It starts at 10am with brief formalities and then Charlie takes questions from the 1,000+ people in the audience for a couple of hours.

Charlie is brilliant – always full of incredible insight and wisdom – so it’s well worth the trip (and at age 95, he's not getting any younger, though he's still razor sharp)! It’s open to the public – you do not have to be a Berkshire or Daily Journal shareholder to attend.

If you come, I hope you’ll join me at the lunch I’m hosting at a lovely outdoor patio at the hotel immediately afterward. A free meal, good company and stimulating conversation – what's not to like?! More than 100 people have already registered, but there’s room for more so if you’d like to join us just click here to register.

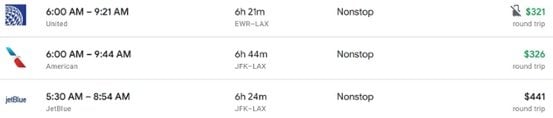

PS—You can do this as a day trip (with no redeye) from NYC. Here are the three flights that leave early enough to get you there in time (I’m on the 5:30am JetBlue flight from JFK), and then just take an afternoon flight back: