This week we cover the price movements of gold, silver, platinum, palladium, the US Dollar Index, the DOW and more on Golden Rule Radio. We have gold at a 10 month high. We look ahead at the possible direction and levels the gold price in 2019 could hit. We’ll then look at the silver price in 2019 alongside platinum and palladium prices.

Gold At A 10 Month High – Silver, Platinum, Palladium Update – Golden Rule Radio

Q4 hedge fund letters, conference, scoops etc

Transcript

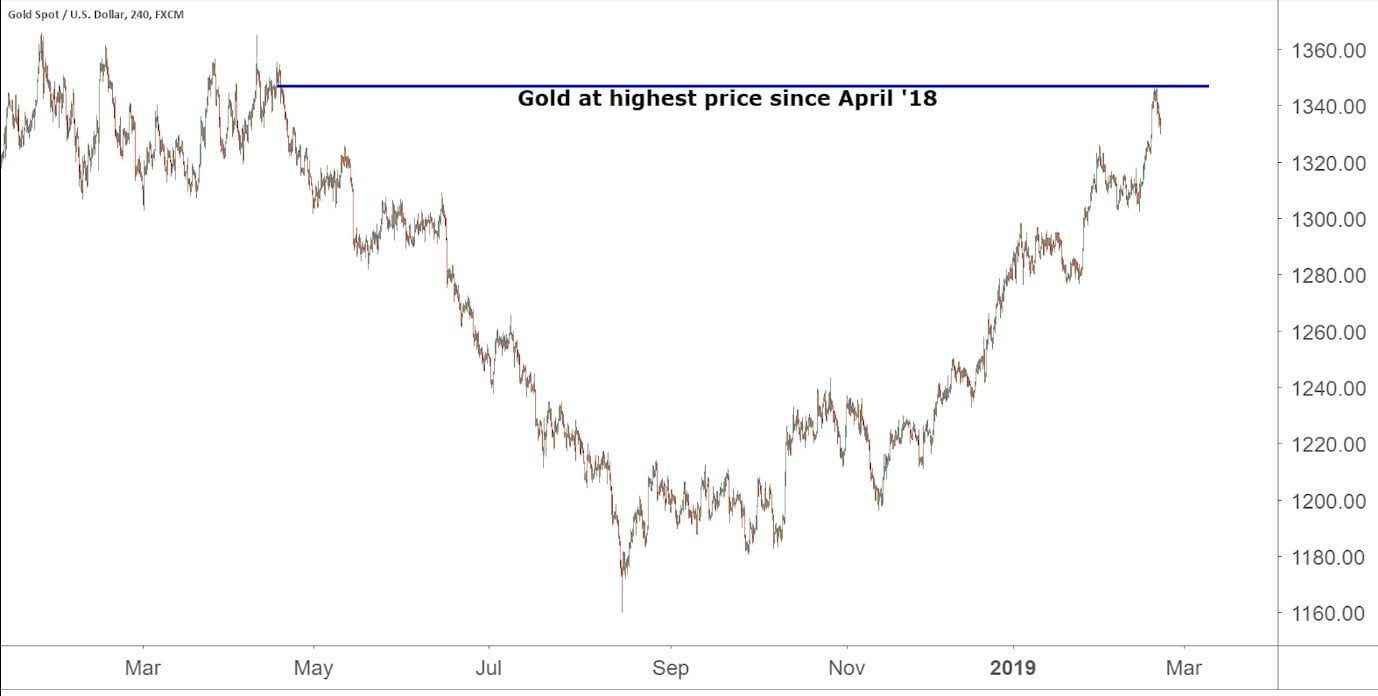

We have gold at a 10 month high pushing above 1340 boy I like this action and goal and that fun we got as high as 1347 and Miles is going to tell us every reason why. Yeah Miles had a brilliant shot chart a couple of weeks ago on a three drives pattern that he said that we were going to see this extension into this level testing the previous highs. And so I like that call Miles a couple of weeks ago you had this. We do have divergent still going on between price and RSI. So where are we today Miles.

Yeah Robert the RSI or the Relative Strength Index kind of that average of buys versus sells over a period of time definitely tells you which trends you see the market going regardless of where the prices going. And you can see some interesting indicators in that correlation between just dollar price and how some of these indicators like RSI respond. So speaking of that price we did see well it looks now like a 3 drives pattern with that divergence RSI we're drawing on the chart here. Now coming right up into the lower end of kind of our top historic range. So you can kind of see over here on the left side of the chart. We've just come into sort of the bottom of the previous trading range between about 13 45 and 13 65. So we had a discussion last week and kind of came to the conclusion if gold can stay above 1500 there's really nothing between here and getting into the old high range loan. Behold one week later here we are. So over the next week we should see one of two things happen Either we'll go ahead and have that immediate pull back that we've been hoping for or we're going to stay in this range and it could end up building a new base here.

Yeah as we said last week gold is going higher. We saw the weakness we wanted there could still be a pullback here where we see lower numbers. Before we had higher but again we'll state it. This is your opportunity. As we said last year words are ringing in my ears there was a 1905 13 10. Now it's 13 40. This is your opportunity buy on weakness.

You did say that last week and it's funny because those words have been ringing in my ears and it's OK that you've missed. Thirty five dollars of this move. It's still a great opportunity. But again like he's saying any dip. This is an opportunity.

All the little micro moves that we talk about each week here. I think we need to zoom back out a little bit on gold and see where we've been see where we're going. We've been three hundred dollars lower than we are today. That was the bottom thousand fifty were 300 dollars higher off that bottom. Everything's been constructive from here. Where were you on the next move draws in the attention of people who don't really care that much about gold on a week to week basis and it draws the attention of an investor that says oh Gold's rallying I better get in on that stock. It's on the mainstream media and that's where we're about to be in the gold market we're on the verge of a breakout breaking out of this little range that we talked about on this show and we're about to be headed into a new world with gold and a bull market.

Yeah Robert and following on the heels of the December market can we call it a crash ninety nine and a half percent in a single month. So following on the heels of something like that plus coupled with a break out 300 350 400 up in gold. It doesn't take a lot of attention to start building some serious momentum and we certainly all remember what happened when gold built momentum back in 2010.

Yeah I mean right now we're 300 up from that low that Robert talked about 1050 400 above that point puts us in a whole new range a whole new channel. Now we're back to the days where we were witnessing 50 even 100 dollar a day move in the gold price and that just wasn't very long ago for us or we get a lot of listener feedback each week just asking you know should we be focusing so much on the technical aspect of the precious metals prices and we try to come back full circle into the fundamentals so let's talk a little bit about why this price action is occurring right because Kingkiller sitting here with me Robert hasn't talked much on that because it hasn't been doing much right. So this is some price action where the dollar has not moved out of its channel the entire time. We are seeing reactions to things like what you talk about that November December equities market crash. We're seeing political uncertainty we're seeing geopolitical strains certainly right We're seeing financial and economic concerns now especially coming out of the eurozone and out of Asia. So all along gold is your barometer telling you that. So yes we're going to focus on the technical. But you have to step back even further as Robert brought up and take a more macro viewpoint as to what are the underlying fundamentals and that's sort of what they are and then today we had a little bit of help just with the supposed non reaction of the Federal Reserve. So any time you see central bank intervention or the lack thereof.