What the activism world is talking about

French spirits company Pernod Ricard said it does not need help improving its governance, days after meeting with Elliott Management to discuss its prospects. In comments to Reuters, a company spokesperson said, “We have not needed any external input as regards our continuous drive to seek to improve our governance.” The message came amid reports that a board meeting next week will recommend changes, including a lesser position for Vice Chairman Pierre Pringuet.

Elliott disclosed a 2.5% stake in Pernod last month, saying there was potential for margin improvement considering the five percentage point differential between Pernod and its main competitor Diageo. The activist also called for approximately 500 million euros of cost cuts, suggested a merger with another spirits firm, and said the board needs more independence since many directors have links to the Ricard family.

Q3 hedge fund letters, conference, scoops etc

What we'll be watching for this week

- How will shareholders vote at Oasmia Pharmaceutical’s special meeting on Friday, where activist investor Arwidsro is proposing to elect a new board of directors?

- Will Luby’s shareholders side with the board or with activist investor Bandera Partners’ four-person slate at the meeting on Friday?

- How will DNB Financial respond to the group of shareholders pushing for a strategic review?

Activist shorts update

Citron Research’s Andrew Left launched a second appeal last week against a Hong Kong tribunal for publishing the 2012 Evergrande Real Estate Group report that has since been labeled false. An investigation by the island’s Securities and Futures Commission (SFC) found that Left made a HK$1.7 million profit by shorting 4.1 million Evergrande shares before publishing a negative report on the company on June 21, 2012. The report included accusations of fraudulent accounting and other malpractices to hide insolvency from shareholders.

Left was banned from trading on the Hong Kong Stock Exchange for five years and fined HK$1.6 million in trading profits and HK$4 million in legal expenses. Left attempted to appeal against the ruling in January 2017 but was rejected. “Because companies have a monopoly on the dissemination of information about themselves, any judicial decision which restricts market participants from expressing their opinions freely as to the quality and meaning of such information impairs the ability of the market to regulate company disclosures,” said Left’s lawyer Timothy Loh, in a statement.

To arrange an online demonstration of Activist Insight Shorts, email us or view our product brochure to find out more.

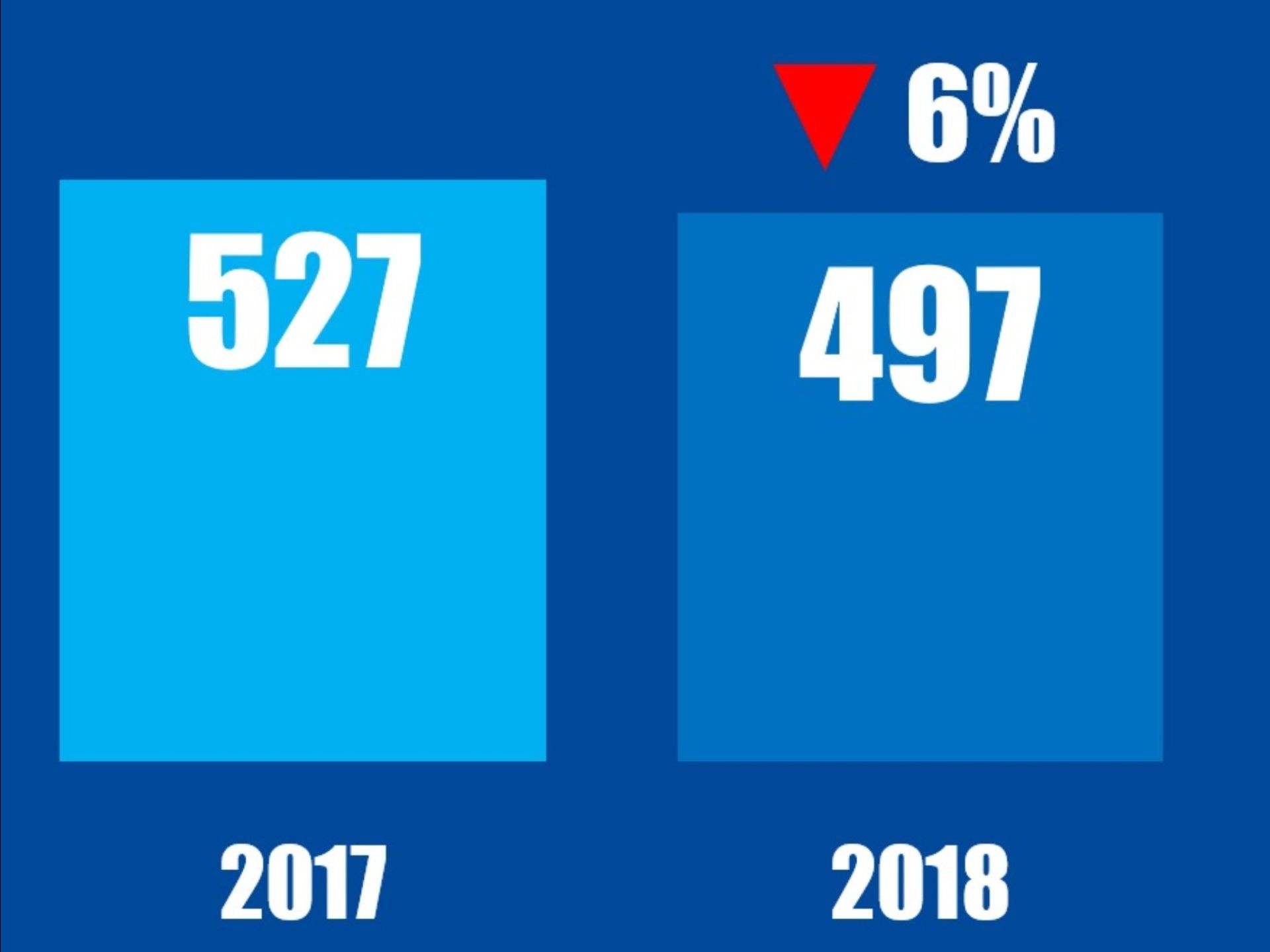

Chart of the week

The number of global companies publicly subjected to board-related demands between January 01 and December 31 in respective years.