DoubleLine Strategic Commodity webcast slides for the month of September 2018.

Rationale for Investing In Commodities

- Diversification benefits relative to traditional asset classes

- Potential low–to-uncorrelated return source to traditional asset classes

- Potential to hedge against unexpected inflation

- Physical assets have tended to move in line with broad inflation measures

- Potential incremental returns from each individual commodity’s market structure

- Commodity supply and demand is correlated to the cyclicality of the global economy

Q2 hedge fund letters, conference, scoops etc

Potential Diversification Benefits of Commodities

- Broad commodities have shown low correlations to other broad asset classes

- The average correlation is 0.17

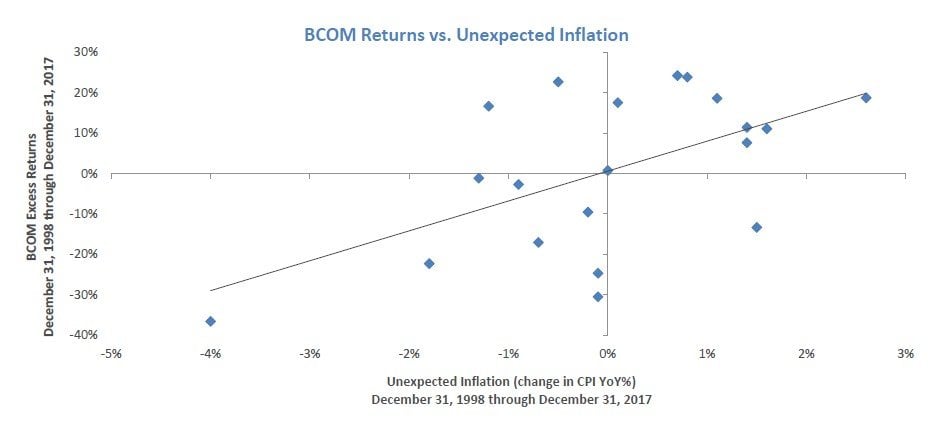

Commodities as a Possible Inflation Hedge

- Commodities can also be a hedge against unexpected inflation

- We define unexpected inflation as YoY change in YoY inflation

- Example: YoY CPI was 1.6% on December 31, 1998 and YoY CPI was 2.7% on December 31, 1991 making unexpected inflation 1.10% for that year

- Commodity performance over the long term rises and falls with unexpected inflation

A Case for Commodities

- Bloomberg Commodity Index (BCOM) adjusted for inflation

- Relatively low during the recent commodity crisis at 55.91 on February 29, 2016.

- Current level as of August 31, 2018 was 58.14 making it low enough to be a potentially good entry point.

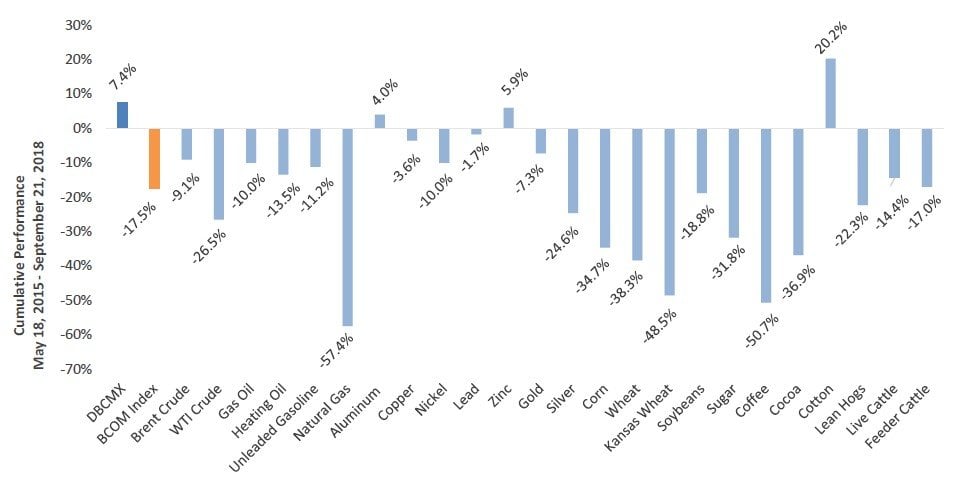

DoubleLine Strategic Commodity Fund (I Share)

vs. Individual Commodities Cumulative Performance

May 18, 2015 – September 21, 2018

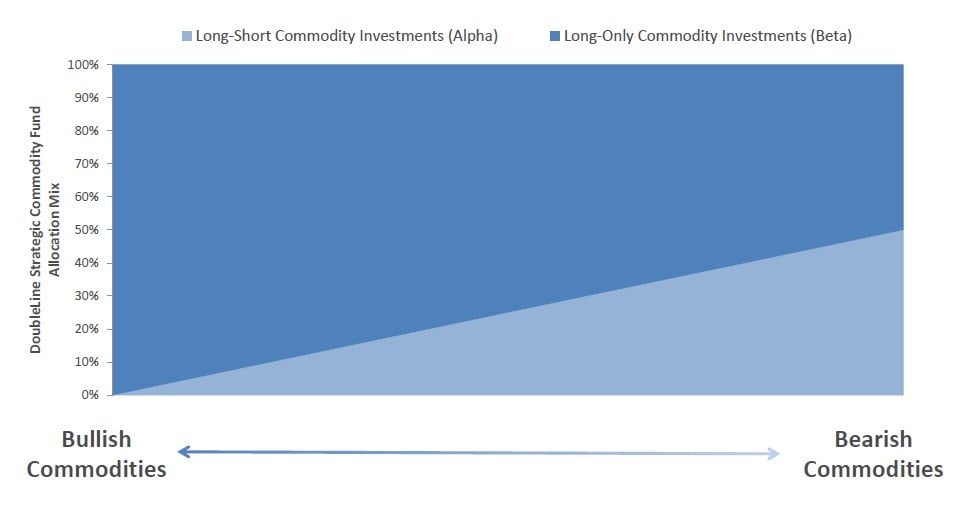

Allocating to Commodities

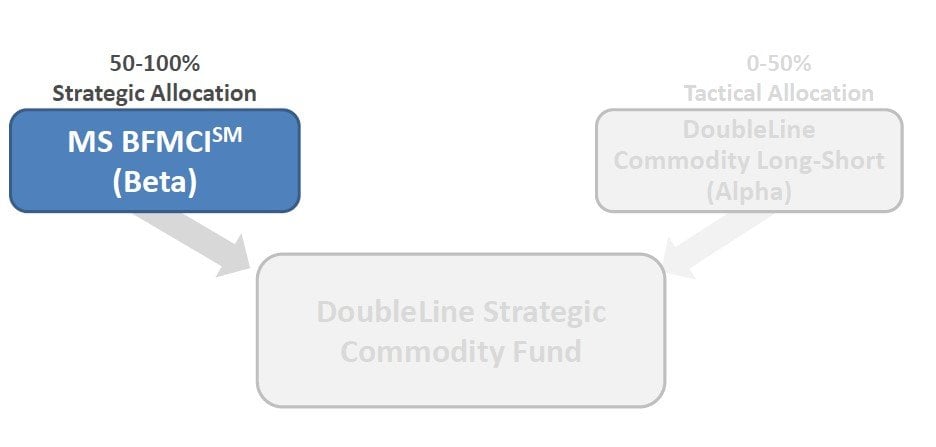

DoubleLine Strategic Commodity Fund’s Approach

DoubleLine Strategic Commodity Fund is a long-biased commodity fund that tactically allocates to a long-short dollar-neutral commodity strategy when a 100% long commodity allocation is unattractive.

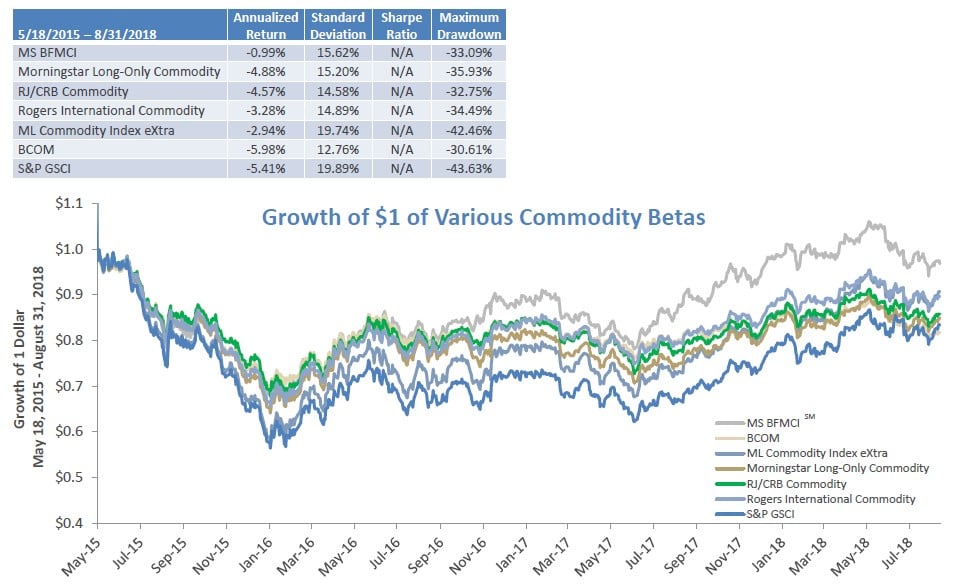

Performance of Various Commodity Betas

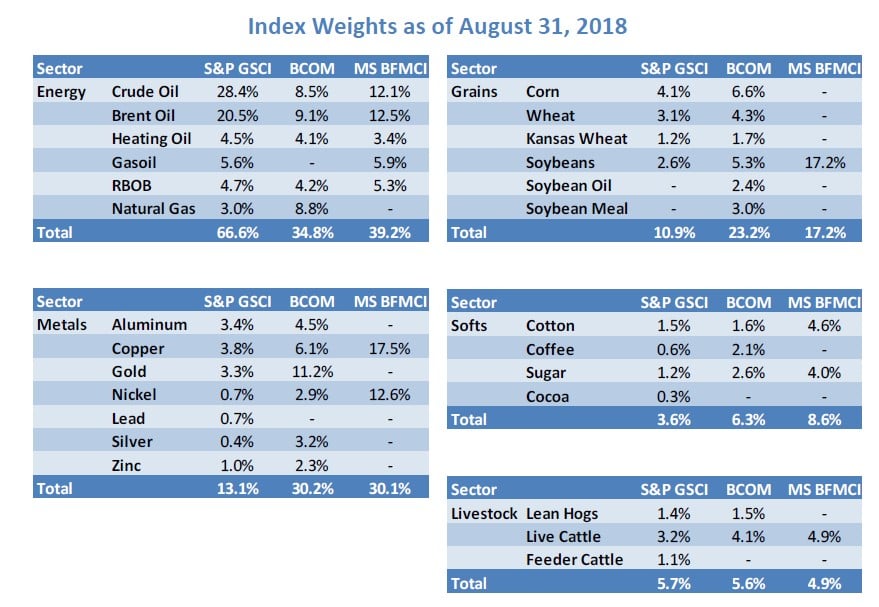

How the MS BFMCI Allocates Across Sectors

Limitations of Long-Only Commodity Exposures

- There are limitations to being long commodities 100% of the time.

- Due to the inherent volatility of the broad commodity market, there can be periods where index investors experience substantial drawdown.

- From January 31, 2000 to August 31, 2018, the maximum drawdown for select long-only commodity indices were:

- BCOM: -69.03%

- S&P GSCI: -82.93%

- One possible way to mitigate some of the drawdown risk in a long-only strategy is to include short commodity positions:

- However, this also limits the upside potential in a rising commodity market.

See the full PDF below.