Whitney Tilson’s email to investors discussing Early bird pricing which expires at midnight; In This Never-Ending Lehman Short, $170,000 Is Still on the Table; Bold Business interview; Victoria Hart/Pandora; Berna Barshay/Ralph Lauren; What Are Capitalists Thinking?; Traders Pumping & Dumping Cryptocurrencies.

Q2 hedge fund letters, conference, scoops etc

1) If you’re considering joining us for any of our programs coming up in a few weeks – webinars (Sept. 4-21) or in-person seminars in NYC (Sept. 24-28) – please register by midnight tonight, when the super early bird pricing expires. See attached for more information or go to these web pages:

Also use “VW10” for a discount!

Webinars

- Lessons from the Trenches investing bootcamp

- How to Launch and Build an Investment Fund

- Advanced Seminar on Short Selling

In-Person Seminars in NYC

- Lessons from the Trenches investing bootcamp

- How to Launch and Build an Investment Fund

- Advanced Seminar on Short Selling

use “VW10” for a discount!

2) A Bloomberg reporter sat in on one of our seminars in London last month and published an article, In This Never-Ending Lehman Short, $170,000 Is Still on the Table, about my unhappy, ongoing experience resulting from my failure to cover my Lehman short:

“My warning to everyone else doing any short selling: you must cover your short position at some point before the stock stops trading," said Tilson, who’s relieved he doesn’t have to pay big fees for being caught in the loophole. "Don’t get too cute on trying to avoid paying taxes.”

This one of the many lessons related to short selling that we teach in both our Lessons from the Trenches bootcamp and our Advanced Seminar on Short Selling.

3) I did a 6-minute interview on Bold Business earlier this month (posted here), in which I discussed why I started Kase Learning and some of the key lessons that we’re teaching our students (e.g., that we won’t always be in a long, complacent bull market and that savvy investors should be building their investing tool kit and learning how to weather a choppy or bear market).

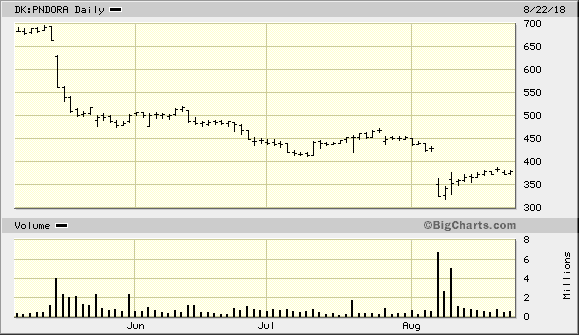

4) At our conference on short selling on May 3 (our next one will be on Monday, Dec. 3, again at the NY Athletic Club – I’ll send out an email when the registration page is live), second only to Gabriele Grego’s epic takedown on Folli Follie (the stock was halted less than two weeks after he exposed the company as a total fraud; you can watch the video here and his slides are here), the second-best performing short idea was Victoria Hart’s analysis of jeweler Pandora. The stock is down nearly 50%, as you can see in this chart:

Victoria has just made the video of her presentation available here.

5) Berna Barshay, who also spoke at our shorting conference, did a podcast interview recently (posted here) in which she discussed why she still believes Ralph Lauren is a short, her investing process, and her philosophy on consumer investing in general.

6) If you’re wondering why so many young folks are rejecting capitalism, this article answers it: What Are Capitalists Thinking? Excerpt:

So, back now to our 28-year-old. She was born in 1990. She will probably remember, in the late ’90s, her parents feeling pretty good about things — median household income did go up under Bill Clinton more than they had under any president in a long time, even more than under Ronald Reagan. But ever since, the median income picture has been much spottier, hardly increasing at all in inflation-adjusted dollars over 18 long years. And those incomes at the top have shot to the heavens.

So if you were a person of modest or even middle-class means, how would you feel about capitalism? The kind of capitalism this country has been practicing for all these years has failed most people.

7) Kudos to the WSJ for confirming what I've long said – that the entire cryptocurrency sector is little more than an obvious bucket shop/boiler room pump-and-dump scheme. Yet the SEC sleeps... Some Traders Are Talking Up Cryptocurrencies, Then Dumping Them, Costing Others Millions, Excerpt:

Dozens of trading groups are manipulating the price of cryptocurrencies on some of the largest online exchanges, generating at least $825 million in trading activity over the past six months—and hundreds of millions in losses for those caught on the wrong side, according to a Wall Street Journal analysis.

In a review of trading data and online communications among traders between January and the end of July, the Journal identified 175 “pump and dump” schemes involving 121 different digital coins, which show a sudden rise in price and an equally sudden fall minutes later.

A pump-and-dump scheme is one of the oldest types of market fraud: Traders talk up the price of an asset before dumping it for a profit and leaving fooled investors with shrunken shares. The Securities and Exchange Commission regularly brings civil cases alleging pump and dumps using publicly traded stocks.

Manipulations of cryptocurrencies are no different, but regulators have yet to bring a case in the more opaque market for them. The SEC declined to comment.