If you like high yield, low volatility, discounted prices, reduced interest rate risk, and improving businesses, then these fixed-to-floating rate preferred units are worth considering for a spot in your diversified income-focused investment portfolio.

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

Note: This report was originally released to Blue Harbinger members on March 25th.

The Opportunity:

The preferred security we are talking about is the relatively new Teekay LNG Partners (TGP) 8.50% Series B Fixed/Float Cumulative Redeemable Perpetual Preferred Units (TGP-B). Teekay LNG Partners provides marine transportation services for liquefied natural gas, liquefied petroleum gas and crude oil.

8 Reasons We Like this Opportunity:

- High-Yield (8.9%): For starters, we like the attractive high-yield that these preferreds are paying. They started trading in October 2017 at $25, and have since fallen to a discounted price of $23.81. Originally, offering an 8.5% yield, it has risen to 8.9% as a function of the price decline. The main reason the price declined is because TGP sold off in sympathy when the parent entity (Teekay Corp (TK)) issued new (dilutive) common units (and some convertible bonds) in late January that were perceived by the market to also be an indication of more liquidity challenges. In reality, these capital raises have strengthened the Teekay family, and made for a more attractive buying opportunity for new purchasers of these TGP preferred units, as we’ll discuss more later.

- Fixed-to-Floating Rate: Before getting into more of the company/market specific details of TGP, it’s worth considering the value of the fixed-to-floating rate income payments as relief to the fear of rising market wide interest rates. Starting on 10/15/2027, the distribution rate per annum will be a floating rate equal to three-month LIBOR plus a spread of 6.241%. This may seem like a long-way off, but in the meantime it’ll keep the value of these preferreds from falling as far as fixed rate preferreds as market wide interest rates rise. Like bonds, as interest rates rise, the value of preferred can also fall. This interest rate risk is a big reason many investors are afraid of investing in bonds and/or preferred stocks under our current market conditions (i.e. rising rates). In the case of these TGP preferreds, the market is overly fearful in our view (more on this later) and the fixed-to-floating rate will also help strengthen the unit price. In a nutshell, the fixed-to-floating rate distribution payments are attractive.

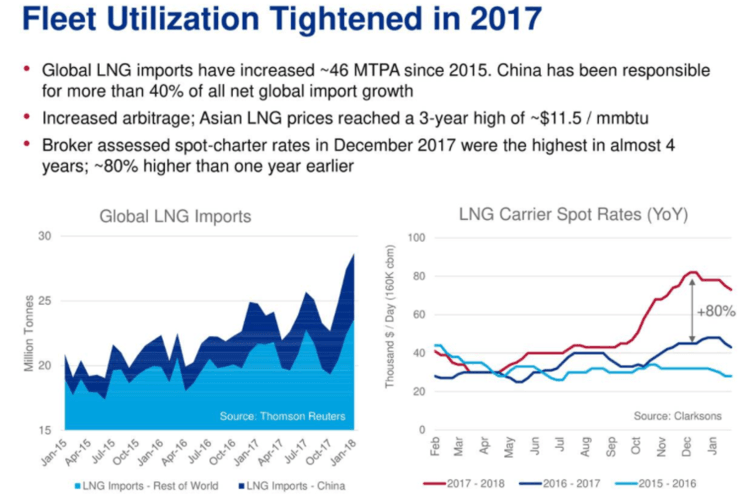

- Market Conditions are Improving: One of the business-related reasons we like these preferreds is because market conditions are improving for TGP. For starters, here is a look at global LNG imports and LNG carrier spot rates—both are improving. The entire industry has been struggling since the second half of 2014 when energy prices declined dramatically, and these improving conditions are a welcome trend for the industry in general and for TGP in particular.

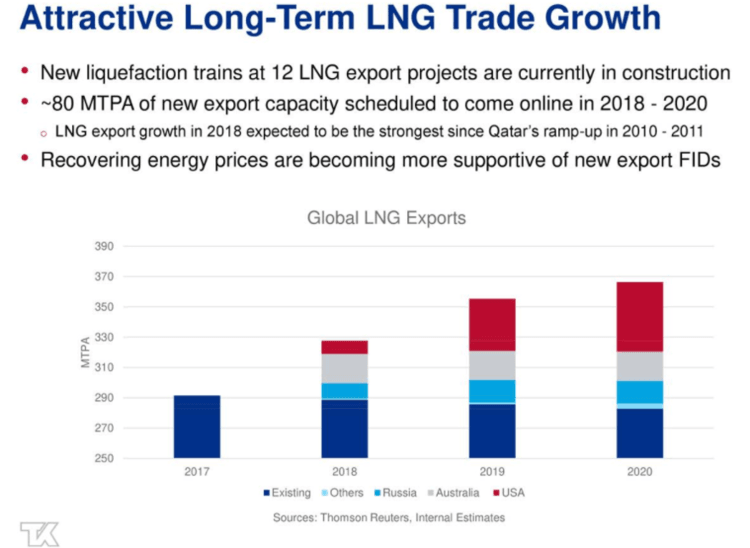

Next, here is a look at expected LNG exports in the coming years. Specifically, exports are set to rise which is also a very good thing for TGP because it means they’ll have more business and more revenues to support more distributions to investors.

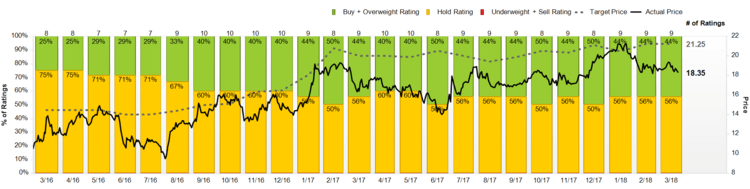

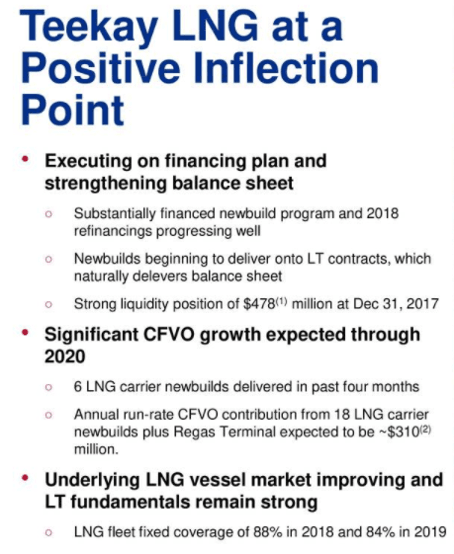

- Teekay LNG is Positioned for Growth: In addition to improving general market conditions, Teekay LNG in particular is positioned for growth. For starters, here is a look at the Street estimates for Teekay LNG (note: this is Teekay LNG (TGP) common units, not the the preferreds).

Analysts are positive considering there are currently no sell recommendations, and price targets indicate expected price increases. And a big part of this lack of negativity is due to TGP’s six new carriers that have been delivered in the last two quarters. Specifically, these new carriers will increase the company’s revenue, which strengthens the distributions to investors.

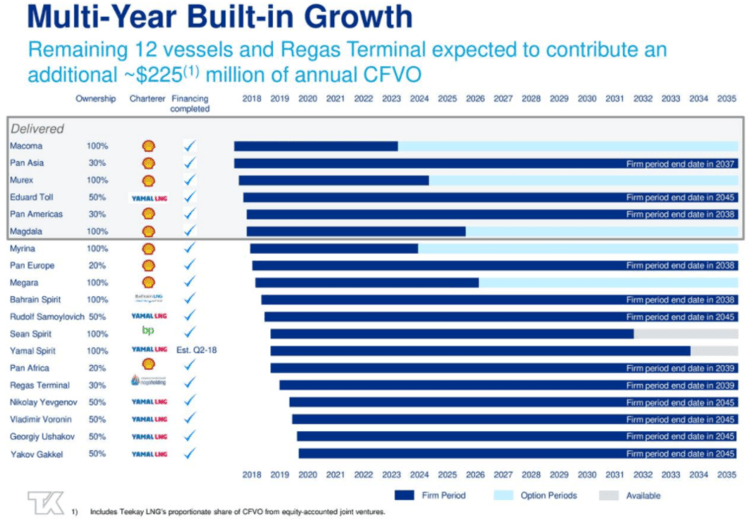

And looking further down the road, TGP is expected to put more vessels into use which will further increase the cash available to support distributions to investors.

- Long-Term Contracts With Strong Companies: Important to note, TGP’s business is with large financially strong, energy-related companies, thereby adding to the strength and security of the business. And as shown in the previous chart (above) the contracts are long-term, which means the company has steady, non-volatile, long-term cash inflows to support distributions to investors.

- Liquidity Position is Strengthening: If you don’t know, Teekay LNG (as well as sister organization Teekay Offshore and parent Teekay Corp) reduced their distributions in 2015 as the industry faced challenges from the dramatic declines in energy prices. However, Teekay has been working diligently to strengthen its balance sheet. Conditions have improved considerably, and the organization is now turning the corner.

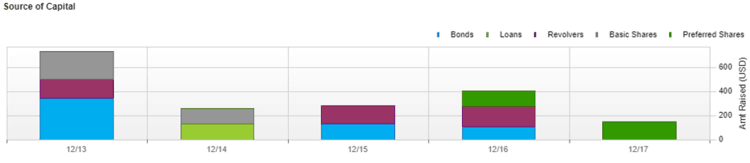

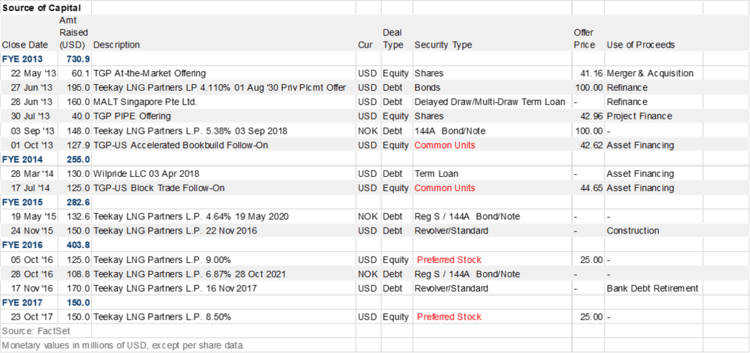

For reference, here is a look at the sources of capital TGP has been using since 2013.

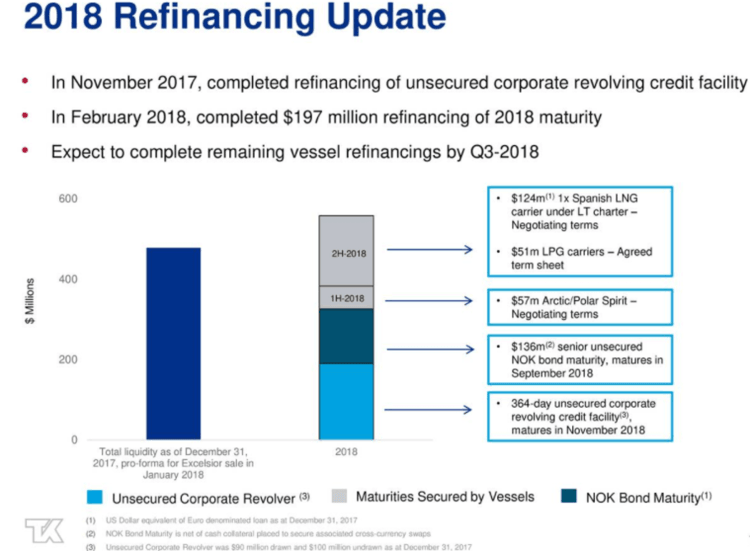

And more specifically, here is a look at TGPs liquidity position as the company progresses through 2018.

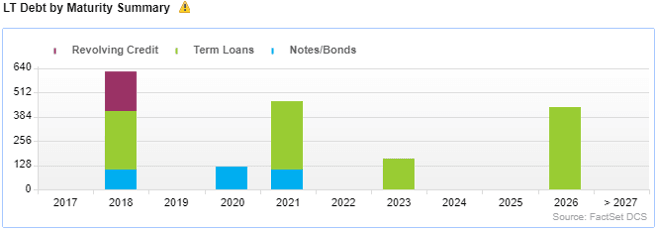

And importantly, TGP has already financed and sourced most of its liquidity needs for the year. This important because 2018 is a big year for debt maturities, as shown in the following chart.

Remember, TGP is has just completed six new vessels that will add to future cash flows, and TGP has more vessels coming as market conditions continue to strengthen (as described earlier).

- The Common Still Pays a Distribution: Another reason we like TGP’s preferred units, is because the common units still pay a distribution. We view this as a sign of financial strength, and also as a source of additional cash flow if needed. Specifically, TGP can always eliminate the common unit distributions if they need more liquidity (remember, preferreds are higher than common in the capital structure). However, based on improving market conditions, it’s more likely TGP will eventually increase the distribution on the common units (more later on why we prefer TGP preferred units over TGP common).

- Cumulative and Perpetual: Another reason we like TGP’s fixed-to-floating rate preferreds is because they are cumulative and perpetual. Regarding cumulative, that means if TGP ever misses a distribution, they’re on the hook to make it up later. In a bankruptcy situation (we do NOT believe one is coming) the bond holders are still ahead of the preferred holders, but the preferred holders are ahead of the common. We also like that this is a perpetual preferred, which may sound odd in a rising interest rate environment. Normally, rising rates can be bad for preferreds (as interest rates rise, preferred prices face pressure). However, because these are fixed-to-floating rate preferreds, that reduces the interest rate risk, and it makes the perpetual characteristic more attractive.

Be Aware of the K-1

Very important for investors to keep in mind, these are not qualified dividends, these payments are classified as distributions and investors will receive a K-1 statement at tax time. Receiving the annual K-1 may be perfectly acceptable for many investors. However, you may not want to hold these preferred units in an IRA for example, because it can set off some tax consequences that basically nullify the benefits of having the IRA in the first place. According to QuantumOnline: “Holders of the Preferred Units will receive specific tax information from the company, including a Schedule K-1 which generally would be expected to provide a single income item equal to the preferred return.”

IDRs: TGP’s Parent Common Units (TK) Have an Advantage

We like the preferred units of TGP (because of their high yield, lower volatility, discounted price, and decreasing risks stemming mainly from the improving business/market outlook), but if you’re willing to take on the greater volatility of common units in search of more upside potential, you may want to consider the parent entity common units, Teekay Corporation (TK), instead of TGP common units because the incentive distribution rights (“IDRs”) seem to tip the scales significantly in favor of TK in an up market. Granted, there are more moving parts to Teekay Corp (the other big one is Teekay Offshore—which by the way is also improving for reasons similar to TGP. You can view our recent Teekey Offshore article here), but it’s worth considering Teekay Corp at this point in the cycle if you’re comfortable with significantly higher volatility.

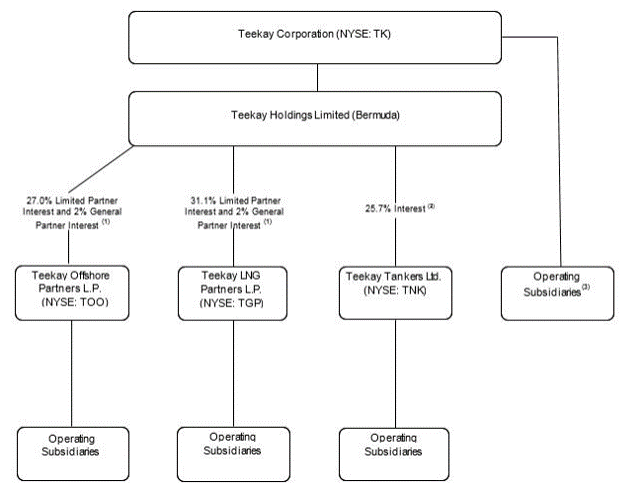

For reference, here is a look at the Teekay organization chart:

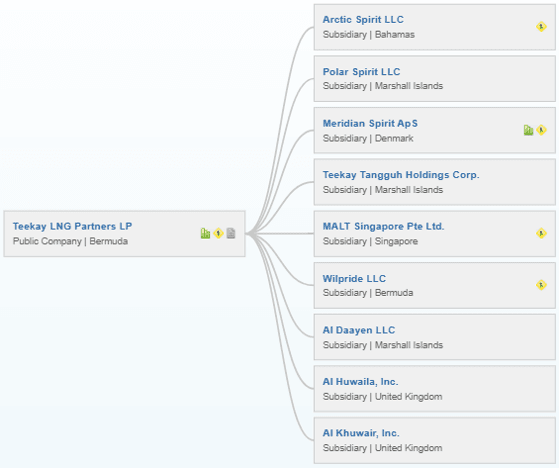

And if you’re curious, here is a look at TGP’s operating subsidiaries.

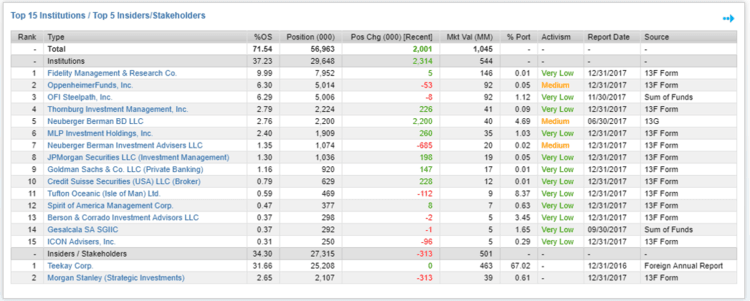

Importantly, you can see in the following ownership table, Teekay Corp is a very large owner of Teekay LNG.

Here’s what Teekay Corp had to say in its annual report about it’s ownership of Teekay LNG and its IDRs, in particular (emphasis is ours).

“Our organizational structure includes, among others, our interests in Teekay Offshore, Teekay LNG and Teekay Tankers, which are our publicly listed subsidiaries. We created Teekay Offshore and Teekay LNG primarily to hold our assets that generate long-term fixed-rate cash flows. The strategic rationale for establishing these two limited partnerships was to:

* illuminate higher value of fixed-rate cash flows to Teekay investors;

* realize advantages of a lower cost of equity when investing in new offshore or LNG projects; and

* enhance returns to Teekay through fee-based revenue and ownership of the limited partnership’s incentive distribution rights, which entitle the holder to disproportionate distributions of available cash as cash distribution levels to unitholders increase.

We also established Teekay Offshore, Teekay LNG and Teekay Tankers to increase our access to capital to grow each of our businesses in the offshore, LNG, and conventional tanker markets.”

It’s those IDRs that make the common units of Teekay Corp so attractive right now, if you believe the Teekay Group is truly turning the corner. However, again, we prefer the TGP preferreds for investors seeking higher yields and much lower volatility.

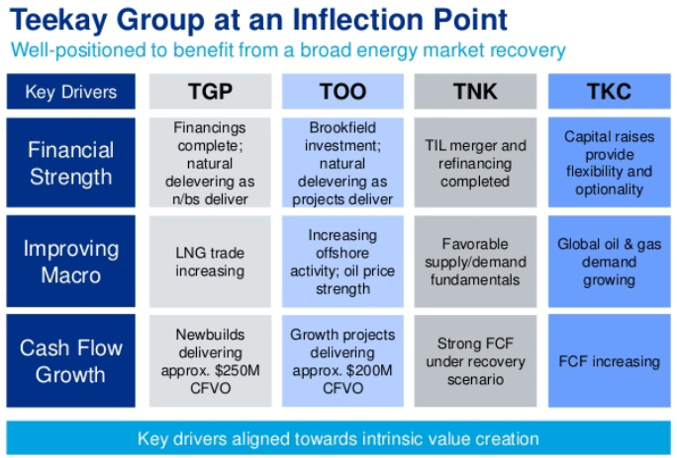

For reference, the following table provides a high-level overview of the current dynamics of the Teekay family of organizations.

Conclusion:

If you are looking for high-yield and low volatility, Teekay LNG’s fixed-to-floating preferreds are worth considering for a spot in your diversified investment portfolio. Obviously there are risks involved as Teekay works to keep improving its financial position (the yield wouldn’t be so high if there were no risks). However, we believe Teekay is turning the corner, and there are many indications that these preferreds will deliver the high-income and low volatility (plus even a little price appreciation) that many investors are looking for

Article by Blue Harbinger