You’ll learn about REIT NAV Models in this lesson, including the basic idea and what makes them more complex than they seem at first glance – with examples from Park Hotels, AvalonBay, and Digital Realty.

[REITs]Q2 hedge fund letters, conference, scoops etc

REIT NAV Models 101: How To Set Them Up, And What Makes Them Tricky

Transcript

Hello and welcome to another tutorial video that was a record this. I have spent almost the past entire year just working on real estate and related case studies and models so some of the upcoming videos including this one are going to be related to real estate. And in this one we’re going to enter a very common question that we get about valuation specifically with the net asset value model for real estate investment trusts. And here’s the question that we often get about this model. I’ve looked at examples of net asset value models online and in various articles but they seem too easy you revalue the Reetz assets and liabilities and then you subtract the Reetz liabilities from its assets and that’s the reeds net asset value. What is so hard about this model. So the short answer to this question is that the basic idea is pretty simple just like anything else in accounting and finance really the difficulty lies in the execution. Just as with a DCF analysis there are some tricky parts and sometimes it can be difficult to come up with reasonable assumptions depending on the type of rate it is the geographies it operates in and the business model that it uses the net asset value model is mostly about judgment. How much is IMX worth. How much item y worth should items be worth more or less than the number shown on the balance sheet.

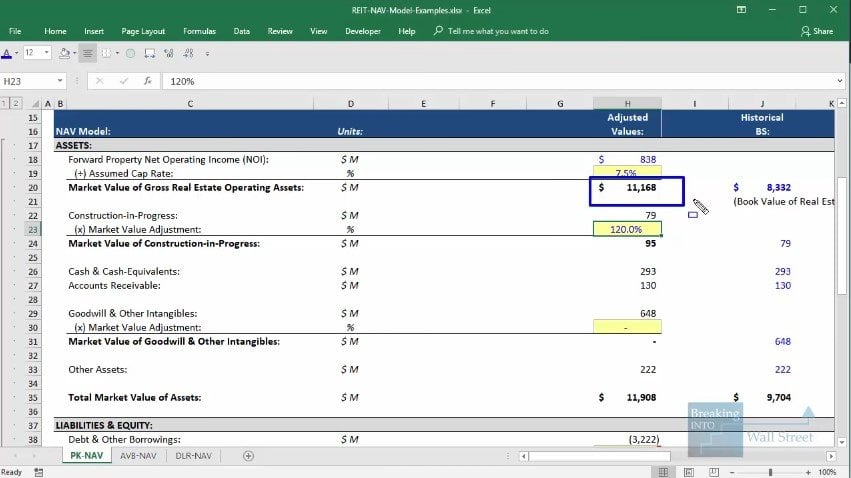

So in this bus and we’re going to start at the basic idea using a simplified example for Park hotels a hotel suite and then we’ll show you two more compact examples one for AvalonBay a multifamily and one for Digital Realty a data center. And use these examples to illustrate why the analysis can be more complicated than it seems. At first glance here’s the basic idea behind Wall Street’s properties are according to historical cost minus accumulated depreciation on the balance sheet. But unlike factories and equipment that wear down and to be replaced over time buildings and land tend to rise in value tend to appreciate over the long term. So the book value of a property on the balance sheet tends to dramatically understate its fair market value. Now this whole concept really only applies to USP streets because routes that fall offer us whether they’re in Canada or Europe or Asia or Australia or other places do mark their properties to fair market value. So the nav model is far less useful there. You might see a few minor adjustments but you’re generally not going to see anything massive. And in those cases you can often use the book value of the reet as a pretty good proxy for net asset value to everything that we’re going to cover here really just applies to a US based reads that follow us gap. For the most part here’s an example of how you actually execute this analysis using Park hotels. The first thing you have to do is project the forward net operating income the operating income from the rich properties and then divide it by an appropriate cap rate or yield to revalue the real estate assets and figure out what they’re actually worth if we go into the Excel model here for Park hotels. We can see an example of it right here. I have the net asset value on screen.

The adjusted values over on the left hand side and then I have the values and the company’s historical balance sheet on the right hand side and the difference as a percentage over here and the right hand most common. So here on the balance sheet the net real estate assets are listed at about eight point three billion the forward and away from those assets is about 8 and 30 million. We use a cap rate of seven point five percent. The lower the cap rate the more valuable the property the higher the cap rate the less valuable the property we take the 38 divide by the seven point five percent. And so we get to a market value of about eleven point one or eleven point two billion for the company’s real estate operating assets which is significantly higher than the book value higher by about 34 per cent according to this. So that’s the first and most important step of this analysis. Now once you have revalued the real estate operating assets of the reet then you have to value the other assets typically you’ll assume a small premium for the construction in progress you will set goodwill and intangible assets zero and the rest of the assets should generally stay about the same. So here we take the Reetz construction in progress we apply a modest 20 percent markup to it so it goes from 79 to 95. We keep cash and cash equivalents in accounts receivable the seme and then goodwill is about 640 million but we just adjust that to zero because this is worthless. We cannot sell it to anyone else. It’s only worth something to us.

So this simply goes to zero and you apply the same to any type of intangible asset that the retests and other assets is also stays the same. Once we have all that we can add at the market value of all these assets we get to Rendelsham point nine billion versus only nine point seven billion on the Reetz historical balance sheet. So this is why it’s so important for us beetroots because of that big difference caused by not marking properties to market value for an eye for Espie Street there would.