Private equity fundraising experienced a further slowdown in Q2 2018: 230 funds reached a final close securing an aggregate $85bn in capital, representing a 7% decline in number of funds and 4% decline in capital raised compared to Q1 2018. While technically a drop in fundraising activity, this is in the context of the unprecedented fundraising that has been witnessed in recent times: more than $100bn was raised each quarter between Q4 2016 and Q4 2017, and overall activity was still healthy by historical standards. The largest managers continue to account for a significant proportion of capital raised. The 10 largest vehicles closed in Q2 2018 raised over a third (40%) of the $85bn secured by all GPs, although this is a notable reduction compared to the 63% secured by the top 10 funds in the same quarter last year – a reflection of reduced buyout fundraising activity in the quarter.

Q2 hedge fund letters, conference, scoops etc

Investor satisfaction with the private equity asset class remains high and, with capital distributions reaching a record high of $517bn as at December 2016, capital continues to flow into the asset class as LPs look to meet their allocations.

There are a record 3,037 private equity funds in market at the start of Q3 2018 for investors to choose from, targeting an aggregate $948bn.

The increase in competition is bolstered by the growing presence of Asia-focused funds in the market: there are more than twice as many funds (985) currently on the road than at the start of Q3 2017 (380).

Strong fundraising in recent years paired with a challenging deal environment has resulted in dry powder levels reaching a record $1.07tn in Q2 2018, a 7% increase from the end of 2017. While buyout deal activity did not outpace Q1 levels, the quarter nonetheless saw strong deal flow with KKR’s $9.9bn acquisition of Envision Healthcare the largest deal announced in the quarter. Buyout exit activity increased in Q2 2018 following a year of decline, with 471 exits valued at a combined $103bn, the highest exit value seen since Q3 2015.

Meanwhile, venture capital activity continued its record-setting pace with 3,648 financings announced worth an aggregate $73bn – a new quarterly record – buoyed by the $14bn Series C financing of Ant Financial Services Group.

The Ekuinas Effect: How Ekuinas Is Committed To Shaping Private Equity In Malaysia

- Syed Yasir Arafat Syed Abd Kadir, Ekuiti Nasional Berhad (Ekuinas)

Christopher Elvin: Ekuiti Nasional Berhad (Ekuinas) was founded in 2009. What were the institution’s objectives and how successful has Ekuinas been in achieving these objectives?

Syed Yasir Arafat Syed Abd Kadir: To provide some context to who we are and what we do, there are a few things that I would like to illustrate. Ekuinas was set up with a very specific purpose in mind, which is to catalyze growth of Malaysia’s next generation of leading local companies. This simply means that aside from the commercial purpose and intent of being a private equity fund, our goals are nationcentric, in that we have a role to catalyze and scale the local businesses.

Ekuinas is also unique in that we are a government-linked private equity firm. Our funds come solely from the Government of Malaysia and we do not have any other LPs.

We have two objectives which set us apart from the conventional private equity set-up: we have commercial and social objectives. Ekuinas has a financial objectivewhere we continually strive to achieve our commercial returns. Secondly, our social objective is to enhance Bumiputera (local) participation through four dimensions: equity ownership, management, employment and creating a good supply chain. Our role is really to promote equitable and sustainable Bumiputera wealth creation and economic participation based on market friendliness and merit as well as transparency. Our ultimate goal is to create the next generation of leading Malaysian companies.

We have two parts to our fund: the first part is direct investment and the second part is our outsourced program where we appoint private equity fund managers to manage funds on our behalf. We target two key groups: entrepreneurs, which we help to supplement their risk capital, and we also support professional managers. We try to get more professional managers with our backing to undertake management buy-in: 94% of our deals are buyouts; only 6% of our investments are minority growth capital deals.

In terms of how successful we have been in achieving our objective, I believe we have been successful in achieving what we set out to achieve.

- Firstly, we set out to change the landscape of Malaysian private equity by getting more people aware of private equity in Malaysia. Part of this is adopting international standards of governance, transparency and disclosure. For example, we are the only non-public listed private equity firm that publishes an annual report. While we are not obligated to, our intention is to provide a template of how a government-linked institution should operate in this part of the world. We provide a level of transparency to the market because we are funded by the government and it is our responsibility to ensure that public funds are managed with clear governance and in a transparent manner. All our deals are made public i.e. whether we buy or sell an asset or portfolio company, we want to be transparent. In the end, it is public money and our announcements create a lot of excitement all around.

- In terms of delivering on our commercial and social obligation, we have, as at the end of 2017, undertaken a total of 58 investments in our investment portfolio across both Direct Investment (35) and Outsourced Programme (23) since inception, with a total commitment value of RM3.6bn. This has led to a total economic capital deployment of more than RM4.3bn that has positively impacted our economy.

- Despite our restricted mandate, we have managed to deliver an IRR of 10.1% for our Fund I with Gross Portfolio Return of RM 476.7mn. Our IRR on realized deals across our three funds is approximately 20%. This goes to show that mid-market buyout is a viable investment model in Malaysia. With a disciplined investment and divestment schedule, Ekuinas, even a first-time fund, was able to outperform the public market index as well as its peers in Southeast Asia with the same fund vintage year. We have also displayed our ability in realizing our assets in a timely manner. At the end Fund I’s fund life on 31 December 2017, our portfolio companies have either been realized or are being transferred to Fund III – a divestment strategy essential to the success of the management of a fund.

CE: Could you share any examples of how Ekuinas has positively impacted the private equity market in Malaysia?

SYA: Financial Restructuring

One of our first investments was a growth capital deal in a company called Tanjung Offshore Berhad, which we eventually restructured. We went through a restructuring process and merged it with another private oil & gas company which would eventually become a market leader in the local oil & gas sector. Our achievement was in helping to clean up and restructure the company and to turn it into a market leader.

M&A/Bolt-on

A second example of how Ekuinas has positively impacted the private equity market in Malaysia is through the education space where we have invested heavily. We had the first-mover advantage at one point in time when we had collectively the single largest private institutional body in Malaysia with over 37,000 students across five educational entities in Malaysia, creating a huge education conglomerate. We eventually sold it on a piecemeal basis to create added value as a whole. We are happy to say that our education portfolio has provided market-leading returns.

Operational

In terms of business impact, we have recently invested in retail sports company Al-Ikhsan. It was founded by a visionary entrepreneur who built his business from scratch. It was a one-man show and the founder realized that to take his company to the next level and to compete with international players, he would need a partner and a team. We were in talks with his company for 4-5 years until he finally agreed to having us as a partner. We institutionalized the company and helped him find a CEO from multinational companies (as he wanted to take a step back) but he remains the primary shareholder. We also hired a CFO and built a strong management team. We are able to achieve this largely due to our reputation in the market and connections with professionals, we were able to attract top talent to work at this company and make a positive impact. Previously, the management of the company was purely instinctive: from the purchasing process to how he managed inventory etc.

Additionally, we have come in and put in place not only in governance measures but we are also involved in value creation initiatives which we identified on the outset, including inventory management, sales marketing improvement processes, ERP upgrade, providing tools for decision making – essentially embedding science to complement his instinct. As an activist shareholder, we have done similar exercises for all of our portfolio companies at different level of intensities depending on their needs so the impact may be different but all in positive ways.

CE: What makes private equity-style investments suitable for developing Malaysian companies?

SYA: Malaysia is similar to developing economies, especially in the space that we are involved in which is a midmarket space. Companies are run by entrepreneurs; typically, you have strong leaders, strong CEOs, but it is very rarely you find a good second-tier management. Again, this is why governance is an important factor and tends not to be high on the list for a lot of these companies where normally one person makes a decision and everyone follows through: processes and decisions are based on gut feeling and instructions, rather than robust analysis and evaluation before making certain investments or projections. So, this is where we come in, and I think private equity has a clear role to play in institutionalizing the processes, providing good governance, adding tools for decision-making and adding value for midsize markets.

CE: What are the biggest challenges for Malaysian private equity over the coming years?

SYA: The most obvious thing is that Malaysia is a relatively small market compared to our neighbours, with a population of 30 million compared to markets such as Indonesia, Philippines or Thailand, so the challenge is the size of the market. Second, the maturity of the economy. While Malaysia is relatively small, it has a mature economy, so you will not see companies with double-digit growth in a market like Malaysia (especially organic growth) so a lot of accelerated growth will have to be driven by inorganic strategies like M&A, bolt-on acquisitions etc. Capital markets themselves are relatively mature; most entrepreneurs will have an option to consider an IPO or partners coming in depending on the valuations that they can get from these two options.

Another challenge concerns the number of propriety deals – we have done a good job in creating awareness in the market but business owners have become savvier and tend to run a process, whereas in the past we would often see a lot of propriety deals or deals going through a propriety direct negotiation of a transaction which has changed the landscape. This has ultimately created the fourth challenge which is increasing valuations. Valuations have risen, resulting in a scarcity of deals, which, together with the factors mentioned before, have posed challenges to the private equity market.

CE: On average, how has pricing for portfolio companies in Malaysia changed over recent years (if at all)?

SYA: Like any other market in the region or globally, I think capital is no longer scarce. In Malaysia and Southeast Asia, you see a lot of pan-Asia and global firms coming to the market especially for bitesize deals and that has effectively pushed valuations upwards. In a market like Malaysia, one of our biggest challenges is being a singlecountry und, with a social objective to fulfil. This limits our options to the extent that we have to be less adventurous from a risk/reward perspective to ensure that some of the deals that are generated (which may not present a high return) will provide some downside protection.

CE: What new opportunities or exciting developments are you seeing within the private equity space in Malaysia? What part will Ekuinas play in these developments?

SYA: We are seeing a lot of disruptive technology. In the past, a lot of private equity firms shied away from this space, but it is a space that cannot be avoided. From our perspective, it is not only an investment opportunity, but a means to futureproof and improve portfolio companies. Innovation and technology are here to stay and that is not going to change.

Fundraising

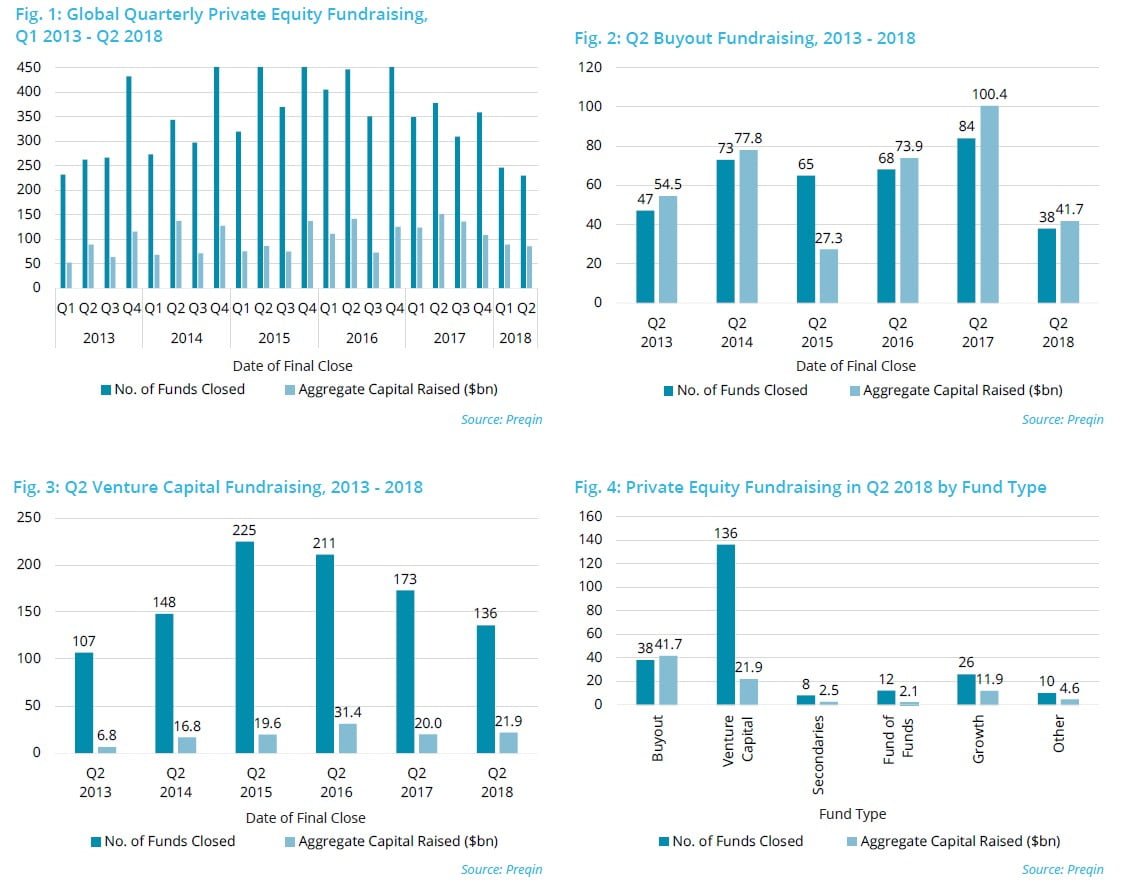

Q2 2018 saw a total of 230 private equity funds reach a final close, collectively securing $85bn in capital commitments (Fig. 1). This continued slowdown should be viewed in the context of the prolific fundraising activity seen in recent years and, overall, activity has still been healthy by historical standards. In fact, Q2 2018 saw the lowest amount of capital raised in the second quarter of any year since 2012, when $59bn in aggregate capital was secured by 266 vehicles.

In terms of Q2 fundraising, buyout has experienced a decline in 2018 compared with the previous six years. Thirty-eight buyout funds reached a final close, securing an aggregate $42bn, significantly below the five-year historical average of 67 funds and $67bn per quarter (Fig. 2). While buyout funds accounted for a small proportion of all private equity funds closed in Q2, they accounted for nearly half (49%) of aggregate capital raised.

Venture capital fundraising in Q2 was on par with previous quarters, with 136 funds raising a total of $22bn – above the five-year historical Q2 average of $19bn (Fig. 3). In Q2 2018, venture capital accounted for over a quarter (26%) of all private equity capital raised in Q2 2018, compared to 13% in Q2 2017.

Compared to Q2 2017, growth funds in Q2 2018 saw an increase in fundraising activity: the proportion of aggregate capital secured was up from 5% in Q2 2017 to 14% Q2 2018. Conversely, funds of funds experienced a slowdown compared to Q2 2017: aggregate capital raised dropped from $4.1bn in Q2 2017 to $2.1bn in Q2 2018 (Fig.

4).

A greater number of North America-focused funds closed in Q2 2018 than in Q2 2017 (122 vs. 109 respectively), but these funds raised just over half ($37bn) of the $68bn total secured in Q2 2017 (Fig. 5). Asia-focused funds (7%) experienced a slight increase in the number of funds closed in Q2 2018 compared to Q2 last year, and also secured 20% more capital. On the other hand, Europe-focused funds experienced a 36% decline in aggregate capital raised, from $33bn in Q2 2017 to $21bn in Q2 2018.

Although fewer funds reached a final close in Q2, fundraising trends in 2018 thus far remain positive: of the 476 funds closed in H1 2018, 79% achieved or exceeded their target size, the largest proportion on record for the past five years (Fig. 6). Moreover, time spent on the road continues to decrease, with the largest proportion (39%) of funds closed in six months or less, up 10 percentage points from the corresponding proportion of funds closed in 2017 (Fig. 7). In fact, the third largest fund closed in Q2 2018 – Nordic Capital Fund IX – raised €4.3bn in approximately six months, and exceeded its target of €3.5bn by 22.8% (Fig. 8).

Read the full article here by Preqin