Farnam Street letter to clients for the month of July 2018.

Q2 hedge fund letters, conference, scoops etc

“Babies being born in America today are the luckiest crop in history.” - Warren Buffett

I’m unapologetically optimistic about the future. I firmly agree with Mr. Buffett’s above quote. Today’s newborns will know a world of more abundance and magic than any of their ancestors. It’s an amazing time to be alive.

You may be wondering: “Wait a second... you’ve been bearish on the market for years now. What do you mean you’re optimistic? Aren’t you rooting for a crash? You’ve pointed out boatloads of problems: extreme overvaluations, excessive debt, trade imbalances, pension underfunding, poorly-timed buybacks, interest rate risk, draconian government intervention… the list goes on. What gives?”

This is a fair criticism. Truth be told, it’s tiring to have a negative investment outlook for such a long time. Yet I hope this letter will clear up this apparent contradiction of my extreme investment caution in the face of global optimism.

Is the World Really Getting Better?

War. Famine. Social unrest. Viral outbreaks. Nuclear dictators. Global warming. Gridlocked bureaucracies. Pick up a newspaper, flick on CNN, or open a news app, and it’s hard not to feel like things are going from bad to truly awful. It can be overwhelming.

But is the downward spiral we feel based on reality? Can we support that view with data?

The short answer is, no, we can not. The data trends are unequivocally encouraging.

Hans Rosling was a medical doctor, professor of international health, and co-founded Doctors Without Borders in Sweden. Just before his 2017 death, he authored a book called Factfulness: Ten Reasons We’re Wrong About the World—and Why Things Are Better Than You Think. Bill Gates called it “one of the most important books [he’s] ever read.”

Here’s an abbreviated quiz from the book:

1. In the last 20 years, the proportion of the world population living in extreme poverty has…

a. Almost doubled

b. Remained more or less the same

c. Almost halved

2. How many of the world’s 1-year-old children today have been vaccinated against some disease?

a. 20 percent

b. 50 percent

c. 80 percent

3. Worldwide, 30-year-old men have spent 10 years in school, on average. How many years have

women of the same age spent in school?

a. 9 years

b. 6 years

c. 3 years

4. How many people in the world have some access to electricity?

a. 20 percent

b. 50 percent

c. 80 percent

The answers are at the end of the letter, but if you’re like me, you probably got at least a few wrong.

Don’t feel bad; we’re in good company. Dr. Rosling posed twelve similar questions about poverty, population, births, deaths, education, health, violence, and energy to thousands of people around the world. He used no trick questions and no controversial data sources. He tested medical students, eminent Nobel laureate scientists, investment bankers, executives, journalists, and senior politicians, from dozens of countries. Most were highly educated people interested in the world.

Yet eighty percent of the 12,000 people tested scored three or less out of twelve. A dart-throwing monkey would score four by chance. One person got eleven out of twelve correct; no one had a perfect score! We’re systematically flawed in our understanding of global trends. There’s a gap in our perception of reality.

The book provides a treasure trove of encouraging trends and lays out ten human instincts that steer us wrong. It’s well worth a read if you’re a student of the world, humanity, or history—or if you ever consume the news. Granted, the world isn’t perfect, but the trends are in the right direction. It’s never been a better time to have your genetic ping pong ball thrown into the ovarian lottery.

Next time you’re feeling down, consider this. One billion people live on less than $2 of income per day. Another three billion earn less than $8 per day. The next two billion earn less than $32 per day. If you make more than $4 per hour working full time, you’re a part of the richest billion people on the planet.

If you have children (or you just like to learning), Dr. Rosling put together a fascinating website which visually conveys the lives of people around the world. Their beds, pets, toys, floors, how they brush their teeth—all shown through pictures. The images transport you into the lives of actual people in a way numbers can not. It’s worth exploring.

https://www.gapminder.org/dollar-street/matrix

Reconciling Long-Term Optimism With Today’s Market

The world is getting better, and there are investment implications which I’ll get to later. Then why so bearish on the stock market? It’s simple: valuations.

The below chart shows the goods and services we’re creating as a country (GDP) and the price of buying the businesses that provide those goods and services (Wilshire Total Market). It’s a way of comparing price and value: “what are we paying” versus “what are we getting.”

Back in 2001, Warren Buffett gave some amazing insights in a Fortune Magazine interview:

On a macro basis, quantification doesn’t have to be complicated at all. Below is a chart, starting almost 80 years ago and really quite fundamental in what it says. The chart shows the market value of all publicly traded securities as a percentage of the country’s business—that is, as a percentage of GNP. The ratio has certain limitations in telling you what you need to know. Still, it is probably the best single measure of where valuations stand at any given moment. And as you can see, nearly two years ago the ratio rose to an unprecedented level. That should have been a very strong warning signal.

For investors to gain wealth at a rate that exceeds the growth of U.S. business, the percentage relationship line on the chart must keep going up and up. If GNP is going to grow 5% a year and you want market values to go up 10%, then you need to have the line go straight off the top of the chart. That won’t happen.

For me, the message of that chart is this: If the percentage relationship falls to the 70% or 80% area, buying stocks is likely to work very well for you. If the ratio approaches [the levels] it did in 1999 and a part of 2000—you are playing with fire.

Mr. Buffett’s message is clear. When the Market Cap is below GDP (most of the 1980s and 90s, 2003, 2009), it’s generally a good time to be a buyer. Investors saw strong returns from those starting places. When the Market Cap gets too far above GDP (1999, 2007, today), it’s likely not a good idea to be too heavily loaded up. This time will not be different.

My optimism is that the green line of GDP will continue its relentless upward trend, especially for those on the lower rungs of humanity (more on that in a moment). My bearishness derives from the blue line of Market Cap disconnecting and levitating away from fundamentals. We’re about 40% above par at the moment. The blue line will catch back down with the green line. The adage holds that this too shall pass.

The above chart allows Mr. Buffett to observe: “I never have the faintest idea what the stock market is going to do in the next six months, or the next year, or the next two. But I think it is very easy to see what is likely to happen over the long term.”

Why the Disconnect Today?

Warren Buffett has an answer on this one as well:

Interest rates act on financial valuations the way gravity acts on matter: The higher the rate, the greater the downward pull. That’s because the rates of return that investors need from any kind of investment are directly tied to the risk-free rate that they can earn from government securities. So if the government rate rises, the prices of all other investments must adjust downward, to a level that brings their expected rates of return into line. Conversely, if government interest rates fall, the move pushes the prices of all other investments upward.

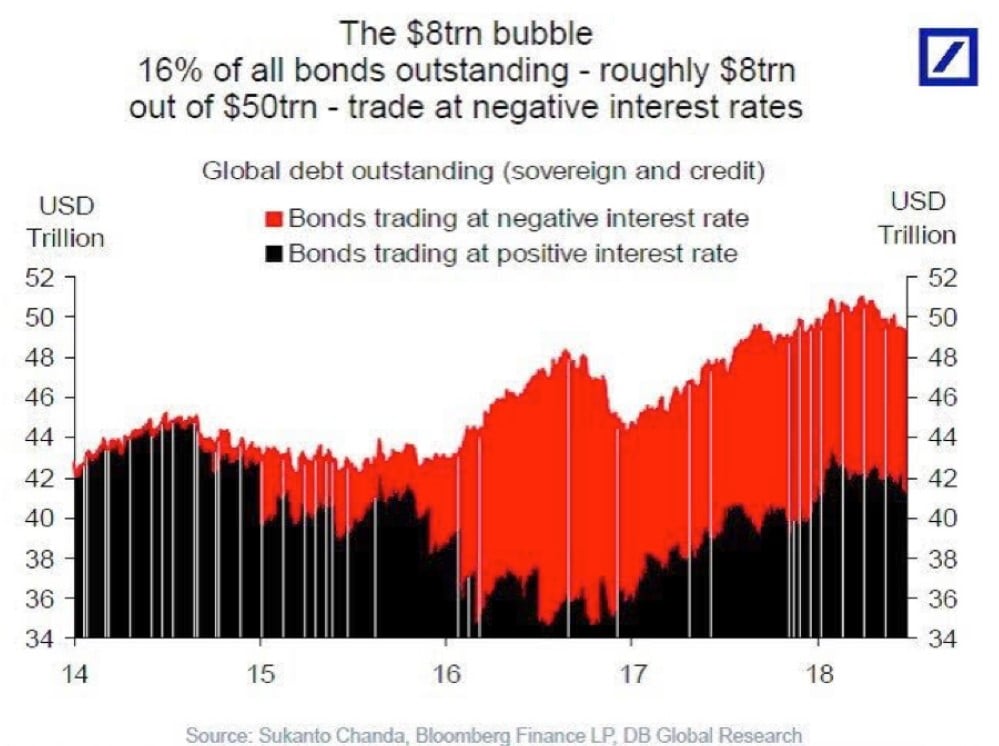

Today, roughly $8 trillion out of $50 trillion of bonds trades at negative interest rates. When 16% of all bonds are paying less than zero, the prices of other investments are going to levitate.

No one knows how the great monetary experiment that the world’s governments have embarked upon will unfold, but it’s hard to imagine interest rates not rising off of zero eventually.

And there’s a lot of debt built up around the world.

There are troubling developments in the internal dynamics of the market, specifically a high concentration in returns. That means a small number of companies are accounting for the bulk of the moves in the market. The S&P 500 rose 22% in 2017. But a quarter of that return came from just 5 companies – Amazon, Apple, Facebook, Boeing, and Microsoft.

It’s gotten worse in 2018. Year-to-date through June of 2018, 84% of the S&P 500’s gains have come from only 4 companies—Amazon, Apple, Netflix, Microsoft. Amazon alone carried 36% of the load. The other 496 companies? Not much happening.

Why does this matter? One study found that since 2000, when the top 5 stocks represent less than 25% of the yearly attribution, the average return was 19.6%. The market performs better when every company is participating. When the top 5 represent more than 25% (like today), the average return was 1.9%. When the market gains are concentrated in only a few companies, expected returns deserve extra scrutiny.

What’s Going On With Value Investing?

How does one keep the faith when their style of investing is struggling? For me, getting more than I pay for is the only investment approach that makes logical sense. From my first car to nearly every economic transaction since, I’ve always been a bargain shopper. I love getting a good deal. Buying partial ownership in publicly traded businesses (aka “investing in the stock market”) is no exception—I want to secretly feel like I’m stealing something.

In addition to the theoretical, the empirical evidence that value investing works is undeniable. The below chart overwhelmingly favors value. We’re in the midst of the worst “pink” stretch in a century, but all of that “blue” is comforting that history is on our side.

Value investing is a sound approach and will eventually have it’s moment in the sun again. It’s not easy to implement though. It requires patience and a firm resolve.

“The higher long-run return from investing in cheaper stock is a righteous form of payback for the pain of sitting around for years watching all those growth stocks with piddling profits go straight up. If you don’t have a vast reservoir of patience and you can’t ignore the better short-term fortune of other investors, you won’t be able to stomach value investing long enough to benefit from it.” - Jason Zweig

Investing In an Improving World

Finally, let’s return to the investment implications of a gradually improving world. It’s a well-known problem that investors tend to overweight their portfolios toward wherever they live. It’s called “home country bias,” and it generally leads to suboptimal returns.

The embedded chart tells the story. In 2017, the US represented 24% of the world’s GDP and the US stock and bond markets were 36% of the planet’s total capitalization. Yet US investors had 70% allocated to the US and 30% to

the rest of the world. We overweight where we live. Home country bias isn’t a US-specific phenomenon. It’s prevalent in every country with a stock market. If you live in England, you likely have too much invested in the FTSE 100. If you live in Japan, you probably have too much invested in the Nikkei.

Buying what you know is generally good advice, but this is a particularly treacherous time for US investors with home country bias.

First, as we’ve cataloged extensively, US stocks are exorbitantly expensive, and high prices lead to low expected returns. Second, there will be powerful demographic and economic forces at work over the next few decades.

Take Africa. It’s worth reevaluating potentially naive views of colonial Africa that are maintained by today’s media. Africa is a huge continent of 54 countries and 1 billion people, at every level of economic development. We tend to lump everything on the Continent into “Africa’s problems.” An outbreak of Ebola in Liberia affects tourism in Kenya. Those two places are a 100-hour drive from each other. That’s farther than London is from Tehran, or if you prefer, it’s farther than driving from LA to NY and back again. To pour so much through a single, low-resolution filter is a little ridiculous.

The current PIN code of the world is 1-1-1-4. That’s the rough current population totals in billions from left to right on the map: Americas 1, Europe 1, Africa 1, Asia 4.

By the end of this century, the UN projects the new PIN code will be 1-1-4-5: Americas 1, Europe 1, Africa 4, Asia 5. There will be radical development in countries which are today poor and struggling. I firmly believe the hand of progress will reach the Continent as democracy, property rights, and entrepreneurism spreads. Is it too far a stretch to believe that the economic miracles of a Japan or Singapore are unattainable in Africa?

What will be an easier business to execute or investment to recognize: finding the next google in the US (where everyone is looking), or building the first Waste Management in Africa (where there’s an existing playbook)? My hunch is the tailwinds will be in the developing world.

The center of economic gravity is shifting from the Atlantic Ocean to the Indian Ocean. Investors with a home country bias and media-skewed perspective will miss out on incredible opportunities. Of course, price is always a factor and the best mitigator of risk, but just being open to the possibilities will prove meaningful.

It’s still early innings and I’m looking for creative ways to implement these ideas in client portfolios. We have plenty of time as the tides of progress slowly advance. If you have suggestions, please reach out—I’d welcome your input.

Friendly reminder: Save the date for the annual FSI Bash on October 7th. We moved it to Sunday because kids’ sports dominates many of our Saturdays that time of the year.

Quiz answers: 1. C. Almost halved, 2. C. 80 percent, 3. A. 9 years, 4. C. 80 percent

You can take the entire test here: http://forms.gapminder.org/s3/test-2018

As always, we’re thankful to have such great partners in this wealth creation journey.

Jake