Investors with longer investment horizons are often told to “stay the course,” but this can be difficult because any long-term period is made up of several short-term periods. At present, stock prices are high and fixed income yields are climbing, putting downward pressure on bond prices. With fresh uncertainty around Fed leadership and the potential for a trade war, volatility has reappeared in what recently had been a historically docile market. Is the best course of action to attempt to avoid large downturns (losses), even if it means giving up some upside (gains) along the way?

In Ronald Blue Trust’s latest Economic Review & Outlook , the company offers steps on how to approach investing for the long term, particularly during times of heightened fear or uncertainty; interviews are available:

- Step One: Determine when you will need to use the money. Understanding when you need to be able to use your money is the most important factor in determining how to invest. In fact, the primary determinant of whether stocks are appropriate given today’s valuations and volatility is time horizon, not speculation or prediction.

- Step Two: Invest accordingly and integrate valuation and growth. Certain timeless principles guide how the economy works. A country’s or region’s productivity leads to better stock market returns and higher economic growth in those areas. At the same time, paying less for a given level of future growth is preferable.

- Step Three: Don’t let fear or greed drive you away from the process. Our emotions can wreak havoc on an investment portfolio if decisions are made based on them. The final step is to ensure that a disciplined process is truly followed.

Ronald Blue Trust is a division of Thrivent Trust Company, which is a wholly owned subsidiary of Thrivent Financial. Ronald Blue Trust serves individuals and families across generations with complex financial needs and helps them to enjoy a healthier relationship with money and be inspired to live more generously. With 13 offices, the company serves clients across the wealth spectrum in all 50 states. The company has four divisions (Private Wealth, Family Office, Professional Athlete, Everyday Steward) and over $7 billion in assets under management.

Although Ronald Blue Trust believes that the expectations in any forward-looking statements are reasonable, it can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this presentation. Diversification does not guarantee investment returns and does not eliminate loss. Approved for general distribution.

Long-term Investing In Expensive Markets

Investors with longer investment horizons are often told to “stay the course,” but this can be difficult because any long-term period is made up of several short-term periods. At present, equity valuations are estimated to be at extremely high levels; fixed income yields are coming off historic lows with expectations that they will continue to rise in the coming years, putting pressure on bond prices. Now, with fresh uncertainty around Fed leadership and the potential for a trade war, volatility has reappeared in what had recently been a historically docile market. Is the best course of action to attempt to avoid large downturns (losses), even if it means giving up some upside (gains) along the way?

In this quarter’s Economic Review & Outlook, we offer steps on how to approach investing for the long term, particularly during times of heightened fear or uncertainty. We will also outline how this approach plays into our current positioning. We begin with an overview of recent economic events and market performance.

Key Economic News

New ‘Sheriff in Town’ Begins Term with the Fed

On February 4, Jerome Powell succeeded Janet Yellen as Chair of the U.S. Federal Reserve. So far, Powell has continued along the current path of signaling a strengthening economy and the need to continue to gradually raise interest rates. On March 21, during his first meeting as Chairman, Powell announced an increase of 0.25% to the Fed funds rate with a target range of 1.50% to 1.75%. This announcement was widely expected, and most are forecasting two to three additional rate hikes in 2018.

A New Tariff in Town Too

During the quarter, President Trump announced plans to impose a 25% tariff on steel imports, 10% tariffs on aluminum imports, and 25% tariffs on certain Chinese imports, as a means to protect U.S. producers’ interests at home and abroad. Many U.S. trade partners, particularly China, threatened retaliatory actions, leading many to believe that this could ultimately lead to an all-out trade war. If this occurs, it could raise the threat of higher inflation and hurt global economic growth. However, others believe that this is a negotiation tactic and are hopeful that a mutually beneficial resolution will eventually be reached.

Volatility is Back for Another Round

After a relatively quiet start to the year, late January to early February brought an increase in market volatility. During this 10-day stretch, global stocks declined -5% to -10%, bond yields increased sharply, and the VIX (a measure of U.S. stock volatility) spiked to its highest levels since August 2015. After a brief rebound, the markets continued to go up and down for the rest of the quarter. While it is always difficult to assign a precise cause to market events, some potential drivers were fears around valuations, increasing interest rates, and trade wars stemming from tariffs. While volatility can be concerning, it is important to remember that it is a normal and common occurrence in financial markets and the stability of the last few years has been an exception.

Asset Class Performance

The end of January was a major inflection point for the quarter. During January, nearly every major asset class was strongly positive, while in February, everything was down. March was more of a mixed bag, where gold, bonds, and commodities were positive, while equities were in the red. For the quarter, commodities led the way with a +2.8% return. Emerging markets led all equity markets with a gain of +1.3%, while International Developed equities were the worst performing asset class, losing -1.6%. Rising rates, paired with increased inflation concerns, led to a decline in bonds (-1.5%) for the quarter.

Our Perspective

Long-term investors are grappling with whether to stay the course or temporarily alter it in the face of high valuations and recent stock market volatility. In response to this common question, we believe that investors should take the following three steps in order to gain confidence that staying the course is still the wisest decision, even when valuations are high. In fact, investors who bought into the U.S. stock market at its absolute peak in 2007 (immediately preceding the financial crisis) were subjected to a greater than 50% decline but still managed to earn approximately 7.3% annualized over the subsequent decade if they stayed invested.

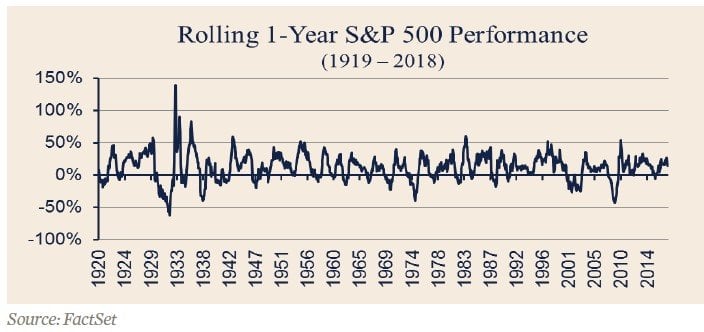

Step One: Determine when you will need to use the money. We believe that understanding when you need to be able to use your money is the most important factor in determining how to invest. For example, stocks are not appropriate investments for money needed in the short term. The chart below shows that there are many large drawdowns over rolling one-year periods. Experiencing a large market decline, such as with the Great Depression or the 2008 Financial Crisis, could be devastating if

you’re counting on using that money in the near future.

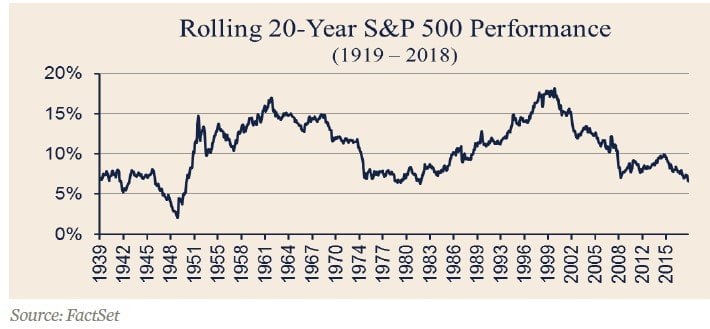

However, for money needed 10 to 20 years in the future, it’s important to expose a portfolio to growth through stocks. The chart below shows the rolling 20-year performance of stocks. Notice the scale has compressed dramatically. In fact, U.S. stocks have not experienced a negative 20-year period in modern history. With this in mind, the question is not if a long-term investor will earn a return; it’s how much of a return they are likely to earn if they stay invested. This perspective can offer some assurance because volatility becomes virtually meaningless and valuations become less important than the compounding effect of earnings growth over time.

See the full PDF below.