Fundraising

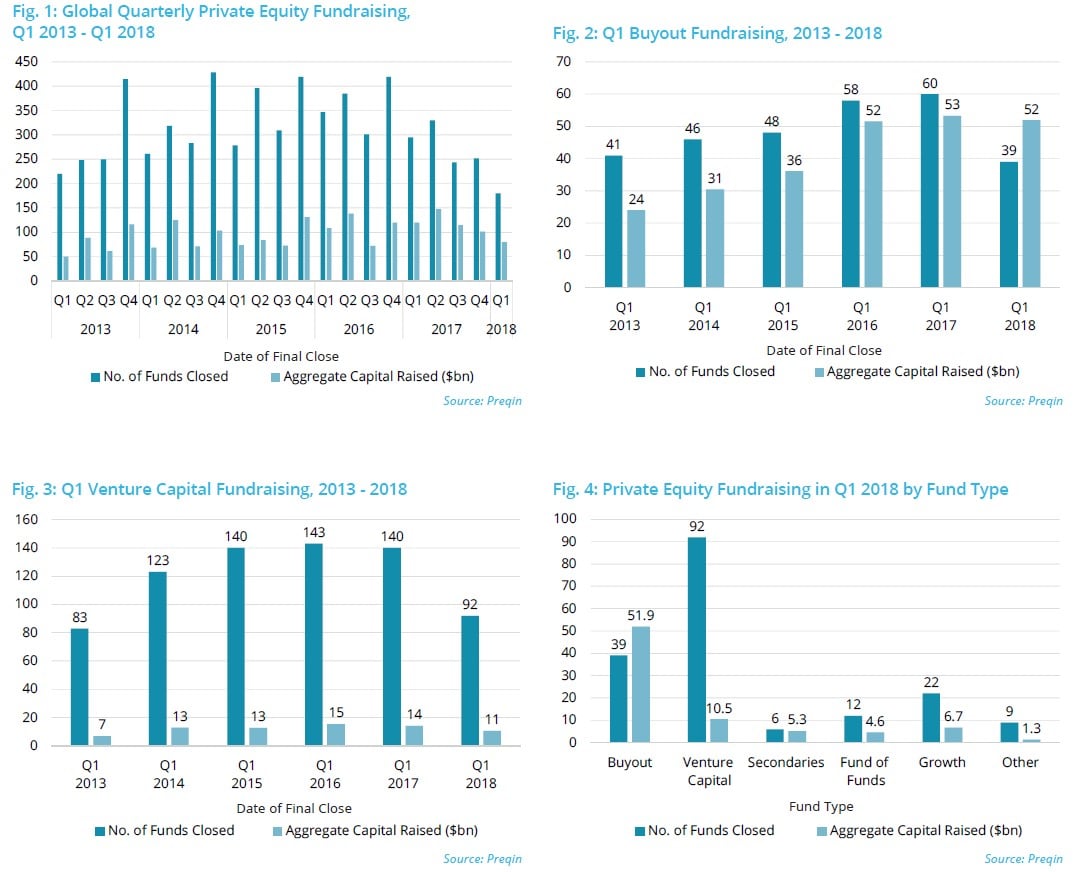

In Q1 2018, 180 private equity funds reached a final close, collectively securing $80bn in capital commitments (Fig. 1). Fundraising has slowed in comparison to the previous quarter, when 252 funds raised $102bn. In fact, Q1 2018 saw the smallest amount of capital raised in the first quarter of any year since 2015, when $74bn in aggregate capital was secured by 279 vehicles.

Both buyout and venture capital totals have experienced similar declines when looking at Q1 fundraising over the past six years: 39 buyout funds reached a final close in Q1 2018, representing a five-year low (Fig. 2). Yet the $52bn in buyout capital is on par with both Q1 2017 and Q1 2016 levels and well above the $39bn five-year historical average (2013-2017).

As in Q1 2017, venture capital fundraising in Q1 2018 accounted for 14% of aggregate private equity capital raised, although this marked a significant decline in the amount of capital raised and number of funds closed compared to prior years. Similar Q1 totals to the $11bn raised across 92 venture capital vehicles in Q1 2018 have not been seen since Q1 2013, when $7.0bn was raised across 83 venture capital funds (Fig. 3).

Growth funds and funds of funds in Q1 2018 also saw a drop in fundraising activity: there was a six-percentage-point decline in the proportion of aggregate capital secured by growth funds in Q1 2017 (14%) to Q1 2018 (8%). Funds of funds experienced an even greater slowdown compared to Q1 2017: aggregate capital raised dropped 66% from $13bn in Q1 2017 to $4.6bn in Q1 2018 (Fig. 4).

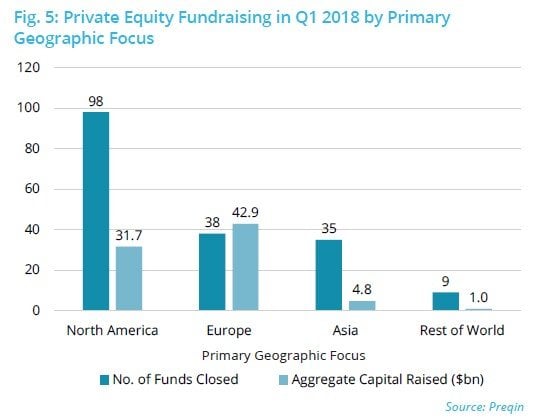

Thirty percent fewer North America-focused funds closed in Q1 2018 than in Q1 2017, and raised less than half ($32bn) the $67bn total secured in Q1 2017. Asia-focused funds experienced a 59% decrease in the number of funds closed in Q1 2018 compared to Q1 2017, and raised 83% less capital in total, securing just $4.8bn. Only Europe-focused funds raised more capital ($43bn) in Q1 2018, up 111% from Q1 2017 (Fig. 5).

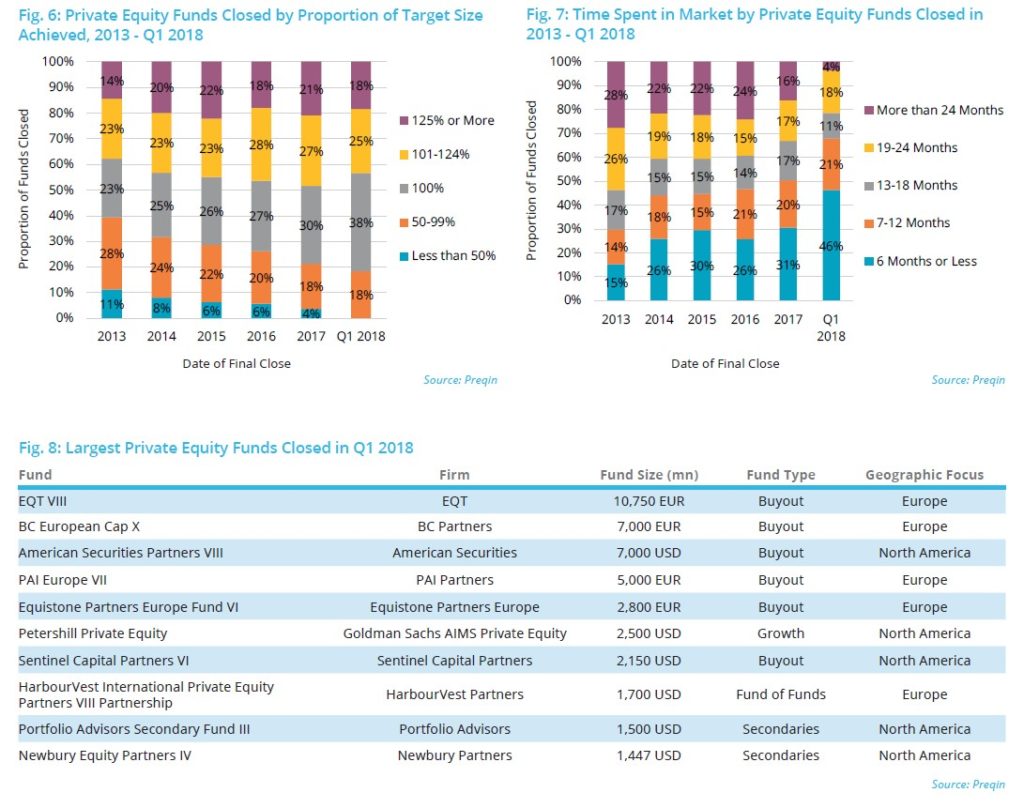

Although fewer funds are closing, fundraising trends in Q1 2018 are still positive: of the 180 funds closed in Q1 2018, 82% achieved or exceeded their target size (Fig. 6), while time spent on the road has continuously decreased (Fig. 7). In fact, the largest fund closed in Q1 2018 – EQT VIII – raised €10.8bn in less than six months, exceeding its target of €8.0bn by 34% (Fig. 8).

Funds In Market

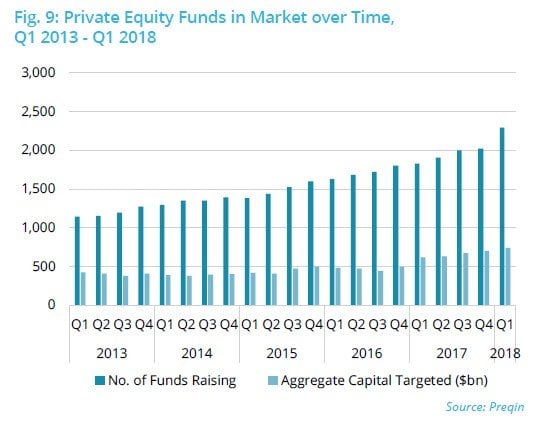

The number of private equity funds in market has continued to grow: a record 2,575 funds are on the road as at the start of Q2 2018, targeting $844bn in institutional capital (Fig. 9). This represents a 35% rise in the number of funds raising capital compared to the beginning of Q2 2017, and a 33% ($209bn) increase in aggregate capital sought.

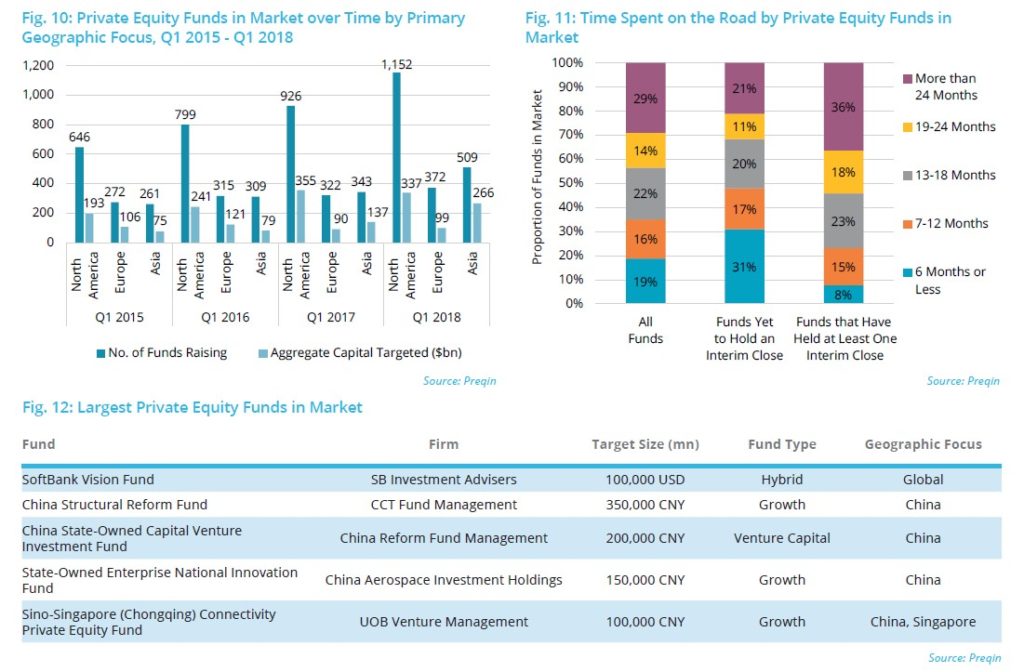

The increase in targeted capital can partly be attributed to the growing number of funds seeking larger commitments than in previous quarters, including SoftBank Vision Fund, managed by SB Investment Advisers, which alone is targeting $100bn – the largest amount ever targeted by a private equity fund. The fund had achieved 93% of its target size by its first close in May 2017.

Four Asia-focused funds complete the five largest funds in market, as seen in Fig. 12. China Structural Reform Fund currently trails SoftBank Vision Fund with a target of CNY 350bn ($53bn), and held a first close on CNY 131bn ($20bn) in September 2016.

Nearly half (45%) of all funds in market are targeting investment opportunities in North America, with these vehicles accounting for $337bn (40%) of all institutional capital sought (Fig. 10). The number of Asia-focused funds in market has increased from 343 in Q1 2017 to 509 in Q1 2018, with the aggregate capital targeted up 94%.

Institutional Investors

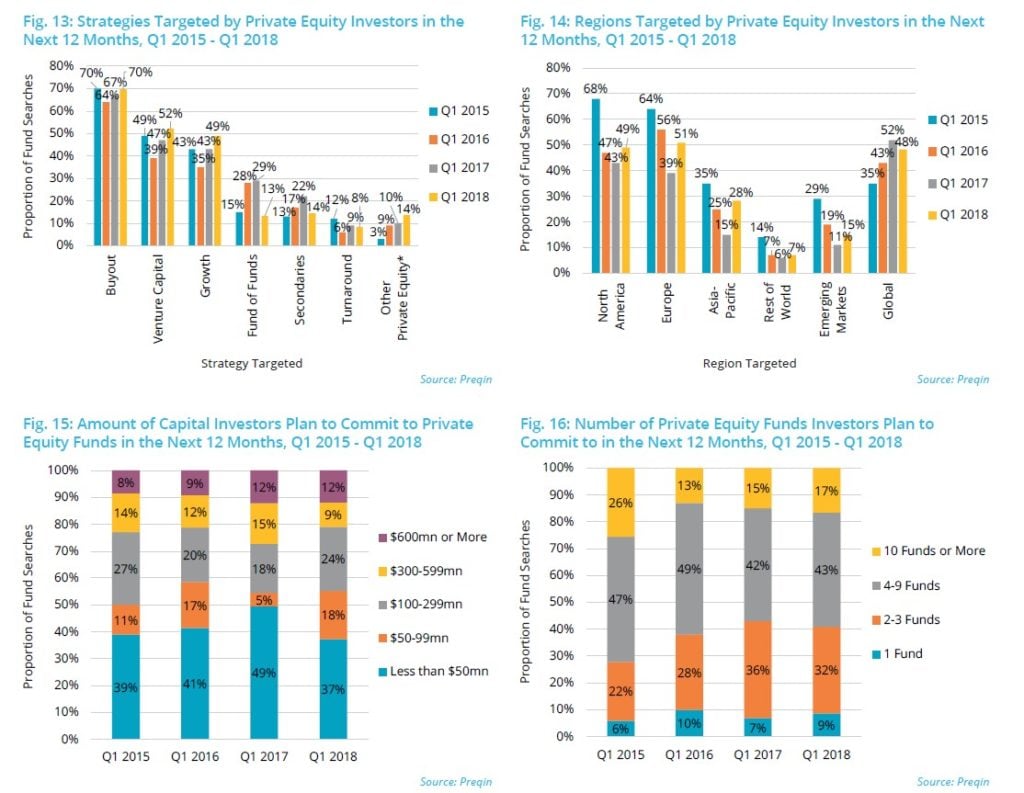

Buyout, venture capital and growth remain the most targeted private equity strategies among institutional investors in Q1 2018, as seen in Fig. 13. Moreover, in Q1 2018, a greater proportion of investors with active mandates searched for these strategies than in previous years, while investor appetite for funds of funds and turnaround vehicles has declined to 13% and 8% respectively.

The proportion of mandates targeting other private equity fund types (including balanced, co-investment and direct secondaries) has steadily grown in recent years. Record levels of dry powder combined with higher valuations in traditional private equity strategies may be driving investors to further diversify their traditional private equity portfolios.

The majority (51%) of institutional investors are planning to target Europe in the coming year, followed closely by North America (49%) and global-focused funds (48%, Fig. 14). Asia-Pacific has seen the largest year-on-year increase in appetite, with 28% of investors targeting the region in Q1 2018 compared to 15% in Q1 2017. While all single markets witnessed increased investor appetite in Q1 2018, fewer investors are targeting global-focused opportunities than one year ago.

The largest proportion (42%) of investors are planning to commit $50-299mn to private equity over the next 12 months, compared to 23% of investors in Q1 2017 (Fig. 15). The proportion of investors planning to commit less than $50mn or more than $600mn has remained relatively on par with historical averages (42% and 10% respectively). Since Q1 2015 there have been fewer investors seeking four or more fund commitments and a greater proportion of investors seeking 2-3 fund commitments, perhaps suggesting an increase in ticket sizes (Fig. 16).

Article by Preqin

See the full PDF below.