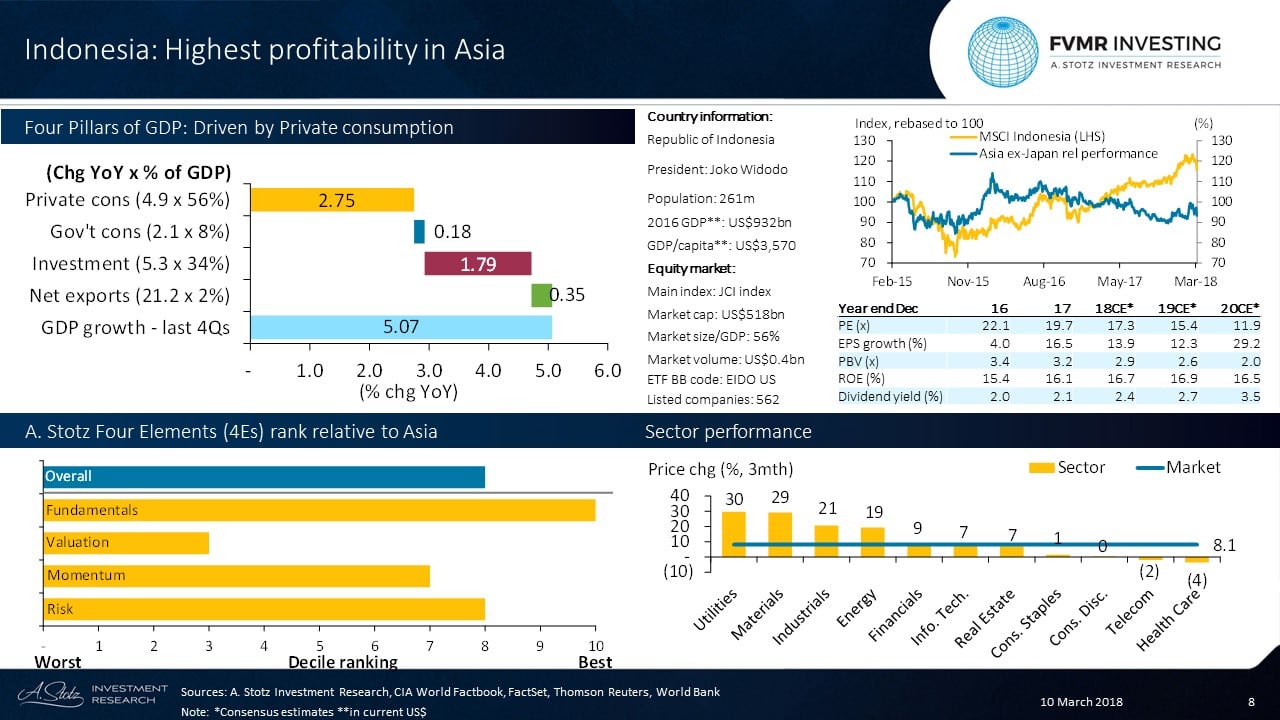

Four Pillars of GDP: Driven by private consumption

Indonesia has good GDP growth, driven mainly by private consumption and secondly investments. Government consumption contributed the least to GDP growth in the past four quarters.

[REITs]Highest profitability in Asia reflected in valuation

Indonesia has had, and consensus expectations are, that the country should continue to have the highest ROE in Asia. This is also reflected in the valuation, Indonesia’s 2018CE* 2.9x PB is the highest in Asia ex Japan.

A. Stotz Four Elements: Indonesia’s rank relative to Asia

Overall, Indonesia appears third most attractive in Asia considering all our four elements: Fundamentals, Valuation, Momentum, and Risk.

Fundamentals: Indonesia has the highest ROE in Asia.

Valuation: This strong profitability is reflected in the highest PB in Asia.

Momentum: Good price and earnings momentum.

Risk: Relatively low volatility and low beta to Asia ex Japan.

Massive price performance in Utilities and Materials

Top 3 largest sectors: Financials: 31% of the market; Consumer Staples: 23%; Consumer Discretionary: 10%.

Best sector & stock: Utilities: +29.7% & PT Perusahaan Gas Negara (Persero) Tbk: +42.8%

Worst sector & stock: Health Care: -3.7% & PT Kalbe Farma Tbk: -11.9%.

*CE is consensus estimates.

Article by Become A Better Investor