Congress has just demonstrated just how bad the American pension system is with the formation of a select committee to bail-out failed pensions. The subtle maneuver happened during the new budget deal where Congress snuck in a provision that forms a committee that allows the use of federal funds to bail-out over 200 multiemployer pensions – pensions plans that are created through the collective bargaining of unions. These plans are supposed to pay for the retirement benefits of employees through employer and labor union efforts, at least in theory. The reality is far darker.

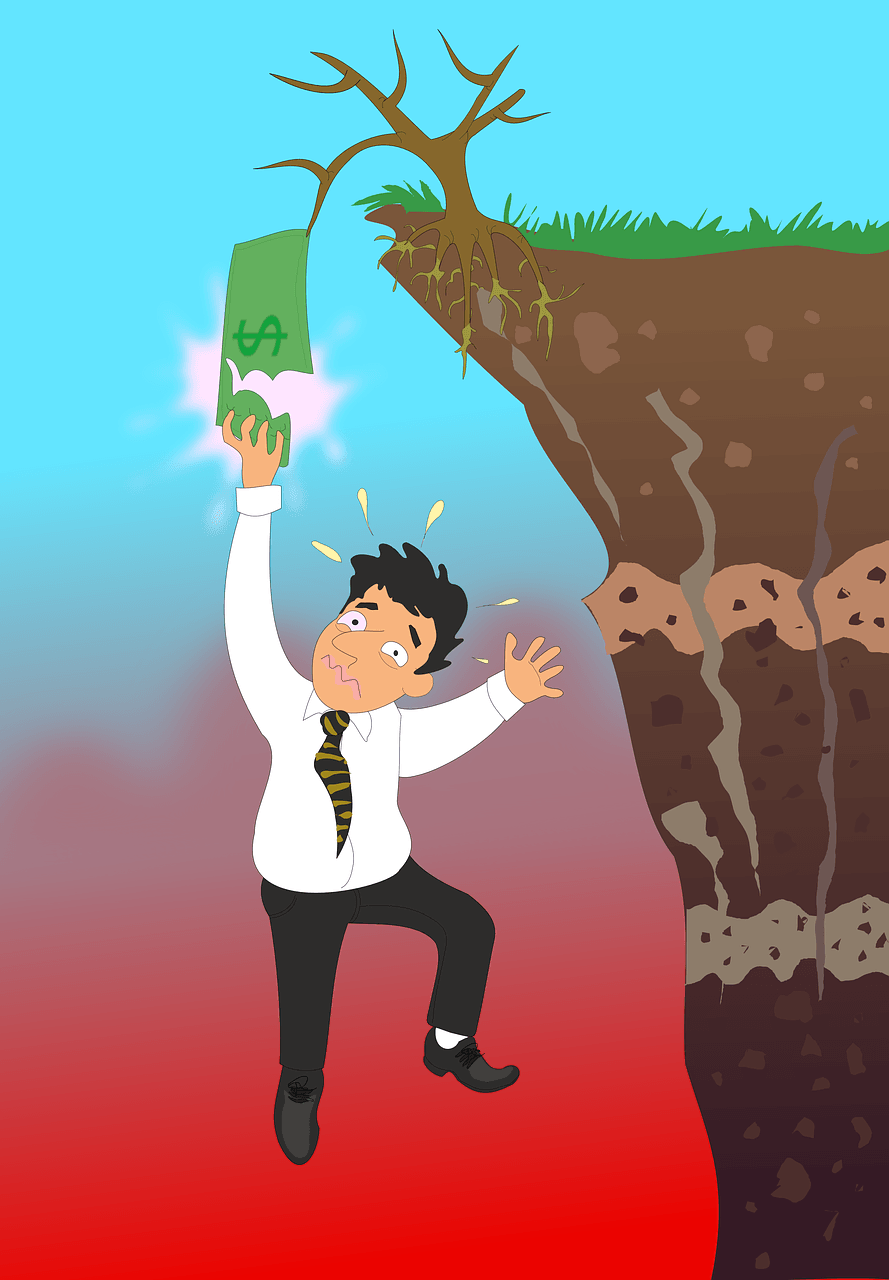

This desperate attempt mars the magnitude of the crisis that is to unfold. Pensions are giant pools of capital that are supposed to pay out benefits to workers. This is usually based on actuarial formulas that are designed to plan for payouts at the advent of employee retirement. Unfortunately, this becomes a severe issue when pensions miscalculate and attempt to play catch up. The miscalculation is so stark in some cases that many state government pension system is only funded at 50% and are expected to go bankrupt within a decade.

A government bailout can not quickly rectify this 7 trillion dollar funding gap by municipal pensions. The amount of allowances in lousy shape is staggering, and the current investment strategy employed by many of them only makes the situation worst. Most funds require a 7-8% rate of return to meet their future obligations, but scarcely any of them can match these targets. Instead, they run headlong into ever increasingly riskier investments with the result being higher volatility and losses. For example, some funds dabbled in the sale of put options, only to be devastated when the Dow fell 2,400 points in a week last month.