Wingstop Inc (NASDAQ: WING) investors have enjoyed seeing the stock price increase by 33.9% over the prior three months. As a small-cap stock with high coverage by analysts, you could assume any recent changes in the company’s outlook is already priced into shares. However, could the stock still be trading at a relatively cheap price? Let’s take a look at the company’s expected growth and valuation based on its most recent financial data to see if there is further upside moving forward.

What Is Wingstop Worth?

Wingstop appears to be overvalued by -31.2% at the moment, based on 9 separate valuation models. The stock is currently trading at $47.98 on the market compared to our average intrinsic value of $32.99. This means that the opportunity to buy Wingstop at a good price has disappeared.

| Analysis | Model Fair Value | Upside (Downside) |

|---|---|---|

| 10-yr DCF Revenue Exit | $32.89 | -31.5% |

| 5-yr DCF Revenue Exit | $33.94 | -29.3% |

| 10-yr DCF EBITDA Exit | $37.61 | -21.6% |

| 5-yr DCF EBITDA Exit | $40.22 | -16.2% |

| Peer EBITDA Multiples | $24.10 | -49.8% |

| 10-yr DCF Growth Exit | $37.04 | -22.8% |

| 5-yr DCF Growth Exit | $39.39 | -17.9% |

| Peer P/E Multiples | $27.39 | -42.9% |

| Dividend Discount Model | $24.36 | -49.2% |

| Average | $32.99 | -31.2% |

Click on any of the analyses above to view the latest model with real-time data.

In addition to this, it seems like Wingstop's share price is quite stable, which could mean two things. One, it may take the share price a while to fall back down to an attractive buying range, and two, there may be less chances to buy low in the future once it reaches that value. This is because the stock is less volatile than the wider market given its slightly low beta of 0.98.

How Much Growth Will Wingstop Generate?

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company’s future expectations.

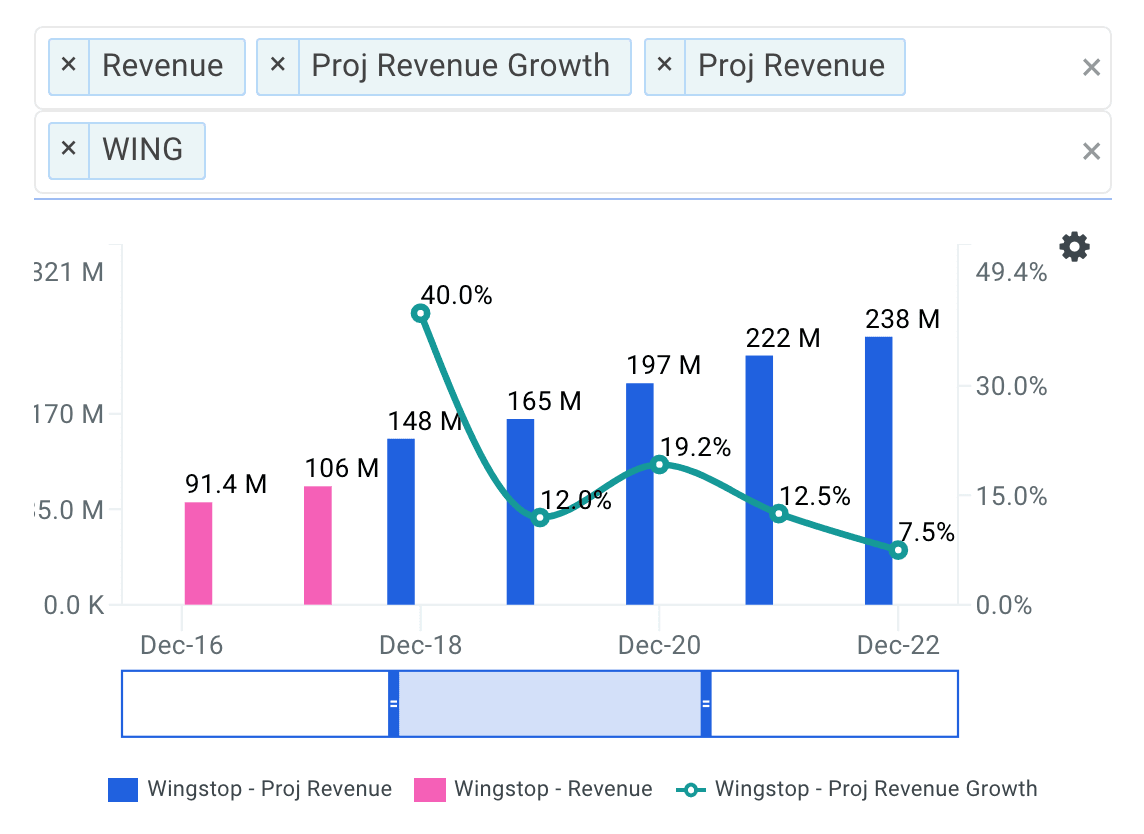

source: finbox.io data explorer

Wingstop's revenue growth is expected to average 17.7% over the next five fiscal years, indicating a solid future ahead. Unless expenses grow at the same level, or higher, this top-line growth should lead to robust cash flows, feeding into a higher share value.

Next Steps

While many investors tend to categorize stocks as either value or growth plays, the most successful investors view growth in conjunction with a company's value. Take legendary investor Peter Lynch for example, who is widely known for popularizing the term growth at a reasonable price (GARP).

GARP is a strategy that combines aspects of both growth and value investing techniques by finding high growth companies that don't trade at overly high valuations. In the application of this strategy, Lynch achieved 29% annualized returns as the manager of Fidelity's Magellan Fund from 1977 to 1990. Needless to say the importance of analyzing a company's fair value in addition to its growth prospects.

Wingstop has positioned itself so that double-digit growth appears to be a reasonable assumption for the foreseeable future. However, this growth does not look highly attractive at current trading levels. As such, investors may want to hold off on buying or adding to their WING position for the time being.

However, if you have not done so already, I highly recommend you complete your research on Wingstop by taking a look at the following:

Valuation Metrics: what is Wingstop's free cash flow yield and how does it compare to its publicly traded peers? This metric measures the amount of free cash flow for each dollar of equity (market capitalization). Analyze the free cash flow yield here.

Efficiency Metrics: is management becoming more or less efficient in creating value for the firm? Find out by analyzing the company's return on invested capital ratio here.

Forecast Metrics: what is Wingstop's projected EBITDA margin? Is the company expected to improve its profitability going forward? Analyze the company's projected EBITDA margin here.

Article by Andy Pai, Finbox.io