Valuation Summary:

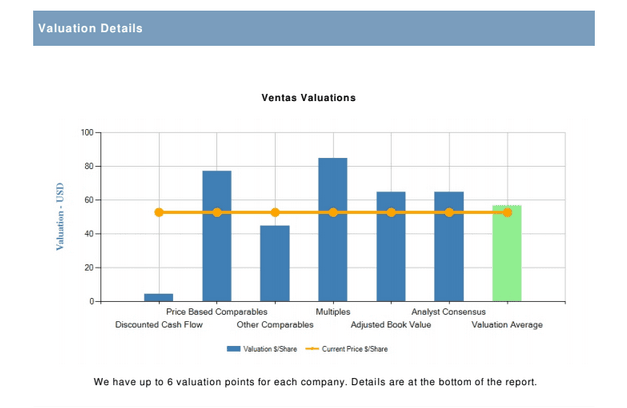

Ventas $52.88 (USD) Close Price as of 05/02/2018Based on the analysis conducted in this report, Ventas, (VTR:NYS) is found to be Undervalued.

| Company | Ventas |

| Symbol:Exchange | VTR:NYS |

| Industry | Real Estate:REIT-Healthcare Facilities |

| Close Price/Date | $52.88 (USD) 05/02/2018 |

| Weighted Average Valuation | $66.96 (USD) |

| Summary | VTR:NYS is found to be Undervalued by 26.6% using the 3 valuation models shown below. |

| Valuation Models Used | Analyst Consensus: $65.00 (USD) |

| (in order of importance) | Adjusted Book Value: $64.72 (USD) |

| Comparables: $77.33 (USD) | |

| Valuation Methods Analysis | This company is: |

| Cash Flow Basis: | Overvalued on a Cash Flow Valuation basis |

| Comparable Company Basis: | Undervalued on a Comparable Valuation basis |

| Asset Basis: | Undervalued on an Asset Valuation basis |

Valuation Details

Discounted Cash Flow and Sensitivity Analysis for VTR:NYS

Using a discounted cash flow model we generated an intrinsic value of $4.49 (USD) for VTR:NYS

Sensitivity Analysis

(showing how changes in the input variables impact the DCF calculation)

| VTR:NYS | Current Values | Valuation If Dropped * | Valuation If Raised * | ||

|---|---|---|---|---|---|

| Calculated Value: | $4.49 | 1% | 5% | 1% | 5% |

| WACC (or Ke) | 8.55 | $12.86 | ($1.31) | ||

| Terminal Growth Rate | 3.00 | ($1.14) | $12.60 | ||

| Tax Rate | 0.06 | $7.52 | $1.47 | ||

| Cash Flow | 2,384,244,000 | ($0.65) | $9.64 | ||

| Capital Expenditures | -1,497,209,800 | $1.66 | $7.33 | ||

| Long Term Debt | 11,252,327,000 | $6.07 | $2.91 | ||

* Changes are absolute: ex WACC from 8% to 7%

Comparables Model

Using similar companies and price based ratios we generated a valuation of $77.33 (USD) for VTR:NYS. We also generated a valuation of $44.96 (USD) using other metrics and comparables. The comparable companies were Welltower (HCN:NYS), HCP (HCP:NYS), Healthcare Trust (HTA:NYS) and Omega Healthcare (OHI:NYS)

| Company VTR:NYS | End Date Value |

|---|---|

| Earnings/Share | $3.27 (USD) |

| Book Value/Share | $30.13 (USD) |

| Sales/Share | $9.92 (USD) |

| Cash Flow/Share | $4.04 (USD) |

| EBITDA/Share | $0.00 (USD) |

| Price Based on Comps | Adjustment Factor (%) |

|---|---|

| $158.86 (USD) | -11.6 |

| $51.93 (USD) | 13.1 |

| $62.79 (USD) | -14.0 |

| $54.15 (USD) | 3.6 |

| $0.00 (USD) | -2.1 |

| VTR:NYS | Ratios Used | Average Values | HCN:NYS | HCP:NYS | HTA:NYS | OHI:NYS |

|---|---|---|---|---|---|---|

| 28.41 | PE Ratio | 48.58 | 24.18 | 20.58 | 115.04 | 34.53 |

| 1.86 | PB Ratio | 1.72 | 1.59 | 2.04 | 1.78 | 1.48 |

| 5.64 | PS Ratio | 6.33 | 5.13 | 5.80 | 8.33 | 6.05 |

| 13.85 | PCF Ratio | 13.40 | 14.57 | 13.22 | 16.49 | 9.31 |

| 16.15 | EV to EBITDA | 17.85 | 17.93 | 13.19 | 25.39 | 14.88 |

Multiples

Using a multiples approach we generated a valuation of $84.75 (USD) for VTR:NYS

| Company VTR:NYS | End Date Value |

|---|---|

| Earnings/Share | $3.27 (USD) |

| Book Value/Share | $30.13 (USD) |

| Sales/Share | $9.92 (USD) |

| Cash Flow/Share | $4.04 (USD) |

| EBITDA/Share | $5.17 (USD) |

| Price Based on Comps | Adjustment Factor |

|---|---|

| $131.34 (USD) | 0 |

| $65.90 (USD) | 0 |

| $64.80 (USD) | 0 |

| $64.60 (USD) | 0 |

| $97.12 (USD) | 0 |

| Ratios | Ratio Average |

|---|---|

| PE Ratio | 40.17 |

| PB Ratio | 2.19 |

| PS Ratio | 6.53 |

| PCF Ratio | 15.98 |

| EV to EBITDA | 18.78 |

Adjusted Book Value versus Historical Price to Book

The average the Price to Book ratio for VTR:NYS for the last 10 years was 2.19

We ran the Adjusted Book Value for VTR:NYS and generated a book value of $29.54 (USD) By multiplying these we get an adjusted valuation of $64.72 (USD)

Analyst Data

In the Stockcalc database there are 4 analysts that provide a valuation for VTR:NYS. The 4 analysts have a concensus valuation for VTR:NYS for 2018 of $65.00 (USD).

VTR:NYS Ventas

| Analyst Recommendation | ||||||

| Buy | Hold | Sell | Rating (of 5) |

Guidance | As Of | |

| 1 | 4 | 1 | 3.0000 | Hold | 2018-1-30 | |

Current Price: not available

| Analyst Consensus | |||

| USD Millions | 2017 | 2018 | 2019 |

| Mean EPS | 2.95 | 3.14 | 3.65 |

| # EPS Analysts | 3 | 3 | 1 |

| Mean Revenue | 2,851.40 | 2,862.20 | 2,539.70 |

| # Revenue Analysts | 2 | 2 | 1 |

| Mean Target Price | 65.00 | ||

| Mean Cash Flow | 4.87 | 4.73 | 5.03 |

| Mean EBITDA | 2,001.00 | 2,044.30 | 2,314.80 |

| Mean Net Income | 999.40 | 799.10 | 970.10 |

| Mean Debt Outstanding | -11,027.80 | -11,038.80 | -11,048.50 |

| Mean Tax Rate | |||

| Mean Growth Rate | 6.16 | ||

| Mean Capital Expenditure | 287.40 | 329.70 | 104.40 |

| Price | 52.88 |

| Range | 52.78 – 54.98 |

| 52 week | 52.88 – 71.93 |

| Open | 54.14 |

| Vol / Avg. | 3.21M/1.25M |

| Mkt cap | 18.83B |

| P/E | 28.41 |

| Div/yield | 3.16/0.06 |

| EPS | 1.86 |

| Shares | 356.16M |

| Beta | 0.99 |

Detailed Company Description

Ventas Inc is a real estate investment trust. It holds a diversified portfolio of seniors housing communities, skilled nursing facilities, medical office buildings, life science buildings, and hospitals.

Explanation of Valuation Models

We have up to 6 valuation points for each company in the database.

The Discounted Cash Flow (DCF) valuation is a cash flow model where cash flow projections are discounted back to the present to calculate value per share. DCF is a common valuation technique especially for companies undergoing irregular cash flows such as resource companies (mining, forestry, oil and gas) going though price cycles or smaller companies about to generate cash flow (junior exploration companies, junior pharma, technology firms…).

The Price Comparables valuation is the result of valuing the company we are looking at on the basis of ratios from selected comparable companies: Price to Earnings, Price to Book, Price to Sales, Price to Cash Flow, Enterprise Value (EV) to EBITDA. Each of these ratios for the selected comparable companies are averaged and multiplied by the values for the company we are interested in to calculate a value per share for our selected company.

We have included the Other Comparables as a way to value companies that cannot be valued using Earnings based ratios. This technique is very useful for companies still experiencing negative cash flows such as mining exploration firms. We use Cash/Share, Book Value/Share, MarketCap, 1 Year Return, NetPPE as the ratios here. Each of these ratios for the selected comparable companies are averaged and multiplied by the values for the company we are interested in to calculate a value per share for our selected company.

Multiples are similar to Price comparables where we look at current or historic ratios for the company in question to assess what it should be worth today based on those historic ratios. We use the same 5 ratios as in the price comparables and value the company with its historic averages.

With Adjusted Book Value (ABV) we calculate the book value per share for the company based on its balance sheet and multiply that book value per share by its historical price to book ratio to calculate a value per share.

If we have Analyst coverage for the company we use the consensus target price here.

Notice to User

The contents of this report and the Stockcalc website are provided on an ‘‘as is’’ or ‘‘as available’’ basis with all faults and may not be current in all cases. The information in this report or on the website is subject to continuous change and Patchell Brook Equity Analytics Inc. assumes no responsibility to update or amend such information or that the information will be current. Patchell Brook Equity Analytics Inc. does not claim that all information, calculations or opinions presented in this report or on its website are true, reliable, or complete. Accordingly, you should not rely on any of the information as authoritative or as a substitute for the exercise of your own skill and judgment in making an investment or other decision. Any information, data, opinions, calculations or recommendations provided by third parties through links to other websites or otherwise made available through this report or website are solely those of the third party and not of Patchell Brook Equity Analytics Inc. Please refer to the Terms of Use on www.stockcalc.com for further information. To access all of the tools on Stockcalc, including more detailed valuation reports and the models used to generate these valuations, please subscribe for a free 30 day trial of Stockcalc here.